Andrew Bailey delivered one of his usual speeches that included little link to reality on Friday. He began by saying:

It is fast approaching twenty five years since the UK decisively changed its monetary policy framework and embraced the idea of an independent central bank with a mandate to maintain price stability in the form of an inflation target. Now, 25 years may not seem long in the broad sweep of history, but the history of UK monetary regimes points to a quarter of a century representing a relatively long-established one. Long may it last, because it has been successful, and it has delivered the much desired price stability.

As openers go few are as bad as this.

First, the Bank of England failed to anticipate, and even facilitated, the 2008 financial crisis.

Then, second, it supported austerity.

And third, it has not achieved its inflation targets for a long time.

Fourth, its only policy measure of consequence, which is the chance to change interest rates , has been inoperative for a decade.

And fifth, QE, which is its alternative measure, has lead to massive and fast-growing inequality whilst hollowing out UK business as it seeks to pay returns to shareholders rather than invest for our future.

So, that's Bailey's first claim debunked. But it gets worse. He then claimed:

I sometimes hear that the Bank has flouted the rules and thereby damaged its independence, by purchasing government debt and lowering the government's cost of borrowing. .... But I'm sorry to have to be blunt, I'm afraid these arguments are entirely without merit. In a world where the Government has to manage the task of spreading the cost of the pandemic which would otherwise fall on individuals at great cost to them, and the central bank is acting counter-cyclically to support demand in the economy consistent with its inflation target, it is hardly surprising, and indeed consistent, that the Government should be able to benefit from those financing conditions. ...

The consistency of the response of monetary and fiscal policy is something that the IMF has emphasised and recognised in its assessment of UK policy. But that does not mean independence has been abandoned. The interventions we have made are effective because the Bank is independent, and because we will reverse these actions when conditions require that. A fallacy of so-called Modern Monetary Theory is that it believes monetary policy can be used without the credibility of independence and thus without the assurance that price stability will be maintained.

There is no one who I think believes Bailey on this. However many times he says that the Bank is not funding the government no one believes him. And there is a good reason for that. It glaringly obviously is.

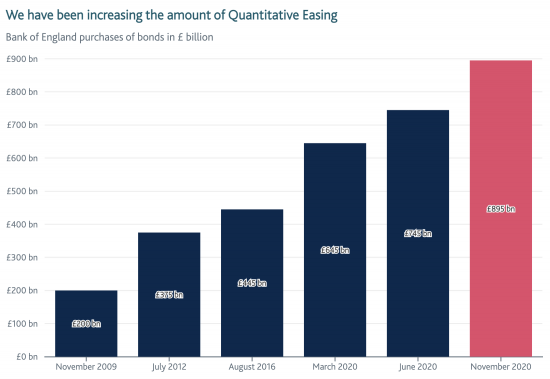

This is the history of QE from the Bank of England website (from which most QE content seems to have been stripped of late, about which fact I have raised query with them):

It is just possible that injections of cash in November 2009, August 2016 and March 2020 were justified to prevent bank crashes. But if so, they could have been reversed quickly in that case once the crisis was over. But none were. In fact, no QE has ever been reversed in the UK. So Bank stability was not the reason for this policy.

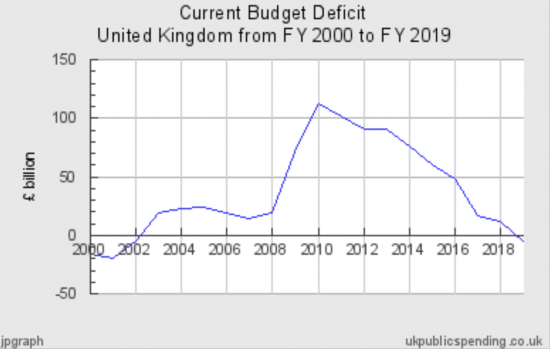

Nor is there much credibility to the claim that QE has been used to support the inflation target. This data is from the ONS:

In 2012 when there was a batch of QE inflation was above target and stabilising. If QE was really intended to drive up inflation there would have been bouts between 2014 and earlier in 2016 than happened. But mysteriously UK government current deficits were falling then, and so there was no obvious need in the view of the Bank:

And has there been a need for £450 billion this year, barring a likely government deficit of maybe similar amount? It's not clear, not for the reasons Bailey says.

Bailey went on to say:

Of course, the real test of this may come when we reach the point at which policy needs to be tightened. Actions will speak louder than words. But the great value of central bank independence — and the reason why it is rightly regarded so highly — is because it is a regime that provides the most powerful set of incentives possible, to do the right thing when that time does come. We are individually accountable and collectively responsible to Parliament for acting, without fear and favour, to hit the inflation target.

So, whatever the social consequences, the Bank will, according to Bailey, increase rates if it so wishes. Which is simply not true, of course. The claim that the Bank if independent is not true.

All QE requires government approval.

The Bank has to do what the government demands or its discretion can be suspended, as the Bank of England Act 1998 makes clear (section 18 as I recall, but it may be 19).

And the Exchequer and Audit Departments Act of 1866 gives the Bank no choice but make payment as the government directs, whenever the government so wishes.

The truth is Bailey has as much discretion as a junior civil service clerk, but is given the option to pretend otherwise, which he overuses in speeches like this, blowing his credibility as a result.

Bailey would be wise to take note of MMT. It is not a theory on this issue. It describes what is actually happening, which I have evidenced to be true.

He would also be wise to note that without policy based in democracy - which he is seeking to deny exists - we have ceased to be the country he might claim to serve. The Bank of England has to be subject to political accountability. For it to be otherwise is a threat to the very core of our democratic process. In that case, Bailey's posturing is not just obviously wrong, it's also dangerous. I hope his pride does not come before a fall.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

An incredible speech,faced with overwhelming evidence he has been caught with his hand in the cookie jar,he resorts to the standard 5 year old child’s response to deny it. Just totally incredible, in the real sense of the word.

The powers that be just cannot and will not face facts.

Brilliant.

Keep at it Andrew.

Nationalise the banks.

I look forward to hearing about the occasion when speaking to the Treasury he just said “No”.

The BoE has certainly not achieved its inflation target in the real economy but inflation is rampant in financial markets and in financial asset prices. What’s the BoE target there? – just let it rip it seems.

Certainly the BoE is not legally “independent” and does act on the authority of “government” – which should mean accountability to the people through Parliament – but Parliament is not doing its job. The whole nexus of government

is thoroughly penetrated by the money interest – the executive, the legislature – it will be the judiciary next. The media is also under their control. Government is “independent” of the people.

From here there are two roads – authoritarian government “in the name of the people”, real democracy. The first is the easier road, the second more difficult and not so easy to understand. The easier road is like a small pond where a small stone makes ripples that quickly reach the outer edge. The harder road is a big pond so needs many stones to create ripples that can reach the edge. We just have to keep chucking them in.

I am torn……

does he believe this nonsense or does he just say it because “that is what Central Bankers are supposed to say”?

… and even if I knew, I am not sure which is worse – no brain or no honesty?

I am also irked by the “strawman” that is always put up when anyone wants to rubbish MMT. “MMT means printing money and hyper-inflation surely follows”. NO, MMT is symmetrical in that it suggests adding money (government spending) and draining money (borrowing or taxing) as appropriate with a clear aim of price stability and full employment. There is no reason to suppose that MMT will be “soft on inflation”…… but good reason to suppose that it will be “better on inflation”. Now, we just happen to be in a period where we need to add money (and Andrew Bailey agrees but dare not say explicitly) but that will not always be the case.

@ Clive Parry

If you asked Andrew Bailey to provide the evidence that government deficits create abnormal inflation he couldn’t it! He’s a poser who knows there are sufficient economically and monetarily illiterate voters in the country he can get away with this lie:-

Here’s the evidence he doesn’t want the voters to read:-

https://evonomics.com/moneysupply/

The “Vague” (sic) paper you link to does have a lot of criticism btl, particularly regarding the definition of money supply used, most of which is above my pay grade. Could you make some general observations about the comments? Presumably you don’t think much of it detracts from the conclusions?

I have to say that, for all Andrew Bailey’s blustering, the MPC seems to me effectively to be an outsourced House of Commons Select Committee, given a mandate by Parliament to carry out a particular task.

The only difference from actual HoC Select Committees is that the MPC has the power – mandated to it BY Parliament – to set the Bank Rate – whereas Select Committees only make recommendations, which the Government can ignore.

And as Richard’s blog observes, that is a power with less meaning than used to be the case.

As you know Richard my stance is that separating out the Bank of England as quasi-separate from government, even though it’s government owned, leads to capture by the financial sector many members of which on the evidence of long form believe telling any lie will do as long as it wins them power and money.

The only way you’ll achieve democratic reform of the BoE as I see it is to get a majority of the nation understanding Democratic Money Theory which shows that Parliament is sovereign in the rules of money creation or rather currency creation. Given the gullibility of many voters to believe any lie that’s thrown at them witness Republican Party supporters in the United States and Brexit supporters in the UK this seems a very long road to travel.

https://www.newsweek.com/republicans-joe-biden-won-election-legitimately-poll-1562343

The shortest route is for politicians to be convinced they should get rid of the BoE altogether, after all it only came into existence because of split governmental responsibilities in the 17th century. The Romans managed for centuries without a state bank. Like the British they never legislated that the government needed to have its books balanced before it rescued the private financial sector from its interminable self-inflicted liquidity crises! So sovereign currency or liquidity creating powers reside in Parliament and the departments it agrees to establish and over which it ultimately has complete autonomy. Let it be like that and not mess around with the fudged autonomy it currently has with the Bank of England, it or rather we don’t need the hassle!

@ Helen,

We certainly do not need a central bank as it stands. Which is not fit for purpose. All it does is prop up a dysfunctional banking system and fails to see huge crashes like that of 2008.It main tool of Interest rate setting is now a broken ever on the economy(if it ever was a lever). We need it bringing back in house and making into a govt dept under normal civil service authority, or subordinated under the Treasury. Bailey is doing a great job of making us realise that.

My only worry was that after 2008 the BoE was the only real power able to counter the govts austerity policies, albiet in a limited way by keeping interest rates really low and using QE as well as other(failed) attmepts to get the banks lending again. They did what they could, but really fiscal stimulus was what was needed. All the while the govt was implementing deflationary and debilitating spending restrictions, the BoE was in fact doing countering that with expansionary monetary policy…such that it was. It was at least some attempt to break that insane policy

To have the central bank and govt carrying out opposite and conflicting economic policies seems rather futile. But if Bailey now thinks it will actually work in reverse, in that he can impose deflationary monetary policy while the gov wants to carry on with its fiscal stimulus, he is even more stupid then he already looks. He has no right to take away that ability in order to keep the mythical market powers satisfied, who are indeed his real lord and master

@ Vince Richardson

I think what you write is well expressed. You raise very important questions in regard to why the country needs a central bank. It would be useful to see arguments in favour to see if they stand scrutiny.

MMT must seem a threat to the private bankers. They have always put the interests of capital above the needs of industry or the state of the poor (outside of war) and the main reasons they were nationalised in 1945. I think the Court of the Bank is comprised of people from the private banking sector, and they decide on monetary policy changes. How much power that gives them in the real world, I am not competent to say, but I would imagine they would not like to relinquish it. Hence the claim that without the credibility of independence, price stability would not be maintained.

The whole of Bailey’s speech speaks of one thing – and that is fear

Given the way evidence is mounting of wrongdoing at the FCA under his time there combined with the increasing attention being given to that evidence it would seem he has plenty to be frightened about.

I’m interested in the history of the Court you refer to.

He says:

“ We are individually accountable and collectively responsible to Parliament..”

How are they legally accountable? Who hired them? How do we fire them if we want to?

Are they ‘independent’ or are they ‘responsible’ to Parliament?

Tony Benn questions………

All I can say about Bailey is to refer you to Milan Kundera:

“The only reason why people want to be masters of the future, is to change the past”.

I find it amazing when you consider that we have a RIght wing Tory Government and its appointees behaving like communist Russians and airbrushing and erasing facts in full public view. But then again, the work of von Hayek, Buchanan, Rand and many others was all about negating historic factuals and creating a new historic narrative of the Neo-liberal ‘rational man’ and ‘the natural order of things’.

Bailey does know his job – his job is to misrepresent his job so as not to upset the private sector and offer hope to millions who need Government help. He’s part of the Right wing Tory project (a coup) to rule over this country by using fear and lies to control our aspirations and to accept our lot. It’s obvious.

This is effectively the Tory response to the 2008 crash: to ensure we don’t get our hopes up that the Government will help us as well as the Banks and the rich when disaster befalls us. They want to put the QE genie back in the bottle and forgotten about and they will stop at nothing to do this. If only the Left or progressives were as aggressive and focussed in their beliefs!

Andrew Bailey the “King John of Non-Democratic Money Theory”!

High time he was served a “Magna Writ” to vacate the premises!

Andrew Bailey either feigns to deliberately not understand the significance of what happened in English monetary history (which now affects the whole of the UK) or he’s just plain ignorant and therefore unsuited to his job as governor of the BoE. On page 12 in the Introduction Chapter of her book “Making Money: Coin, Currency and the Coming of Capitalism” Christine Desan writes the following (words in brackets from me to help clarify):-

“… the (17th century and onwards) innovation of circulating public bonds marked a new era. Bonds signified a fiscal promise to take contributions; that promise would now be mediated by a host of creditors with claims against the public. The change would split the public into tax-payers and bondholders, directing benefits (see below) previously absorbed by the government from one group of citizens to another. As importantly (at the time), the change gave the government a mechanism to secure paper money (chiefly banknotes long term): notes taken by the authorities to pay down debt would hold value as cash.”

The “benefits” are of course what were former contributions in-kind such as labour and resources but now rendered in currency as tax payments which effectively gave sufficient time length value stability to the currency for the government to spend at will subject to dealing with any abnormal inflation that developed in the economy from whatever source.

Ignoring bank rate manipulation, the money payments for government bonds (whether in specie, banknotes or today’s electronic money) can therefore be simply regarded, when all is thought through, as discounted tax payments which help give some additional stability to the currency’s value!

Agreed

The question that Andrew Bailey genuinely needs to ask himself is why government should share its authority over money creation with a central bank when he, Andrew Bailey, cannot produce any historical facts that in a non-war time situation the government creates regularly hyper-inflation or abnormal inflation!

Suggest both Bailey and the BoE have not to forget that the Treasury created Bradbury’s over 100 years ago and actually they could do the same right now…

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/683458/FOI2018-00037_Bradbury_Pound.pdf

Indeed…..

@ Peter May

Peter was it ever asked what was meant by the phrase “wholly backed by securities”?

This involves asking two questions.

Firstly, what securities backed the the issue of banknotes after the formation of the Bank of England in 1694?

(If the person writing this letter really means the capital subscribed to form the joint-stock company for this bank this ceased to exist after the company was nationalised in 1946)

Secondly, where is the parliamentary legislation stating the government cannot create any currency without it being backed by a securities issue?

(The recent GIMMS’ paper issued makes clear Revenue and Spending departments don’t share a balance sheet:-

https://gimms.org.uk/2020/12/26/accounting-model-uk-exchequer/ )

@ Helen Schofield

The only thing could be the collateral of the repayments/reflux of taxpayers.

Which might be a very useful admission!

I’ll try asking…

Helen,

I think the word “securities” is quite straight forward there. It is govt issued bonds. The exact same thing that backed the issue of notes in 1694.The fact that the BoE was nationalised in 1946 changed very little in the scheme of things.

The issue of the Bradbury pound was a very revealing incident. Of course, as was the case for Lincoln’s Treasury issued Greenback dollars, the notes eventually withdrawn after the war(but not until 1928),to allow the banks to continue their lucrative business of creating the nations money unopposed.

The Govt , our Parliament and the civil service stand by, largely ignorant of the history or the significance of this situation. Although I am sure some in the civil service do.

Helen,

Actually on rethinking this, I was not correct. This letter hides way more than it reveals and is very cleverly written. Note issuance after 1844 Bank Charter Act was an exclusive prerogative of the BoE. Private banks were not allowed to issue notes after that date. Note issuance it was then “officially” backed by gold, held by the BoE.

The hidden part here, that this letter avoids altogether, is that the private banks had issued way more liabilities in the form of Sterling denominated bank deposits(by making loans in chequing accounts backed only by personal loan agreements) than there was gold at the BoE or in bank vaults. The panic of 1914 at the outbreak of the War meant banks meant that they did not have access to enough notes to cover the demand on its own liabilities. So the BoE closed the banks to stop the runs and suspended that right to redemption of its own notes for gold. So the treasury issued notes saved the BoE gold and the banks at that time. As depositors now received the Treasury notes instead of the usual gold redeeming notes. The banks themselves probably issued these notes in return for bank assets as a type of emergency liquidity loan. Crucially they were accepted by the banks customers and initial panic was averted and these notes were simply rebanked at a later stage. All in all proving the govt can do this as well as the BoE.

All notes issued after 1931(when we came off the gold standard) would have then been backed by the BoE based only its right to issue reserves. It wasn’t fully “backed” by gold anymore.So there was not any other “security”, like govt bonds covering these post gold standard notes at all. And today the BoE still creates the notes we use and backs it merely with its own reserves it creates on a ledger ,at will. So this letter is an out and out fabrication, you are right to question it.

Dear Richard, sorry to return but this time I can be very specific. I have been enjoying a lengthy exchange with the BoE which enabled me to focus my concerns, but my last question to them they dodged and ended the exchange. My question was this:

“When a new loan is arranged by a commercial bank, they create the money and pay it into the borrowers account.” [The BoE had informed me that the commercial bank makes journal entries comprising a debit entry in its liabilities (new deposits) and a credit entry in its assets (new loans)]. “Could you please explain why the ‘new deposit’, the created money, is treated as a liability? I am unaware of any requirement to repay this money, which is really a gift from — presumably — us, the nation.” The BoE dodged this question and ended our exchange, nothing new.

I believe that there is a fundamental error with the bank’s “liabilities” entry, which they are treating as if the funding for the loan had been taken from the bank’s own reserves. The reality is that there is no liability for this money, the bank is legally entitled to create money for new loan purposes and with no requirement for repayment. I believe that the bank should have a “money creation” account which is debited for each new loan and then the “liabilities” entry would properly be a credit. This credit entry would remain when the loan is repaid representing a profit for the bank.

The core issue is that a loan cannot be made to a customer of the bank until that money is first created and that should introduce an additional journal entry which remains after the loan has been repaid and cleared. This is apparent if we look at the life cycle of a loan:

1. Bank creates money for a loan.

2. Bank makes loan to customer.

3. Customer repays loan with interest.

At this point the newly created money is back on the bank’s ledger as loan repayments and there is no liability against this money, therefore it is profit.

I roughly estimate that the UK banks are benefitting with loan repayments and interest, from seigniorage, to the tune of around £100 billion a year and at a time when the country has endured 10 years of austerity, this is obscene.

There is a residual matter, that of the money supply, where these bank profits do not show up. This is because bank reserves are held in the BoE settlement account which is not included in money supply figures.

I am sorry to say that you have this quite wrong

All money is debt

Creating money requires two promises

The bank promises to pay whomsoever the customer instructs from the current account that they create for them and the customer promises to repay the loan account that they owe the bank

Without both there is no money creation

Tha6t is the fallacy in your argument – the bank cannot create money without the third party promise to repay it

On repayment the money created disappears – it is not the banks

There’s a step missing from this;

“1. Bank creates money for a loan.

2. Bank makes loan to customer.

3. Customer repays loan with interest.

At this point the newly created money is back on the bank’s ledger as loan repayments and there is no liability against this money, therefore it is profit.”

It should look more like this

1. Customer approaches bank for loan, signs (SIGNS!!!!) document agreeing payment schedule regarding the principal amount agreed and all the interest they’ll be paying on it too.

2. Bank makes loan to customer etc…

There are those who argue that the initial document – a promise to pay, after all – is itself currency of a sort, created by the customer, so when the bank responds by creating money for the loan in the form of bank credit (ie into the customer’s account) it’s really only replacing or exchanging one sort of newly created money for another, one recognised by broad society. An exchange, not a loan then. The argument runs it’s customers who create money, not banks, so customers shouldn’t be paying interest to banks for money they themselves have created. An interesting thought…

On examining the procedure as a whole though it becomes apparant banking is really an exercise in wealth extraction. It always takes out more than it puts in, and is left with the interest as profit. Administration aside, the process costs banks nothing, while customers will have to work in some fashion to earn the money to meet the agreed payment schedule. This is hardly fair. As a society we could certainly use a means of increasing the supply of money into the culture which excluded banks as the extant process is clearly parasitic. I suspect much of the Establishment’s Islamaphobia is inspired by Islam’s dictate that while it’s perfectly ok to lend to your fellow man, it’s very much not ok to charge him interest. Think what would happen to banking, politicians’ favourite retirement environment, if that idea caught on more generally…

I haven’t read all the replies to this, and I see Helen Schofield has many, which I suspect shall cover a lot of information.

Other than for purely political reasons, why isn’t the position of governor of the BoE held by the Chancellor of the Exchequer, or a similar elected government minister? With the current governor post being the civil servant position it actually is.

Would this point not be a step towards the public understanding that the BoE isn’t independent? Then further the BoE being subsumed into the Treasury proper, as I think Helen is suggesting (but I could be wrong on all this).

Thanks.

Blame Gordon Brown who bought the neoliberal logic that a grandee from banking must hold the democratic state to account

@ Gordon McKendrick

Peter May made an excellent post on his blog Progressive Pulse yesterday. Here it is:-

http://www.progressivepulse.org/economics/seven-reasons-why-we-never-tax-and-spend

If you read points 6 and 7 plus their links it’s clear that Parliament over the centuries has been careful to legislate so that government has no check on its ability to spend when it wants other than to be cognisant that such spending may contribute to abnormal inflation and for which it also has ample powers to correct. For me the Bank of England is an anachronism adding in an extra layer of bureaucracy, confusion, corruption and impediment to democracy. The BoE was set-up at the end of the 17th century for the simple reason governmental powers were split between Parliament and the monarch and this was causing problems. This no longer applies plus the BoE after nationalisation in 1946 has been brought in house to be under Parliament’s ultimate control.