This morning four of my recent co-authors published a joint paper on the future of auditing in the UK, and much more widely. Funded by Luminate, the work was undertaken under the umbrella of the University of Sheffield's Centre for Research into Accounting and Finance in Context (CRAFiC). Copenhagen Business School were the other project partner. As they noted:

Auditing with Accountability: shrinking the opportunity spaces for audit failure

In recent years a number of high-profile company failures have raised fundamental questions about the willingness and/or ability of auditors to exercise the professional scepticism necessary for the production of robust audits.

This report, co-written by Adam Leaver at the University of Sheffield and Leonard Seabrooke, Saila Stausholm and Duncan Wigan at Copenhagen Business School, examines the causes of those failures and makes a series of recommendations on how to resolve them.

The report argues that audit failure takes place within a particular configuration of economic, cultural and regulatory arrangements which create the 'opportunity spaces' for poor practice. Shrinking those opportunity spaces therefore requires a multi-dimensional response, including the structural separation of audit and non-audit functions, a more robust system of fines and the integration of a civil society voice into the reform process to prevent regulatory capture.

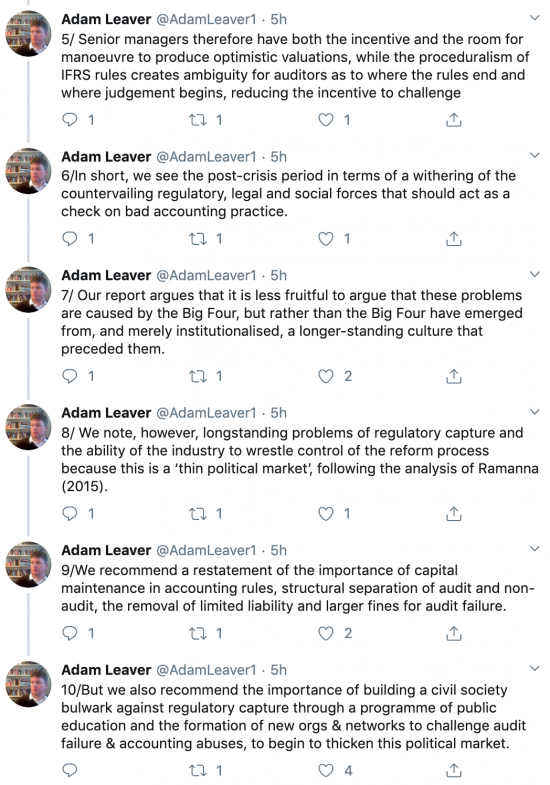

Adam Leaver of the University of Sheffield, with whom I am currently working and who is a director of the Corporate Accountability Network has tweeted about the report saying:

I recommend the report.

In the interests of full disclosure, I am one of the interviewees who views are recorded in it.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Hi Richard.

I’m posting here because it’s a thread with no comments, so will probably not interfere with the above topic.

I asked a couple of questions on MMT and money creation on a thread from the ( Sunak ) 11th March. It’s no longer taking comments though and I have a couple of follow up questions.

Thanks for the two links. One on money creation and the other on QE.

If private banks create money by making loans/credit (which I agree with), how then in MMT is/does the government become the money creator? Are the private banks making the money by proxy for the government if the government isn’t making the money directly itself?

By selling government bonds, is the government getting the banks to create money to then buy the bonds? I don’t understand the mechanism by which the government controls how and when private banks create the money? I get the idea that governments spend money first and tax later rather than the other way round, but it seems that it requires private banks to create the money first, before the government can go out and spend it?

(When private banks buy government bonds, I believe they use central bank reserves? Do they purchase CBRs, for the purchase of the bonds, from the BoE with “broad” money, that the government then spend in the economy?)

With QE, does the BoE purchase bonds that have already been sold to private banks? If so, are banks forced/obliged to buy more bonds from the government if the BoE/Government sees the need for more QE?

I appreciate there are other more pressing issues to discuss at the moment, but if you find the time to answer, I would be very grateful.

PS. Hope you get well soon.