I have this morning published a new report that considers the appropriateness of the claims made in the Tax Justice Network's (TJN) State of Tax Justice (SOTJ) report issued last November.

My report has a simple aim: it considers whether that TJN report lives up to its claim that ‘it is the first piece of research to present comprehensive estimates of the huge sums of tax each country in the world loses every year to corporate and private tax abuse — and what this means in terms of countries' health spending.'

The SOTJ claim as evidence is that:

[T]he world is losing over $427 billion (USD) in tax a year to international tax abuse. Of the $427 billion, nearly $245 billion is lost to multinational corporations shifting profit into tax havens in order to underreport how much profit they actually made in the countries where they do business and consequently pay less tax than they should. The remaining $182 billion is lost to wealthy individuals hiding undeclared assets and incomes offshore, beyond the reach of the law.

These claims are suggested to indicate ‘the state of tax justice'.

Regrettably, the claim made cannot be substantiated. My full report has to be read to substantiate the whole range of issues that arise, there are so many of them. This blog post simply summarises some of the more obvious failings that I have noted.

Overstated claims

Of the two claims made as to the cost of tax abuse in each year only one has been investigated. For now, it has been accepted that the claim that $245 billion is lost to multinational company tax abuse each year may be reasonable. The same cannot, unfortunately, be said to be true of the claim that $182 billion is lost to abuse by wealthy individuals.

Firstly, that is because the data used for the purpose of this analysis came from the Bank for International Settlements (BIS) and relates to the balances on bank accounts held by both individuals and corporations by country. TJN, unfortunately, ignores that there are many good reasons why some companies e.g. reinsurers, might hold substantial cash balances offshore. They also ignore that some multinational corporations also run treasury functions from offshore for ease of regulation and not to avoid tax. Instead, they seem to assume that all the balances recorded by the BIS in tax havens relate to individuals. That is wrong.

Second, TJN calculates 'excess bank deposits' by country in proportion to GDP as an indication of tax haven activity. It assumes all such excess deposits are subject to tax abuse and are undeclared for tax purposes. That is bound to be wrong. First, that is because multinational corporations are very likely to declare their deposits as well as the income arising on them. Very often that declaration will be in a country where tax is due, and not in the tax haven itself. There are many cases of companies registered in tax havens but actually tax resident in places like the UK. TJN has not allowed for this. And given that this is supposed to be a Sateg of Tax Justice Report for 2020, TJN's assumption that the impact of automatic information exchange from tax havens has had no impact on disclosure by those holding balances in tax havens appears to be very strange. In fact, that is bound to be wrong. Even if the base data used is for 2018, automatic information exchange from tax havens will have had an impact on taxpayer behaviour by then: many of these balances may well have been disclosed to tax authorities. To assume otherwise presumes that the TJN's own campaign for automatic information exchange has not worked, which is unusual, to say the least. I suspect the TJN assumption as to the proportion of undeclared balances is seriously incorrect in that case.

But the wildest assumption is in the methodology note, where it is said that:

Following Zucman (2015), we assume that investments made in secrecy jurisdictions yield an average of a 5 per cent return.

The trouble is that Zucman was considering investments, and TJN is specifically considering cash deposits. I did a little research on cash deposit rates in tax havens. In 2020 Barclays in the Channel Islands were offering 0.05% on US$5 million deposits, nothing on sterling deposits, however big, and nothing on euro deposits. I agree that rates had been higher in the past but the idea that cash earned 5% offshore when bank base rates have been close to zero in the last decade is somewhat surprising. Dollar accounts might have reached 1.5% at one time, but that was exceptional.

Considering these issues in combination, it is very likely that the tax loss claimed for personal tax evasion of the type appraised within the SOTJ is seriously overstated. Precise determination of that degree of overestimation is hard, but given that a 1% rate of return on offshore bank deposits might have been difficult to secure during much of the period being considered, and given that it is likely that a significant part of the income made offshore is now being declared by those with the benefit of it in the places that they are resident, the TJN claim may well be between five and ten times the likely sum actually lost. In other words, the tax evasion that they claim to exist in the sum of $182 billion per annum may actually be no more than $18 billion per annum and is very unlikely to exceed £36 billion per annum. The overall scale of overstatement of tax lost is likely to be not less than 34% as a result.

Tax gap data

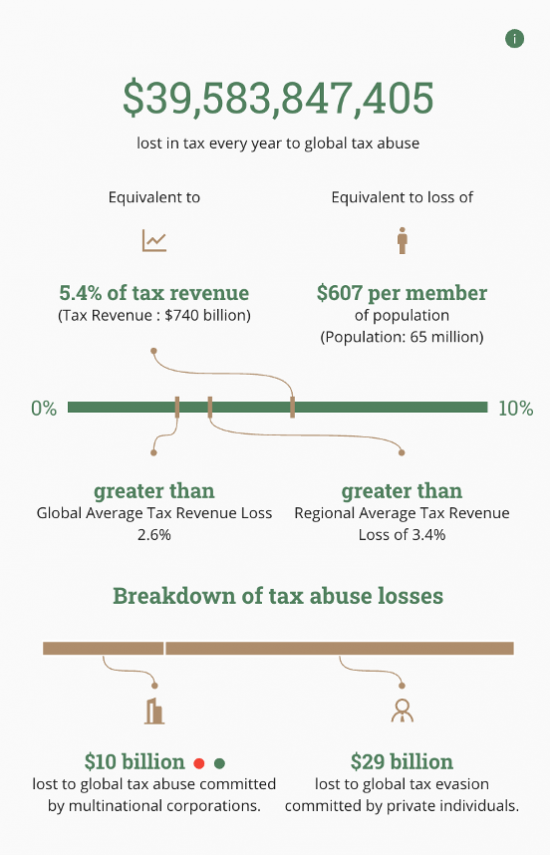

TJN's claimed tax gap data is allocated to countries in the SOTJ report. I will not discuss the basis on which it does so here. What, instead, I want to discuss is whether the resulting country based claims are reasoanble. I tested this claim using data from the UK. The analysis in question is in appendix one to my report. In there I note that TJN claims this as the relevant UK data:

They contextualise this data as follows:

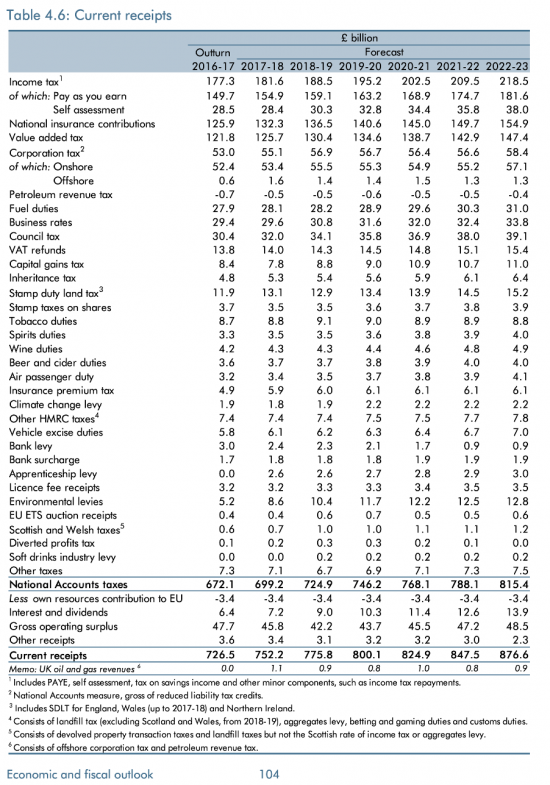

I have checked these claims. First, working out where precisely the UK tax paid data in the SOTJ report comes from is hard. I used a single year for comparison - 2016/17 - as that was the year for which the data that TJN used for corporate tax abuse came from. This was UK tax revenue that year based on Office for Budget Responsibility reports of the final accounting data for the year in question:

UK tax revenue that year was £672 billion. The SOTJ says that UK tax revenue is $740 bn, which is £597bn when translated into sterling. The difference is material at 12.6 per cent. The SOTJ does not explain the difference.

The UK tax gap for that year, published by HMRC was £33.4 billion. The SOTJ tax loss for corporation tax alone is, when translated into sterling at official rates, £31.92 billion. HMRC says that of the UK tax gap only £3.5 billion relates to corporation tax. As is apparent, these figures do not equate with each other. The SOTJ offers no explanation for the difference. I am not saying that HMRC is right: I am well known for not agreeing with their estimates. I think, however, that when there was a local estimate of the tax gap TJN should have noted why there was a difference of view.

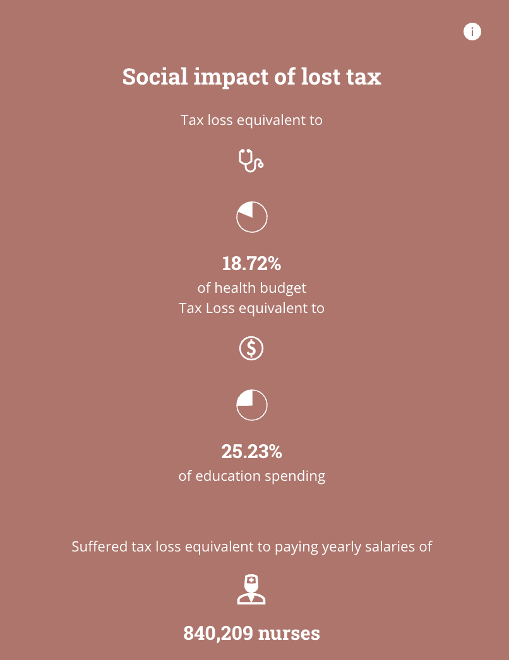

The SOTJ report implies its tax gap (which is at least 34% overstated in my view, as noted above) is 18.72% of UK health spending, implying that spending amounts to $211.4 bn a year, or £170.52bn when translated into sterling. Actual health spending was £145bn in 2016/17. The overstatement is 15 per cent.

The SOTJ report also implies its tax gap is 25.23% of education spending, implying that this spending amounted to $156.9 bn a year, or £126.5 bn when translated into sterling. Actual spending was £102bn a year. The overstatement is 19.4 per cent.

Extrapolating nursing pay from the data in the SOTJ report suggests each nurse was paid £37,992pa. In 2021 average UK nurse pay is £33,384 pa. The overstatement is at least 13.8%. It could be argued that TJN has taken some oncosts into account. It is not clear whether that is the case or not.

The SOTJ report suggests the UK lost the equivalent of 840,209 nurses pa as a result of the tax gap it estimates. In 2021 there were 299,184 nurses in the UK. What the lost nurses might do in the UK is not explained within the SOTJ. The comparisons make little sense in that case.

In summary, it would appear that all the data used by the SOTJ for the UK is materially inaccurate, meaning that it makes misleading suggestions as to losses arising to the UK even if its estimate of the UK tax gap was right, which as previously noted seems very unlikely as the figure it uses for evasion is likely to be between 5 and 10 times overstated.

The number of nurses comparison for the UK is also materially misleading: it implies the UK requires many more nurses than is actually the case. The comparison is not, in that case, of any practical use, and is misleading.

Is the TJN estimate of tax gaps likely to be comprehensive?

The SOTJ claim is that 'it is the first piece of research to present comprehensive estimates of the huge sums of tax each country in the world loses every year to corporate and private tax abuse — and what this means in terms of countries' health spending.'

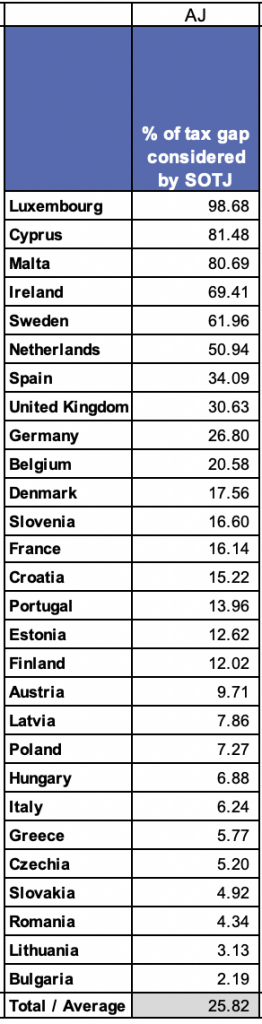

I sought to test this hypothesis by checking whether or not the SOTJ estimate of the tax gap was likely to explain EU tax gaps, including that of the UK since the data relates to the period when the UK was in membership. This is actually the longest part of my report, and the method for extrapolating from the EU's VAT tax gap to a likely tax gap by country is explained in my report. I am aware that the analysis could be challenged: as I say in the report, measuring tax gaps is always about measuring shadows. But, I think the analysis is as robust as could be made for the sake of comparison: that is my suggestion. And what the concluding table for the EU suggests is that the proportion of the tax gap for each member state that is explained by the SOTJ is as follows:

Excepting tax havens and Sweden and Spain (where there are some known doubts as to the accuracy of the EU source data) the SOTJ is not good at explaining tax gaps based on extrapolation of EU VAT gaps. In many states the proportion of the tax gap explained by the SOTJ is very small, even though the tax gap in those states may be very large as a percentage of the anticipated total tax take. Even if my tax gap estimates are not right (and no tax gap estimate can be right: I am aware that) the scale of the SOTJ failure to explain the data would still be significant, whatever adjustment might be made. I think my conclusion robust, in other words.

The analysis results in three conclusions. The first is that the SOTJ claim for itself is wrong. The second is that TJN is asking the wrong question about tax gaps: they have, tax havens excepted, usually very little to do now with international tax flows. And third, as a result, it is not indicating the true state of tax justice in its report. Despite the best efforts of many to draw attention to the existence of domestic tax abuse issues that are much larger than those caused by tax havens and multinational corporations TJN has consistently refused to engage with this agenda, which is deeply disappointing.

Conclusions

My conclusions from this review are simple. I do not think the SOTJ properly estimates tax gaps: that for tax evasion has to be overstated on the basis of calculation used simply because interest rates assumed to be appropriate in the calculation are materially wrong. Other factors also indicate that material errors are likely.

There also appear to be material errors with regard to individual country data.

And as the third part of my analysis shows, the SOTJ makes a claim about being a first study of the losses arising from personal tax abuse that is wrong because TJN has not engaged with the broader domestic dimension of this issue.

The unfortunate conclusion is that the TJN State of Tax Justice report 2020 is unreliable as a source with regard to any of the claims that it makes.

I hope the 2021 version can be entirely revamped to address the issues raised.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

Do some of the discrepancies between your and their numbers come from dollar/sterling exchange rates? Does the SOTJ report state how currency conversion was done?

Offshore avoidance by corporates of £10 billion sounds on the high side but it is at least believable when total corporation tax revenues are £50 to £60 billion. But can offshore tax avoidance by individuals – specifically just from returns on offshore cash balances – be about the same size as the whole of self assessed (non PAYE) income tax?

I think it implausible that the differences can be that big. And if that were true the scale of differences would be consistent, but they are not.

I think the corporate claim is likely to be reasonable: that is why I did not address it.

The claim re individuals is not