I have argued that there is ample scope to increase the tax paid by those with wealth in the UK. A whole part of the Tax After Coronavirus (TACs) series is based upon that logic. But within the whole Tax After Coronavirus (TACs) theme that we do not need more taxes at present, overall, but that we do need better ones, is there scope to increase other taxes as well, so that redistribution to those who need more income now, is easier to do? The answer would appear to be that corporation tax also falls into this category.

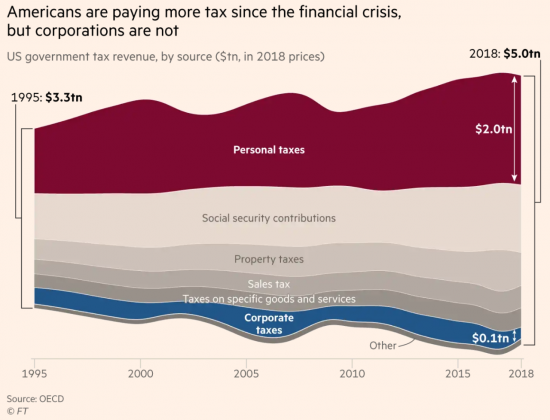

And the impact is clear, the data in this case coming from the USA:

The issue of tax avoidance is real, but the issue on tax rates is as important.

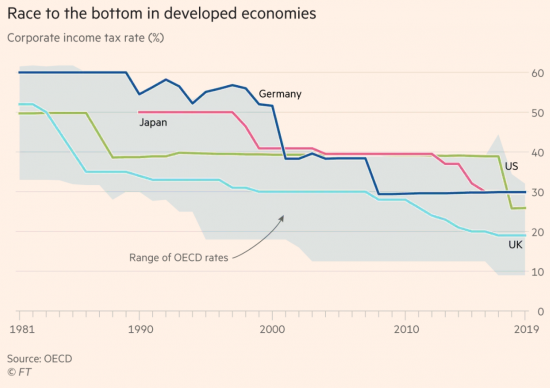

Successive, and successful, corporate lobbying for reduced corporation tax rates has had a massive impact on the tax burden of companies, and most especially the largest multinational corporations.

Is there room for more corporation tax when wages comprise a bit over 60% of GDP and profits a smaller part at around 8% in the USA, but disproportionately the rates of tax on them is widely different, with labour bearing a far larger part, as is apparent.

The reasonable question to ask is why is that? And is that fair?

It would seem that the race to the bottom in corporation tax has resulted in a fundamental shift in tax burdens from companies onto individuals. Tax After Coronavirus (TACs) has to tackle this issue.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

“And the impact is clear, the data in this case coming from the USA”

Irrelevant to the UK to cite data from the USA. What are the figures for the UK?

If you have it please share

Why don;t we have it?

Whether there is SCOPE for companies to pay more tax is not the right question to ask. Instead, whether it is FAIR for them to pay more tax is the real question.

However, companies don’t actually pay tax – we need to understand how tax charged to companies is actually paid by customer, shareholders and employees.

Then a sensible discussion can be had.

The right claim CT i paid by employees and customers

Kim Clausing disagrees: she says it is shareholders and so a tax on wealth

I agree with her

And taxes on wealth need to rise

Just because you and Kim Clausing say something does not make it true.

The fact that corporation tax falls really falls on individuals has been recognised by economists for years. How this splits between employees, customers and shareholders depends on the nature of each business.

Given you’ve previously referred to the Mirrlees review to support your other claims, you might like to remind yourself what this said about Corporation tax!

I have not used the Mirrless Review to support my claims: I referenced it on an issue. It’s what academics do

And Kim Clausing is a world expert

And has debunked the utter nonsense from Mike Devereux et al at the Oxford Centre for Business Taxation on this issue

Kim Clausing and I say this because it is true

It is quite hard to draw any conclusions about the “right” rate of corporation tax by looking at the US, where the tax system until recently allowed corporate income generated offshore to be kept offshore without being taxed until it was repatriated, where there are so many exemptions and reliefs that the effective rates of tax is much less than the headline rates, and they still don’t have a uniform sales tax like VAT.

Personally, I’d favour a higher rate of corporation tax in the UK: 30% always seemed about right to me, and I’ve not really heard any corporations asking for the rate to be 19% instead. But, while headline rate of UK corporation tax has undoubtedly fallen in recent years, the amount of tax actually paid is a function of tax rates applied to the tax base. Has the amount of corporation tax actually paid each year in the UK since 2008 fallen by about a third with the rates (from 30% to 19%), stayed about the same, or risen? Has the corporate tax base expanded at the same time to compensate for the fall in headline rates? A wider base (for example, eliminating exemptions and reliefs) with lower rates is usually a better way to go. What has happened to effective rates?

I argue effective rates have risen because of anti-avoidance measures

And today taxes have risen as a result of there being millions (literally) more companies

But profit as a proportion of GDP has risen too

So we don’t know

I have asked the ONS for data and they’[re taking forever to supply it

I would say there is probably also a shift within the Corporation Tax category away from large companies and on to SMEs, at least in proportion terms. At least in the UK the Small Corporate rate has I think stayed more or less the same at 20% for the last 21 years it has been of direct interest to me, while the cuts have mostly been to the Large Corporate rate. I have just paid our Corp Tax bill for last year which was £3,300 out of turnover of £160,000, so roughly 2% of turnover. If that applied to Facebook, Google, Amazon and the like they would be paying hundreds of millions each per year. I recall it was four or five years ago that Facebook UK paid almost exactly the same as we did that year, which was £4500.

It is the old story that it is a lot easier to get £10 each out of 50 million people than it is to get £500 million out of 1 person or company. The former will shrug and pay while the latter will employ every accountant, lawyer and tax expert on the planet.

As large corporates are generally predatory and have massive economies of scale it would be reasonable to charge them much higher Corporation Tax rates than SMEs as part of a policy to level things out and a) provide fair competition and b) discourage the creation of mega-corps and monopolies / oligopolies. At the moment, for example, Amazon are aiming for a monopoly on all retail sales, which somebody will have to stop at some point. They are like a virtual shopping centre where everyone like us has to rent a shop and then pay Amazon 15% of whatever you sell as the rent.

All sensible Tim

Ultimately all taxes are paid by individuals. Corporation taxes are largely a way of attempting to tax 3 disparate groups of individuals:

a) Customers

b) Employyees

c) Shareholders (often large pension funds, but in general savers/investors)

There is much disagreement about how corporation taxes are shared across these 3 groups, so corporatiion taxes are not particularly well targeted. It is no great surprise that corporation taxes are largely being superceded by taxes that focus directly on these groups. The same amount of tax can be raised but it is much easier to tweak policy to shift the balance in targeting. It is also has the benefit of helping to attract larger businesses to locate within your country.

The main exception to this is small (often single-person) companies which are in effect disguised employment. Corporation taxes for this group should be structured so that the individual does obtain tax benefits simply by the way they use legal structures to shape their employment. For medium/large companies there are lots of arguments that corporation tax should be abolished and simply direct tax at customers/employees/shareholders as appropriate.

Sorry, “does obtain tax benefits ” should have read “does not obtain tax benefits “

Firdt, the change has nothing to do with theory

Second. This theory i wrong, largely because it assumes we can tell which indivduals pay the tax, and we simply do not know in the vas majority of cases

Third, corporations change where, when, how, and at what rate tax is paid so the pretence implicit in your theory that they are fiscally neutral is not true

Fourth, the idea that the entity does not exist is for fantasists: their impact is real and continuing

I disagree with your logic

You’re right that corporations can easily change where, when, how and what rate the tax is paid which is another reason why coporation tax is intrinsically a bad idea. There has been a gradualy shift away from corporation tax towards VAT to tax customers directly. Employment taxes are largely only increased through stealth (eg employer’s NI). Taxes on investors/savers (shareholders) are not in fashion. Personally I would favour a progressive tax structure for this group similar to income taxes (eg initial tax free allowance, next £nK @ 20%, rest at 40%). Using corporation tax to focus tax on shareholders is too blunt a tool.

But if we don;t have CT we won’;t have residence based tax

And the developing world loose 20% of its tax income

Your answer to that is what?

Cut the aid budget?

Like a good academic, I’m referencing Mirrlees to support my claims regarding Corporation Tax, and why your ideas are wrong.

Why do you dispute the findings of the Mirrlees report?

Because they are neoliberal nonsense

And not supported by evidence

Funny how it wasn’t ‘neoliberal nonsense’ when you using it to support one your opinion!

At least try and be consistent!

Let me ask a simple question?

Have you ever disagreed with someone?

And did you always thereafter disagree with them on everything?

No?

Why are you so inconsistent then?

Or such an idiot?

One of the two?

Discounting something that you disagree with as ‘neoliberal nonsense’ (without justification) is hardly consistent with the ‘academic rigour’ that you were claiming above.

Of course you might agree with some aspects and disagree with others, but a true ‘academic’ could justify why that is the case, they wouldn’t resort to insults.

That you now seek to throw out abuse when this is highlighted to you speaks volumes.

With respect, dismissing Mirrlees as Neoliberal nonsense is entirely acceptable shorthand for what it is

And given you do not have the courage to even say who you are, that speaks bigger volumes

Including the fact that you’re only here to troll

Please don’t call again

The report was headed “It’s a matter of fairness”. It would have been interesting to see graphs showing how these lower rates affected issues such as shareholder returns in the form of dividends, executive compensation, share buy-backs to boost shareholder “value”, and how reinvestment in the company, eg R&D, fared.