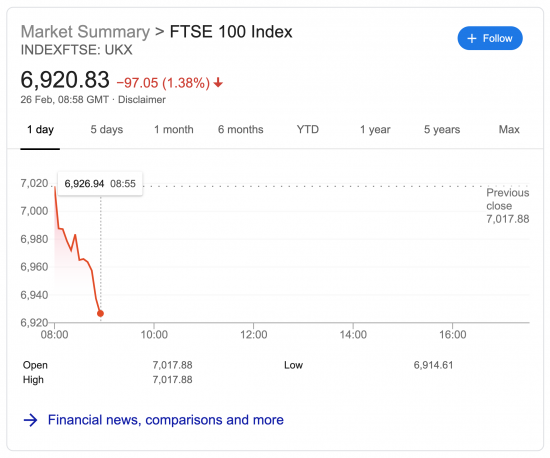

The FTSE 100 chart as I started to write this looked as follows:

That's not pretty. And it's the third day in a row of sell-off, the cause being the feared consequences of coronavirus. But, much as that virus is a real threat - and if it kills one in fifty people who get it, as seems possible, there is real threat to well being in its spread - coronavirus will only be the catalyst and not the reason for a global financial downturn if one happens, as might be possible.

The reasons should be obvious. Coronavirus would not be the issue it is in economic terms if we did not have such an interconnected world, where supply lines are stretched to their limits so that many companies are at risk from the slightest disruption to their systems, which coronavirus is already creating, and which could get much worse.

And nor would coronavirus be such a threat if households in many parts of the world were not already over-stretched with debt, meaning any disruption will tip many over financial limits and into serious financial risk of bankruptcy.

Whilst governments in the west, in particular, have for so long walked away from any crisis that has faced them and said that the market must find a solution that on occasions such as this, where markets will not be able to deliver on anything like a timely basis, leave their abandoned competence to manage critically exposed.

Coronavirus is a real threat whose significance I do not underestimate.

But the calamity it may create is because of a transmission mechanism wholly unrelated to health. That transmission mechanism is the fragile state of an economy maxed to its limits by a neoliberal logic that has presumed that all contingencies and provisions for prudence must be removed from the global financial system in the name of maximising financial returns.

And now those returns won't happen.

And the system will not have the resilience to manage the threat that this poses.

It's the over-stressed state of the economy that coronavirus will really reveal.

If it does the world might never be the same again.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Do you not think the inter connectivity you mentioned has gone some way to creating wealth in the emerging economies? Isn’t that a good thing?. Are you suggesting all economies should have remained insular and self dependent? There is still serious global inequality but wouldn’t it be far worse with the self dependency you outline? Part of the inter connectivity has been the travel and relocation of many from other countries and continents which obviously helps account for enhanced business connectivity around the globe. Are you suggesting this movement should have been prevented?. On balance globalisation has been positive in so many ways. The coronavirus will ultimately be stopped by science. Let’s hope the global scientific community find a solution ASAP. By trying to score political points is a poor show on your part.

I have no issue with fair trade

I am not arguing against trade per se

But I did make a point on resilience, and the lack of it, which that trade exposes all to

Why distort what I said for petty point-scoring reasons?

You talk some nonsense but this is as silly as it gets..what are you suggesting we go back to an age where we, and everyone else are cocooned in their own little community where we are all responsible for our own dependency and survival? So the west has the medicine to cure so many ills but we say “look after yourself” to less developed nations who are dying? so you would also deny export opportunities to countries who have an abundance of raw materials needed by wealthier nations who can pay sufficiently to significantly improve the lifestyles of the exporter nations?

you really need to think before you write. Intricate supply chains and inter country dependency is indeed a function of globalisation and serious problems have and will emerge through the coronavirus. But to think international trade is a thing we should have avoided and we should have set up instead with self sufficient communities is quite bizarre.

That is not in the least bit what I said

But you obviously either a) didn’t read it or b) didn’t understand it

Your comments are a poor reflection on you, not me

But carry on repeating Worstall if you like

In practical terms what would supply chain resilience look like?

In a past role I was on a number of building boards in a large university. There was always a 10% contingency and detailed staging reports and examination including costs allocated to budget sections. By and large buildings were completed on time and within budget – can’t remember any which used all the contingency. This indicated resilience for me in that context.

I think it is obvious what I mean from what I have written

“I think it is obvious what I mean from what I have written”

The only thing obvious is your desperation to link human tragedy with neoliberalism..you haven’t remotely explained your concept of “chain supply resilience”

You prove your foolishness with your claim

Goodness me Richard, I don’t know how you put up with the likes of Pesenti, Jason H, and Benali (or is ‘Banal—ee’). You’re a thicker skinned man than I will ever be.

I’m just fed up with having to read their denials about there being anything wrong or related to the coronavirus outbreak and other issues – because like the typical Neo-libs they are, they can only ever try to over simplify things and take the man, not the ball. I’ve got to pipe up I’m afraid. It’s getting on my nerves.

Let’s just get something straight for you narrow minded people who are ignorant of human history: mankind worked together and traded BEFORE contemporary globalisation OK?

Before white men entered America for example, the great Indian tribes would have traded together (and even fallen out with each other from time to time) quite happily. So what is this ‘self-dependence’ and supposed ‘insularity’ you are talking about? Even today, the few isolated remote tribes still try to trade with other communities. And it was another human invention — navigation (by land, sea and then air) — that really boosted trade long before ‘globalisation’ as we know it got going — think about how Venice grew for example, or the Silk Road — competitive but more principled trading from another time. Trading is as natural to humans as breathing it seems to me.

All this talk therefore about the recent ‘globalisation’ of the economy is a bit over-blown — typical hyperbole for the unprincipled Neo-liberal age we live in – the world economy has been globalised for centuries folks, CENTURIES! To sort of forget that human societies traded before etc., is just so much typical Neo-liberal arrogant guff.

But let’s have a closer look at this nice, new Neo-liberal ‘perfect’ version of globalisation shall we?

The myth of wealth creation, of ending poverty certainly gets on my nerves. It is great to see a country’s standards of living raised as their economies grow and jobs are created. But should it be at the expense of someone else?

All too often globalisation is a double edged sword.

Too many of these new jobs were previously in the West. That’s right: workers in the West have lost their jobs as the firms they have worked for have moved operations into cheaper, less regulated jurisdictions. So all that has really happened is that wealth creation has been simply moved around — nothing new has actually been created; there is not a net gain therefore for human kind or for the world. And not only that, the cheaper labour means that more profit can accrue to the owners, managers and investors of those companies instead — which is just what the Neo-Liberals are all about.

What would be better was if these countries could grow their own industrial capacity instead of harbouring existing capacity from abroad or having to bid their conditions down as they compete against other poorer countries for ‘inward investment’ (in other words, racing to the bottom). But no, we let the ‘market’ lead economic development and see workers in the West increasingly live on debt — not real wages.

But let me now move on in defence of Richard’s main point I think he is making — the inherent structural weaknesses in globalisation itself.

Yes — it’s true, globalisation has speeded up trade and transactions to levels only dreamed of before. Fair enough But — again — there is a dark side — contemporary globalisation also turbo charges RISK. Already it seems those of the Neo-liberal mentality have forgotten the ‘little episode of the ‘credit crunch’ in 2008?

Here we had a market for mortgage based debt that was being created chiefly in the USA and elsewhere and sold as an investment worldwide, as well as insurance type policies (credit default swaps — a form of financial derivative) on those mortgage backed securities. The globalised under-regulation of mortgage selling and of derivative trading meant that basically these investments were very unsound and as the mortgages that made up the debt investments began to unwind (as people who had been sold mortgages they should never have had started to default on payment) the whole enterprise (enterprise!! It was criminal!!) collapsed rapidly as panic set in and it affected everyone — every country was hit in some way. The insurance payouts alone could make the insurers bankrupt (remember AIG?).

As Satyajit Das (the man who wrote a derivative text book you could buy on Amazon for £165.00 if I recall) says in the film ‘Inside Job’, derivatives were meant to diversity risk, but because anyone could take a bet on these securities, what actually happened was the opposite – globalised derivatives actually increased the contagion of the crash globally because more people would either be entitled to a pay out or lose their cash. Result? Job losses worldwide, austerity, life expectancy stalled, the growth or poverty stalled, markets flat. And we are still feeling the effects now — wages in the UK have still not got back up to their pre 2008 levels (is that Neo-liberals I can hear clapping — it would not surprise me?). All of this because of a globalised unwillingness to regulate financial sectors for fear of being left out perhaps or other ‘penalties’.

So what has this got to do with the Coronavirus outbreak? Well, just use your imagination will you.

Where did the last avian flu outbreak originate? China. Don’t you think they would have learnt a thing or two now about how to manage bird livestock in a way NOT to promote infectious diseases?

Don’t you think that good, high worldwide standards of animal welfare might have helped China not be the crucible for such a pandemic? Is not the latest outbreak not a fact, or consequence of the globalised world, with its emphasis on low regulation, low standards in the name of cheapening the means of production and delivery because of either servicing debt and or just simply for yielding obsessively more and more profit via fewer rules and regulations?

I think so. And all of this could kick off in a credit crunch addled world, still blighted by austerity, with huge added challenges in changes to the weather brought about by globally under regulated pollution that could very well change the map of the world — another fact of the global obsession with short term profit over everything.

As Richard says “That transmission mechanism is the fragile state of an economy maxed to its limits by a neoliberal logic that has presumed that all contingencies and provisions for prudence must be removed from the global financial system in the name of maximising financial returns”.

The NHS is already struggling as it is because of Neo-liberal generated austerity; Britain has the left the EU and whatever standards there were over trade quality seem to have been thrown out; workers may not have any rights at all if they choose to ‘self isolate’ if they have the flu because workers rights are eroded and hire and fire is just too easy and employers use zero hours contracts anyway; Universal Credit routinely pauperises people. It’s a recipe for social disaster if the virus spreads. How many people will lose their income this year because of a possible drop in tourism? My family are already toying with cancelling our holiday.

This then is what to me Richard is getting at. We deserve a better world than this but more than anything else, pray that Richard is wrong.

My apologies if I have been a little severe here, but I just had to say something in answer to the inveterate Neo liberals who like to turn up here and demonstrate their ignorance.

Go and do it somewhere else. You won in December didn’t you? Go off and enjoy yourselves elsewhere. Whilst you can. Knock yourselves out. But not here.

I know that you can stick up for yourself Richard, but I just had to say something. Bloody hell!!!

Thanks PSR and great to have you on here

I think I got the award for being thick skinned….

But just one issue

You are right o draw attention to risk but I would go a stage further – what is created is increased uncertainty – and that, of course, is much harder to manage. And I would not have thought of that without your comment

Yes Richard – absolutely – uncertainty is also a key component especially in those who affect such markets. This is when the so-called ‘wisdom of the crowds’ of the ‘efficient (Ha Ha!) markets hypothesis’ turns against itself as the confidence inducing arbitraging of regulation, taxes & workers rights – all done in the name of creating certainty of return for investor – is undermined by stuff that is just not considered as the focus is on wealth extraction. Then the so-called wisdom is a wisdom of panic and withdrawal from the market and calamity for the rest of society. As ever contemporary North American capitalism works against itself in the end.

The problem that the adherents of globalisation and such hypotheses face is that the very factors that could actually make supply chains more robust – regulated standards, workers rights – taxes are those that they reject for reasons of pure short term greed.

What is it they say? When you pee into the wind, it comes back at you twice as hard.

Typo correction above – I meant to say that the reductions in poverty stall too under austerity. Anyhow, keep at it Richard.

I will….