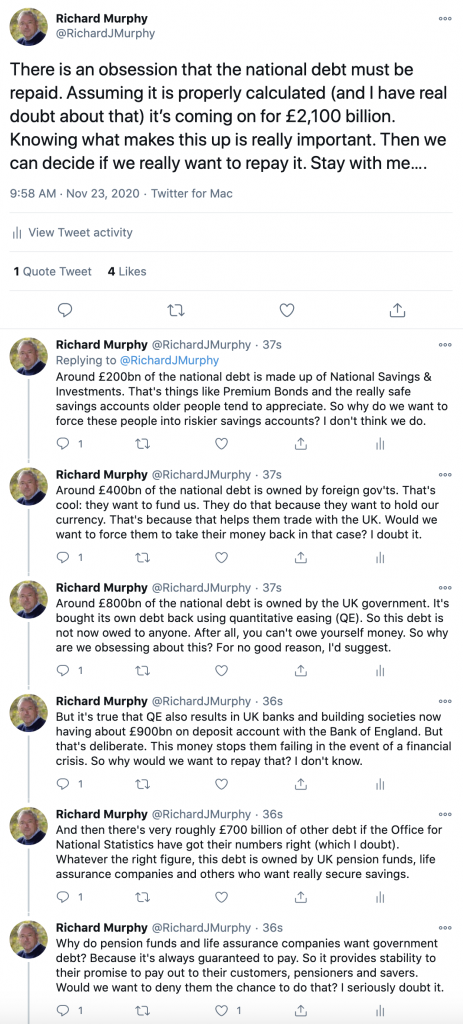

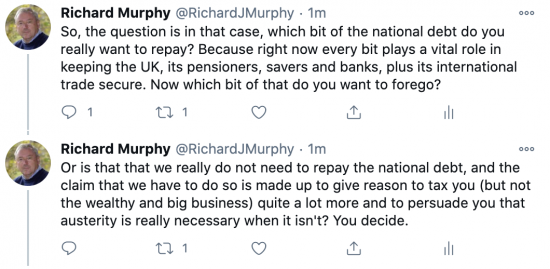

I just posted this on Twitter:

Answers on the back of a £20 note please to a charity of your choice.

Or, in the comments box, if you like.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Thanks for this Richard.

Like many, I get lost down the rabbit hole when it comes to Debt but it’s becoming clearer by the day!

Couple of questions. Is foreign debt acquired through other countries buying UK government bonds? If so do they use their currency or a mixture of their’s and ours? If theirs in any form that helps us with our trade too?

Also presume if it is bonds there is a fixed term repayment agreement so the debt cannot be called in early?

On repayment is that done using our currency or theirs and if ours presumably Treasury can print new money to repay?

This is a pretty mixed up question – and so hard to answer

Foreign countries own UK national debt

Most of that is deliberate holdings acquired as part of what are, in effect, currency holding portfolios. After all the national debt is just money that carries a very small interest rate

This underpins trade but is not as such part of it: it stabilises exchange rates, for example

They can buy from a willing customer in any currency they like – but the debt is always in sterling

Bonds are fixed term – up to 55 years – early redemption is not possible. Average is around 14 years right now

We always rep[ay in sterling – so they have sterling at the end of the day

The BoE can create new money to repay but remember redemptions are invariably matched by new issues

So what are the downsides of “national debt” and quantitive easing?

Can we create limitless money?

No

We can create enough money to create full employment

Then we hit a real constraint – there is nothing left to spend money on

So extra spending then has to stop or taxes go up

Unless additional money is spent on automation productivity gains? Wouldn’t this effectively keep employment from topping out? It should increase the supply side, which would also keep inflation in check. A UBI could then support incomes during redeployment ‘churn’ into new green sustainablity jobs as older ones are increasingly automated. The aim being sovereignty in supply, especially the basics of food, energy and housing. This is from my perspective as a professional futurologist and UBI supporter 🙂

Automation has always happened

It’s a normal process

The question is what we mean by full employment – which has to be defined around the ability to live on the resulting sum

If there is less than full employment and a UBI is less than the real living wage it should not be inflationary

>>Automation has always happened<<

Agreed. But one thing that many people don't take into account is that automation isn't a linear process, it is an exponential one, with a virtuous circle feedback loop. Additionally AI is increasingly automating White Collar jobs which, in the past, haven't been as impacted by previous cycles of automation.

But yes, UBI will be below the real living wage, hence the 'B' in UBI. I look forward to the day we can replace the 'B' with a 'C' for Comfortable.

£232.9b of the national debt is attributable to the BoE as at end Oct 2020 according to the OBR.

£107.8b is the loss on the value of the £875b of gilts held by the APF.

£119.2b is attributable to the Term Funding Schemes which provides banks with subsidy to loan cash at very low rates.

Why either of these is classified as national debt is dubious at best.

The government procurement scandal is currently gaining traction in the media but nothing is said about the BoE wasting over £100b by paying way over the odds on market prices to buy back gilts. BoE seem to get a free pass on scrutiny.

I will have much more to say on such issues soon…

Because….err…mmm…splutter, splutter…..waffle, waffle…..’ too much borrowing’, ‘have to repay’….blah, blah…’live within our means’, ‘bankrupt the country’….’burden on future generations’ and so on and so on.

And other such bollox will be sprouted by politicians, the lamestream media etc. if asked about this topic.

Craig

Richard,

I’d like to paraphrase your Twitter thread when I next write to my MP, would you be OK if I did that?

Bob

Of course

And please share!

It was interesting to to note that this morning’s edition of Today included an interesting segment on QE and money creation, led by the business correspondent at about 06.18, and later on, in the next hour, with Justin Webb, we were back to National Debt and ” How do we pay for it”.

One one hand, a pleasing development, but on the other, plus ca change.

Indeed

A few years ago I wrote to BBC R4 and suggested that they send all their presenters and journalists on a macroeconomics training course to be introduced to the basic ideas of how money is created, and what the national debt really means – or at least have them attend a seminar given by somebody who understands the subject (not a neoclassicist, obviously). You’ll be surprised to hear that not only did they not take up my suggestion ( I may have proposed a few names as tutors, possibly including Richard’s) but they never even replied.

The inane regurgitation of so-called “conventional wisdom” on many topics, but especially economics, is what has driven me to no longer listening to R4 Today, or watching BBC news. Sadly most other news and political output across the broadcast media offers the same unchallenged assumptions disguised as fact.

Agreed

A lot of what you are saying here isn’t correct.

Banks don’t hold £900bn on deposit with the BoE. The actual number is currently zero. You can see this in the data the BoE provide on open market operations.

https://www.bankofengland.co.uk/statistics/tables

Pension funds and insurance companies don’t want Gilts either, by choice. They are forced to hold a certain amount for regulatory reasons, use some for hedging and collateral purposes, but they currently give zero return on a liability basis and a negative return on a real basis. So holdings are typically kept to a minimum. DC pension funds rarely hold many so that leaves DB funds, who have on the whole reduced their allocation to Gilts steadily as their assets increase. Of that, the holdings are heavily skewed towards inflation linked bonds.

This can be seen in the data. In 2000, 74% of Gilts were held by pension and insurance companies. Today, that figure stands at 29%.

https://www.dmo.gov.uk/data/gilt-market/

Sorry, but banks do hold that money with BoE on central bank reserve accounts

You are wrong

And pension funds do own less

They still own a lot, but then 40% are now owned by Treasury / BoE. unsurprising that they own less.

You suggestion I am wrong is not true

I have provided the data on the BoE OMOs. Which is where commercial banks would place their money with the BoE.

The data clearly shows that Banks aren’t doing this. Which shouldn’t be a surprise really. Banks aren’t forced to place their reserves with the BoE, so will place their money elsewhere as long as they can beat the 0.1% the BoE is currently offering. Which isn’t that difficult.

Your claim was that pension funds and insurance companies want government debt. The data shows this isn’t true. They hold less in terms of the amount of debt outstanding as I mentioned above, which you claim is down to the BoE buying Gilts.

That doesn’t explain why they hold less in Gilts as a percentage of their own assets (about 75% in 2000 down to about 40% today). It doesn’t seem like they are rushing out to buy them, does it?

That is just DB funds. Which are typically closed, and aren’t going to experience much growth. DC funds rarely hold anywhere near as many Gilts as DB funds, so pension funds holdings are likely to decrease over time even more. Again, it’s not surprising as holding Gilts at these low nominal rates and negative real rates almost guarantees a loss.

I’m a bit surprised you are arguing this point in the face of the data being as it is.

Patrick

This is not OMO operation per see

This is the operation of central bank reserve accounts.

Read Note 11 here and stop wasting my time https://www.bankofengland.co.uk/-/media/boe/files/annual-report/2020/boe-2020.pdf?la=en&hash=2E9658E006FC1AA89E39415B9833BAE0BA753877

And given that pension and life assurance funds are still massive holders of gilts and significantly up in absolute value terms (which you ignore) I’m very relaxed with my argument

Just look at a UK Bank’s annual Report. Eg. at end 2019 Barclays held GBP 150bn on deposits with Central Banks. That is not zero.

The £479bn in the BoE report you link (didn’t you originally say £900bn?) to includes the money in the RTGS and CHAPS settlement systems. CHAPS had £479bn outstanding on the end Feb accounting date of the BoE. QED.

https://www.bankofengland.co.uk/-/media/boe/files/markets/sterling-monetary-framework/reserves-accounts-quick-reference-guide

CHAPS is pure settlement, custody and clearing. It doesn’t tell you how much money banks are putting out on deposit to the BoE – it tells you the volume of transactions that are occurring.

Which is why you look at the OMOs to tell you how much cash the BoE is actively taking on deposit, rather than having flow through it’s accounts on a given day. Which are currently zero.

It would rather defeat the whole purpose of QE if the BoE swapped bonds for cash…then took most of that cash straight back in again. The whole point was for that cash to get out into the market, so the banks take the money and invest it elsewhere – and has often been said the effect is to push up asset prices across the board. If you managed a bank, would you just park your assets at the BoE for 0.1%, which in real terms means you are losing money every day, or would you go and find other things to go and buy that offer more return?

As for the pension funds. Yes, they are still massive holders. The fact that they have reduced their holdings dramatically in (for pension funds) such a short space of time, and now hold only slightly more than the regulatory minimum doesn’t really lend much credibility to your claim that they “want” government debt. Forced to hold it, yes. Want to hold it, no.

Patrick

This is kind of boring

I am discussing these issues right now with all the agencies involved

The BoE says these are central bank reserve accounts

They are deposits

They are pretty much fixed

They are used for settlement but you have wholly misinterpreted them – they are created by QE

And since QE is cash creation what else do you expect as an outcome?

I won’t be discussing this again….QE creates these deposits, near as dammit (hence my ability to predict the increase). Full stop. The BoE agree. A bit of a waste of time arguing

And as for pensions – maybe there’s a reason for the regulation? Which is precisely what I describne…

Again, I won’t be repeating myself

Richard,

QE creates reserve account deposits. Pretty self explanatory really.

What you seem to be missing is that these deposits don’t stay at the BoE. If they did, there would be very little point in QE.

The £900bn….now £479bn you are quoting is the balance of the CHAPS/RTGS system. These accounts happen to be reserve accounts, but their main purpose is transaction and settlement. The balances change every day. The BoE has these accounts on it’s balance sheet in the same way any exchange or intermediary would.

A transaction settling through CHAPS is very different to a bank actively going out to place money with the BoE – and that is the point I am trying to make, and you are failing to gather. QE has affected the amount of money in the banking system, but it doesn’t mean that all of that QE created cash goes directly back to the BoE.

Similarly, the BoE would still show large balances in CHAPs, and so large reserve balances, even without QE – as long as transactions are taking place. Had you bothered to look, you would be able to see this in the data.

As for pensions – what regulation do you describe? Can’t see you describing anything anywhere, other than saying pension funds “want” Gilts, when the reality is they want the bare minimum they are legally forced to hold, and view them as a terrible investment. How is that want?

Do you ever admit when you are wrong? Even in the face of the data? Or is it just the case that if the data doesn’t agree with you, the data is wrong, or you dissemble as you have done here?

Sorry – but this is utter nonsense – and the BoE think it is utter nonsense

And 11 years of Bank of England evidence shows it

As does the ONS also believe it

I don’t admit I’m wrong when I’m not

You even seem unable to differentiate stocks and flows…

Please do not call again

Hi Richard,

The debt has always been a mystery to me but I’m now getting a handle on the £2,100bn of debt and what it’s actually made up of so thanks for all your posts.

What about the asset side? Presumably we’ve bought foreign government’s bonds to facilitate trade? The debt we have has presumably been used to build infrastructure that has value? How does this fit into the picture?

There is a giant con trick going on on the asset side – there will be more on this soon, as I keep saying, but the research is talimng time

I was wondering about how much we had of other countries’ debt ,,, and now I’m intrigued: ‘a giant con trick on the asset side,,,’. I’m starting to suspect you are just trying to build up suspense with all the hints about this research you are doing Richard!

Yes….guess the number

Hmm.

I’m not sure it’s fair asking me, of so little internal and international financial knowledge, to guess a number. But okay, I’ll take a stab in the dark, it’s a number that’s of exactly equal value, mysteriously so, to our foreign debt?

Do I get a prize if I’m right, and do I get extra guesses if I’m wrong?

Wrong I am afraid

And there are no prizes…

Bah. (To being wrong, and to there being no prize. Good that I didn’t lose out, I suppose, though)

I’ll go away and think about it rather than make endless stabs in the dark – my next one would have been zero – but I don’t see why, and it’s the reasoning I need isn’t it.

We don’t want to pay off the £800 billion right now. But we might well want to in the future.

The £800 billion is £800 billion in new money that has been created. So, with all that new money sloshing around the economy we might get inflation. Don;t worry too much about whether we actually need full employment for this to happen as you insist or whether we can have inflation and unemployment — stagflation, as we historically have had.

Just run with the idea that lots of new money might lead to inflation. As it might.

So, we’ve two solutions here.

One is the MMT one. We’ve got inflation, we increase taxes, feed the money back into the Bank of England and cancel it.

There’s the standard QE explanation of what we do. We sell the bonds back into the market and raise interest rates which curbs inflation. The money we’ve received for the bonds is fed back into the Bank of England and cancelled. Cool. But, note, we’ve now got £800 billion of gilts not owned by government but owned by all of us out here. And we’d likely like to have our money back, or at least the interest payments. So, taxes must rise to pay us all.

So, MMT or QE, doesn’t matter. If inflation turns up — I’d say it will but that isn’t crucial to this point — then taxes must rise and the debt paid off in order to destroy the money.

We get to the same place either way.

So, why would we like to pay off the £800 billion? To kill inflation if it arrives.

How much inflation do you think there will be to require £800 bn of bond sales?

And don’t you think new bond sales might be more effective as they will be at lower interest rates?

“How much inflation do you think there will be to require £800 bn of bond sales?“..Do you now accept QE can be reversed to stem inflation.

“And don’t you think new bond sales might be more effective as they will be at lower interest rates?”

Err no quite the opposite. The higher notional (and therefore real) rates the more attractive bonds will be and the more demand will be created.

New bonds are going to be at substantially lower rates than old ones that have been QEd

And no government is going to let rates rise – the risk of mass mortgage failure is too high

ZIRP is policy now, as well as the ine=vtiable trend and society cannot afford anything else

Well, when a neat round billion of that new money sloshes in my direction, and sloshes firmly into my bank account, you can carry on and pay off whatever debts you like, I won’t be caring. Actually, I think I’ll create my own bank to hold the money – no point in having others profiting from it.

Wow, even I’m shocked at how quickly my normally generous nature changed there, and that was with just thinking about the billions sloshing my way. And I think that’s my answer too Richard – just as soon as I am as rich and greedy as those that allegedly run the country are (well, richer would be best), I’m quite happy for the population of the U.K. to pay off whatever debts they feel like 😉

As one of those oldies who has far too much cash currently (sold my house and not found a new one to buy- foolish move!) I am furious that having lodged it safely in NS&I I am now spending an inordinate amount of time opening numerous bank accounts that pay some interest rather than leave it at NS&I at effectively 0%. Not only do I feel it is less secure so having to ensure each account does not exceed £85k, its now much harder to keep track of where it is and will be a pain to release as and when I find that house to buy instead of one simple transfer. But I will not give Rishi totally free money.

I sincerely hope a lot of other people re doing the same.