The ONS has announced another pile of economic news this morning, all of which is framed in a way intended to misrepresent what is actually happening in the economy.

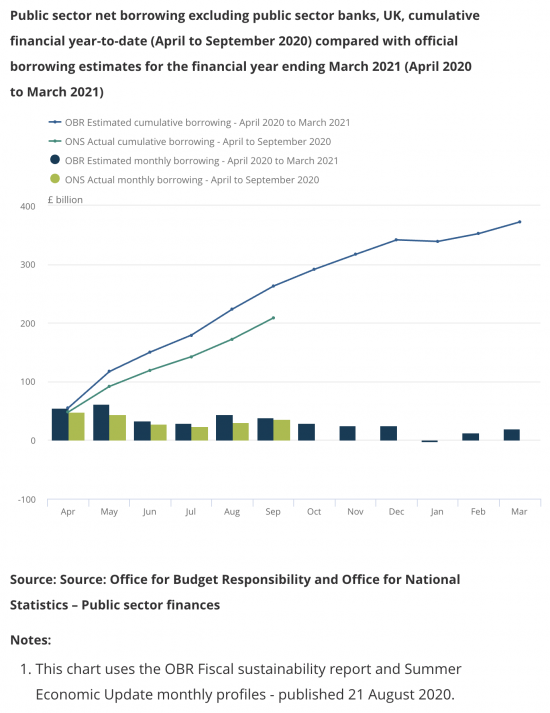

Take this chart:

Breathless journalists are reporting that UK national borrowing went up by £36 billion last month and has now exceeded £200 billion so far this year.

This claim is wrong. So far this year the Bank of England has spent well over £250 billion buying back UK national debt through the quantitative easing policy that it is pursuing on behalf of HM Treasury. The consequence is clear. If £200 billion of debt was issued by the Treasury, and £250 billion of debt was brought back, UK national debt has fallen so far in 2020/21. In fact, there is approximately £50 billion less debt now then there was in March 2020. There is, admittedly. more money in issue on central bank reserve accounts held by the UK banks and building societies with the Bank of England, but that's not the same thing, at all. That is new money, and not debt.

And, for the record, this is clearly not causing inflation. CPI Struggled to 0.5% this month, seemingly avoiding going into negative territory because of the incentives provided for people to eat out.

There is, however, another implication of this. So long as inflation remains well below the, fairly meaningless, Bank of England inflation target of 2% per annum then there is absolutely no reason why it cannot undertake more QE purchases in the months to come. In fact, I can fairly confidently predict that it will.

So, is there a debt crisis as the government wishes to claim? Of course there is not.

And is there money available for Manchester? Of course there is.

Just as there is money available to prevent anyone from facing a personal economic crisis as a consequence of coronavirus.

Government, aided in abetted by the incorrect framing of economic data from the likes of the ONS is claiming otherwise. This is fraudulent misrepresentation, in my opinion. And the fraud is on the people of this country.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

The real fraud is intellectuals who wish to talk about debt not talking about the cost of servicing it. On average the nation is worse off. If the cost of servicing the debt has gone down less than the reduction in national income then this is not a good thing.

Tell me what this cost is?

Tell me how it is paid?

Tell me who gets it?

Tell me why it is so bad that they do?

Tell me what you would rather happen, please?

Hint. Interest rates are at historically low levels (if we can, we should probably redeem outstanding gilts carrying higher rates and issue new ones at lower rates). But in any event gilts acquired under QE are held held by the APF subsidiary of the Bank of England, which is 100% owned by the government. So the “cost” of servicing this debt is paid back to the debtor. The left hand is paying the right hand. That is, there is essentially no cost.

I rather hoped that was clear…at least in other posts as well as this one

Dear Mr Traction,

If you cannot answer the questions, then I’m afraid this blog is not the place for you. It is not the type of place were you can trash talk the host, and make unsubstantiated claims. However, you can come on here with an argumentative challenge. You just have to back it up.

I recommend you read Debt: The first 5000 years by David Graeber. Might add a new perspective to your thoughts about debt and morality.

With a due respect, you are talking bollocks Mr Traction 🙂

The debt and the service cost are ultimately owed by the government to the government. They will always net off / contra / cancel out and are therefore irrelevant.

If you lent yourself 1bn Traction pounds and 1m% interest APR, would principal repayment or dsebt service costs ultimately matter?

Also worth bearing in mind that you /government can set interest rates to some degree…or reschedule the debt owed to yourself over a longer/shorter period.

The government can set interest rates entirely

That’s one good reason for it having both gilts and massive central bank reserves in existence

It gives the government control…

The governmental control aspects of the UK’s reserves based monetary system (including what gilts are and do) just simply aren’t taught en masse in the UK and this is reflected in the country’s relative decline as well as the election of governments not really fit for purpose. It’s like the whole country is benighted under a self-generated dense fog with no leadership with the wits to lift it!

I have just seen that the head of the Centre for Policy Studies claims taxes are at a historical high as an argument for yet more public spending cuts and for cutting taxes. . Surely this is incorrect as I recall the standard rate of income tax in 1975 was 35% and allowances much less generous than today ?

Everything the CPS has to say should be presumed to be wrong

This article shows everything that is wrong with the fiscal influencers in this country. Everything has a price, you cannot just print money and by magic this issue goes away, else everyone would do and we all live happily ever after. If we were a net exporter like China then a lower exchange rate can work but we are not, fr from it. Using QE in the long run when all other factors average out will lower the wealth of the country globally. Santa Rishi and his magic money tree will not hide actual debt in the end. He is running out of quantative tools as it is like pyramid economics. Just like like the stamp duty holiday that did nothing to help the buyers or the national purse it just lined the pockets of the land owners of his friends and created an even bigger bubble. A 7.5% rise in prices did more damage to the lower income buyers than it was supposed to help. The banks know the bubbles are going to burst and it will become self fullfilling. Next step 95% government mortgages and 40 year terms.

When will people realise that real money needs generating and not building an economy on services and bubbles. The future of virtual enterprises is truly global and our financially orientated economy is going begin reducing as a consequence. With shaky financial foundations a shrinking manufacturing base, nightmare public pension pot, a health service that is only going to get more expensive due to drugs, lawyers and an aging population and shrinking tax revenues everyone seems to think all is good on the finance front. Keep smiling Rishi and smoking the dope the reaper will get here eventually!!!!

Have you actually read any MMT?

You know it says money must not be reprinted without limit?

You do know it is obsessed with controlling inflation?

You do know that its whole focus is on reel value creation?

You know it says QE is not the right way to inject money int 0o the economy – because there are better ways to do it?

No one is saying printing money has no consequence, least of all MMT

Now that you know all that, why not read some MMT?

Can all this about ONS definitions of debt be thrashed out in some proper forum? UK Statistics Authority? I think Richard has put some of this direct to ONS – any reasoned response?

I am working on this

It is taking time

That is because this, it turns out is no small issue

Give me another week or so…

It will be worth the wait

I agree with your comments and the difficulty in breaking down the “UK economy is like a household,” thinking.

Godley’s equation:

Government deficit = Nongovernment surplus

Demonstrates that reducing the government deficit reduces the money available to the private sector to expand.

The core of the problem is that British people are not taught to understand how the “black ink” arrives on their bank statement. By this I mean they are not taught using Sectoral Balances Accounting principles to understand all the influx and reflux flows that take place in the UK’s economy that result in the black ink on their bank statements. Instead there’s a national clutching of some “thought straws” how this might happen. Such partial analysis leaves the UK economy under-performing.

Agreed

QE purchased gilts are bought on the idea that they will be later resold on the markets. My understanding was the main benefits is the compression of interest rates on public debt and the fact that the interest generated on the QE goes to the treasury not international investors. The idea that QE is not still debt is nonsense imo. If we just decided to cancel all our debt and reprint another 500b, or whatever you seem to fantasise about, it will simply collapse the value of the pound and we will be no richer for this. The economy has to produce goods and services of value. That is the only marker of wealth. Money/debt is just the lubricant that allows these things to be exchanged.

Your understanding is wrong then

That is not remotely why QE was done

Just read what the BoE says

Oh, and they do say they created new money

Now, if that money is a liability how too is the gilt a liability

It can’t be

Only one of them is owing

Of course money is but a lubricant. But what you don’t realise is that there is no shortage of it. You’d crash the economy fir the absence of freely available lubricant. I would not

Now which of us is wise?

The QE was initiated to keep funding available for banks when their was a crash in the supply of credit so they can keep lending to businesses and individuals. Thats how the people described it who came up with it ffs. How was what I said wrong? If there was no QE then banks would have paid a lot more to get enough liquidity to keep lending as competition for funds would have pushed up interest rates for banks as I said

I think you need to read how banks work

They don’t need funds to lend

They need funds to pay each other

That’s what is actually supplied

And that’s quite different

And there was no competition for funds….

There were no funds, hence QE in March

Banks do need funds to lend thats fractional reserve banking they cant just keep magic’ing money forever. Banks borrow from each other to sustain that correct? Otherwise why bother? When you say ‘they don’t need funds to lend they need it to pay each other’ what are you even saying? Why are they ‘paying’ each other if not to sustain their reserve requirements so they can continue to lend. They don’t pay each other, they lend to each other. I think its you that doesn’t understand basics of banking not me

There is no such thing as fractional reserve banking

Read the BoE quarterly report April 2014

As they said, that’s an idea in out of date textbooks, which were wrong

Money As A Social Relationship

The ideology underlying Neo-Darwinisn that everybody is only out for themselves is now under pressure particularly from biological research. It’s becoming apparent that development of complexity in life is highly dependent upon friendly cooperation and currently human beings are the poster-child on this planet for this process.

Critical to the maintenance of this process is the teaching of “we’re all in it together” by our parents. What’s missing though is relaying the understanding that money is a means of cementing human relations for cooperative purposes.

This understanding especially comes into focus in times of crisis. The instinct to cooperate with each other becomes particularly acute. We’ve developed a democratically elected parliamentary system where we “parle” (speak) with each other to find solutions particularly to crises.

How though can we rapidly implement a solution when time is of the essence but Neo-Darwinist thinking refuses completely irrationally to recognise this requires a “Financier for Crisis Management” who can conjure up the necessary money quickly, from nothing and in the necessary quantity? In short refuses to recognise this can only be government!

You say you can fairly confidently predict that the BoE will undertake more QE purchases in the coming months. Two days ago Gertjan Vlieghe of the BoE MPC didn’t rule them out but considered them to be “probably less potent now than in March” and seemed more open to negative interest rates.

Section 2 of his speech on the supposed tradeoff between health and economy is also worth reading. He suggests the “majority of the damage to the economy arises from restrictions that people voluntarily impose on themselves in order to protect their health, not from restrictions that the government imposes” so that the prevalence of the virus has a much larger impact on economic performance than government restrictions, so there isn’t a strong tradeoff between health and economy and the best way to protect the economy is to minimise the spread of the virus. According to Vlieghe this was true in the 1918 flu pandemic as well as being true now.

https://www.bankofengland.co.uk/-/media/boe/files/speech/2020/assessing-the-health-of-the-economy-speech-by-gertjan-vlieghe.pdf?la=en&hash=6F764B4A74358C059E7BCE6C322C3DDE7746AC77

I read the speech yesterday

I think he is signalling significant amounts of QE to come

The implication was we should expect 70% of gilts to be government owned

That suggest we’ll over £500 bn new QE

Pot, kettle, black?

With all due respect your institutions worldview also is rather limited to what it’s question begs.

Can you still not see this after all these years?

Maybe you need to explain that

It depends on the view of the world you believe is truth.

For example, the ONS are reporting what they see from a limited view of the world – the one they chose to believe in. Just like the Georgists do, its perfectly correct if they just consider their limited view. Living in a sort of bubble.

So one has to look in the mirror and ask if “I” am also perpetrating that mistake.

I’m not perfect either, it took me a year or two to even recognise it. I still do it, but I now know I’m doing it and occasionally correct it in an ingoing process. Whereas before, I didn’t know that I didn’t know, I was the problem.

What is the result? The world remains imperfect, sure. But now I’m less likely to contribute to it. Because every limited view, nobly and boldly put into practice, inevitably causes division, conflict and ultimately adds to the suffering.

The ONS view is not limited

It’s wrong

There is an interesting conundrum in this debate.

Provided that commercial banks keep within the “reserve requirements,” they are free to continue lending by creating the money. Indeed, they have created £1 trillion in the last 8 years and no one suggests that this money is ever repaid to the Bank of England.

The UK treasury, on the other hand, similarly creates some money – albeit circuitously via selling treasury bonds – and although Richard has shown that in government accounts the debt has been offset and cancelled – all we ever hear is that the debt must be repaid one day.