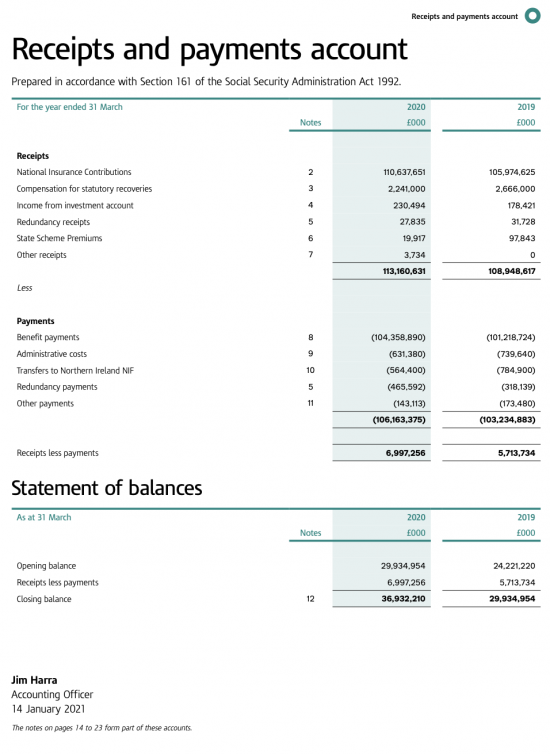

It seems to be little known that there is a thing called the National Insurance Fund within UK government accounts. This is what the accounts of that fund say:

The fund accounts are certified as true and fair by the Comptroller and Auditor General, who charged £136,000 for doing so. This is despite the fact that the accounts note that:

For reasons that are not glaringly obvious it seems that around 19% of NIC contributions are paid to the NHS. Why the accounts are true and fair without this being shown is very hard to work out.

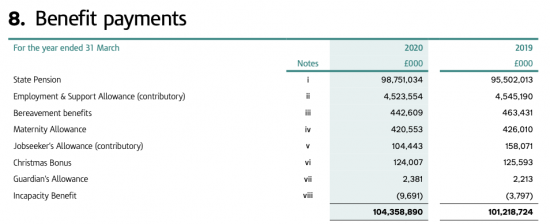

This, however, is not my concern today. That concern relates to pensions. As note 8 to the accounts makes clear this is what this fund is really all about:

What is also clear is that more is being paid into this fund than is required at present to pay pensions. There is at present a surplus of £36.9 billion on the fund account. Under the provisions of the Social Security Administration Act 1992 this surplus has to be identified and the use of these funds is ring-fenced.

Right now though the government is seeking to pass a Bill that will reduce state pensions by reducing the triple lock that has been in place since 2010, which provides that a pension increase in any year is the highest of:

- Average earnings

- Prices, as measured by the Consumer Prices Index (CPI)

- 2.5 per cent

Average earnings rose exceptionally in the last year. That was the consequence of the ending of furlough. As a result, the government want to suspend the triple lock. This is despite the fact that the UK state pension is just £9,350 a year. However, only four out of 10 retirees receives that sum. 2.1 million pensioners receive less than £100 a week in state pension, most of whom are women. The actual average state pension is £8,000 a year or roughly 25% of average earnings. This is the lowest among industrialised nations, with the average being around 60% in OECD countries.

Maintaining the triple lock would cost roughly £5 billion. There is £37 billion in the National Insurance Fund to cover not just that payment, but also the payment due for many years to come, and by continuing with the operation of this fund parliament acknowledges that the funds for this purpose are already set aside for it.

So why is the government refusing to pay what is due under the triple lock? Do we really want to remain at the bottom of the state pension pile and leave millions in poverty as a result? It would seem so.

Instead of paying what is literally due to pensioners, it is lending their pension fund, such as it is, to the Treasury to reduce the national debt. I am sure that they are delighted about that.

I am not. This is economic callousness in action.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Tories are callous. Simple as.

It’s typical snakes and ladders finance policy by the Tories.

None of what I have read here makes sense.

Low pension payments mean less disposable income which is disaster waiting to happen if economic conditions become harsh – there’s less resilience in households to cope; if people do not have money to spend ,where’s the economy without income? Where’s the tax? Where’s the health? Where are the housing standards?

As well as being callous, it’s all stupid, stupid and stupid – blind ideology yet again.

Forensic, excellent and due diligence.

Where is the opposition? What do Labour researchers do all week?

Ask them, because I do not know

is that why we came out of the EU? because we would have to bring our pensions up to EU standards…do not expect Labour to sort it out…too many RED Tory’s on that side.

Don’t worry, Richard. I have forwarded this to the Mail and Express editors. When it is published in full tomorrow, you can expect an assault on Parliament by the grey battalions by Saturday at the latest. The Tories are history, thanks to facts and you. I am recalling the film, “If”!

The National Insurance Fund is a nonsense, as it is operated similarly to the Bank of England Asset Purchase Facility Fund Limited (which gives all its profits to the Treasury in return for having any losses indemnified by the Treasury). Any surplus in the “fund” is “invested” in gilts (that is, the government lends the money to itself and uses it for other purposes). Any deficit is covered by a government top-up.

The NHS allocation has been around for a long time. It is a peculiar form of hypothecation, but it only accounts for about 20% of NHS funding. After a tiny contribution from prescription charges and parking fees and the like, the bulk comes from general taxation.

The current government’s “health and social care levy” is following in the footsteps of Gordon Brown, who found a convenient and relatively popular way to top up NHS funding without annoying taxpayers too much when he increased NICs by 1% in 2003.

It may be nonsense but it is also legal fact

It is as much a legal fact as the gilts held by the Bank of England Asset Purchase Facility Fund Limited. Sure, it exists, and it could and should be used, but there is no idle pot of gold.

But there is a ring fenced reserve

Refusing to use that fir the reason it was created when the money to do so can be created at will is the issue

Ignore the ‘money’ – look at what it means. That is all a set of accounts ever means after all – the figures are always simple entries in ledgers, not a physical reality. The art is deciding what they mean

In this case they mean there is money that should be spent on pensions and is not being so

Oh, for sure, breaking this manifesto commitment (page 16 in the 2019 Conservative menifesto – “We will keep the triple lock”) is a political choice. Oh, sorry, pensioners. You are shafted.

Just like the political choice to increase tax on employment and self-employment (also a manifesto commitment, on the second page, “My Guarantee: … We will not raise the rate of income tax, VAT or National Insurance” and on page 15 “We promise not to raise the rates of income tax, National Insurance or VAT. This is a tax guarantee that will protect the incomes of hard-working families across the next Parliament.”) Oh, sorry, “hard-working families”. You are shafted too. (As are all the other taxpayers who are either work-shy or not in families or both – but not those in receipt of investment interest or rent or capital gains: they are our friends.)

Or to cut back Universal Credit. Again, shafted.

Agreed

But that is why opposition is required

My note is a small part of that….more later to explain that

Well, at least we know the government’s priorities.

Alongside lower pensions, and reduced social security benefits, and increased taxes on earnings, we have cuts in tax on shipping, domestic air travel, and alcohol.

At least the UT taper will be cut back to the 55% originally proposed back in 2012, along with an acknowledgment that the taper is “a tax on work. And a high rate of tax at that.”

It may be cut back from 63% to 55%, but this “tax on working people” – the 5 million or so least able to pay – will still be higher than the 45% additional rate of income tax for the 400,000 or so earning over £150,000.

Perhaps they should all flee to tax havens…..

That’s what the rich claim they would do in the face of this

I believe the NIF does have a balance but it is just a number, totally internal to government, it is not £ that you or me can spend. All surplus is passed to the DMA and recorded and the funds sent out into the baking system, keeping the DMA balance at zero. When an NIF payment s to be made it draws on the DMA which has recourse on the CF, hay presto, government spending the same way all government spending is carried out.

You miss the point – the fund exists. It has a surplus. That surplus could be used for the purpose for which the fund exists. It is not being so. Change the law if you want to use it as a pot. Otherwise, use it as required. But do not do this. That is the point. You are simply bending yourself to their ways and so let them get away with the abuse of pensioners.

The government don’t realise that they are shooting themselves in the foot by targeting pensioners – their main pillar of support, let alone the reimposition of the TV licence fee for the 75+s

A great many pensioners saw the way the wind was blowing years ago and became landlords.

The refrain I hear all around is “they are doing the best they can” (the thought that they could do worse is worrying). This continuing level of support means that they can do whatever comes into their heads, without electoral damage.

I would argue that the pension settlement comes under the wonderful heading of being “fiscally responsible” which is a very popular concept, and sells well amongst Tory voters.

Look at the 50’s born women . Majority struggling with ill health, working , caring for elderly parents and grandchildren. Contrary to belief they are exhausted, desperate for help and ignored by the majority. Until you live this life you cannot understand how these women are suffering. These women’s SPA not phased in they were hit with the full force of 6 year increase. Government had no need to inform them of state pension changes by mailing them. Many of these women are existing, is this how we treat our older generations ? Until women’s rights CEDAW is action women will never have a voice that is heard.

I am aware….

Womens SPA was set at 60 after WW2 following representations by womens organisations pointing out that many working single women of that age would have caring responsibilities and needed to be able to stop work.

Interestingly enough although my Grandfather was a Reckitts rep the expectation was that my mother would have stayed at home when she left school to help her mother run the house. Fortunately WW2 meant she went out to work.

I have quoted parts of your article and linked it on the Gransnet Forum (part of the Mumsnet family). I hope that is okay. You have followers on there who try to explain MMT; this is actually probably easier for most to understand.

We have (thanks to Gransnet HQ) just been given an area where we can help one another know what benefits they can get if they or their family members are on low income – especially those of pensionable age. Obviously, those whose pension is all or mainly State Pension will be hit the most by the drop of the Triple Lock.

You are very welcome! Thank you.