Much of my criticism of the Budget has focused on the reliance it places on wildly optimistic economic forecasts. In that case it is worth looking at the track record of the OBR as a forecaster.

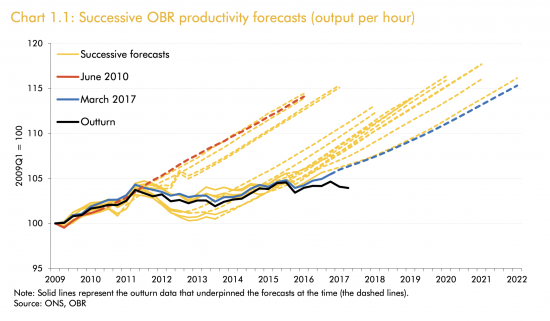

They did this themselves in 2017. That document included this chart:

Since it is productivity growth that drives much of the OBR growth forecasts this staggering record of over-optimism is significant.

The simple fact is that the Office for Budget Responsibility is not what it claims. It is not independent. It is not even an office; it is a unit in the Treasury. And it is not objective; it supplies the forecasts a Chancellor wants.

Yesterday the Chancellor wanted growth to make his claims work. That is what the OBR delivered. But their spreadsheet is not reality. Only Sunak thinks it is. All Chancellors do until the cold leather of the backbenches reminds them how unwise they were to believe the promises made by the geeks with a supposed forecasting tool that actually delivered numbers on demand.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I was about to ask if you thought the OBR was independent and now we have the answer. I fear the same about the proposal for “fiscal referees” – if it ever came about. Although there is much to commend in the report it would be too easily captured by the treasury and filled with their compliant “usual suspects”.

Getting a truly independent OBR or “Referees” is a conundrum like PR. Neither are in the interests of either of the parties likely to be in power to do anything about changing the status quo. So they won’t because they prefer capturing power and “evidence” to independent thinking.

Who believes that the Bank of England or the Office for Budget responsibility are independent? I wonder who this ruse is aimed at – the average person on the street is unaware of the attempted chicanery of independence, I am reasonably engaged but I have completely dismissed the claims of independence of both institutions, so who do they attempt to fool? Papers? Other countries? The few that are politically engaged?

I know Richard has already covered this, but the legislation makes for fascinating readings.

-Section 19 of the Bank of England Act 1998, the same Act of Parliament that ostensibly gave the bank its independence, covers the Treasury’s reserve powers on setting Monetary Policy. Subsection 1 states that the Treasury may give directions to the Bank on setting monetary policy if, during times of extreme economic crisis, it’s satisfied it’s in the public interest to do so.

-Section 4 of the Bank of England Act 1946, the same Act of Parliament that nationalised the bank and is still in force, also covers the Treasury’s reserve powers. Again, Subsection 1 states that the Treasury may give directions to the bank if it’s satisfied it’s in the public interest to do so.

-Sections 13 and 15 of the Exchequer and Audit Departments Act 1866 cover expenditure authorised by Parliament. Section 13 covers standing services, which is any expenditure that’s been permanently authorised by Parliament, Section 15 covers supply services, which is any expenditure that needs to be voted through via a Supply and Appropriations Bill. Subsection 3 in both of those sections state that once any expenditure that falls under either of these categories is approved by Parliament, the Bank is to carry out that expenditure. This isn’t some law that was written centuries ago and forgotten about; it was updated as recently as 2000.

-The Bank of England’s own website even also says it’s wholly owned by the government and has been since 1946 since it was nationalised and the Treasury became the sole shareholder. The same page, called ‘Who Owns the Bank of England’, also states that it’s just free from political interference during day-to-day operations, but that the government still sets the target rate for inflation, it still appoints the Monetary Policy Committee, its senior policymakers and its governor.

Anyone who buys into the independence myth needs to read into things a bit more than what a smartly-dressed man on the tele in a suit and tie and plummy accent tells them. What it means for them is ‘You have the independence to do whatever we tell you to do to in however you want to go about doing it. But even then, we can even tell you how to do it as well, if we decide it’s a matter of public interest to do so.’.

Agreed

Thank you

Past history is a good guide to future performance. When I look at plans, wildly enthusiastic forecasts should always be treated with the utmost suspicion.

Boosterism, the sole contribution of Johnson to political discourse, now appears to be central to government thinking. Garbage in, garbage out.

One of Government’s “useful fictions.”

Apart from the fact that the pursuit of continuous economic growth (of the sort that Tories want) is destroying the planet with the emphasis on advertising pressure for greater and greater consumption, OBR wishes for “greater productivity” means lowering the cost of labour input per unit of production with the consequence of either loss of jobs for workers or wage reduction and lowering of already awful working conditions in many sectors such as lorry driving, food delivery, warehousing etc. As previous OBR economic predictions have mostly been wrong, Sunak has no plan B for this almost certain eventuality of lower productivity, increased unemployment more inflation more “supply chain” hold-ups Brexit mess, fishing……………..

>OBR wishes for “greater productivity” means lowering the cost of labour input per unit of production with the consequence of either loss of jobs for workers or wage reduction

That implies that there are some people who are working more than they demand work in return. For growth to be sustained everything you produce must be consumed. However, if you don’t intend to consume things you produce the machines allow you to work less. However, people who are satisfied with their economic situation don’t work less. Especially the super rich just start working harder which consolidates earning opportunities with those who do not want the earnings.

The problem here isn’t the increase in productivity. It’s that full time employment is a fairy tale of busy work and people do not want to share work. The problem isn’t that we are running out of jobs. It’s that machines let us work less but our protestant work ethic makes us work more. This is what concentrates jobs among fewer people. We want to eat 10 apple pies and it takes 10 people to make them. Then a kitchen appliance makes us 20% more productive. Every person can work 20% less and then nobody is unemployed. Alternatively you allocate pie baking to entire people which inevitably means only 8 people bake apple pies and 2 people do nothing. There is a problem with this arrangement. The 8 bakers do not want to give their extra 2 pies to the unemployed. It’s bizarre. They don’t want the pies yet they don’t want to give them away either. Instead the usual answer is “growth”. Just bake 12 pies and all 10 people get to work. That is the source of consumerism.

‘the cold leather of the backbenches’, fantastic.

Thank you

It is always cold. No one wants to sit there.

The Dispatch Box is always warm. Someone always sits there.

“But the[OBR] spreadsheet is not reality. Only Sunak thinks it is. ”

Does he ? ….or is he just pretending to believe it ? Because as PSR observes, elsewhere, the budget is not economic it’s political.

I haven’t (of course) read the whole thing, but what I have read is shot through with caveats to the optimistic predictions which both OBR and Sunak appear to ignore with the rosiest tinted spectacles.

OK, maybe I am being over optimistic now

Reading the drivel that passes for economic analysis in the Guardian today, listening to Starmer talking about the broadest shoulders bearing the greatest burden while ruling out a wealth tax and reading Rachel Reeves waxing lyrical two days ago about tax injustice while carefully observing the prohibition on wealth tax, I am feeling profoundly grateful to have regular access to the analytical discussions on this site. Perhaps THE most depressing aspect is that public discussion is dominated by the “independent “ Bank of England and the equally independent OBR, plus the “expert” guidance of the Treasury, all which sources appear to enjoy a more or less uncritical reverence by public and media. I look in vain for hints of opposition and counter arguments from either the Libdems or Greens. UK politics has truly entered its very own Dark Age.

Do I understand correctly that the graph was published in 2017? Is there a more recent version?

Would it still show the “porcupine” of expecting reversion to the pre-2011 trend, or have the OBR accepted that we might bump along the bottom?

And how does it tie in with the graphs at https://obr.uk/forecasts-in-depth/the-economy-forecast/real-gdp-growth/ ?

You are right, this chart does date from 2017. I do not think it has been updated since then. I have not had time to look at your other chart.

Oh, this is from their Forecast Evaluation Report. See page 6, here – https://obr.uk/docs/dlm_uploads/Forecast-Evaluation-Report-2017_Web-Accessible.pdf – accompanied by the explanation: “Our rationale for basing successive forecasts on an assumed pick-up in prospective productivity growth has been that the post-crisis period of weakness was likely to reflect a combination of temporary, albeit persistent, influences. And as those factors waned, so it seemed likely that productivity growth would return towards its long-run historical average.”

They go on to say, “While we continue to believe that there will be some recovery from the very weak productivity performance of recent years, the continued disappointing outturns, together with the likelihood that heightened uncertainty will continue to weigh on investment, means that we anticipate significantly reducing our assumption for potential . productivity growth over the next five years…”

So how did that turn out?

There is a graph in the December 2018 report, page 30, which shows the familiar over-optimism, with the comment at paragraph 2.36: “productivity has fallen well short of our recent forecasts on both the output-per-hour and output-per-worker measures (Chart 2.10). ”

They seem to have stopped publishing a graph by December 2019, when they said, at paragraph 2.25: “Productivity has performed much worse than in our November 2016 forecast, having risen only 1.5 per cent since mid-2016.” (that was against a forecast of 6.4%)

And here is the latest from January 2021, when they commented at paragraph 2.10: “Growth in hourly productivity was just 0.2 per cent in 2019-20, even weaker than the lacklustre 0.9 per cent we forecast at both March 2018 and March 2019. This weakness more than offset the stronger employment growth, consistent with downside surprise in real GDP growth. We had expected steady productivity growth of around 0.2 per cent a quarter over 2019-20.” They are talking there about the pre-pandemic period.

See: https://obr.uk/fer/forecast-evaluation-report-january-2021/

Despite admitting four years ago that they keep getting it wrong … they still keep getting it wrong, like a gambler expecting their luck to turn.

You know what Einstein said about keeping on doing the same wrong thing? Thanks for that….

Why are all the starting curves for each projection different to the outturn curve? Are the historical numbers revised and the curves are showing the numbers at the point the prediction was made?

The projections are made at different times

Sure, but doesn’t that mean the shared historical data should be the same?

I am not sure I am following…and this is not my chart – and you are asking about a point not relevant to my argument or theirs

I’m just trying to understand what the chart is showing. My understanding is the solid line is the historical data and the dashed line is the forecast. Is that right? If so, I would have expected the solid lines to be all on top of each other, but they aren’t.

Data is rewritten. in retrospect in nati0nal accounting…

That is why it can be inherently unreliable for analysis

Isn’t it clear from these graphs that it is Tory policies of moving wealth out of the productive real economy and into assets owned by the grotesquely rich that is preventing growth in the real economy? Even after the Great Recession Labour had returned the economy to growth before the Tory-led coalition. Once the Tories austerity policies kicked in – which haven’t been reversed yet, only exacerbated by a decade of underfunding – the growth stopped and in fact reversed, that’s why George Osborne was nick-named “double-dip”, after narrowly avoiding a double-dip recession on a technicality.

So will the Office for Budgetary Responsibility ever get their forecasts right? Probably not while the Tories are in charge of fiscal policy and government investiment. They never understand that government spending is an investment, a stimulus that drives the private sector and encourages it to grow. This is lesson the Tories failed to learn during their unnecessary austerity – hence, why they still haven’t truly reversed these policies. Not increasing wages and benefit payments with inflation – by not tackling the gig economy and zero hour contracts, and not considering carers and the disabled living off benefits (despite Sajid Javid wanting people to give up their jobs to care for their family) – shows that they do not want to increase people’s wages despite Boris’ rhetoric about levelling up and creating a high-wage high-skilled economy.

Given this I believe Rishi Sunak knows that the forecasts are fictional. Fictional forecasts are part of their play book: they can force people into debt to try to create growth, even though more are borrowing just to survive the week, at the same time as justifying the next round of austerity due to lack of growth. And so the lie continues: growth cannot happen while the government fails to invest to redistribute wealth (requiring increased taxation on the rich), but austerity is imposed to reduce government spending to “balance the books”. But history tells us that government debt is reduced when the government invests in jobs and infrastructure, eduction and health, but grows when the government stops this investment to concentrate wealth among the rich, by erroneously using tax cuts as a form of government stimulus.

I think your opening analysis is fair and all else follows from it

The worked I have done on hollowed-out firms suggests nothing has changed and much has got worse over the last decade

My thanks to Andrew who is clearly quicker at reading than I am, and who has produced a more lucid summary than the note I was preparing. For the avoidance of error, Andrew is absolutely right about the underlying optimisn that pervades their forecasting approach – along with, as Richard Murphy implied, a world view that doesn’t recognise the importance of government spending:.

Though Richard Murphy also stresssed an implied acceptance of large scale government spending – I am less convinced about this, seeing more than an attempt at window dressing and no long-term commitment (to combating climate change, but also for instance to taking the NHS seriously and not as something to be privatized more or less stealthily).