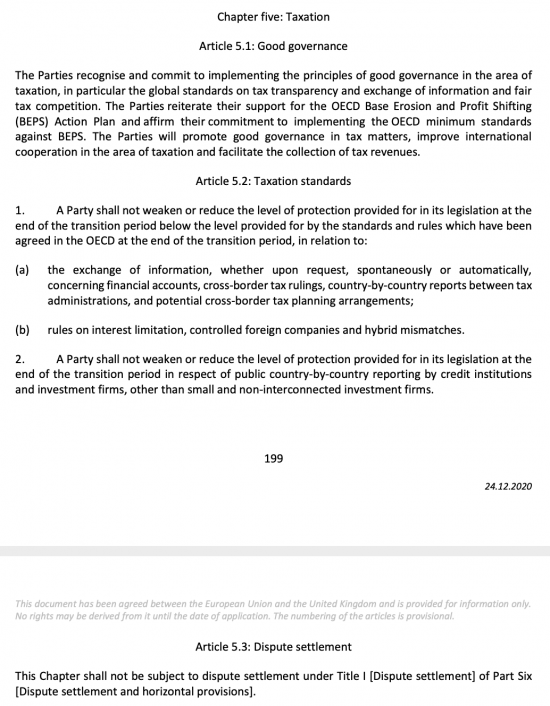

The Brexit deal's arrangements with regard to tax are surprisingly limited, unless they relate to VAT and imports and exports. As far as I can see they are this:

That really is lowest common denominator stuff (although I can't help by be amused and paled by the references to country-by-country reporting, for obvious reasons).

The UK is already committed (in its own half-hearted manner) to the OECD's Base Erosion and Profits Shifting programme. And automatic information exchange is now normal. There is nothing in these commitments that goes beyond the obligations of OECD membership.

As I noted on Christmas Ece, the notable absence is any reference to the EU Code of Conduct on Business Taxation. This was created in 1997, and was heavily UK influenced for a long time. The EU's summary is that it effectively seeks to ban arrangements that are potentially harmful, including:

- an effective level of taxation which is significantly lower than the general level of taxation in the country concerned;

- tax benefits reserved for non-residents;

- tax incentives for activities which are isolated from the domestic economy and therefore have no impact on the national tax base;

- granting of tax advantages even in the absence of any real economic activity;

- the basis of profit determination for companies in a multinational group departs from internationally accepted rules, in particular, those approved by the OECD;

- lack of transparency.

I have written on this many times in the past and most especially with regard to its application to the UK's Crown Dependencies, and to a lesser extent to the Overseas Territories. This was because I was engaged by some members of the States of Jersey to write a report on whether Jersey would comply with the Code in 2005 and forecast that it would not. In 2010 I was proved right and it had to change its laws, as did the Isle of Man and Guernsey. What they had proposed included ring-fences of classic tax haven type that clearly contravened the Code.

Now it would seem that these ring fences are permitted again, both within the UK's tax havens and within the UK itself. No wonder the government is making such a song and dance about the fact that so-called 'freeports' will be a major part of the post-Brexit UK economic landscape. The aim is to introduced tax havens on the UK mainland now. I have discussed the dangers, here. I now suspect that these will be much more abusive than the government implied in 2020.

It would seem that tax haven UK is on its way. Lowest common denominator abuse is the stock in trade of this government at a great many levels. It seems that dredging the buck and seeking a return to the old days of tax havens is going to be one of their chosen weapons of aggression. I sincerely hope the EU are ready to retaliate. Blacklisting will not be enough. Tax withholding should be their preferred weapon of choice, making sure financial flows to the UK are taxed before arriving here. Only this might be effective.

This could get very ugly.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Off topic but to draw your attention to the following:-

https://new-wayland.com/blog/#Bonds%20Pay%20For%20Themselves

https://gimms.org.uk/2020/12/26/accounting-model-uk-exchequer/

https://gimms.org.uk/wp-content/uploads/2020/12/An-Accounting-Model-of-the-UK-Exchequer-Google-Docs.pdf

Why should we be surprised sleights of hand are a specialty of the British establishment when, for example, in 1694 a private joint-stock company could start issuing hard copies of the currency (medium of exchange) piggy-backed on a retirement process enforced by the government!

Blog coming…..

Can you explain how the EU Code of conduct relates to Italy introducing in 2017 law that enables non-residents to apply for residency and only pay a max of 100k euro’s tax on any income earned outside of the country?

As with most EU rules, whether it be on standards or government aid – a lot of EU countries do not adhere to the law. I hope the EU are as stringent in righting these wrongs and do not just focus on the UK.

I can’t

The Code of Conduct Group is decidedly opaque, I admit

But it worked against the Crown Dependencies

Maybe because someone pursued the issue hard 🙂

As a real novice on tax havens, what sort of things should I look out for that will demonstrate this behaviour is happening?

Craig

Another day….

Thank you.

Taking a step back from this (and I’m someone who has read ‘Putin’s People’ and is reading ‘Kleptocracy’ at the moment) if we reflect we’ve (well, you Richard and an honourable mention to Helen if I may) have spent a lot of time defining money and MMT but I feel that once again we may need to go back to defining tax as a concept in the contemporary setting.

If we say (and agree) that taxes in a modern economy don’t pay for Government services, then people will rightly ask ‘Well, what’s the beef about being a tax haven – just print all that money you’ve been boasting Government can do – right?’.

BREXIT has certainly reified its original intent to me (that being to make England at least into some sort of Klondike-like freeport country capitalising on the gross flows of supra-national wealth). But the role of tax is now more than just a retirement plan for money to prevent inflation. Arguably it is even more political now and plunged even deeper into the realm of sovereignty and democracy (there is nothing original here from me as you’ve alluded to these attributes of tax yourself BTW but it is still useful to re-state them).

It’ obvious to me that:

1) Under-taxing wealth leads to certain individuals (those with legitimate wealth and those of the criminal persuasion) amassing huge fortunes.

2) Some of that cash can end up being used to support particular political projects in States (we’ve seen this already in 2016).

3) These factors can completely undermine democracy and make voting even more of a sham where the popular vote is used to basically manoeuvre politicians into position who will uphold the ‘new’ tax status quo.

4) If a state prints money even as a tax haven, who gets it – the chumocracy, the tax evaders or the voter?

Might it be possible for a State to be a tax haven AND operate an MMT policy in line with the requirements laid out so ably here? What would that economy look like – might such a model appeal to Starmer and Co?

I suppose that it is the ‘values’ of those using their fortunes for political/non-democratic ends – they always want more don’t they – to use State retrenchment in money provision as a means to prop up the value of their fortunes; to create artificial markets and chaos on a whim to make more money out of more money when they feel like another super yacht or country pile or acquiring a brand name.

Being a tax haven isn’t just about not paying tax: it’s the consequences of not doing so and who we ‘enable’ to be in charge – it’s about enabling a surreptitious sovereignty to take control of our lives that stands behind and above our Sovereign Government (much like the way in which the so-called social relations on line are enabled by the crafty and unseen capitalist money machine third person as Jaron Lanier points out so well in the documentary ‘Social Dilemma’ ).

Maybe the new challenge post- BREXIT is that we need to be working on portraying there consequences more often and more clearly?

PSR – agreed

I am planning some work in this

My colleague Andrew Baker at Sheffield wants the two of us to do a book on this

Well – in that case make sure you do stop a little for Christmas (or a lot) for the work ahead.

And DO keep us posted about that impending book.

I’m putting my name down for a copy NOW.

@ PSR

Here’s a description in regard to taxation that might interest you to be found in the GIMM’s pdf “An Accounting Model of the UK Exchequer” in the Postscript section page 119 (125) :-

“ ‘Liabilities to be funded by future revenues’ in the government sector precisely matches the equity held by the non-government sector.”

https://gimms.org.uk/wp-content/uploads/2020/12/An-Accounting-Model-of-the-UK-Exchequer-Google-Docs.pdf

A lot of the problem that creates confusion in understanding money as currency is “funding” especially that taxes drive the “funding” of the currency. This of course was the central point Christine Desan makes and it enabled a single unit of account which enabled government to establish the market and this in turn enabled capitalism.

To be candid, that claim makes no sense at all

In the sense that cash expended not reclaimed might get considered potential tax revenue this can, in an exceptionally limited sense be considered to be true

But the rest of that is nonsense: potential tax revenue is not restricted in this way and liabilities can exceed bonds in issue, of course, and do re pensions

This, I am afraid, is then simply wrong.

I won’t beat around the bush, as time is short.

What is the Leader of the Opposition and the Shadow Foreign Secretary position on this ‘taking back control’ and turning the U.K. into a tax haven OFFICIALLY?

To be the place where to steal from the poor and give to the rich and give these robber barons a safety deposit box, guaranteed by the State?

I have warned continuously about exactly this.

And them.

It should be clear to all that Starmer and Nandy are deepstate neolib/con artistes – whose actions with regards the previous leader , Corbyn under whom they flourished and who they instantly stabbed in the front; & Starmers actions in allowing the unprecedented withholding of the Lords peerage for the Speaker – who allowed Starmer to actually get the Meaningful Vote on the Withdrawal Agreement that delayed this all but hard in name BrexShit deal. And made Starmers name as someone who had the Many’s interest at heart. That they believed in him and gave him the leadership.

Which he is using to pursue his primary task of dismantling the resurgence in social democratic politics and membership of the Labour Party and scatter the new grassroots influx of PLP MP’s.

The MSM and their DS handlers are ready to feed that falling apart – see the story today about the inflammatory Islamophobic Donor to Labour to help the harikiri actions of the quisling Opposition.

The answer ? and it really is the only option before it is shut down, is to do what THEY attempted to do to the Corbynites – a instant leadership election in Starmers first year – let’s see him on the stump as Corbyn had to be against Owen Smith (remember that stooge?). VOTE HIM OUT.

Anyone who votes for this Tax Haven BrexShit Deal against their principles and for the global elites benefit will forever be stained by treachery.

Sorry for the angry Boxing Day post but I don’t think there is time to be diplomatic with the vote due on the 30th.

I am not surprised as anything resembling EU oversite would have brought in the ECJ again, a definite red line for Lord Frost and his team.

The review panels replace the ECJ

UK freeport tax havens are a sort of equivalent to currency rigging, part of “Barge Economics” if you like. Until there’s global agreement that countries can protect themselves against taxation manipulation and currency rigging through tariff adjustment not to mention non-monetary manipulation without retaliation I can’t see how the UK can prosper given it’s relatively high exchange rate despite high wage rates and persistent current account deficit.

This is rather confusing Mr Murphy.

From what I can establish the comparison on tax between this deal and no deal is not unfavourable.

And considering this deal derives a lot from the the Canada-EU deal and the Japan-EU deal, is there anything in those two deals which the tax justice campaigners have found which they would like to have been in the UK-EU deal.

It would be a strange position indeed if there was nothing in the Canada-EU and Japan-EU deals you could point to on tax that is missing in the UK-EU deal, and still promote the EU as something the UK should desire to have membership because of where it has been on tax.

The point is that in this case we have gone back considerably

That was not relevant in the other cases

Your comparison is irrelevant in that case