I watched some of the Treasury Committee hearing this afternoon. A Bank of England team were being questioned on many issues, including MMT. Steve Baker MP was the stooge (the correct term on this occasion) on MMT. It was at 16.48 here.

I was infuriated by all the usual nonsense. Andy Haldane's zinger was MMT is not modern, not monetary and not theory. Oh dear, not enough Greek symbols to keep him happy in other words. And as for his claim that it was a 'one-off trick' that was unrepeatable, who knows what he was talking about? I am sure he did not.

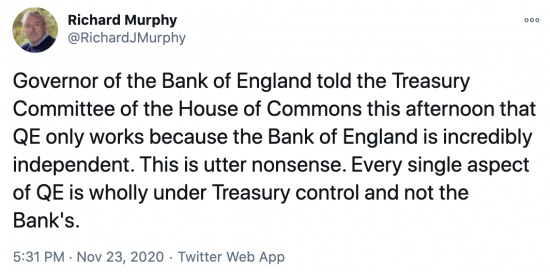

But the Governor, Andrew Bailey was much worse. I tweeted twice in response. The first tweet was provoked by the claim that QE can only happen because the Bank of England is 'incredibly independent'. Actually, as I explained yesterday, absolutely everything about QE is wholly under the control of the Treasury.

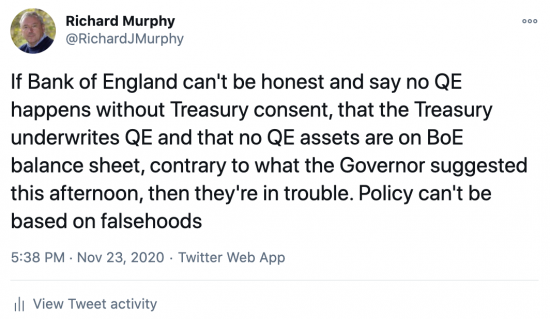

The Bank cannot do QE without written permission from the Treasury. And the company that manages QE assets is wholly indemnified by the Treasury for its actions and so not considered for accounting purposes to be part of the Bank of England, which fact (for fact it is) motivated this tweet:

The Bank cannot do QE without written permission from the Treasury. And the company that manages QE assets is wholly indemnified by the Treasury for its actions and so not considered for accounting purposes to be part of the Bank of England, which fact (for fact it is) motivated this tweet:

This was in response to claim by the Governor that if the gilts subject to QE were written off there would be a massive hole in the BoE balance sheet. There would not be. There would simply be money owing to the BoE from the Treasury, which is, of course, the case now, albeit via a convoluted route, because all that a gilt actually represents is a promise to pay by the Treasury.

I admit to having been shocked by the display. The arguments on MMT were incredibly weak. And the claims on QE were, in my opinion, false. I can't put it another way. I think they were wrong. And I don't expect the Governor of the Bank of England to either a) make false claims or b) make claims that are false but he is so unaware that he does not know it. A shocking performance in that case.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Do you think this was deliberate lying? Or ignorance? I’m not sure what’s worse.

Remember when he said the UK nearly went bust, that he would not print money to help tackle coronavirus, or that he wanted to shrink the Bank’s balance sheet, or when he said: “Central bank independence is crucial. The good news from all the evidence I see is that it’s holding well.”

He’s certainly set a high bar for monumental stupidity which the next Governor will be pushed to reach. I suspect as the months go by that bar will go ever higher.

How did he get this job?

There are those who suggest it’s his reward for looking the other way with regard to the RBS/GRG looting of SMEs and bank misbehaviour in general. I’d say that was entirely credible myself.

Haldanes zinger seems to be from the Mises Institute

https://mises.org/power-market/mmt-not-modern-not-monetary-not-theory

There’s also a lengthy review of Kelton there –

It is always worth arguing theories – but there is at least as much value in arguing our way through the present juncture – which seems a clear demonstration / experiment which has already wiped out any case for the last 10 years austerity being ‘necessary ‘.

MMTers and ‘conventional’ economists already agree that any paying off ‘the debt’ is years in the future – or never. In this sense there is convergence towards MMT ideas in practice, even if not acknowleged.

“not modern, not monetary and not theory” is neat, but the put-down deserves some examination to see if if bears any weight.

As might be expected, the Mises Institute and its president (the delightfully named Jeff Deist, former chief of staff to Ron Paul, which tells its own story: lets abolish income tax, end most public provision of services, and return to the gold standard) adopt a framing in that June 2020 blogpost which is largely pejorative:

* MMT is not modern, as kings “used seigniorage and currency debasement for centuries … always at the expense of their subjects”

[because governments and central banks are unaccountable “seignors” infringing on the inalienable liberties of free citizens on the land, and “debasing” a currency which has its own existence as some sort of Platonic ideal, as if any modern currency was still minted from gold or silver to which base metals could be added and not just created from electrons, of which we have a ready supply, at the press of a button]

* MMT is not monetary, but rather primarily fiscal.

[That is probably right – it is about the creation of money and what can be done by spending it, and not about controlling the economy by restricting the money supply. But it is “Of the nature of, relating to, or concerned with money” so “monetary” is appropriate, even if that brings unhelpful allusions to monetarism. ]

* MMT is not a theory, just “an accounting subterfuge which bizarrely claims government deficits represent private (societal) surpluses” or “accounting gimmickry”.

[Odd that a conceptual framework for understanding a social system is attacked for trying to get the maths to add up, but anyway, it rather depends on what you mean by a theory. Is MMT “The conceptual basis of a subject or area of study” (OED definition 1a) or “An explanation of a phenomenon arrived at through examination and contemplation of the relevant facts; a statement of one or more laws or principles which are generally held as describing an essential property of something.” (OED definition 6a) or “More generally: a hypothesis or set of ideas about something.” (OED definition 6b) ? Or, like evolution, is it “just a theory”, a speculative conjecture devoid of practical import? ]

There is some faint praise (“Kelton deserves credit for writing a book aimed at lay audiences instead of for her peers in academic economics. Unlike most of those peers, she seems genuinely interested in helping us understand how the world works.”) But then the bizarre contention is that MMT “must be fought with appeals to reality”. As if the prescriptions of mainstream macroeconomic theory (another MMT) were closer to how the world really works, and was not drive itself by theoretical mathematical abstractions with little practical underpinning.

Unusually, it does not raise the baleful spectres of hyperinflation in Weimar Germany, Venezuela, and Zimbabwe. Perhaps they don’t play as well in the US.

MMT is of course an attempt to explain and describe how the system of money works in the modern world, a basis for understanding the modern money system, or succinctly a modern theory of money. Let’s call it “Modern Monetary Theory” for short. Yes modern, yes monetary, and yes theory.

Thanks Andrew

Agreed

The current Governor was not a very good regulator if I remember correctly.

He is in the same vein as USA’s Tim Geithner – a useful, nice but rather dim person to have in charge and whom will not ask too many questions about what is actually going on. And of course, he’ll be paid well to …well…..not be too clever.

Remember who appointed him.

“So tell us, Mr Bailey, just so I can say I asked, what you think of this bat-s**t crazy idea called MMT?”

“Not a lot”

“Glad we agree. Moving on…”.

Not exactly an insightful discussion, was it?

And Baileys answer about reversal of QE – total non-answer because he knows it won’t be.

Sounds like my time was used more productively…. I was walking not watching Andrew Bailey.

However, I am not so pessimistic about the BoE. When COVID struck the QE announcement was swift and substantial….. in a way that went far beyond what might have been necessary for controlling interest rates and keeping the system liquid. It anticipated monetary financing of government spending. Actions speak louder than words…. whatever Mr. Bailey says.

What could the BoE do, short of calling out the government for being mendacious fools? Not a lot more than they have already done.

On the other hand, I am deeply depressed by our government where both words and actions are appalling.

Made a similar but weaker and more historical criticism of the same thing:

http://www.progressivepulse.org/economics/fiat-money-facts-continued

But if even a non-economist like me, can see the inconsistency, it certainly suggests that in the BoE we have people either without a broad understanding – or simply without all the necessary tools in the box – and worryingly the BoE shares that with the government, which is occasionally good at PR but certainly little else..

Great minds…and all that

The Bank of England has long been an unaccountable cult organisation. So much for all the rhetoric pumped out about the UK being the first true democracy. Simply a partial version of the truth!

I think the game is up and they know it. I’ve never known a time where so many people understood and discussed MMT. The BoE will be the last to give it up, but they will eventually

Can’t you write to the committee and offer to appear?

They don’t have to invite because I offer

The fact that they are discussing MMT is a victory in itself.

Events will force their thinking (or they will be replaced).

MMT is entering the mainstream.

What do you think about this modern theory that the world might be a sphere? Oh, some crazy people have occasionally proposed that mad idea since the Greeks. So it is not modern, nor even a theory, just an idea or a description. But everyone knows the ground is a flat disc supported by elephants, and if you go too far you’ll fall off the edge. Ha ha ha.

🙂

Like many, I am frustrated by the apparent ignorance of the BoE. I feel it is a wilful adoption of an anti- MMT position; they insist…”The Emperor DOES have clothes” knowing full well that he is at the very least rather threadbare. But, a question on the balance sheet issue: If the BoE writes off, say, £500Bn of gilts, surely the government no longer owes the money to the BoE. The BoE say the government WILL contniue to owe?. A retirement of the gilts would surely entail at least an exchange of correspondence to say that the legal document requiring the payment of interest – and eventual capital – sum had been cancelled. The obligation which it had set down would no longer exist. Why would the government still owe money? Might not the “hole” (that the BoE referred to at the committee) not refer to the imbalance which would emerge following cancellation of the gilts with regard to the commercial banks reserves accounts at the BoE?. Is it not these reserves which form the BoE’s liability against the asset of the gilts.? I’m an amateur, so don’t beat me up!

An interesting watch if very irritating in the immense smugness of the participants.

What they didn’t answer is if the UK Gov wanted to raise money why doesn’t it simply issue bonds into the market since there must be in the view of the BOE a surplus of cash available? Obviously there is not. The only reason for QE is a roundabout way of creating money and giving it to the Govt to spend. Here is the flow

BOE creates £500bn and lends it to the AFP.

AFP buys bonds from market using the lent funds.

Govt issues bonds into the market to get hold of the cash created

Net effect is UK treasury now has £500bn to support the economy. No change in assets in bond market. AFP has assets and liabilities of £500bn = net zero and BOE has a supposed loan asset of £500bn with AFP a company it owns. So BOE has lent UK Govt £500bn.

Bailey’s reason for not cancelling the debt is that it would blow a hole in the BOE’s balance sheet. But if you have just expanded the balance sheet by £500bn why does cancelling the debt not simply reduce the balance sheet to the size it was prior to the QE? No hole simply cancelling the date due from yourself.

Steve Baker seems to think the bonds have to be sold back to the market! Why would that be necessary since the market hasn’t paid for the bonds in the first place neither is it sitting with the cash to buy them. The bonds have been purchased by the BOE via the AFP to facilitate the creation of £500bn of cash to support the liquidity of the consumer by the UK Govt spending the money back into the economy via furlough, grants and loan schemes.

The BOE is deceiving itself, as seems clear from the comments of Haldane and Bailey, if it believes QE’s sole purpose is simply to suppress interest rates and so ensure that the market for bonds does not demand a higher return for ‘lending’ money to the Government.

Lastly or nearly so the criticism of Stephanie Kelton for not being academically rigorous disregards the fact that her book was written to engage the non-academic. I am sure if these economists took the time to engage properly they would be more enlightened but it suits them to stick to their 19th century view of the world. They still seem to think that the economy is pegged to Gold and no doubt some of them wish it were but it isn’t so move on and deal with the world as it is now and not as it was in 1920.

Lastly I noticed Baker didn’t pick up on the comments that the biggest inflationary threat arises from Brexit not from so called Government borrowing. Priceless.

I’ve done it again.

When I read that the lamentable Steve Baker was a stooge I thought you’d written ‘stool’.

Funny that I should make such scatological assumption!

BTW – I really don’t like how he walks Westminster like some over promoted school prefect. Baker represents one person: himself.

Very funny if it wasn’t such a serious subject!

Oh very well…….sorry!

I think the comments are a little harsh on the BoE. Certainly, Andrew Bailey is an uninspiring Governor but do remember who the BoE reports to – Parliament (or, in practical terms, the Treasury). As Richard has observed frequently, the BoE is NOT independent. Are we really surprised that that boss of the BoE spouts Treasury orthodoxy to a committee representing his bosses? Bosses who appointed him not to challenge anything.

Aim the criticism where it is deserved – the politicians. The government for operating against the interests of the Nation and Labour for being unwilling to challenge it.

Some Governors have shown gumption Clive.

Bailey has not, so far.

I think that point is fair.

I am no fan of Bailey…. for a lot of reasons. The criticism of “lack of backbone” is fair…. but he was hired for that quality so we should not be surprised. I just want the pressure kept where it is due – on the politicians.

Fair