Forgive me if I appear absorbed by my concern with government debt when commenting on yesterday's Spending Review, but given that debt management is the predominant Tory economic narrative that dictates all other policy it seems appropriate to concentrate on it in the first instance.

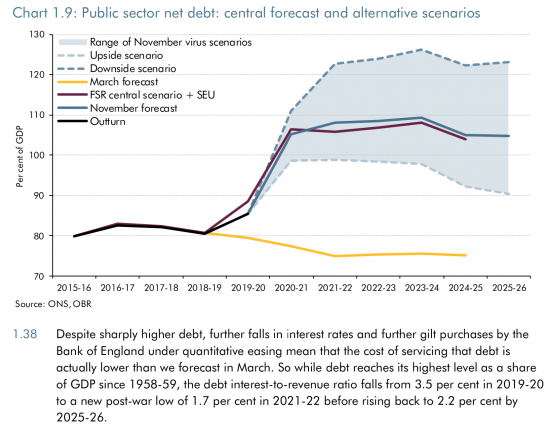

This chart comes for the Office for Budget Responsibility review of the Budget proposals:

My belief is that borrowing will be at the top end of the OBR forecast range, and not where they suggest it is likely to be.

However, it is the paragraph numbered 1.38 that is most important, in my opinion. This is one of a number of references within their report that make it clear just how beneficial QE is at present. The cost of government borrowing is at a record low, and is going to remain that way, even with the forecast significant increases in debt. Even my higher expectations will not change that by much.

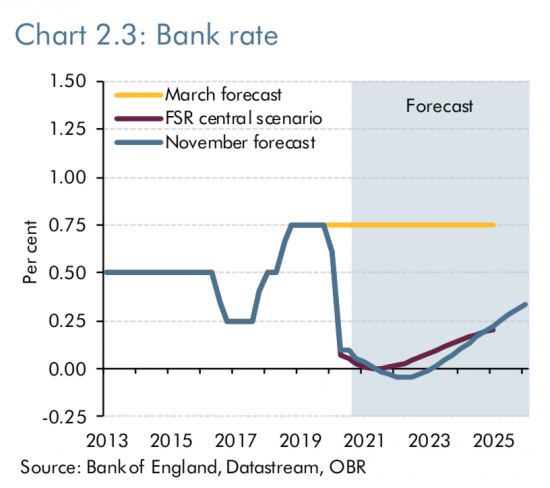

And the reason for this? This is the OBR forecast on Bank of England base rates:

Note that they now forecast that these will go negative, and the rise is to 0.3% by 2025, which has little impact on their forecast cost of debt.

Indeed, as they note:

The average effective interest rate on new issuance has fallen from 2.8 per cent in 2010-11 to 1.9 per cent in 2015-16 to 0.3 per cent in 2020-21.

Inflation is higher than this: the real value of debt is declining. And yet the obsession with debt continues when the cost of servicing it - which is the only issue that matters, is falling, which fact is unsurprising as it remains almost wholly within the control of the government given the scale of the debt that it now controls directly, by owning it, and indirectly via the consequential balances that are held by UK banks and building societies on Bank of England central bank reserve accounts.

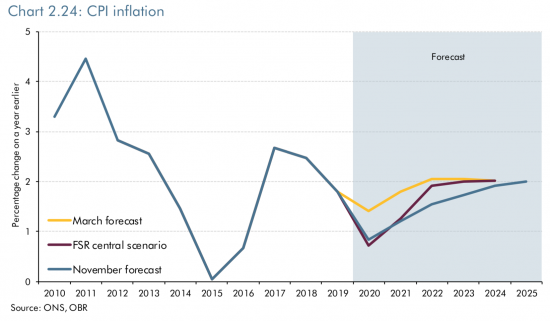

The debt obsession is misplaced in other words. And in case anyone thinks I have ignored inflation, this is the OBR inflation forecast:

The expectation is that inflation will struggle to reach its target rate. The OBR does not, then, expect money creation to cause problems.

All that is odd in that case is that they are not forecasting more of it. I will, though. I will forecast that quantitative easing will exceed £100 billion, and quite possibly £150 billion a year until 2025, at least. Whether conventional economists like it or not, money creation is the foundation of our government's finances now.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Genuine question: isn’t QE simply an asset swap? Buying back gilts is simply moving reserves from an interest paying account to one that pays hardly any interest at all. Are pounds actually being created or is one type of pound being replaced by another type of pound? It might explain why there is so little inflation.

Cash is definitely created – but ends up on central bank reserve accounts that end up back with the BoE, but the Treasury has no effective repayable liability anyone

And that is money creation

What is chilling is that the BBC never query the debt narrative. There are enough economists out there, not only MMTers, that are prepared to ask to whom the debt is owed – that it’s money creation, not borrowing.

Does this mean we have a self censored media, little better than Hungary, Russia, China and other autocratic regimes?

In fairness, a BBC journalist I cannot name has reached out to discuss how to frame this issue today

More than obsession, I just see fear (and also purpose ,as it just makes Government look good if they actually help and our modern public sector hating Tories hate that).

But the thing is, the fear is totally irrational. It’s as if this money is being funded by some significant body that is out of Government control – let’s call it the ‘Money Ogre’ – a mythical beast.

The Government thinks that the Money Ogre is out of control and roaming the lands and forests waiting to turn up and ask for the money back.

Except that the reality is that the Money Ogre lives in a cage in the BoE and the zookeeper is actually the Government itself. And this Ogre is actually a pussy cat and purrs when you bother to stroke it.

But they just don’t realise it because Margaret Hilda Thatcher sayeth that there was no such thing as Government money and the privatised and corrupt finance sector seem at liberty to tell the world that Governments that spend money into the economy are up to their eyes in debt (when in fact all they have done is create real cash, and not the debt that private finance are notorious for).

That’s right – we pay our politicians upwards of £80K a year to believe in a bogey man called the Money Ogre and the words of an extreme dogmatist called Margaret Hilda Thatcher (as well as the rating agencies who still think post 2008 that they have some say in the matter when in fact they don’t – or should not be allowed to).

Yep – she’s still here. And she is the real Ogre and she still has not be vanquished – Labour politicians please note.

Not only is the cost of servicing the debt falling (as old higher coupon bonds mature to be replaced by lower coupons that reflect current market rates) but they will stay low for a long time. Even if base rates eventually rise it will be a further decade or more before that is reflected in rising debt service costs.

The answer to “what happens when rates rise?” is “nothing”…… although I will pop the champagne if I am still alive – higher rates will be a signal of success.

Besides, interest payments put money in pockets that will be spent (although I accept that gilt holders are hardly the best target for fiscal largesse).

Could it all go wrong with QE? I suppose it is possible…. but it is at least 20 years away. Do we really want to condemn a generation on the vague possibility of problems in 20 years time? Failure to act will condemn the next generation with certainty.

Hear, hear

Mr Parry,

A clear, concise and persuasive statement, but I wish to focus on this observation: “Could it all go wrong with QE? I suppose it is possible …. “.

What, specifically is most likely to go wrong; what form would it take? What action might be taken in response?

In the near-term I am not sure that anything can go wrong.

Long term I would be worried that a future government might, in the event of inflationary pressure, be too slow to drain money (through taxation) from the system. Politicians will surely want to put off the day when they raise tax or cut spending. Of course, the draining could be done by issuing bonds (or selling some of the BoE’s gilt portfolio) but this would have an impact on interest rates and asset prices more generally….. with consequences for the banking system and the real economy. These are the sort of risks that might come up ….. but not for the next 5 or 10 years.

Having said that, the REAL long term risks are the failure of Capital Markets to allocate capital effectively. The last 40 years have seen governments try to deliver stable, low inflation using short term interest rates…. and then stand back to let the “hidden hand” do it’s work. It has delivered fantastically well in many ways…. but not in other very important areas – in health, education and infrastructure. Maybe I am just getting old but it seems to me that we have enough “stuff” and that the things we really need can only be organised/delivered collectively (ie. by government). So, whatever one’s monetary theology of choice we must have a system that delivers care for the sick and old, opportunity for the young and protect us from climate change. Getting capital from those that have it to areas that need it is to important to be left to the market.

I so agree on ‘stuff’

But I did when I was young as well

There were always better things than ‘stuff’ I thought

Books excepted

Mr Parry,

Thank you for the clear response. If I understand you correctly, however it does not appear that QE creates any unique or distinctive policy issue that would require especially difficult or technically complex creativity to find solutions. I say this because you wrote this: “Long term I would be worried that a future government might, in the event of inflationary pressure, be too slow to drain money (through taxation) from the system. Politicians will surely want to put off the day when they raise tax or cut spending.”

Inflation and taxation are fairly standard problems governments have conventionally faced. This is not new. I am not sure, on this analysis that QE would create a new or unforeseeable problem for government (unless of course there is an ‘unknown unkown’!).

Richard, have you seen this, which seems to support your position ?

https://www.theguardian.com/commentisfree/2020/nov/26/uk-maxed-out-credit-card-bad-economics-pandemic-austerity

I like Daniela and her work

She’s not pure MMT but very good

Good stuff here

Surely the real worry is deflation? Pulling demand forward from the future is just going to add to the existing deflationary pressures that exist due to demographics and technology? I think it’s pretty clear QE is good at restoring market function but poor at creating inflation and is perhaps even deflationary. If the reserves created to buy Gilts become legal tender it would set off an inflationary explosion. MMTers will probably say well the government can raise taxes to combat inflation but would the government react fast enough? I highly doubt it. There really is no easy way out.

The reserves created by QE are legal tender. They are the ultimate form of money.

Has it sparked inflation in the last decade anywhere that has done it? No.

In Japan, over thirty years? No.

So why now, here? When there is no demand side indication to indicate any reason for it? You tell me. With analysis, and not with the claim the government will not react, which is wholly unevidenced assertion.

They are central bank reserves that banks can trade with each other but the reserves aren’t real money. I’ve explained that I see the real risk as deflation and not inflation due to demographics and indebtedness. However were the BoE ever to create any real inflation, I believe the economy being as levered as it is will make it incredibly difficult to get back under control.

Tell me why they aren’t real money?

I am curious

https://www.bankofengland.co.uk/knowledgebank/how-is-money-created

So according to this article 18% of money are reserves. If these were converted into bank deposits there would be no effect whatsoever?

They are money for all practical purposes – the ultimate form of settlement, and provided by the government

What do you think the impact would be?

According to the Bank of England:

Why the extra reserves are not multiplied up into new loans and broad money

As discussed earlier, the transmission mechanism of QE relies on the effects of the newly created broad – rather than base – money. The start of that transmission is the creation of k deposits on the asset holder’s balance sheet in the place of government debt (Figure 3, first row). Importantly, the reserves created in the banking sector (Figure 3, third row) do not play a central role. This is because, as explained earlier, banks cannot directly lend out reserves. Reserves are an IOU from the central bank to commercial banks. Those banks can use them to make payments to each other, but they cannot ‘lend’ them on to consumers in the economy, who do not hold reserves accounts. When banks make additional loans they are matched by extra deposits – the amount of reserves does not change.

Moreover, the new reserves are not mechanically multiplied up into new loans and new deposits as predicted by the money multiplier theory. QE boosts broad money without directly leading to, or requiring, an increase in lending. While the first leg of the money multiplier theory does hold during QE – the monetary stance mechanically determines the quantity of reserves – the newly created reserves do not, by themselves, meaningfully change the incentives for the banks to create new broad money by lending.

https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/money-creation-in-the-modern-economy.pdf

Thanks

I had forgotten that piece, which is archaic now.

What is curious about it is that it refers to money multiplier theory when in the same issue of that quarterly bulletin that theory was dismissed as being wrong, and rightly so.

The reality is that no deposit at a bank is required for any loan to be made, and as such the amount of money created by the private banking sector is independent of the level of deposits that they hold. However, if the acceptability of private sector created money is based upon the confidence in the bank that creates it, then QE funds clearly assist the process of money creation and the transmission of that bank loan created money into the economy because the central bank reserve accounts of these institutions do provide them with the means to always settle their obligations to each other, And as a consequence I would argue that the transmission has already taken place, but not in any way remotely like that described by the Bank of England in 2014, because that referred to ancient history.

I seem to recall that the BofE Quarterly Bulletin, 2014 was a really important moment; I have never thought of it as ‘ancient history’. I am therefore trying to unscramble a number of issues here. David argues QE is potentially deflationary, not inflationary; a very surprising and striking proposal. If I recall correctly, the first QE tranche was after the Crash, and its purpose was to assist the rescue of the financial system from disaster, as the commercial Banks were no longer willing to lend to each other. Safe Asset theory tends to suggest this fear has become entrenched in the psychology of banking (psychology being the most important part of economic science). So far that fits with David’s proposition.

Correct me if I am wrong, but I understood the first QE was also supposed to stimulate the broadereconomy; some benefits were supposed to cascade down the banking system into real economic activity? Which, if I correctly understand David’s thesis, he effectively rejects for a restatement of fractional reserve banking. My problem here is that what transpired was not deflation, nor a rise in real economic activity, but a very sharp rise in asset price inflation, distributing the supposed wider economic benefits of QE to a narrow profile of rentiers who were inevitably the clients of banks. How did that happen? It is not clear to me how this is reconciled with David’s thesis, or the proposition that the QE reserves do not feed into the broader economy. So what is going on – or have I lost this plot somewhere?

See the thread I did last Sunday on QE history. I think it was right.https://www.taxresearch.org.uk/Blog/the-history-and-significance-of-qe-in-the-uk/

Stage 1 QE was meant to reduce interest rates and create an appetite for riskier assets which would supposedly boost investment – which was complete nonsense as it just stimulated speculation

Rationing the supply of assets did that

And vendors of them were paid – via the banks. Page 16 here tries to reconcile that https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/money-creation-in-the-modern-economy.pdf

I watched parts of the IFS briefing yesterday. https://www.ifs.org.uk/events/1871 Whether or not you agree with what they say, they are always given a lot of respect and airtime.

One interesting point (about 1:06:15 to 1:09) was the hope that the economic “scarring” from the coronavirus crisis will be less than it was from the 2008 financial crisis . They seem to agree that the OBR central scenario (3% down) seems to be too optimistic, given significant downside risks and uncertainties from coronavirus and Brexit and little clear upside. but is it correct that financial crises such as 2008 tend to have worse and longer lasting economic effects than other one-off shocks?

And then (about 55:00 to 56:00, and about 1:23 to 1:24) while borrowing currently is very cheap, they point to a risk that interest rates could rise which could rapidly increase the cost of government borrowing, a thought that seems to be driven not by current or prospective bond rates, but rather by interest paid at the base rate on bank reserves. But isn’t that a choice?

I can’t see why financial crises scar more

I think the real economy risks are much more serious

As to rate rises – where are they coming from? And why? And why won’t QE be used to stop the need? It’s all very odd that such options are not mentioned

Hi RichardÂ

Thanks very much for your series of videos and also for this blog.Â

Please could you check my understanding around the two major “rounds” of Quantitative Easing. It appears to me that the QE used to bail out banks is quite different from the QE used to bail out the country after Covid-19.

My understanding is that QE is undertaken to stimulate the economy, and although the various rounds are all referred to as “QE” they work differently chronologically.

The first round was an asset swap where the public sector (BoE) swapped money for interest bearing gilts held by the private sector. Neither public nor private sector increased their financial assets. Then the private sector was encouraged to use its (more liquid) assets to invest in the economy. So, QE first and, hopefully, investment to follow. In the recent rounds, the public sector has invested in the economy by purchasing goods and services from the private sector. This is balanced by the government going into “debt” with the BoE. In this case the investment comes first, the economy grows, and QE is then used to pay for it.

Many people said the first rounds of QE did nothing for the “real” economy but simply stoked house (and other asset) prices. The more recent QE will help the economy recover from its terrible state.

Do you agree?

I do

See here where I explore these ideas https://www.taxresearch.org.uk/Blog/the-history-and-significance-of-qe-in-the-uk/

I’ve now read your detailed explanation.

I do try to read all your output, but you are so prolific!

Best regards and thanks again.

I have problems resting my own stuff

Hence the typos 🙂