The Conservative's obsession with debt repayment was on display in the House of Commons yesterday. As I noted when live-tweeting on comments made by MPs after Rishi Sunak's Spending Review:

John Penrose MP has just told the House of Commons that every penny of government borrowing has to be repaid. They must have had rubbish history teachers at his public school. The national debt has never been repaid since 1694, so why does he persist in talking nonsense?

— Richard Murphy (@RichardJMurphy) November 25, 2020

You will note that the sentiment resonated.

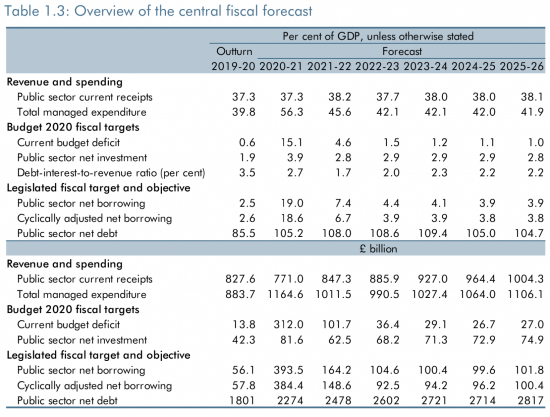

What was particularly telling was that the obsession is not matched by the practice seen within the statement. This table comes from the Office for Budget Responsibility (OBR) summary of the proposals being made:

The critical line is the one three from the bottom. Despite the obsession with debt repayment Sunak is forecasting a deficit of £394 this year and expects to borrow £100 billion or more for the next few years to come. Debt rises every year except 2024-25 and that is because of an accounting quirk (which reflects the absurd way in which national debt is calculated, but that is another issue).

Sunak will, of course, prefer to highlight that this forecast suggests that debt as a proportion of GDP falls by the end of the period. But, as I have already noted, the assumptions that underpin this are that business and consumers spend, spend, spend from 2022 onwards and there is simply no evidence based on past economic recoveries, where caution persists for a long time after recovery begins, to suggest that this is likely. If the behaviour is more normal, as I strongly suspect it will be, then borrowing will be approximately double that which Sunak is forecasting - and will be roughly £200bn a year, and debt will most certainly rise significantly, as measured in this way.

Does that matter? I suggest so for three reasons. First, Sunak pandered to this wing of Tory thinking yesterday. He has set himself up to fail as a result. This Spending Review will be added to all the other OBR wildly optimistic forecasts which have characterised its whole history. And he will be held to account for this. His star will fade pretty quickly, I suspect.

Second, the debt paranoia has already had an impact. The spending cuts announced are intended to achieve the goal of lower borrowing and will not achieve that aim but will absorb massive political capital for Sunak. Fighting civil servants on pay and his own backbenchers on overseas aid will harm him, but also harm the government: these are foolhardy policies that in the overall scheme of things are not worth the fight.

Third, when this paranoia translates into tax increases (as it surely will) then Sunak will make the continuing downturn (because that is what it is compared to expectation) so much worse, as he drains yet more demand from the economy when it will be very badly needed.

In that case what Sunak's debt obsession does is actually make the debt worse, which is very bizarre, but also true. His own belief that he cannot afford to spend more to stimulate the economy, which is the only way he has to restore the balance he desires, is precisely what is stopping him achieving this debt goal. You could not make such incompetence up.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

[…] belief is that borrowing will be at the top end of the OBR forecast range, and not where they suggest it is likely to […]

By capping wages & probably taxing the working & middle classes through direct or income taxes Sunak is going to crush spending. Many better off (not rich) have stockpiled or saved to defer perceived problems with supply following Brexit. To stimulate the economy the chancellor needed to encourage spending & consumerism. The fact that their circle of rich friends will be relatively unaffected by rising prices whilst the majority of population with fixed costs of housing, utility,fuel & food bills seems to have escaped them. This out of touch thinking will I fear lead to a self feeding lack of confidence in the economy and lead to depression rather than stimulus.

Agreed

“The fact that their circle of rich friends will be relatively unaffected by rising prices whilst the majority of population with fixed costs of housing, utility,fuel & food bills seems to have escaped them.”

More likely he’s well aware of it and his policies are deliberately fashioned so as to increase inequality, Under Sunak, just as it was under Osborne, the rich get richer by comparison, the poor, poorer. One wonders what it will take to get the poor to stop voting for this.

Truth be told, I rather doubt that there is anything malicious in Sunak’s ‘plans’ and I doubt he believes or even perhaps understands that the chief outcome will be the continued transfer of wealth upwards.

He’s a creature of his environment. Went to an expensive school, married to a billionaire’s daughter, worked for Goldman Sachs, became a hedgie. He might well have studied PPE at Oxford but recent history shows that the ‘economists’ they are producing there don’t have the first understanding of anything about how the economy actually works.

As far as Sunak is concerned, what he’s doing is following the TINA orthodoxy of debt fetishism which has been the mainstream economic thinking since the 1980s. He doesn’t have the experience or mental flexibility to imagine anything different. He’s obviously an intelligent enough chap but it takes a lot more than just simple intelligence to think your way out of an intellectual straight jacket and he’s not going to be getting any economic ideas from outside his peer group or the various right wing think tanks.

I don’t doubt that the people quietly funding said “think tanks” understand exactly what they are doing, but I’m not convinced that too many of the politicians they lead by the nose have the first clue.

Heck, I’d have to say the fact that he’s a Conservative MP by itself shows he doesn’t have the first understanding of real world economics!

I was recently trying to explain how money really works on a private preppers forum. The only support I got came from a woman who claimed she was familiar with the argument and knew it to be correct as her husband was teaching it at Oxford. That was something of an eye-opener, I’ll admit. I think we can assume Sunak’s familiar with the workings of QE anyway as, if I have this right, he has to sign off on it everytime the BofE do any.

Where in Oxford? That’s the question…

Hello Richard.

My comment is a general one. As you say, you’ve been talking a lot recently about debt.

The country is in fear that the government is going to go bankrupt.

Where is the opposition in this debate? Where is any MP from any party who’s willing to say the country is not going to go bankrupt? Isn’t it their job to question things?

Where are the journalists in this debate? Isn’t it their job to investigate, ask hard questions, put forward a different narrative?

It just baffles me why there is only the one narrative from these groups.

As I have mentioned, one journalist has reached out to understand this

I can hope that may go somewhere

I just became aware of this article from two weeks ago and I don’t recall seeing you mention it on your site (apologies if you covered it and I missed it). It says that MMT is sort of right but it is flawed in that using QE to fund the government leads to an accumulation of money with the rich and an increase in inequality so instead we need to tax the rich more, which to me doesn’t seem to be incompatible with MMT in the way the author seems to think it is. I don’t fully get his distinction that we have to choose between MMT or taxing the rich more when there’s nothing in MMT that says you can’t do both. I think the issue is that he believes that governments tax and spend rather than spend and tax and he is viewing MMT through this belief.

https://www.opendemocracy.net/en/oureconomy/who-should-pay-covid-crisis/

In the article he refers to another article he wrote in March where he thought that this accumulation would be the result of the new QE.

https://www.opendemocracy.net/en/oureconomy/following-coronavirus-money-trail/

I have submitted a reply to Open Democracy – but have heard nothing back from them

I really do not get the argument

MMT does not say that QE is needed to fund the government, so he’s wrong to say MMT is flawed on that basis alone.

As you say, there is not a choice between MMT and taxing the rich. However, the way I’d put the point on tax is that MMT is a description of how fiat monetary operations work, and at that level says nothing about whether or how you should tax the rich.

Economists know that, if inflation is rising and you want to reduce demand, taxing the rich is not very efficient. However, progressive economists, including those who understand MMT, would certainly argue that taxing the rich is necessary to reduce inequality, and would probably impose wealth taxes. Many would say this is also necessary to reduce their power and influence.

MMT suggests six reasons for tax:

1) To ratify the value of the currency: this means that by demanding payment of tax in the currency it has to be used for transactions in a jurisdiction;

2) To reclaim the money the government has spent into the economy in fulfilment of its democratic mandate;

3) To redistribute income and wealth;

4) To reprice goods and services;

5) To raise democratic representation – people who pay tax vote;

6) To reorganise the economy i.e. fiscal policy.

Much of the debt that is repaid is either rolled-over or renewed with new debt. ‘Safe asset’ principles establish that only sovereign debt is considered to meet the highest standards of safety required by private sector investors, especially but by no means exclusively in periods when the economy is depressed or fragile. The excessive fear of debt flight is emphasised by neoliberalism, because this is required to justify neoliberal ideology.

The question I ask is; given the long periods over which sovereign debt is repaid, rolled-over or renewed, how much of the “repayment”, over Britain’s modern history, is actually the product of economic growth (or inflation) disguising the degree to which the significance of the absolute level of debt shrinks because economic growth counteracts the fact that a relatively low level of NET (of roll-over or renewed) debt is perhaps, actually being repaid? It is noticeable, for example that economic critics and commentators prefer to look at debt as a %age of GDP; a basis of calculation which requires optics that of course embrace the disguising power of economic growth.

It would be invaluable to strip out all of these elements and identify the real (not statistical) data here – which I suspect otherwise may be distorting the facts as much as informing us of the true NET debt position.

I would suggest that until recently most debt was simply inflated away

And if that happened again, maybe that would be a good thing

Richard,

If I may tease your response out, that implies that debt is not generally repaid (outside roll-over or replacement by equivalent debt), but is principally eliminated by the attrition of inflation, or rendered slowly insignificant in material terms through economic growth. My real point here is to argue that it would be telling, powerfully, and publicly persuasive if that could be turned into hard evidence; the macroeconomic data over several decades.

If only I had time, but am inundated now

I appreciate the burden that falls on you; I did not intend to add to it. Rather, I was throwing that observation out to the wind, in the hope that one of your readers knows about the existence of this evidence already being available, or is currently being researched; or a commenter like Mz Schofield, tirelessly resourceful in her references and sources, produces a miraculous link!

Thanks!

Wonder if the red wall will react if MPs get their promised pay rise.

The arrogance of MPs to consider themselves as something other than public sector from a pay perspective never ceases to astound.

So what might be going on here and is there any potential risk.

Demand has collapsed due to the economy being shut down. The Government has had to step in to prop up that demand to stop people falling into destitution. At the higher end those with jobs and an income have nothing to spend their income on.

As a consequence private households in aggregate are saving and this is being matched by Government money creation.

The important issue is the nature of that saving. If the savings are being put into pensions or used for paying off mortgages then the money is removed from the economy and counteracted by the Government putting money in. When the economy picks up these savings will not be released back into the economy quickly risking inflation. Instead they will be slowly released on retirement or when houses are sold again.

If on the other hand these savings are sitting in instant access accounts then there is a danger that the money could suddenly be spent back into the economy quickly risking inflation. The supply of essentials has not been affected by the lockdown due to things like furlough but there could be pent up demand for other goods and services which may see general price increases post lockdown. Oil and fuel costs may well rise as global demand for them increases and these have consequential effects for lots of other things. Businesses effected by lockdown may try to recoup their losses and pay for loans taken out by raising prices. What we have seen is significant rises in housing prices so some of the saved income is going into non-first time buyers moving and share prices also have surged so asset price inflation is visible as a consequence of the better off saving.

So there is a potential for the increase in money supply to create inflationary pressures which could also be exacerbated by Brexit induced shortages and increased trading costs. The last time demand plummeted and then recovered rapidly after WW2 tax rates were very high in the 50’s, 60’s and 70’s and interest rates rocketed together with high levels of inflation by 1975.

So there is not zero inflationary risk as a result of Government money creation. But it is an unknown risk. Global supply may take up the slack as may the type of saving that is happening. Should Government stop spending now, absolutely not. Government, Tory or Labour, should have much better industrial and energy policies and commit to full employment, governing for all not just for friends and cronies. But government does need to be vigilant.

At some point taxes will rise as will interest rates. The important thing is that the burden of correction should not fall on the least well off but it is the better off who have the greatest power and always use it to protect themselves. The capitalist world has a crisis coming and unless the wealthy realise that without greater benevolence and understanding towards their fellow citizens and the need to share more equitably then that crisis could turn nasty.

See my analysis of the sectoral balances yesterday

I think inflation risk very low

[…] belief is that borrowing will be at the top end of the OBR forecast range, and not where they suggest it is likely to […]