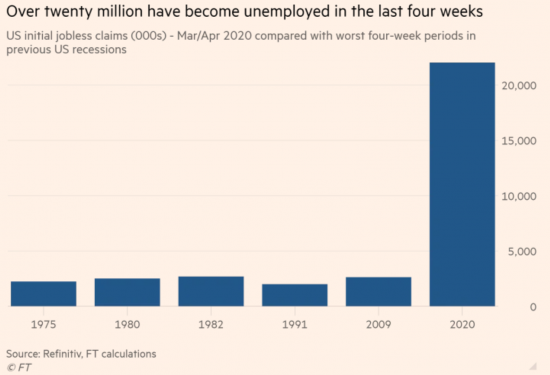

The FT has published a chart following the announcement that another 5.5 million people registered as unemployed in the USA last month:

This recession is unlike anything else.

But I have already explained that. As I said on 19 March:

I was told by an economist today that the situation that we face now is exactly like the 1930s. Without wishing to name the person in question, I fundamentally disagree with them. In my opinion the crisis that we face now is nothing like that of 1929 and what followed then, or 1987, 2001 or 2008. There is very good reason for saying so, and it is fundamental that this be understood if we are going to get the reaction to this crisis right.

All of those crises, and the downturns that followed them, were of fundamentally similar type. Overheated financial markets crashed. The result was a decline in demand (largely neutered, it must be said, in 2001 but otherwise very apparent). That downturn in demand then lead to supply-side problem as businesses reacted to the falling demand for their products, and in turn this then lead to unemployment and spiralling economic issues of varying degrees of significance on each occasion.

The important point to note though is that the cycle was:

- Financial crash

- Fall in demand

- Supply side response

- Economic issues as a consequence of multiplier effectsThis time the cycle is very different. The crisis has started with a real issue in the economy. A pandemic has created what, initially, was a supply-side shock: lockdown resulted in almost immediate supply-side issues, appreciation of which was only deferred by the Chinese New Year. Thereafter, and in this case not long after, two demand-side issues emerged. One, arising as a result of fear and further lockdowns, has been the virtual collapse of demand for certain goods and services, whilst simultaneously there has been panic buying of a limited range of other products. And then, but really only then, have financial markets realised the scale of the crisis that 21st-century capitalist economies are facing as a result, and massively marked down share prices.

In other words, the sequencing this time is:

- Supply-side causation

- Demand-side reaction

- Resulting financial crash

- Massive potential economic consequences as a result of multiplier effectsThe net outcome is the same, but the route to it is utterly different.

As a result to pretend that this downturn can be treated like others, for example like that of the 1930s, is at this moment wholly inappropriate. It cannot be.

In effect, in every other crisis the economy has underperformed. But this time we've closed it.

Sop in other recessions the requirement has been a stimulus. But this time the economy is shut. And it will take some time to re-open. Try too quickly and three things will happen.

First, businesses will fail because of a lack of capital.

Second, people seeking to spend and unable to do so might drive up prices in the very short term.

Third, more instability will follow, especially if the stimulus is accompanied by too big a relaxation of lockdown that then has to be heavily reversed.

And no one has ever tried to do this before.

Which given all else our government has got wrong is not encouraging.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Interesting, but we also have Brexit to look forward to later in the year. That should add some spice to the mix!

Some other commentators are saying similar things, notably Mohamed El Erian:

How Would You Decide to Restart the Economy?

The experts weigh in on the risks and trade-offs. Now it’s your call.

https://www.bloomberg.com/opinion/articles/2020-04-08/coronavirus-how-would-you-decide-to-restart-the-economy

“The one thing that we haven’t talked about is the risk of a W–and that is something I really worry about,” says @elerianm “What if we re-open and end up like Singapore and have to shut down again?”

El-Erian: Coronavirus ‘worse than the Great Recession’

https://www.foxbusiness.com/economy/coronavirus-great-recession-great-depression

https://twitter.com/elerianm/status/1250775789278126080

Charts capturing the #jobs tragedy unfolding in the US due to the #CoronaVirus shock:

First illustrates how, in a month, a decade’s worth of job creation has been wiped out (source:

@markets

);

Other comparing this to prior recessions (

@FT

)

Markets and economists are still too upbeat on coronavirus

Sentiment is too bullish, judging by price-earnings ratios and credit spreads

https://www.ft.com/content/acc0414e-527c-43e2-826b-c87ab1fa5f79

https://twitter.com/elerianm/status/1250614993013239808

Re below from last week:The $350 billion allocated to this program is likely to run out tonight.

Tomorrow’s weekly jobless claims number–already up 17 million in just 3 weeks–will serve as a reminder of the importance of supporting viable small businesses facing liquidity issues.

Although the mainstream narrative will be that the economic crash was caused by coronavirus, there were a number of structurally concerning issues appearing in the second half of 2019.

In the US, the year had started with interest rate increases and monetary tightening, but this had caused the markets to stall and an inverting yield curve (almost always a certain precursor to a recession). The subsequent change in policy direction was having a notable impact on the markets, but in December, valuations were at historic all time highs and looking very precipitous.

Since the ‘global financial crisis’ of 2008, the ‘recovery’ was certainly not organic and founded on a raft of unconventional stimulus creating a myriad of asset bubbles, drifting around looking for a thorn…

The coronavirus pandemic has presented an enormous tree of thorny prickles with which to burst the over inflated bubbles, but trying to switch the economy back on by printing vast quantities of money could well encounter some unintended consequences.

The economy was, as you say, already in trouble

If money injection is not the way to survive this, let alone turn the economy back on, then what is?

“If money injection is not the way to survive this, let alone turn the economy back on, then what is?”

adapt to the new reality,

one thing I’ve found interesting is that Sweden hasn’t implemented a lockdown, businesses are still open but the public isn’t coming out to use them,

the lockdown has been imposed from the bottom up by the people not the govt.

although there are currently certain items that are in short supply such as PPE & certain pharmaceutricals broadly speaking on a global scale there is a large oversupply of consumer goods & commodities,

demand for goods was already dropping long before the virus appeared, now demand is even more muted and if you force the global economy to restart you’ll probably created a massive oversupply,

not only will you create an oversupply you’ll also create a new spike in infections leading to another lockdown,

a degree of money injection is required but it seems to be being injected to sustain chains of debt payments,

if mortgages, rent payment, credit card payments and installments on loans were frozen you’d hardly need to inject any money compared to the current largesse of injections,

the money should also be injected into the bottom of the pyramid not the top, let it trickle up to the type of businesses that can still operate under these conditions,

bailing out passenger airlines, cruise lines, hotel chains and the tourism industry is futile, these ‘industries’ are dead in the water and may never live again,

hyper globalisation has caused nations and regions to specialise to such an extent that they’ve become economic mono-cultures bereft of all the local support systems that make a healthy mixed economy,

a popular tourist destination doesn’t produce it’s own tourists, it imports them,

a nation of consumers such as “Britain the nation of shopkeepers” imports all the goods it sells from China and is utterly dependent on what they produce and whether they are able to produce it,

we’d already killed our mixed economy before the virus arrived, the virus stopped the international flows of hyper globalised specialised manufacturing output and mercifully slashed demand at the same time,

we can’t restart Britains economy because Britain as an independent regional entity no longer has an independent mixed economy, our economy is the consumption of foreign made goods and the despatching of tourists to foreign locations,

we do need to restart the British economy, but a mixed economy that no longer exists, the powers that be want to restart the hyper-globalised economy which is now dead and will probably never fully recover,

we are currently in a very sticky situation and we’ve no one to blame but ourselves for allowing this easily forseen situation to arise,

currently we can’t do anything without the means to suppress new infections,

the only way to loosen the lockdown is to make wearing of facemasks mandatory in public,

we no longer have a manufacturing base to produce our own and if we order 60 million facemasks from China they’ll take 6 weeks to make and 6 weeks to ship,

what we do have is 60 million people at home who can make their own face masks,

https://masks4all.org/

https://masks4all.co/

ok people, let’s do this, our govt. hasn’t a clue and is clinging to the old world which has died,

they’ve destroyed our mixed economy so we’ll have to start from scratch again with cottage industries,

let’s equip ourselves so we can venture out and start tentatively rebuilding our mixed economy that successive govt.s have so successfully destroyed!

if you fancy having something to eat next winter then you should be digging over and planting your garden now,

we can’t all up sticks and move to Norfolk to harvest the mega fields of commercial growers,

our govt. is currently flying in Romainian agricultural workers to try and prop up their discredited globalisation model,

we need local solutions to local problems,

Sew for Safety & Dig for Victory!

Matt

I buy all the green arguments

But a failed economy is really not going to help – a transition will

Hence my belief that attaching substantial conditions to support is vital

Richard

I humbly offer the following thoughts about the future here : twoviruses.com ‘ Teachings of the Coronavirus.

I am assuming that you question pertains to the mechanics of how – I think your macro suggestions for turning on the money tap are sound and you have the answers in terms of money supply/auto finance.

The weakness is on frontline delivery – the answer to getting the economy back whilst balancing infection risk lies there.

This is why I think that testing and face masks should be made widely available than it already is. Testing would at least mean that those who spread infection were taken out of the economy , leaving those not infected to carry on. This is why the lock down is so indiscriminate.

Bits of our society are still working – you see it everywhere from bin men to outside workers like postmen, people in the public sector etc. The things is is to build on this whilst offering some form of protection to these and similar workers. Face masks could become compulsory for example for everyone to wear outside, either freely available or at ‘crisis’ prices (cheap enough to afford).

It is the waiting for a vaccine that is the biggest, most stupid idea.

It also strikes me that HMRC and the Government should be recruiting now to fill posts that offer help to local businesses so that money set aside for assistance is delivered. Using digital by default or telephone lines is a complete nonsense – real people need a real person to talk to at times like this to solve their problems. It would also help the Government to deliver its assistance (assuming of course that it really wants to – not an inappropriate question to ask a party inculcated with disaster capitalist thinking).

My worry is that as the crisis continues, it is being used by other vested interests to effect changes in (say) surveillance capitalism/statism and even maybe the money making potential of vaccine production as well as the re-ordering of employment and employment rights and conditions.

I’ve read somewhere for example that Australia is already telling its public sector that it will get a wage freeze as a result of the virus. Covid-19 may well initiate a new round of austerity for the masses.

So maybe the lack of action is actually deliberate rather than because of incompetence? This is why I think the Tories are OK with it, they’d rather be seen as incompetent than scheming for obvious reasons.

My big worry is that some countries who seem to have done testing and got their PPE sorted out are talking about reasonably lessening their lock down and this will also influence the UK who have not had widespread testing and problems with PPE – we may come out of it far too early having been in a less than fantastic state whilst dealing with it as well – a recipe for disaster.

But this also leaves us at the mercy of those I’ve already mentioned – the surveillance capitalists and their state cronies as well as those pedalling a vaccine.

When a state fails it’s people like Boris’ Government has, you have to ask why and ‘Cui Bono?’ – who benefits?

Capitalism these days is extreme – used to and perfectly happy using chaos, flood and famine and destruction to its advantage.

I think these are dark days indeed.

The fear of austerity returning is wholly justified

But austerity would not be

Richard, with great respect,

I’m not actually making any green arguments,

with respect to a failed economy I’m saying the economy had pretty much already failed before the virus arrived,

I’m not suggesting attaching conditions to a perpetuation of the previous state of affairs,

I’m suggesting we need to discard the previous model (hyper-globalisation & neo-liberalism) and return to a balanced mixed economy and prudent financial policies, those should be the conditions.

we are within a classic case of ‘you can’t solve problems with the thinking that created them’

restarting hyper globalisation will only restart virus transmission,

hyper globalistion is what enabled the rapid spread of the virus and it’s disabled the over extended supply lines that hyper globalisation relies upon paralysing the entire global economy simultaneously,

a hyper connected world is ideal for the spread of a virus, if this round of virus doesn’t destroy the global economy and we continue as before then the inevitable next virus will wreak equal or greater havoc,

TINA has created a situation where a mere virus can stop the entire world in a matter of months,

surely there has to be a more sensible alternative?

green arguments are another conversation entirely, currently we need to rescue the nation if we’re going to have a functional nation to turn greener.

populism & nationalism have been labelled ‘bad’ to discredit them and perpetuate TINA, hyper globalisation and hyper financialisation,

with the virus here, a degree of civic nationalism and increased national autarky is plain common sense,

the popular sentiment is that we are long overdue in making some of these adjustments.

the virus isn’t going to magically disappear, it’s here to stay, another virus will be along in due course.

don’t restart the old economy, enable a new economy that reflects reality,

don’t prop up a financial system that had already failed back in 2008 and has never recovered, reform the current one,

harness popular sentiment and a spirit of civic nationalism, don’t fight it,

embrace realism and discard discredited ideology,

we can no longer afford the luxury of ideology.

I know I speak in sweeping macro terms whilst you specialise in the complex micro arrangements but if the micro isn’t targeted by the macro implications then no change is possible, we just continue to perpetuate an already failed model.

the transition we need is much broader than just green.

Matt

I really don’t think we’re actually disagreeing very much

What I do not think possible is that we do this overnight

People have to be taken with this and they’re not there yet

So a transition is required, not a shock that people will reject

But do we need that transition? Heaven’s, yes

Richard

This is what Macron is recommending for France. Restart local production of some crucial items eg pharmaceutical