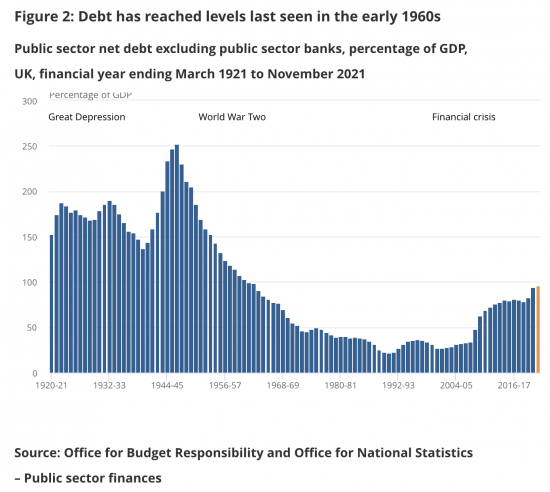

The Office for National Statistics has produced a new publication on public debt this morning, including figures for November 2021. It includes this chart:

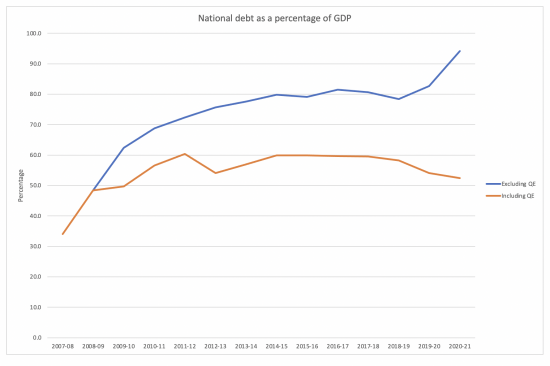

However, this chart is wrong. Using data from the Bank of England on quantitative easing authorised, which is used to repurchase UK government debt, and Office for Budget Responsibility data on GDP (as the ONS seek to hide this from view) the true figures are:

The figures are identical to 2008/09 when the use of quantitative easing began.

Quantitative easing is a relatively simple process. The Bank of England creates money which it lends to a company controlled by the Treasury but legally owned by the Bank that then buys back the debt issued by the Treasury, so reducing the amount in issue. The equation is balanced by the fact that new money has been created by the Bank of England, which is then represented by deposit accounts held with it by the UK's clearing banks. Collectively those clearing banks cannot reduce the balance on these central bank reserve accounts, as they are called. That is not surprising because they represent government created money and not debt. As such they should not be in the figures for the national debt, at all.

Focussing on the more recent period:

To explain this more appropriately than the government and the Office for National Statistics does, the national debt is under control. It is running at less than 60% of GDP. The trend is, if anything, downward. And what is emphatically not true is that the national debt is at anything like the level it was in 1963. It is substantially lower than that.

It is to be regretted that the ONS, the Bank of England and the Office for Budget Responsibility all join with the Treasury in misrepresenting the truth on this issue because what they say is profoundly misleading.

This will become especially important if and when the Bank of England begins to reverse QE, which it is threatening to do, although which I think is very unlikely given the threat of omicron. They will claim that bthis reduces the national debt. The simple fact is that the exact reverse will be the case. Reversing QE increases the national debt. 2022 may see a lot of untruths being said on this issue, all of them to support wholly unnecessary programmes of austerity intended to reduce the wellbeing of the people of this country and to threaten the viability of its public services.

These charts are where the forefront of the economic warfare on the people of the UK is to be found. Getting them right is essential.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Keep making this point. It matters (for all the reasons you say).

They claim that Public Sector Nebt Debt is GBP 2.3 trn.

“Net” means balancing off (in this case bonds issued with bonds owned)…. and last time I checked the Asset Purchase Facility/Bank of England were part of the “Public Sector”.

So, either they need to either

(a) publish the correct figure or

(b) alter the title of the data to Gross Public Sector Debt or

(c) explain why created money should be included as debt

I will eventually publish my research on this issue – there are other issues to address on top of those. I am of the opinion that there is significant overstatement of the public debt in the remaining figures, but I just have not had time to write that research up as yet.

ASAP in my view.

Article in the Guardian this morning stating that gov debt is 95%. Article written by Michael Jacobs is professor of political economy at the University of Sheffield,

https://www.theguardian.com/commentisfree/2021/dec/22/brazen-treachery-rishi-sunak-sabotaging-boris-johnson-policies?CMP=Share_iOSApp_Other

As usual the Guardian permits no BTL (which is why I refuse to fund them).

Had Jacobs done a bit of research (or even visited your blog) he would have got the right figure and his analysis would have been somewhat different.

I have no doubt the halfwits in Liebore agree with the 95% figure.

Jacobs is on the Progressive Economy Forum which expelled me because I wanted to cite Stephanie Kelton in a paper I wrote for them and they refused to let me do so, and I would not withdraw it.

Need I say more?

“The Bank of England creates money which it lends to a company controlled by the Treasury but legally owned by the Bank that then buys back the debt issued by the Treasury, so reducing the amount in issue.”

Why can’t the Bank of England buy back all the debt ever issued by the Treasury? The National Debt would then no longer exist.

So, in principle, anyone holding Gilts which pay a small amount of interest, would be required to sell them to the BoE which would then pay the same amount of interest by allowing anyone to open an account with them. Alternatively, they could come to an arrangement with the commercial banks to allow them to hold the deposits which would be then guaranteed by the BoE and Government. No-one need lose out.

Start here

https://www.taxresearch.org.uk/Blog/2020/12/20/why-we-dont-need-to-repay-the-national-debt-and-why-doing-so-would-be-incredibly-economically-harmful/

I’m still confused by all this. You are saying that the National Debt does not need to be repaid which I accept. It very rarely decreases. On the other you are taking the trouble to make the case that the National Debt is grossly overstated.

So what does it matter if it is? If you think it does make a difference then it is easy enough to get rid of it completely. If you don’t then there is little point in arguing that it should be considered to be lower than it is.

It matters because the level of debt is used as an excuse for austerity

Yes, that can be the only reason.

So why not argue that the National Debt should be reduced further and have even less excuse for austerity?

Because we need a national debt, as I have explained

How big does it need to be? Wouldn’t 25%of GDP be plenty? Then there would be absolutely no excuse for any austerity.

It would seem a little over 50% of GDP works – look at the data

Could you get an “open” letter published challenging the head of the ONS to explain their treatment of QE?

I doubt it….most on the left do not understand this

Yup, good luck with that. Richard’s obsession with continually publishing anti-Tory rants masquerading as serious politico-economic comment, leaves serious organizations like the ONS unwilling to engage with him because of an obvious lack of objectivity, even when he occasionally has something interesting to say.

That unfortunately is the price of accepting politically motivated donations and being a political campaigner for hire preaching to a small coterie of unquestioning acolytes, rather than a serious economic commentator.

The ONS cooperated considerably with me on discussions on this issue

Mr Green,

On the matter of rants, you have just aired your own. If you are a “serious economic commentator”, I have rarely observed one quite so keen to undermine his reputation, before even providing any exposition of his ideas; by vacuous resort to the ad hominem, blustering, windy insult. It was feeble and witless. I grant, however it is a thoroughly novel approach to serious commentary, but doubt it will catch on with anyone beyond the flatulent circles of the Trollerati. Nevertheless, be our guest – show us your mettle.

Well, the ONS publishes the data on/about 21st of each month. It will surely be covered in the FT so I will write in…..

Here is a draft.

Your article (xxx xxx) states that Public Sector Net Debt is £2.3 trn or 95% of GDP, but it is not. The Bank of England is part of the Public Sector so its portfolio of bonds (about £875 bn) should be deducted from this figure – that is what “Net” means. Why does this matter? Because this number is being used to promote a particular economic policy – austerity. By all means, have the policy debate but please base it on the correct data.

This is the way to do it. five sentences; to the point. It neatly creates the expectation of an answer, which may take a little more than five sentences to squirm round. All done with understatment. Hmm, I should think about that!

Apologies for another off-thread contribution; but this is absurd. Researchers from the IFS, the Fraser of Allander Institute, and University of Stirling Management School have reviewed the COVID-19 pandemic ’funding arrangements of the devolved governments of Scotland, Wales and Northern Ireland. Cutting to ‘the chase’ here, they argue for better cooperation and coordination of policy (really? Who knew?). More significant they argue as follows:

“The Treasury has already provided some additional funding to the devolved governments. But if it is decided that more stringent measures and significant additional economic and fiscal support are needed, two ideas discussed in the report may be particularly relevant: First, the devolved governments should be provided with minimum funding guarantees (as they were in the first year of the pandemic) or enhanced borrowing powers (as devolved governments in many other countries were). Such measures would provide devolved governments with additional financial ‘headroom’ above the funding they receive via the Barnett formula. Without them, the devolved governments will not know how much funding would be available to them until funding and policies were announced for England, potentially forcing them to play ‘catch up’ and delaying their policy responses.

Second, in case the expected wave of Omicron cases – or some future outbreak – impacts some parts of the country much harder than others, HMRC should examine the feasibility of making the furlough and self-employment income support schemes (SEISS) available on a geographical basis. It may turn out to be impractical without risking significant fraud or error if HMRC is unable to obtain good data on where jobs are based. But if feasible, devolved governments could be given the option of paying for furlough and the SEISS to be reinstated in their territories if they want to tighten public health restrictions significantly. Thresholds for hospitalisations, for example, could also be agreed above which the UK government would pay for the schemes, to provide extra support to areas facing the most serious situations.”

What is extraordinary about this can be reduced to a simple question: what took them so long? The rest of us didn’t need a world pandemic to observe a basic and quite obvious flaw in the devolution financial settlement; obvious from the fundamental structure of the settlement from the start.

The idea of science is that you make usable predictions before the calamity makes the crisis worse. This is not science. It is too late, and it is a half-hearted rationalisation to reconcile the economics with the status quo ante. They are now making some relevant points, but laced with the typical nervous lack of conviction of economics (presumably because of the ‘politics’ that economists protest is not part of their analysis), when exposed to demands for advice in the real world, before it is too late to help. I am so glad they are not handling the development of vaccines.

Agreed

It may be the subject of my National column this week…

Richard,

What you are saying in this article is factually and logically incorrect.

The act of issuing new debt increases the national debt. I hope we can agree on this at least.

Your argument is that the BoE buying that debt somehow cancels it or allows it to be netted off. This is clearly incorrect.

The BoE i still clearly exposed to both the capital and interest rate risks of the debt they hold, as evidenced by the profit and loss items for that debt in their accounts. Not withstanding that, when QE is eventually reversed – which seems imminent now – the debt will be sold back to the market or maturing debt will not be replaced. The debt the BoE holds still very much exists as a liability of the government.

Which then leads to another error you make. Selling the debt back to market doesn’t increase the national debt, in much the same way as the BoE buying it does not increase it.

If you subscribe to the idea that government can simply print ever increasing amounts of money to fund ever increasing amounts of spending with no economic risks then quite simply you are living in a fantasy world.

I disagree

There need be no interest rate risk on central bank reserve accounts – there is no reason to pay interest on them – a position widely argued

And what is the capital risk? This is money issued by the government – an instrument wholly different in its hands to that in anyone else’s

And if the debt is sold back that is purely nominal – it is no different to a new debt issue, which is exactly what it would be – hence my argument that this increases debt, because as a matter of fact it will

I do not subscribe to what you call the fantasy in your last para – no one who is responsible does. But tp pretend that money created by the government ids debt in its hands is a lie – and that is what you are promoting

Richard, please explain again why reversing QE increases the national debt. Or refer me to a past article because I simply cannot remember the argument.

If the national debt is cancelled by QE – and it is – then taking money out of the economy to create a new debt on which an interest obligation arises definitely increases the national debt

Any sale of a gilt does that

I am not sure why that is so hard to understand – except that it is so obvious that it repels the mind, like most things about money

A gilt is in effect a term deposit account with the Bank of England (I know in the UK it is legally with the Treasury, but the reality is the central bank and the treasury are simply two parts of one entity) while the commercial banks maintain current accounts (their Reserve Accounts) at the BoE. If a bank or a customer of the bank buys a gilt for say £100m then that will switch out of that bank’s reserve account and into a gilt, so the effect is that £100m moved from a current account to a time deposit account. The interest rate on the reserve accounts is as of last week 0.25% and on the gilt it will be more like 1%. If the Treasury repay a gilt then the £100 m simply switches out of the term deposit and back to the current account. Those reserve accounts of the banks are of course liabilities of the BoE and thus of the Treasury. So there is an asset switch but no effect on total liabilities. In accounting speak they switched to current liabilities instead of liabilities due after 1 year or more. There is a limit to how many gilts can be sold (other than to the BoE) which is the total of the funds available to buy them which is given by the total balances of the commercial bank reserve accounts. Those balances are determined by the difference between state spending (which increases the reserve balances) and taxation (which reduces the reserve balances). That makes it clear that the state has to run a deficit in order to increase the commercial bank reserve balances which are then available to buy gilts if the state wishes to sell them. So the state spends and runs a deficit which provides us with a surplus and thus savings which we can use to deposit with the state for safe keeping by buying a gilt. So the state is funding the private sector by running a deficit. The conventional view that the private sector funds the state by lending it money is thus exposed as the complete opposite of what is really happening.

Of course you are then into Richard’s big problem that the ability to save is highly skewed to the wealthy and wealth trickles up and not down. So you also need tax aimed at removing some of that wealth and re-circulating it via further spending.

Tim

I agree with the MMT logic that there is an asset swap going on when money is moved into and out of gilts.

I do not agree with your suggestion this does not change the total liabilities of the Treasury. It does.

You are wrong to assume that because a balance is a credit on a balance sheet it is a liability. For example, share capital is not, but it is most definitely a credit balance.

Nor is money liability for the government. Money is not the same as a gilt. It is not a liability, not least because there is no mechanism to repay the central bank reserve accounts except at the choice of the government, which makes them the weirdest form of liability that exists.

Richard

OK, I accept that. The reserve account balances are a technical accounting balance sheet credit but they are base money and there is no way to ‘repay’ them or clear them other than by just not having any money. What I was aiming at, I guess, was that the ‘National Debt’ isn’t like any normal debt. So I think continuing to use that terminology and demanding it ‘must be repaid’ and ‘what about the cost’ etc is completely erroneous framing that then allows the likes of Sunak to exploit that as an excuse for cutting the state. Maybe you could suggest some new terminology and definitions that we could then try to get people to adopt? It will be a slow process to change the mindset.

This a major project for me in the new year

I have the funding to really work on this

Here’s another depressing article “explaining” it:

https://www.bbc.co.uk/news/business-50504151

I don’t envy you your job Richard – good luck with dispelling as much nonsense as you can with the latest politically motivated twaddle.

There’s a big tranche of commentators who keep pushing the narrative that the government should be ashamed of the debts, as should we all I suppose. This shame narrative seems to be what prevents people making logical connections in their head.

How a government can really owe anyone else money when borrowing something they themselves created seems to be lost on almost everyone.

There is a lot to do

To me, the ‘National debt’ is just a record of what government has spent (as well as what it has not spent or should have). It’s investment in my view or/and the support for services on the back of promises that were made in the immediate post war era.

Reducing the national debt is actually a lowering of commitment to spend to support public services and commitments.

I do realise that Government also has peoples savings (which is an obligation to pay out plus some interest but not really debt) and can borrow other people’s money by issuing gilts and bonds for specific reasons etc.

‘National debt’ is a total misnomer. Bringing in interest rates too for example just adds to the confusion and lets Government bankers ape their private counterparts but for no good reason. Why would a Government want to charge interest essentially on itself, though am institution (BoE) it owns? Absurd. But also purely agnotological.

Now I admit that I may have got some of this wrong (long day at the orifice) , but it all points to the fact that it enables modern society and vested interests to disenfranchise Government from doing its job with the sovereign money IT invented and created.

Now how unfair and destructive is that I ask you?

You say “The equation is balanced by the fact that new money has been created by the Bank of England, which is then represented by deposit accounts held with it by the UK’s clearing banks. Collectively those clearing banks cannot reduce the balance on these central bank reserve accounts, as they are called.”

It’s not clear to me why the new money has to end up with the clearing bank deposits at the BoE. Does the money move directly from the government to the clearing banks? Or is it indirect, where the government spends the new money, which circulates around the economy and then inevitably ends up with the clearing banks who then have nowhere else to put it (which presumably means that the clearing bank deposits have roughly increased in a corresponding amount to new QE with some time lag)?

You say the clearing banks cannot collectively reduce the balance on these reserve accounts, but why is this? Are they compelled to not reduce it or do they just not have anywhere else to put it?

I presume there is no iron rule that the QE money must (A) end up with clearing banks and when it does (B) be held in reserve accounts at the BoE, so is this a good or bad thing, and if it’s a bad thing what can the government do to ensure the money either ends up in a more socially useful place than these reserve accounts at the BoE or is taxed (destroyed) before it gets there?

The money has to move from the Bank of England into the commercial banking system and that is why it has to go through into their accounts

Both sides are correct. The ONS is entitled to state their data as recorded, and others are entitled to note that if bonds are held on the balance sheet of the Bank of England they cease to exist from an economic point of view. Both sides of the debate are likely to use the data for their own purposes

I disagree

This data is I presented as it is to support austerity

That is not politically neutral, and it is wrong

There is no option to be neutral on this

‘This data is I presented as it is to support austerity’

This is what people need to get their heads around time and time again.

The motive is far from benign.

There must be some way of getting this debate into the wider public arena – Have been trying to engage some bits of the Labour Party – but not easy.

‘What is the true size of the National Debt’ – ought to get attention . Couldnt there be a virtual public conference – with BBC, FT et al commenting – bringing in IFS, RF, NEF, NIESR etc, Richard/Taxresearch etc.

If this isnt done soon the next election will be lost.

Labour is already wedded to ‘responsible’ spending – not increasing debt – so it has to be shown that there are some kinds of spending which don’t increase it, otherwise they are just tying themselves to austerity.

I will discuss this with others…..

I wonder whether some of this confusion & disagreements in this discussion are connected to a general confusion in the issue itself. That were trying to understand the macro economic elements re national debt QE BOE reserve accounts from a micro economic perspective eg a ( private sector )business wishes to invest/deposit with the govt. Both sides have the mirror-imaged double entry —debit (asset ) & credit (liability ).But thats micro. The govt is macro.– it can & does create money Were talking about different things & this perhaps affects our thinking.

and thats before we start trying to distinguish the roles of (individual ) commercial banks & BOE

I spent this morning in discussion on a book on this…..

That’s great Richard- it needs to cover for me the three most important questions- what is money? Where does it come from? How can it be used to create a fair and equitable society? I understand the core of MMT but reading Stephanie Kelton’s book is a difficult starting point as it’s not UK-centric. Then I get bogged down when discussing these issues with long in the tooth Labour (and Tory) supporters as I don’t have a clear enough picture of exactly what happens with the created money, where does it go, how is it used and it’s relation to national debt and taxation. My understanding needs ammunition to refute the oft- quoted tropes and memes so that the dis-believers either agree or retreat to their bunkers as they have other agendas….

That’s the aim, but it will be hard work

Alternatively, take a look at Merhling’s ‘Money View’; it emphasises double-entry, rejection of ‘equilibrium’ economics, quantity theory of money and focuses instead on liquidity (“(il)liquidity kills you quick”). The underlying problem is the ‘survival costraint’ and the matching of the time patterns of assets with the time pattern of liabilities to ensure liquidity at any given time. Mehrling is very deceptively, very gently, very seductively, radical.

I think there is a pretty long running , but unresolved debate and analysis (Krugman etc etc) about the Japan economy – they have been running a huge ‘debt’ for decades – much of it down to the central bank.

That could be a fruitful part of the proposed conference/book etc?

Yes….

Could this help?

http://www.progressivepulse.org/economics/seven-reasons-why-we-never-tax-and-spend

Thanks Peter

I’m still having some difficulty with this.

If, for example, the BofE were to buy up £1000 worth of gilts from a holder, then the holder would get the £1000 and the BoE would own the gilts. That’s why Richard says it’s an asset swap. But if the BoE then offers, either directly or indirectly by arrangement with a commercial bank, to guarantee that £1000 and also pay the same interest as the holder would have earned from the gilts, nothing much has changed.

The treasury still owes £1000 except it is to the BofE rather than the former holder. The BofE in turn owes £1000 to the former holder. So no net change there. There is still no net change if the effective interest (the yield of the gilts) the BoE receives from the Treasury is equal to the interest it pays out on the deposit account to the former holder.

All that is happening is the BofE is inserting itself unnecessarily into the chain. Combine the BoE with Treasury, as per MMT theory, and it is even more apparent that nothing has changed.

I have to admit that your suggestion that ‘nothing has changed’ when QE is used is hard to agree with.

What happens when QE is used is that quite a lot changes.

First, indisputably, new money is created.

Second, that money is used to buy gilts. They change hands.

Third, by increasing the demand for gilts the price of them rises.

Fourth, that increase in price makes it easier for the government to fund its deficit.

Fifth, this price increase reduces the interest rate in financial markets.

Sixth, financial institutions who have sold the gilts now have funds to invest in other assets, and there is ample evidence that they have done so.

Seventh, the gilts are now owned by the government. In its consolidated accounts they are shown as effectively cancelled, as is indeed the case.

Eighth, in their place there are balances on central bank reserve accounts held by clearing banks with the government. These represent new money. They are unavoidably created as a consequence of that new money being injected into the economy. They are not made at the choice of the banks themselves.

Ninth, those central bank reserve accounts (CBRAs) cannot be redeemed by the banks that hold them in total. They can only be transferred between them.

Tenth, whilst by convention BoE base rate has been paid on these CBRAs this is not a legal requirement. There are numerous proposals to pay low or no interest on these balances and break the link with base rate. Since all banks offer multiple interest rates there is no reason why this cannot be done.

Eleventh, to date the coast of the CBRAs has considerably reduced the overall cost of government borrowing.

Twelfth, unwinding this would have further major ramifications.

In that case how can you say nothing has changed? In reality the government has funded its deficit, the interest rate has been changed, asset profiles in portfolios have shifted and bank liquidity has been increased.

If that is not a change, what is?

@ Richard,

I can see how the intervention of the central bank into the market for gilts can force up their price. A higher price means lower yields and thus lower interest rates. However, now that they are ultra low I can’t see how it makes any difference.

I don’t know about anyone else but I really wouldn’t care in the slightest if the central bank paid me interest on a deposit account or the treasury the same effective interest on on held bonds. How would switching from one to the other change anyone’s behaviour? Anyone holding bonds can sell them almost as quick as withdrawing money from a deposit account if they do want to make a financial investment.

Isn’t what I’m arguing standard MMT theory?

I am not really sure what you are arguing

There are some in MMT who do just describe this as an asset swap

I would beware some who say they know MMT – in my experience there is quite a ,lot of nonsense said on the MMT side that is massively over-simplistic

@ Richard,

I’m trying to clarify the situation in my own mind rather than arguing. You yourself said in answer to Dr Rideout that “I agree with the MMT logic that there is an asset swap going on when money is moved into and out of gilts”

That seems to be obvious and I wouldn’t have thought it needed any MMT insight to see that.

The question is whether Dr Rideout is right when he says “So there is an asset switch but no effect on total liabilities.” or you are right when you say there is an asset switch which does have an effect.

I have explained that an asset swap (and fir the record. All transactions are both asset and liability swaps – double entry requires it) has major ramifications

I am not sure what I can add

I do not agree with Tim if he was saying this is neutral, but I am not sure he is

This has been an interesting discussion on an important post. Mostly, as a regular reader of your blog, I think I understand government finance but do at times worry about the logic. I think I see one of the issues (which may be what Rob Gray is also trying to point out): the tools we have to interpret government accounts – and they need to be interpretable as part of government transparency – are the accounting tools used to analyse the accounts of businesses or for that matter households. If expenditure isn’t balanced by income we expect a balance sheet item to record that, which government using its fiat power to create money doesn’t provide.

You are in a rare position on this, being both an accountant and a political economist as well as academic. I hope a future blog can suggest a framework outlining how government accounts can be created that allow sums to be reconciled at the same time as recognising their special macro-economic powers.

Or even a book?

See my post this morning?

I see that the Professor of Political Economy at Sheffield has written an article very critical of the Chancellor (as a kind of Conservative Iago), in the Guardian, titled, “In an act of brazen treachery, Rishi Sunak is sabotaging Boris Johnson’s policies” (22nd December); but in the article Jacobs makes this remark; ” It is true that, at 95% of national income, the UK’s debt is much higher than it used to be”. Jacobs is not concerned, however; but not because of QE, but because of the historically low interest rates. Surprisingly, he does not challenge the 95%, or mention QE. As Mr Parry says, the point needs to be made, over and over ….

Oops, I missed Mr Parr picking the Jacobs article already. my comment is redundant.

Not at all…