As I noted earlier today HMRC published their tax gap data for 2020 this morning. I have been distracted all day by other demands, but have now had a chance to look at the data and methodology.

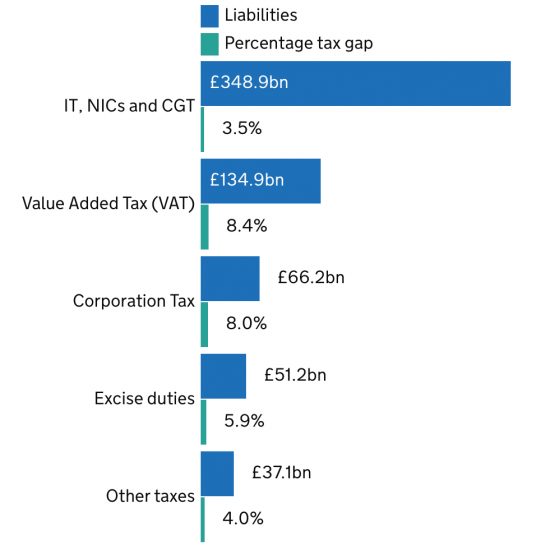

The latter remains flawed, still working in the case of all taxes but VAT on what is called a ‘bottom up' basis. This means that the estimate is, in effect, an extrapolation of errors in submitted tax returns. That this method does not work is obvious. This chart shows the various gaps:

Note the VAT gap is biggest. 8.4% of that tax is lost - which means that at least that much turnover is not recorded in the UK. If that is the case then every other tax gap must logically be as big because as an accounting fact that missing turnover can never reappear in accounts, and that income should have been subject to other taxes when extracted from the business that suppresses the income. So, logically, the income tax gap must be at least as big as the VAT, and very clearly it is not. So, the estimate is understated, I am certain.

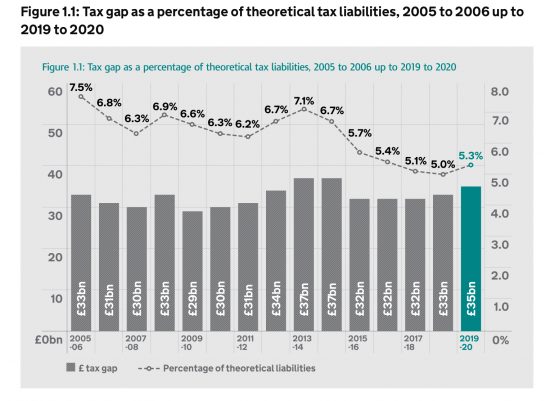

I note another trend. It is that the gap has gone up:

The VAT gap increased this year, as did the overall gap. This is despite the claim that Making Tax Digital - which I have always opposed because it places far too much burden on taxpayers - would reduce errors. It has not. That system has failed then.

To that extent this tax gap measure is proving that HMRC is failing, but so too does the whole failure of this process - which bizarrely always produces a near identical numeric result. I acknowledge that HMRC at least does tax gaps. But it would be so good if it tried to do them properly, and matched them with tax spillover analyses to explain why they arise. Then they might be useful. At present they are insufficiently credible to be so. And that's really disappointing when this tool could add so much value in the battle against tax abuse.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

“If that is the case then every other tax gap must logically be as big ”

That’s just nonsense. The vast majority of income tax is collected through PAYE and has nothing to do with turnover. Independent research by the OECD has demonstrated that operational experience shows that tax regimes such as pay-as-you-earn that withhold tax at source have far far smaller tax gaps than other types. You managed to add £30bn to your tax gap figure by assuming the same tax gap for PAYE as for VAT, which is just ridiculous.

Your estimated of the tax gap also included £28bn owed to HMRC despite that just being the amount owed on a particular date and £25bn of that was subsequently collected.

I suppose you think that if you just keep repeating your claims, despite not bothering to admit such obvious and glaring errors, your numbers will float around and be accepted by the ignorant. The sort of nonsense adopted by Andrew Wakefield on autism. Like him, you are discredited among anyone with any proper knowledge on the subject.

You mean you think there are no employees paid out of the till – many of them family members?

Naïveté can very definitely be the enemy of the good

Well the OECD is the one that’s done worldwide research and come to that conclusion on payroll taxes. What research have you done other than pluck figures out of thin air and double them for luck? And of course the IMF have endorsed HMRC’s methodology and figures. Who has endorsed yours?

You think £30bn a year in income tax goes missing because family member employees are being “paid out of the till”? Given the percentage of employees employed by the government, local authorities or large employers that’s some pretty rampant evasion going on by family owned companies. Laughable. Or maybe you think the NHS does the same.

The IMF did not endorse HMRC’s figures

They said they should do top down as well to check that they were reasonable, as I ask

In other words, you really do not know what you are talking about. I know because I read the report.

Don’t waste my time again

Frank Kinsella. If you think the NHS gets its payroll taxes right you have a double dose of naïveté. There are all kinds of scams going on, encouraged by Government efforts to privatise aspects of the service and limit training their own staff to do the work. This results in dodgy practices with recruited workers that would shock the public if they realised what was going on.

It seems that HMRC does not have the staff to do a full check on company accounts to find out whether the number of employees is correct or the declared turnover. There is an assumption that the black or shadow sector is around 8% but in the past, I think I can remember some commentators thought it was as high as 15%.

I’ve always wondered about Making Tax Difficult. The sole public, overt, justification seems to be reduction of human error, but within its current scope it’s a huge hammer to crack a tiny nut – it could only have any effect at the simplest, least error-prone step, easily verifiable step in a potentially long and complex trail of transactions. So what’s it really for ? Is it just another ‘We must do something. This is something. Lets do this’ ? Someone’s pet wheeze that’s still running because it’s got ‘digital’ on the label ? I have speculated that it’s the thin end of a wedge to allow government backdoor access to everyone’s full accounting records, and a bit of carefully applied mission creep could make that plausible. OTOH, someone I know who ought to know reckons that to be a bit beyond HMRC.