The Government Expenditure and Revenue Scotland (GERS) statement for the year to March 2020 has now been published. It would take a stronger will to live a boring life than I have got to spend much time on this ludicrous statement, but let me note what it is meant to do. As the Scottish government says:

The headline estimates of Scottish public sector expenditure and revenue in GERS embrace two key principles:

1. Public sector revenue is estimated for taxes where a financial burden is imposed on residents and enterprises in Scotland

2. Public sector expenditure is estimated on the basis of spending incurred for the benefit of residents and enterprises in Scotland

I added the italic, bold emphasis.

GERS compares tax paid in Scotland with spend for Scotland. That earns the following are ignored:

- Scottish income taxed outside Scotland e,g. rents, interest, profits, royalties and maybe more, all of which can be significant;

- Tax paid on providing the benefits for people in Scotland when that spend occurred outside Scotland;

- Tax paid on the multiplier benefit in the spend outside Scotland nonetheless charged to Scotland.

The result is a system designed to overstate the Scottish fiscal deficit.

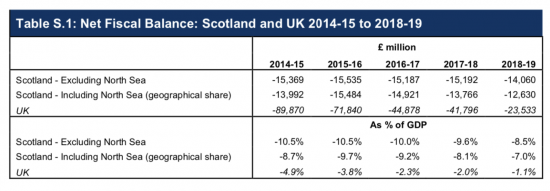

In the context of that suggestion, the first thing I noted about this year's report was a change in the format of the very first table. Last year it looked like this:

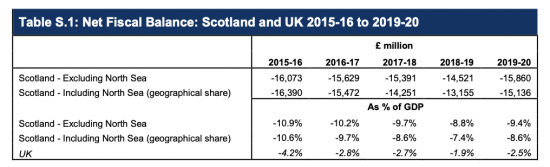

I tore it to shreds then, saying how implausible it was that Scotland played such a significant role in the UK fiscal balance. This year the table looks like this:

Look! The UK has disappeared. Why could that be? To make it harder to make the same claim? Surely not? Or maybe, of course just for that reason, as I strongly suspect. Data has a habit of disappearing when I use it.

And note too that history has got a lot worse this year with all prior-year figures now looking worse than they did last year. The word 'restatement' that might offer an explanation as to why this is does not appear in the report.

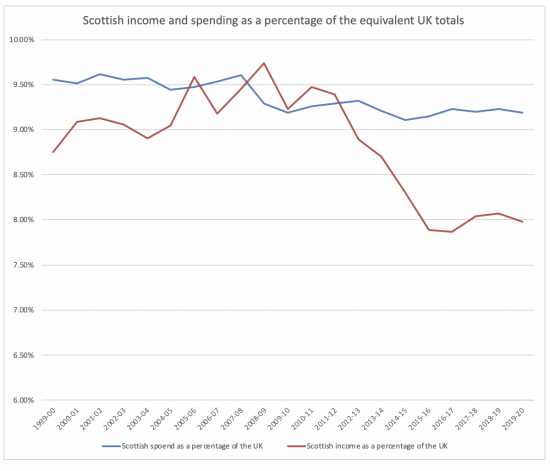

So let's look at some data that I have prepared from the GERS dataset issued this morning. First of all there is income and spending data as a percentage of the UK, over twenty years:

Note I have not shown a full Y axis.

Scottish government spend as a percentage of the UK is falling. But since 2011 its income has fallen more. And we all think we know why.

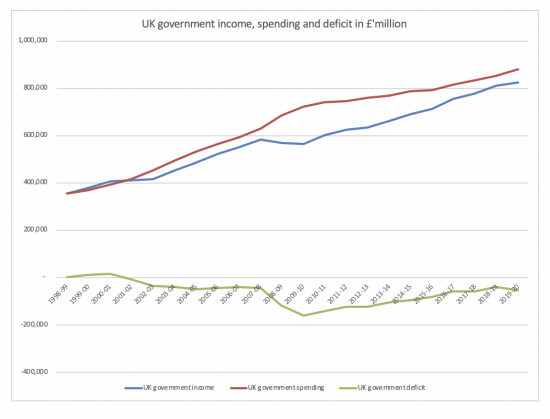

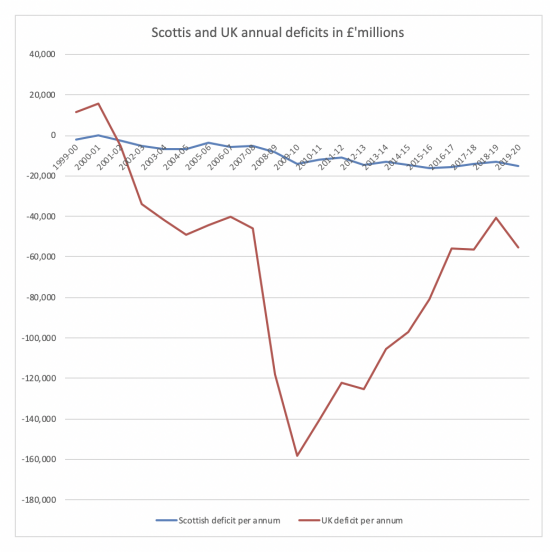

But before anyone jumps up and down too much about this, let's look at whole of UK data:

Of course, this is not presented in the same way, and I have not allowed for weighting by inflation or head of population, but the message is clear: if anyone is out of control here it is not Scotland. But what Scotland did not appear to do is benefit sufficiently from the spend of the UK as a whole just as its own economy needed realignment to restore income. That is my point. Spend could, and did, happen in the UK to deal with its financial threat from the City of London, but the same did not happen when oil began to decline in Scotland. That is apparent from this chart:

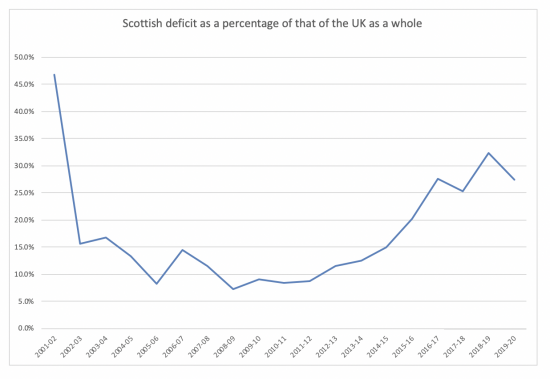

There was no spike in spending in Scotland to compensate for the loss of oil, but there was a spike in spending in the UK to manage the collapse of the City of London. The whole of the UK got a boost then, and Scotland did not. Unsurprisingly Scotland's deficit grew as a proportion of the whole as a result, because the new investment was not for its benefit:

Note that the 2001/02 data was aberrational as the UK was only just in a deficit that year and had actually been in surplus the two previous years, which I have treated as outliers.

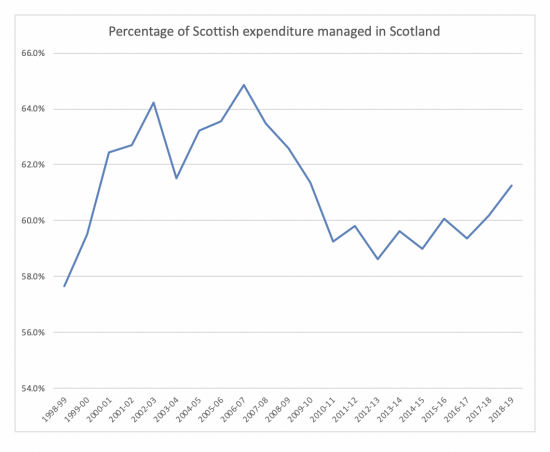

And let me go back to the point as to how much of this is controlled by Scotland anyway. This is the answer:

So what you will note is that as Scottish expenditure supposedly rises, and the deficit grows more as a result, much of that is due to increased costs being 'dumped' on Scotland by Westminster. But there is no proven benefit to Scotland in revenue-generating terms at all as a result of this. Nor is there evidence that all of the tax paid as a result of that additional UK government spend outside Scotland is credited to Scotland for the purpose of this exercise either.

What's the story then? I conclude several things. As ever, this is a fabrication, with the deficit that arises being at least as much the result of decisions made in London and not Scotland.

Second, with so much of spend for Scotland being under London's control it remains quite possible that far too little tax is being credited to Scotland. The declining revenue figures may simply indicate that fact now. As a result, the deficit figures are almost meaningless.

Third, Scotland has not had the spending it needs to move it on from oil, but the rUK has seen spend to help it recover from its own revenue failure.

Fourth, this means that, almost inevitably, Scotland would be better off as an independent nation, and the GERS figures show that.

Fifth, though, it really is time that the game playing, including the elimination of useful data people used in the publication, come to an end. It gives those who produce this information no credit at all and makes us doubt their intentions.

So, use this data with extreme care, but in the meantime ask three things:

- Why does Scotland control less of its spend now than it did despite increasing devolved powers?

- Why hasn't Scotland had the investment it needs?

- Why isn't Scotland credited with the tax it might really generate?

One day we may get answers. But not this side of independence, I suspect.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Horrendous flood of ranting comments on the BBC report of GERS, confirming the bias you suggest is built in to the GERS method and presentation.

On the point about “restatement”, there is a very long-winded explanation in Annex B of the changes to the figures for 2018-19. However, I suspect you will not be impressed.

The following “explains” the £0.5bn worsening of the 2018-19 fiscal balance.

On-shore revenue was revised up by about £2,8bn, arising from increases of £1,7bn each in “Interest and dividends” and “Gross operating surplus” and a decrease of £0.6bn in tax revenue. The changes in tax receipts are given in gory detail, but mostly reflect a double-counting of corporation tax by HMRC.

The change in off-shore revenue is tiny.

Total expenditure is revised up by £3.3bn, mainly due to “Accounting adjustments” of £1.9bn and an increase in “Public sector debt interest” of £1,5bn.

When errors of this size are made, it’s hard to imagine how the so-called confidence intervals quoted in GERS can be justified. As I’ve said many times, there is in fact no published attempt to justify them.

Interesting, when public sector debt interest fell…..and I bet it is gross, not net of QE

I think the revision to debt interest is explained in the Preface –

“Since the move to the European System of Accounts 2010, the ONS has been reviewing the recording of public sector pensions in the Public Sector Finances. Following a consultation with the Public Sector Technical Advisory Committee, and a public consultation in autumn 2018, the reporting of public sector pensions has changed from a net to a gross basis. This change is primarily presentation, but due to the inclusion of the pension administrators’ costs, as well as including the Pension Protection Fund within the public sector boundary, there is an impact on overall public sector spending. This includes increase in public sector debt interest payments, as well as interest receivable by the public sector. In 2019-20, Scotland is apportioned £1.5 billion of debt interest associated with public sector pensions, and £1.7 billion of interest income.”

Looking at the amounts quoted for “debt interest” and “interest and dividends” revisions in Annex B, it seems that an identical apportionment was made for 2018-19.

Thanks

But we still do not know if this was gross or net debt

I suspect gross

Thanks for this analysis Richard; trenchant and informative.

I was curiously fascinated how level and stable (relatively) the Scottish deficit was over the period; almost as if it had been smoothed out (compare with the volatility of the UK deficit over the same period). Smoothed, did I say, inadvertently? Start with the Answer? Heaven forbid! Certainly not! Nothing political about GERS!

If you wish to catch the sense of British triumphalism essential to GERS play a Proms last night recording as you read: ‘Rule Britannia’ is perfect for GERS (a good Scots song after all; lyrics by James Thomson 1700-1748, the first Romantic poet, for ‘the Seasons’ 1726-30, especially ‘Winter’; which was revolutionary – although just an anglicisation of the much older techniques of the Scots Makars).

I admit that the idea crossed my mind….

I found this gem of a quote from a Fraser of Allander Institute spokesperson:

“I think one of the legitimate criticisms of GERS is that it shows Scotland versus the UK as a whole, and we know that the UK is an exceptionally unequal economy, you then get the impression Scotland is wildly out from rUK – it’s not.”

Please correct me if I am havering; but I have always perceived the Fraser of Allander as stoutly defending GERS over the years? I would not wish to be unfair, but I am pinching myself. It is quite amazing to me how, out-of-the-blue, what has been blatantly obvious for years to some of us suddnely becomes, eh…. blatantly obvious.

I thin k you’l still find that they are defending it to the hilt

As was Andrew Wilson i9n defending them today…

Deeply disappointing

Richard,

It’s easy to sit on the sidelines and snipe, especially when you provide as little evidence as you have have. You mostly just say “nobody knows – this is all propaganda”.

Why don’t you provide us with a wee sample of your own calculations of GERS, or Scottish GDP, tax revenues, spending and budget deficit to compare against?

Please provide the funds and I’ll be happy to oblige

Perhaps the reason why (presumably) no one has yet obliged is because no one seriously expects a credible alternative to show anything other than a significant deficit?

I do

Mr Steel,

My objection to GERS has never been based on the issue of the deficit itself. It is an objection to the inadequacy of the evidence, the lack of transparency of the underlying data, the lack of facts over surveys, the objectivity of the data, and the slapdash nature of the methods, rigour and accuracy expected. Whatever the result of an alternative accurate accounting, even a large deficit; so be it.

The idea that slapdash guff is alright because it may stumble close to the real outcome by accident (like the stopped clock right twice a day, so that is better than an atomic clock that is the thin edge of a nanosecond ‘out’); so that is alright, tick the box and move on, is just absurd. What is really frightening is that to many people in Britain actually think that the slapdash methodology is alright. No wonder we are in the mess we are in, with such a public attitude to facts. QED.

“Scottish income taxed outside Scotland e,g. rents, interest, profits, royalties and maybe more, all of which can be significant;”

Were Scotland independent, it may well start taxing Scottish income currently taxed outside Scotland in the form of rents and profits etc.

But so might rUK start taxing rUK income currently taxed in Scotland in the form of rents and profits etc. This could be significant.

You seem to be assuming that Scotland could carry on taxing rUK income of Scottish residents whilst adding in Scottish income of non-Scottish residents. I would have thought you knew that it wouldn’t work like that.

Unless you know the balance of this, it’s not possible to say whether Scotland would be better off. Have you done an analysis?

Oh come on, we know where the balance of wealth lies

Please don’t be stupid

I am not sure I can be kinder than that

I see the Fraser of Allander Institute’s reaction to today’s figures includes the following choice quote, already being approvingly tweeted by Tory MSPs:

“Put simply, it’s not possible to run structural deficits of this scale over the long-run (even if you believe that a country’s central bank can simply print money to pay for it…btw, they can’t)”

https://fraserofallander.org/scottish-economy/gers/and-were-off-government-expenditure-and-revenue-scotland-2019-20/

And they are claimed to be independent whilst clinging to the wreckage Of neoliberal economics

You can. I gather that China has run a deficit of around 14% of GDP for over 30 years. They have had growth of around 7% pa, some small downturns but nothing you could call a recession and very little inflation. It seems perhaps they understand how to run a capitalist economy rather better than the capitalists? The downside is they did not worry much about the externalities such as massive pollution until recently but that is changing quite fast.

@Alan W

I saw that FAI article. They actually give a reference for that claim about central bank “money printing” –

https://www.coronavirusandtheeconomy.com/question/should-modern-monetary-theory-inform-economic-policy-crisis by Jagjit S. Chadha of the NEISR – possibly well known to you I think Richard.

I’ve read quite a few attempts at criticising MMT, but this may deserve the booby prize!

He says “Under MMT, the central bank provides tokens or claims for the state to deploy to meet its economic objectives without prior statements or plans for how those tokens will be met by future taxes. These claims mean that the central bank cannot control Bank Rate, as setting quantities for central bank money means that the resulting fluctuations in demand for central bank money will set interest rates if the economy is not at the ELB.

Since these claims are uncoordinated, they also seem likely to compete with private sector resource allocation decisions. Furthermore without an articulated plan for monetary and fiscal stability, the private sector will also be unable to understand very clearly the path of the price level or of future taxes. It is thus difficult to see how the MMT framework would lead to a credible monetary and fiscal framework.”

Like most of the critics, he clearly hasn’t read or understood MMT.

It’s the usual drivel based on make believe. The author says:

And this is wrong. That’s not what MMT says. He assumes we only live in a monetary world. MMT sees the real world out there and says it imposes a constraint. And that means it never says these two things. In fact, the first is an extremist only position to be avoided, and the second a corrective only if full employment is overshot.

But making up claims is the easiest way to deal with MMT, very clearly, because their own logic can’t

Hi,

I had read previously that the revenue figures to do not include VAT . Does anyone know if that is the case?

S

That is not true

VAT is included

But no one knows if it is right because it is based on surveys and ignores imports and exports to rUK

[…] expert Prof Richard Murphy has also highlighted this problem by showing that in the years since the Conservatives came to power, the proportion of UK […]

Fascinating stuff,

I briefly watched Nicola Sturgeon in the Scottish parliament today laying into the Labour opposition who had had the temerity to challenge the size of Scotland’s £51bn national debt. She said that bearing in mind the UK gov under a Tory gov had now run up an £2 tn national debt for a Labour party leader to go down that route was “suicidal”. Quite!

” The result is a system designed to overstate the Scottish fiscal deficit “, memorable words Prof Murphy , as succinct a summation of GERS as could be found in a month of Sabbaths . I’m reminded of the WHAuden lines

” A host of columbines and pathics who teach the poor by mathematics

In their defence

That wealth and poverty are merely mental pictures

So that clearly , every tramp’ s a landlord really

In mind events . “

[…] that rat just be in the near 40% of costs supposedly for the benefit of Scotland that the UK government dumps into GERS without there being any […]

I’d like to see the Auditor General have a look.

I asked the previous Scottish Gov Finance Secretary why he didn’t get Audit Scotland to audit GERS as there was no way an independent auditor could give an uncritical report on its contents. The response, from a civil service economic adviser, was the familiar get-out used by Ombudsmen trying to duck awkward questions: there was no recognition that the factual realities resulted in unrealistic conclusions, but, instead, a great deal about how prescribed statistical procedures had been properly applied and guidelines followed, thereby missing the crucial point that rubbish in inevitably results in rubbish out.

Today’s media is, as predicted, awash with lurid and derogatory articles and this begs some important questions:

1) Given the massive political damage caused by publication (by the Scottish Gov) of GERS, by whose order is the Scottish Gov required to produce GERS?

2) If there is no legal requirement to publish GERS, why does Scottish Gov persist in producing it?

3) If GERS must, by legal requirement, be published, can this be reversed and, if so, how?

4) If GERS must, by legal requirement, be published, why does Scot Gov not get an independent auditor to report on it?

5) Given the misleading nature and widespread use of the GERS data and conclusions, could the party responsible for ordering GERS to be produced, whether Scot Gov or UK Gov, be charged with false accounting, willful misrepresentation or fraud?

6) What happened to the alternative report on Scotland’s economic status which Scot Gov had quietly trailed would be produced at the same time as GERS?

Excellent questions Ken

Richard

I’ve just discovered an answer to my Q6 (and I’d have spotted it if I’d been properly awake when I read my Herald this morning!). This is summarised in Common Weal’s Source newsletter which I’ve just managed to read:

“The Scottish Government has ditched plans for publishing an “economic case for independence”, which was supposed to be published alongside GERS figures this year. The idea was developed by disgraced former Finance Minister Derek Mackay. Current Finance Minister, Kate Forbes, said the idea was shelved because of the pandemic, and there was no immediate plans to revive it”. (The Herald)

Those are VERY good questions Ken, do you mind if I reproduce them (if I get an opportunity)? (Fully attributed of course)

I think we all just take it on the chin every year, without thinking too hard about is it actually necessary,,, and what DID happen to that alternative report we were promised,,,

Kate Forbes said that the SG had devoted all it’s time and resources to the Covid-19 pandemic. I for one don’t buy any of that BS for a second.

I can’t help thinking the entire SNP leadership heaved a collective sigh of relief when Covid struck. It meant there would be few awkward questions to answer about their inaction on the independence front – at an already curtailed spring conference (then cancelled) – for a start. It now means any independence campaigning has been officially put off indefinitely. Sturgeon has already said so.

I’ve been screaming this from the roof tops since the 2017 UKGE. The leadership of this SNP Scottish government does not have the courage, determination, wit or imagination to do what is necessary to bring about independence for Scotland. I fear the chance has been lost for the foreseeable future. Certainly not in this decade unless some kind of political coup happens.

The next few months will be key. Gers and anything else is just a distraction.

Problem is the response is to a non expert quite complex whereas 15b decicit is very easy to trot out

[…] the old enemies that must be continually reminded of its place in the world. Political dialogues, like GERS, simply reinforce this view, suggesting that the down-beaten populace of the territory should be […]