The Office for National Statistics has published new inflation data.

The Consumer Prices Index for April has fallen, to 0.8%.

Factory prices actually deflated by 0.2% in April.

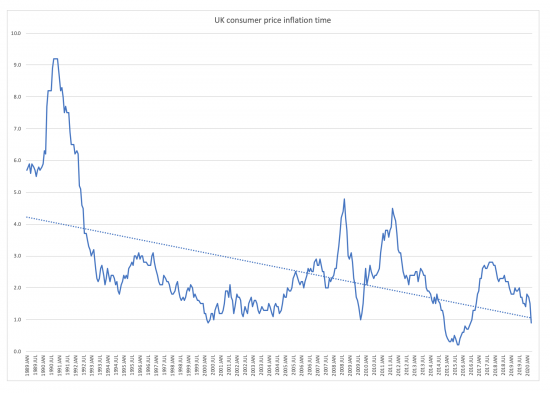

The trend, which I have plotted and to which I have added a linear trend line is as follows from January 1989 to April 2020:

It did not matter much what trend line I added: they were all downward, so I used a simple linear one.

And this matters, a lot.

I am aware that there is an argument that there could be inflation during this crisis, caused by those who remain at work and who have little to spend their money on pushing up prices for whatever is available. There were some signs of this in some of the April trends: the cost of children's games rose, for example, if only slightly. But personally I can't see that trend being significant unless good supply chains are disrupted.

I don't dismiss the risk of our food supply chains being disrupted. Brexit is one reason why they might be. More likely, if we continue to have high coronavirus cases and France does not then the shutting of physical supply routes is a bigger risk if they close them to prevent Covid-19 contagion. But for now, I'm going to dismiss the concern.

And, anyway, oil, energy and other core supply prices are going down and, whilst volatile, are unlikely to increase heavily for some time.

And demand, in the meantime, will fall as the reality of mass unemployment grows.

If that trend line continues downward, in that case the risk is of deflation. And that's the real concern. Deflation means that prices of products fall over time. There are three consequences.

First, people then defer spending in the hope that items become cheaper in the future. This fuels recession, or slump (which is what we are heading for) by deferring spending.

Second, this can feed back into wages and real wage growth ends.

Third, fixed monetary obligations - like loan repayment, do however remain fixed. Relatively they become more expensive as a result. Inequality rises as a consequence. Money moves from those in work, and in debt, to the owners of that debt, and this will create massive economic and social stress.

We cannot afford deflation: it would add to the considerable difficulties we already face. What we could, in fact, do with is a solid dose of income inflation to deflate debt, house prices and the wealth inequality in our society.

But it does not look like we are going to get inflation any time soon. And that worries me, a great deal.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I follow the argument, Richard, and would add the need in times of inflation for government spending to increase to support those impoverished by increasing their social security payments at least in line with inflation, as well as increasing spending on the support mechanisms (children’s and adult social services) they so clearly need.

wouldn’t falling prices and people deferring purchases reduce consumption, wouldn’t this help over stressed supply lines and reduced production due to the constraints physical distancing puts on manufacturing facilities?

isn’t reduced consumption a very green objective in our over developed and over consuming western society?

deflation might halt wage growth but the purchasing power of that frozen wage level would always be increasing in a deflationary environment and effectively making people more prosperous without growing their wages,

I agree that the fixed payments are the bug bear in a deflationary environment,

I can see that the UK govt. has done everything it can to prop up the current status quo, avoid the writing down of debts and stop over inflated asset valuations from falling,

but isn’t this what really needs to happen?

stocks, shares, rents, loans based on previous expectations of possible future returns are all priced far beyond the current reality,

these are the financial valuations that need to be allowed to correct under normal market forces to allow the economy to deflate to a realistic representation of what is possible in the new normal,

I know you don’t like the idea of degrowth but in reality it’s been happening gently since 2007/8 and now is happening in earnest,

why fight with the inevitable and unavoidable, just because it doesn’t suit your current mental image of how things should be doesn’t mean it isn’t happening,

if you accept it as an emergent phenomena and incorporate it and work with it then solutions become more readily discernable,

growth was causing all our mounting problems, deflation and degrowth can reset the imbalance and return us part way down the hill to a point that can be sustained and much more green,

we can’t grow our way out of our current connundrum, can’t we find a way of sustaining as much of what we currently have without always seeking more?

a further collapse in excessive valuations is inevitable, do we just wait and endure it chaotically or do we start organising an orderly retreat?

In the long term reduced consumption is good

But systems need to transition

In the short term they are chaotic

And that is not good for green change

Deflation is a bad thing, it would blight lives and we should avoid it…. and, with the correct policies we can.

I don’t think that OVERALL consumption has to fall in order to save our planet but the pattern of consumption MUST change. We must not fall into the trap of thinking that GDP can only grow at the expense of the planet. GDP is not just “stuff” it is ideas, too…. and becoming more so. . If I fly off the the Caribbean for a holiday this might raise GDP but at a dreadful cost to the planet but if I subscribe to an online magazine GDP still rises but the marginal damage to the planet is negligible. Encouraging this switch (rather than reduction) should be the aim.

I would also add that these transitions always work best in a (modestly) inflationary setting. Changing behaviours will require changes in the relative prices of things… for example, if we want to encourage more people to become nurses they will need better pay relative to other jobs. It is easy to raise their pay – not very controversial but slightly inflationary. Try cutting everyone else’s pay and see what happens! It would be virtually impossible…… but without accepting some inflation this is the only way to achieve the relative adjustment.

You are exactly right Clive

I have friends who are ‘de-growthers’

I respect their opinions, but the reality is that just because we do more things for each other does not mean that we have to consume all the planet

For example, what the current crisis has shown is that care is absolutely vital, but it has a very small impact upon the planet overall

I think that the economy to come will a great deal more services in it