The government has finally published its Whole of Government Accounts for 2018-19.

The first thing to note are the dates:

It takes 16 months to get these accounts - which is about 10 too long. If the government expects PLCs to report in seven months then so should it. This delay means that the government and those who hold it to account are always working with outdated data when it comes to reviewing public finances and that is totally unacceptable.

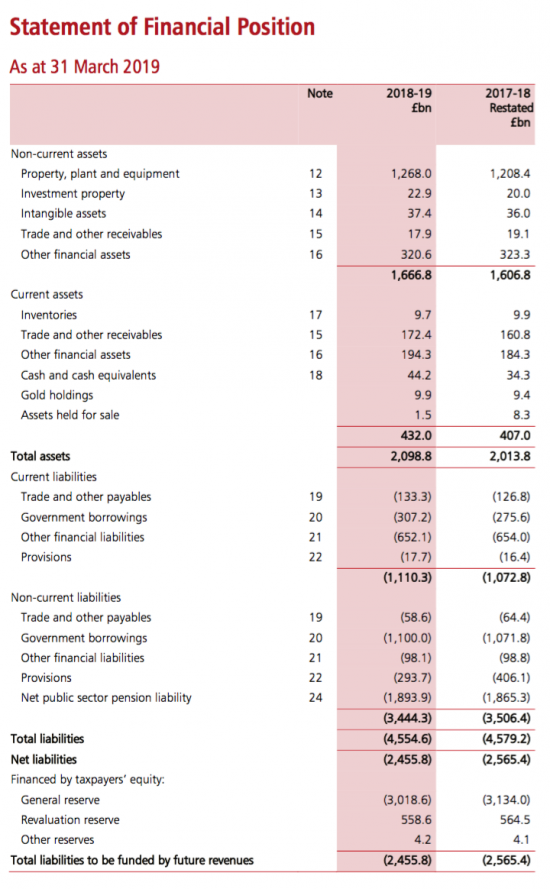

Second, this is the government's balance sheet at 31 March 2019:

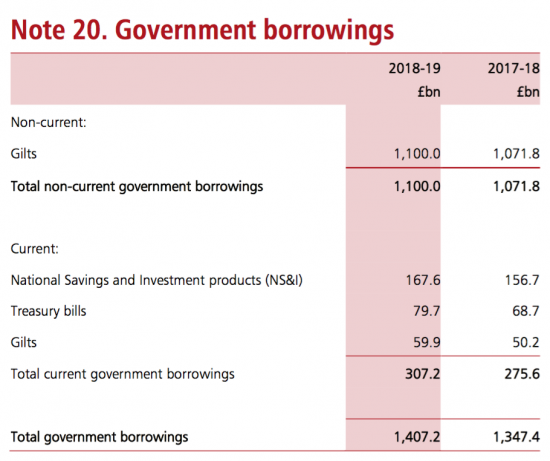

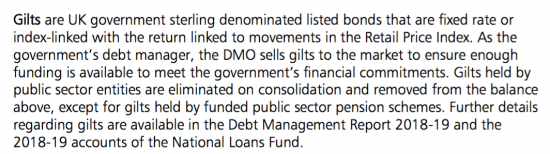

What I am most interested in noting in this post is government borrowing. This is explained in note 20 to the accounts as follows:

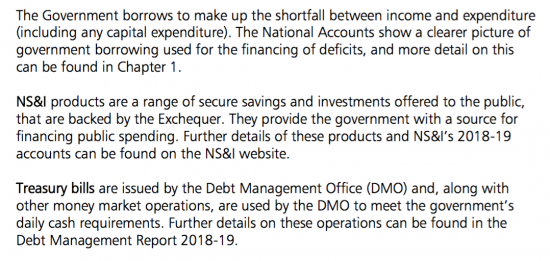

This sin explained by the following notes:

But crucially they add this:

In other words, as I have always argued, gilts owned by the government are cancelled within its accounts because they are not owed to anyone. And that is, very obviously true.

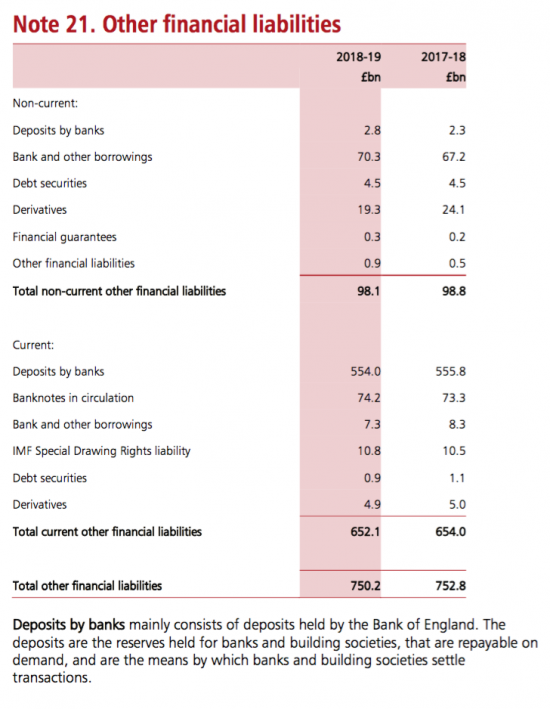

I do not dispute that the result is that central bank reserves rise. Note 21 covers this:

In other words, QE creates bank deposits, otherwise known as money. Again, I have never said anything else. But the banks and building societies will not be withdrawing these funds from the Bank of England where they are held, because they are used for clearing their own payments. So let's not pretend that there is risk in this: it's vital liquidity to keep markets functioning.

So what we have are accounts that show that UK government debt is £1,407 billion, of which £167 billion are savings accounts which can be ignored for this purpose. That leaves £1,240 billion of actual gilt and Treasury Bill notional debt. GDP was £2,138 billion in 2018/19. So debt was 58% of GDP.

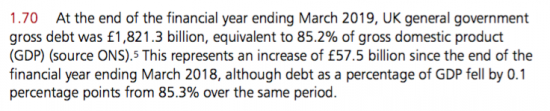

And yet the accounts say this:

But that is untrue. First, it's untrue because it conflicts with the accounts and such contradictory statements are not permitted in audited accounts.

Second, it's factually untrue. There is no such debt owing.

And third, it's relying on an unaudited third party claim that is itself false to make a statement in audited accounts, which are therefore wrong.

And I know they are wrong because on the previous page it says this:

The accounts are self-contradictory. Only one claim, at most, is right. At most debt was 65.8% if GDP ion this basis as well, which also makes the claim on that issue wrong as well.

So much for true and fair reporting. But all the evidence that I am right on this issue is there to see, despite government best efforts to lie about it.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Thank you. Interesting to see that what is clearly true (at least to you and me) is confirmed by another route.

Who’d had ever thought it eh?

We’re now more old style Soviet Russian than the Russians were in our lying and air brushing of the truth.

They get away with it by using “technical” sounding words like “gross debt” and “wholesale debt” and quoting an allegedly independent source like the ONS. Might as well quote the IFS for good measure.

Do the auditors understand the question of what counts as debt?

The NAO audited this or I’d be making a professional complaint

Perhaps what this really reveals on ‘consolidation’ is that our economics faculties are producing micro and macro economists and econometricians, who generally have never adequately learned the principles of double-entry book-keeping. It always seemed to me that Samuelson’s explanation of fractional reserve banking was an illustration of a man who did not fully understand the principles of the double-entry system, and consolidation.

🙂

Consolidation baffles most accountants, I think

Presumably the Whole of Government Accounts are consolidated, so there is a setting off and stripping out of debts owed and receivables due within the group, rather than just adding them up line by line?

The QE debt exists in formal legal sense – the “parent” (the state) has issued a debt instrument representing a liability, and that debt instrument is held as an asset by its “subsidiary” (the QE company owned by the Bank of England, which is owned by the state). I expect the sole company accounts of the subsidiary shows it holding gilts as an asset, for example. And “sole company” accounts for the “parent” would show it owing a liability, but also holding an asset in the form of its interest in its subsidiaries. Both the asset and the liability disappear on consolidation, but it doesn’t mean they don’t exist. Unless you think wholly owned subsidiaries also don’t exist as separate legal entities.

It all becomes a bit circular when you consider who gave the subsidiary the funds it needed to acquire its asset …

Actually, the reason why we do consolidated accounts is precisely because we did not think subsidiaries have substance, they are merely form

And the substance is the debt does not exist

I am not interested in legal form: I am only interested in substance and the debt ha been cancelled

I do not wish to over-simplify, but the world tends to fall into those who believe in form and those who believe in substance. We both believe in ‘substance’, but many people, including a large number of mathematicians are Platonists (Form over Substance). Form seems esoteric but is actually easier to find (because it lends itself to quantitative methodologies), and certainly to believe in; substance looks easier (too easy, too subject to glib misjudgment) but is actually far more elusive, difficult and resistant to discovery.

The 2019 accounts of the subsidiary (Bank of England Asset Purchase Facility Fund Limited) are pretty clear. https://beta.companieshouse.gov.uk/company/06806063/filing-history

It had £477.8 billion of assets, matched by £477.8 billion of liabilities.

“The Company is fully indemnified by HM Treasury: that is, any financial losses as a result of asset purchases are borne by HM Treasury, and any gains are owed to HM Treasury. … The Company’s operations are fully indemnified by HM Treasury and in return any surplus from these operations after deduction of fees, operating costs and any tax payable are due to HM Treasury.” [To whom is the tax payable, one might ask…]

The indemnity is accounted for as a financial instrument – like a total return swap.

So it is in effect a nominee. Since 2012/2013 there has been a process of cash transfers, now quarterly, with £9.3 billion of “net indemnity” paid by the Company to the Treasury in the year to February 2019, and £7.3 billion paid by the Treasury to the Company in the previous year. The balance sheet shows another £32.6 billion due to the Treasury under the indemnity, and another £445 billion owed to the Bank of England. All of the assets (two thirds which are gilts with maturities of 5 years or more; nearly half over 10 years) are matched by loans or by liabilities under the indemnity. It has no appreciable equity, just 100 £1 shares.

To be frank, I’m not sure there is very much “form” here. It is a clean conduit: everything passes through without touching the sides.

Indeed

But the point is then it is a government operation

So much for BoE independence

Indeed – BoEAPFFL is not even a conduit for the Bank of England – all the gains and losses go directly back to the Treasury.

Agreed

Hi Richard,

have you checked the govt. accounts in the past? And, if so, do you know if this is this a new phenomena? Or has the treasury always played fast and loose with the accounts like this?

This is recurring

I have pointed this out in previous years as well

QE could obviously be reversed. Not obviously in current environment but definitely to if inflation looked to be a problem. Probably A more palatable method to dampen inflation compared to tax rises

We could also very obviously go to the moon

But we won’t

And nor will QE be reversed

And nor is there a hope in hell of serious inflation needing fiscal reaction

So what logic is there to your comment?

The logic is there.. if we face the threat of inflation the BofE could reverse QE, decrease the money supply and raise the term structure of interest rates. It remains a policy option.

That is not the same as inflation being on the horizon but it remains a policy option. And a more palatable one than raising taxation.

Do you not think of it as a policy option alongside tax increases to stem inflation? If not why not?

OK it’s an option that the government could sell new debt

It could just sell new debt though and run a budget surplus

QE is not relevant to this

Richard,

Definitions are important here and explain some of the confusion. General government is a combination of central and local government but excludes public corporations most importantly the Bank of England. Whole of government is general government plus public corporations

It is logical that central government debt would be lower than general government debt. In a time of huge QE it is also logical that general government debt would be higher than whole of government debt (which would consolidate out the debt owned by the BoE).

The accounts have been written very sloppily. Lack of consistency of one debt measure or appropriate explanation of the differences. But 1.70 which refers to general government debt does not contradict 1.66 which refers to central government debt. And neither directly contradict any whole of government debt measure.

In accounting terms there is one figure – and that is for the entity being reported on

This is not just bad accounting in that case, it’s wrong

No economic logic can overcome that

I’d call it false accounting – and utterly unacceptable

If this is a nation living a lie then logically because it argues it’s a democracy there should be some possibility of accountability. It’s doubtful this current government would be interested. Why not dip your toe in the bath water and sending your findings to Anneliese Dodds? Yes I know I’m being provocative!

I might….

I regularly send links to Richards blogs to the Labour Party Treasury team urging them to listen to what he is saying. Never get a reply, mind you. But if all Richard,s readers did so…… As well as Annelisa, they are Wes Streeting, Pat McFadden and Dan Carden.

Richard

Do you think that the Government (and various economic commentators) really believe in what they are saying, or is it a deliberate ruse used to keep the population in ignorance so that they can control how money is spent? ie to achieve political objectives like destroying the welfare state?

Harold

The likelihood it’s a ruse is as high as the implausibility of your name

Had the same problem attempting to consolidate the numerous restricted and unrestricted fund accounts of an exempt charity /NDPB with the Whole of Government Account which is a single fund account. A procrustean approach is taken, if the legs of the sleeper are too long they are chopped off.

As for bank reserves I again smell a rat; the purchase of the gilts produces a debit balance in the BoE books which, if the account of the BoE is consolidated into the government account, can only be consolidated against the borrowing credit.

The bigger lesson must surely be that the BoE is, in its entirity, a subsidiary of the Government. This must be so in substance and I would argue should also be in form if democratic accountabiity is to mean anything .

QE shows up as a debt on the BoE accounts then BoE plus government debt are consolidated to give 85.2% of GDP.

I do not have a problem with this number.

The scandel is not so much what number we assign to debt to GDP but rather the use of this ratio by politicians to justify austerity or other policies.

Money is never the constraint. It is what we do that matters.

Charles

But Richards point is that BOE Debt is netted off in the Governments accounts already so that the net debt to GDP is the lower figure of 58 per cent.

Gross debt gets you to 85 per cent but this needs to be netted off because the BOE is a government entity.

I agree that its the bullets fired that kills you not the pile of ammunition.

But war can be avoided if we all understand that the position is not nearly as bad as some portray it.

Roger

Richard, you indicate that this accounting is a ruse, other commenters suggest it is used to

control spending. To me it looks likes a double bubble con trick. On the one hand politicians get to argue for austerity and reducing expenditure on spurious grounds of too much unaffordable debt burden for our grandchildren. On the other hand I presume the gilt markets are effectively rigged so the government pays more interest than it should, presuming bodies with “weaker” finances pay higher rates. Also the £ must be weaker on currency markets using the same logic.

If you are right it suggests that Con, Lab, LibDem, Scot Nats et al, civil service, financial services, academia, journalism and the judiciary, legal and accountancy professions are all in on this ruse against ordinary working people. Either they are complicit through stupidity or coercion. It is difficult to get a man to understand something when his salary depends on him not understanding it? Do I go too far or is this country being run as the mother of all control frauds? For whose benefit one has to ask.

Have you or anyone else looked at debt ratios of the G20 in these terms. Is U.K. a standout case of manipulation or do all sovereign currency issuers use the same ruse?

The gilt markets are rigged

But I am not sure how you think a negative Interest rate is paying more than the government should

And yes, they are all in on it

8 out that down to ignorance of economics and fear of being called to account for contrary opinion

As you point out this situation has persisted for sometime likely before interest rates became negative. Without the rigging they might be even more negative.

Fear of being called out for contrary opinion, all of them? We are supposed to have rule of law and freedom of speech. Just another ruse?

Does every country do this, if so is it a previously unidentified hallmark of western “civilisation”.

I think they are negative as a result of QE….

This is group consolidation 101 in that an entity cannot have liabilities or assets owned or owed by itself.

Such wouldn’t reflect a true and fair view of the financial position, which is the whole purpose of statutory accounts.

However do see the viewpoints reflected within some of the comments as valid, a business combination is deemed to have occurred should a business have “control” over another.

But in the case of the BoE does the UK Government have “control” or merely “significant influence”?

Complete control through ownership and appointment to the Board plus statutory control providing a veto

Impossible to say not completely controlled