I have been asked how much additional national insurance might be due in the UK as a whole in each year if all earnings were subject to the current 12% national insurance rate due by employees on all earnings up to £50,284 in the tax year 2021/22, above which sum just 2% is due at present. I have estimated that sum to be at least £14 billion, and in this blog explain the workings.

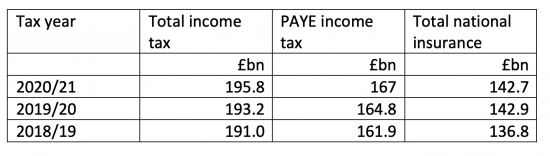

According to HMRC[1] the following income tax and national insurance has been paid over the last three complete tax years, with the income tax paid by PAYE total being included in the total income tax figure:

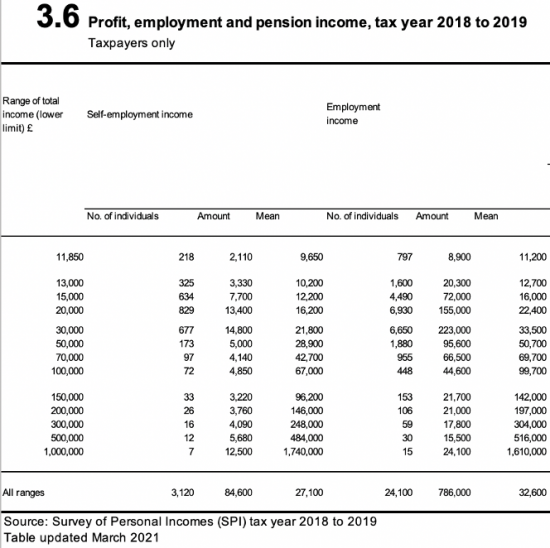

The latest year for which reliable tax distribution statistics are available is 2018/19[2]. HMRC statistics table 3.6 for that year shows the following data:

The current analysis applies to employment income alone, with self-employment being largely ignored.

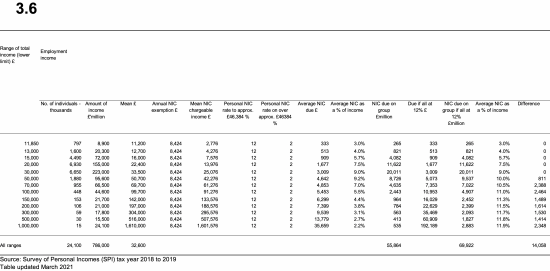

In 2018/19 the approximate annual national insurance exemption (and I have to approximate here because of the way in which NIC works) was £8,424 a year[3]. The threshold at which the rate fell to 2% was £46,384 a year. Using this data the following can be estimated:

A larger version of this image can be found here.

There are approximations in here: I accept that. None is, I think, material. Some paying NIC are not in the calculation, for example; they do not have taxable income. The consequence of multiple employments is ignored. It is assumed income is spread evenly during a year. The income means noted can only be approximations, but have been used to calculate NIC charges for bands and that can only be an approximation. It is assumed that there is no behavioural change, but I am not sure there would be, so do not think that is significant.

Overall, the total estimated NIC due for employees at £55.9 billion would be significantly lower than that due by employers, which would be payable at 13.8% across all income levels. That liability is likely to be close to £80 billion. The two together allow for less than £10 billion of NIC to be paid by the self-employed: this is likely given the lower rates at which they make payment and their average much lower incomes than employees. The overall calculations make sense as a result: the estimate is credible.

As a consequence, some conclusions can be drawn.

The first is that whilst NIC looks to be mildly progressive as a result of the basic income exemption to the threshold at which it stops being charged at 12% it rapidly becomes regressive thereafter and as such can be considered regressive overall, especially when other exceptions from the charge are considered. Anyone claiming otherwise is not properly representing the data.

Second, if the cap on income at which the 12% employee NIC rate was due was removed approximately £14 billion more in NIC could be collected a year.

Third, if you only wanted £10 billion more you could remove the cap for those earning over £100,000 if you charged them at 12% on all their income.

Fourth, if you only wanted £5 billion more you could remove the cap for those earning over £300,000 if you charged them at 12% on all their income.

I stress the numbers are approximate: HM Treasury could clearly finesse them, but within the parameters of published data they provide fair approximations in my opinion.

What the data does show is that the capacity to charge the highest income earners to more national insurance is readily available if sums of up to £10 billion a year are required to pay for additional social care. In addition, there need be no additional charge on those earning less than £50,000 a year.

Given that the government must know this the question to ask is why are they charging additional NIC right across the income range instead of making the charge a progressive tax, as it should be, across all income ranges, which mp0ve would more than meet their income needs?

Notes

[1] https://www.gov.uk/government/statistics/hmrc-tax-and-nics-receipts-for-the-uk

[2] https://www.gov.uk/government/collections/personal-income-by-tax-year

[3] https://www.gov.uk/government/publications/rates-and-allowances-national-insurance-contributions/rates-and-allowances-national-insurance-contributions

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Thanks, that is important to know. It seems to me that the fiction that NI funds welfare does mean that increasing the NI take is the most politically acceptable way of raising government money for social care (assuming it is needed, which needs another of your informative calculations). But it needs to be done in ways which makes NI less regressive, as I have argued on your blog previously, and equalising the rate for the higher tax bands is one of those.

Given that NI is basically just part of taxation, it could also be further extended to cover pension income (possibly with a different threshold) and non-salary income (such as dividends and bank interest).

[…] on the analysis I have done of the additional national insurance that might be due if the rate cap a… I have done two charts showing average NIC due by employees in their earnings, each based on data […]

Are you able to deduce what flat rate of NI across the board would raise as much as the currently touted increase? I’ve if everybody paid 8% on all earnings would that raise the same amount as the current regime +1%?

There is absolutely no desirable reason for that as a policy so I have no interest in calculating it

I agree the best way to pay for Social Care is to abolish the NI upper threshold we must also increase the NI lower threshold till it matches the income tax allowance. Completely unfair that this allowance has been frozen but while it is this gives the opportunity to increase the NI lower threshold over the next few years till it is equal to the tax allowance taking the low paid out of tax and NI altogether.

The best way for the government to fund increased spending on social care (and the NHS and anything else) is for the government to create the money that is needed.

If this results in too much money being created, a reasonable and non-regressive way for the government to withdraw money from circulation is to remove the cap on both Class 4 and Primary Class 1 NI contributions.

It would also be logical and symmetrical to impose Primary and Secondary Class 1 NI contributions on an employer’s contributions into an employee’s pension scheme.

This really is a no-brainer if you believe in a tax system that is less unfair but it’s hard to imagine this government (or any Tory government) doing it.

The phasing out of personal allowances between £100k and £125k already results in a 60% tax bracket for people with income in that range, so including NICs on top would create a very high marginal rate of taxation for people in that bracket.

I have never supported that allowance removal

[…] 12% rate of NIC on monthly incomes above £4,189, it could have raised £14bn a year. By taxing dividends at the same rate as earned income, another £5bn a […]

[…] tax rise is designed to hit the poorest the most, as a person earning an average wage of £30,000 ($41,300) pays 9% of their wages in NIC, a person earning £300,000 only pays 3% of their income in NIC. Just equalising the rate to 12% […]