As I have already noted this morning, the new Governor of the Bank of England has been throwing down the gauntlet to the government this weekend, threatening not to undertake direct monetary funding (DMF) of government spending if he does not want to do so.

I wrote this blog in 2015:

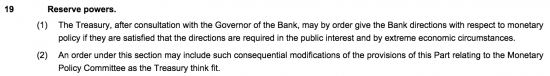

I argued on the Today programme on Radio 4 this morning that the Bank of England's independence from the Treasury is just a charade. It was always designed to appease the stupidity of the bond vigilantes. This is why. It is Section 19 of the Bank of England Act 1998:

To put it another way: they have independence so long as they do what the Treasury wants or independence can be suspended at any time.

And that is precisely why the Bank of England has always done what the Treasury wants, as I said. They really don't have much choice in the matter.

It's time we talked economic reality and not the silly games people have played in pursuit of neoliberalism.

I also wrote this at about the same time (slightly edited for context now):

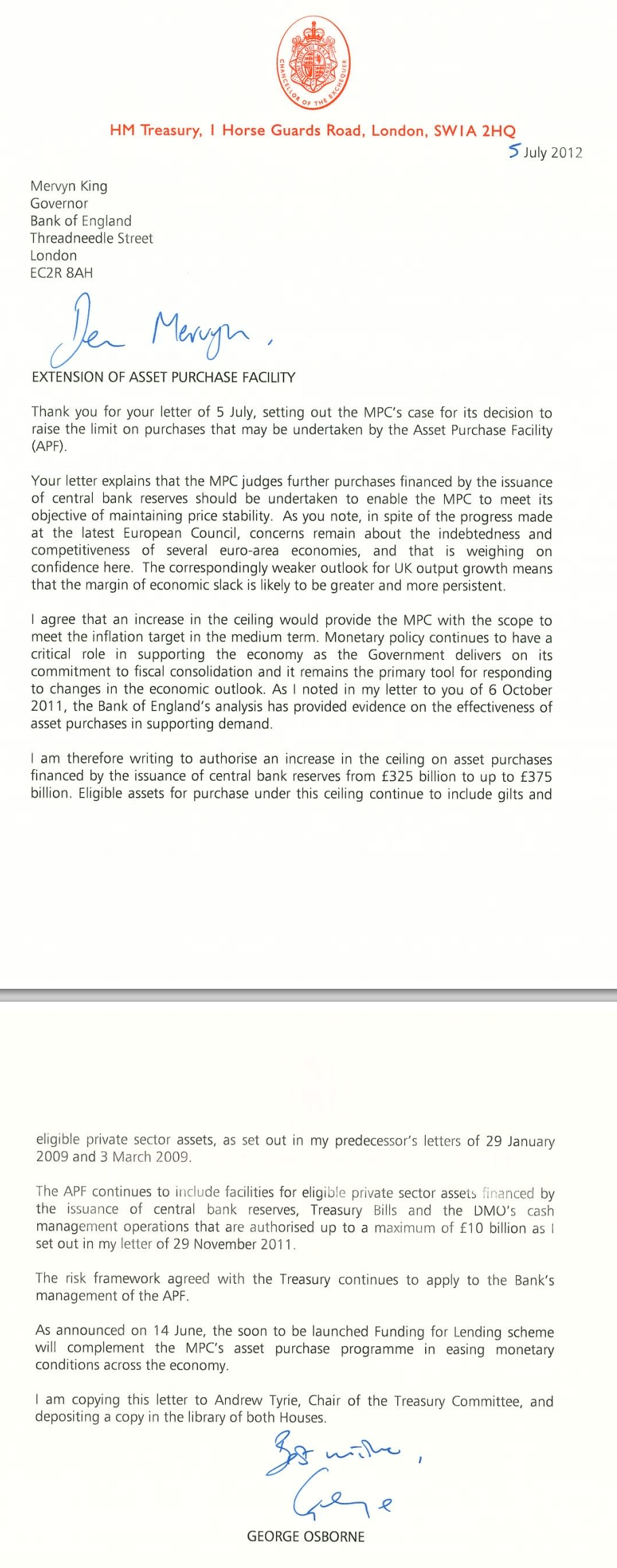

This is a letter from the Treasury sent in 2012 authorising the purchase of assets other than gilts (and so, by default, People's Quantitative Easing), this time from George Osborne in 2012:

And as I showed in another blog at that time, all conventional quantitative easing by the Bank of England was explicitly undertaken on the instruction of the Treasury, who indemnified them for it. So much, then, for Bank of England independence.

And as the above letter shows, that arrangement was extended to non-gilt purchases, which are the precedent for other arrangements, including direct monetary funding (DMF) of government spending by the Bank.

In other words, there is nothing for Andrew Bailey to jump up and down about. Presumably he just does not know what actually happened in the last decade: he was not, after all, involved in any of these decisions.

Several thoughts follow. First, the Bank of England is not independent. That's just a charade.

Second, the Bank does what it is told to do by the Treasury. Let's not pretend otherwise.

Third, the Treasury picks up the risk. So much of talk about threats to the Bank of England balance sheet.

Fourth, Andrew Bailey is talking complete nonsense at this moment for all these reasons.

Fifth, misrepresenting reality at a moment of crisis is really not a clever thing to do.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

You seem to be getting quite upset about Andrew Bailey’s comments.

You told us that the Bank of England was already printing money and was going to do DMF. Andrew Bailey has ruled this out, which makes what you have said wrong.

I said it could do it…and it said it might

Carney’s influence has gone

Bailey’s has arrived

I was not wrong

You said it could do it, would do it and already was.

Man in charge says they aren’t going to do it.

Looks to me like you are wrong. Why can’t you just admit it? Makes you look even more ridiculous when you say

“I was not wrong”.

I wasn’t wrong

It will happen

Trust me

I know I am right

So too does the FT today, and they published Bailey’s article and think he’s wrong

Can he really be so uninformed? I wonder if it’s more likely that he is either deliberately lying, or has been told what to say by his Treasury masters.

George

My view is that he knows EXACTLY what he is doing I’m afraid.

Agreed PSR – central banks probably know better than most how money works.

e.g. BoE will be well aware of what we read recently here from the Bank of Canada.

BoE governors like to guard jealously their *supposed independence*, and/or are prepared to lie on behalf of others.

“the game is a foot Watson” I have just read the FT piece by Mr Bailey. I fear for our institutions. This is the Gov. of the BoE writing:

“This type of reserve creation has been linked in other countries to runaway inflation.”

A reference to Zimbabwe perhaps. A subject dealt with Dr Murphy and other on these pages.

The narrative is now “yes” we always knew that we can do X but we have chosen not to do it because,

“The law requires the MPC to deliver price stability, which is defined through an annual inflation target of 2 per cent.”

All the Governors since 1997 are evidently in jail.

The cat is so far out of the bag that we are now being asked to look in the bag and see a cat. Was this all planned does it have the fingerprints of our betters all over it? Austerity comes back with a vengeance for our own good and in respect of the sacrifice made by others.

On a personal note I wish all your readers good health and for the author of the blog keep up the sterling work (intended) but be afraid just because I am paranoid does not mean they are not after you.

🙂

Ah, but it’s Shrodinger’s cat both dead and alive, somewhat like the BoE’s so-called Independence. Why would any government want a wholly independent Central Bank that went its own sweet way, telling the Chancellor to go stuff himself?

I think Mr Bailey mistake who is master and who is servant. He may be in for a rude awakening.

Yes Denis – my thoughts exactly.

I can understand Bailey insinuating about having to pay it off all later because he would say that wouldn’t he – afterall he made a complete hash of his former job. He seems to me like Britain’s version of Timothy Geithner – a malleable buffoon paid loads of money to say and do the most stupid things in order to retain the status quo.

But the worst of it is as Richard points out – given the impact of Covid-19 – how on earth are people going to live with a closed down economy? This does not seem to occur to him at all. He thinks his job is just to report figures – not to take any action – because by not doing anything, the vultures who back him and whom I believe he actually represents can make money out this crisis.

He needs to be shown the door.

Could Boris be considering what Trump has just done?

Quote.

“In other words, the federal government is nationalizing large swaths of the financial markets. The Fed is providing the money to do it. BlackRock will be doing the trades.

This scheme essentially merges the Fed and Treasury into one organization. So, meet your new Fed chairman, Donald J. Trump.”

This was not just another 4-year election.

https://finance.yahoo.com/amphtml/news/feds-cure-risks-being-worse-110052807.html

It’s doubtful Boris is considering anything much as he’s in intensive care with the C-virus… I’m wondering if Sunak at al aren’t going to take Bailey’s convenient theatre at face value and use it as an excuse to let the economy collapse, this after first seeing a handful of their chums (Branson, usual suspects) alright of course… if the MSM then treated that as though it were some natural and inevitable occurrence, who except an informed handful would know different?

The converse of course applies whereby in the run up to the GFC the financial sector tried to create its own equivalent of treasury bonds in the form of mortgage bonds which were much in demand. Of course the financial sector got greedy and the mortgage bonds became toxic. The government in the shape of the Federal Reserve chairman Alan Greenspan refused to take any action despite repeated pleas to do so by different parties including the FBI. So where exactly does the moral hazard lie in regard to the behaviour of either the private or public sectors?

So how has the government reacted this shot across the bows? Well they order him and if he refuses to do as they say, will the tories give him the boot? Why ruffle the government’s feathers in a time of crisis esp with 6 million projected unemployed by the end of May?

Don’t you think it is possible that this posturing by Bailey is being done with the endorsement of the Treasury to maintain the paper thin facade of BoE independence? As you rightly point out the Treasury will do what they want and Bailey will jump to attention when told to.

A very interesting take on the subject. I suggest you read it

https://notayesmanseconomics.wordpress.com/2020/04/06/mr-bean-and-two-barons-are-pressing-for-monetary-financing-in-the-uk/

I found it really hard to find an actual argument in what that was saying

Thank you for the mention Tim and as to what was said I think most would consider this to be pretty clear.

“Let me finish off on the subject of monetary financing. The simple truth is that we have an implicit form of it right now. Why is the currency not collapsing? Because nearly everyone else is at it too! “

What a shambles that the country now has a monetary illiterate governor of the Bank of England and especially in the midst of a major economic crisis caused by the coronavirus pandemic! Here’s Charles Goodhart going straight to the heart of the matter in his 1999 paper “Myths About The Lender of Last Resort”:-

“CBs in some countries, mainly in Latin America, have actually become technically insolvent, (using generally accepted accounting principles), as a result of losses incurred on loans in support of the domestic financial system. But such insolvency does not make much difference because what stands behind the liabilities of the CB is not the capital of the CB but the strength and taxing power of the State.”

See page 18:-

http://www.lse.ac.uk/fmg/assets/documents/papers/special-papers/SP120.pdf

Precisely….

A sentence which caught my eye (on p17): ‘In such cases the Government would step in to declare the Bank’s liabilities to be legal tender.’

And my other thought – fear – is over the extent the government is (or not) acting to maintain ‘the strength and taxing power of the State’ (see other posts)

Whilst Charles Goodhart published his paper in 1999 before the Great Financial Crash of 2007/2008 and the economic impact of the current coronavirus pandemic I cannot help but think if publishing today he might re-title his paper “Understanding The Supplier of Last Resort” and send the first complimentary copy to the new governor of the Bank of England, Andrew Bailey!

At the end of the day if you take the view as I do that a primary feature of humankind’s 4000 year old invention (money) is that it acts as a signalling device then ensuring there is an “optimum” amount continuing to circulate within a nation body hit by a crisis makes it easy to understand what needs to be done as a supplier of that device. Pretending that you’re not a supplier but a user and must hoard some of it in order to make your books balance ought to be automatically “laughed out of court” in a sane society!

[…] that the Bank of England is really independent of the government, which happens to own it, when as I have shown it is most definitely […]