HM Revenue & Customs published a 'factsheet' on Monday on the supposed success of the 'Diverted Profits Tax' (DPT), introduced by George Osborne in 2015 and then commonly known as the Google Tax.

The fact sheet is really quite strange and makes some claims that are very hard to undertsand, or seemingly justify. This is the summary:

- DPT was introduced specifically to change behaviour — only being levied where businesses aren't paying the right tax in other areas, principally Corporation Tax (Corporation Tax">CT)

- DPT has revolutionised our approach in countering contrived arrangements used by some multinational corporations to shift their profits offshore and avoid paying tax in the UK on their economic activities here

- We've seen increases in both CT and VAT as DPT starts to have an impact as a behaviour change tool, with the amount of DPT receipts beginning to fall away

- To the end of the 2018 to 2019 tax year over £4.6 billion had been secured - this includes:

- £2 billion in VAT from businesses restructuring their operations

- more than £2.2 billion in CT where DPT helped settle existing investigations

- £369 million net from DPT charging notices

- As at the end of December 2019 HMRC has secured another £480 million through DPT investigations

- HMRC are currently carrying out around 100 investigations into multinationals with arrangements to divert profits - the total amount of tax under consideration was £2.9 billion as at March 2019

- 2018 to 2019 alone saw restructurings that will increase VAT billed through UK companies by around £1.8 billion

- In 2018 to 2019 we secured more than half a billion in additional CT from diverted profits investigations

- In 2019 HMRC launched a new Profit Diversion Compliance Facility to encourage businesses to stop diverting profits and pay what is due - around two thirds of the large businesses initially targeted have decided to use the facility to bring their tax affairs up to date quickly and efficiently, enabling HMRC to focus even more resources on investigating businesses which continue to divert profits

- The 2,000 largest and most complex businesses in the UK are responsible for around 40% of the country's tax receipts - in 2018 to 2019 this was £251 billion

- In 2018 to 2019 where HMRC stepped in to ensure the correct tax was paid, this secured over £10 billion in additional tax revenue from the largest and most complex businesses, more than ever before - this is money that would have otherwise gone unpaid

Many of the figures used in this report are hard to reconcile one with another, but I am going to focus on two issues. The first is the claim that DPT has increased the VAT yield by £2 billion.

HMRC must have their reasons for saying this. I am curious as to what they are. VAT is, after all, a tax on end consumption in the UK. It is not a tax on most business (the financial services sector is the main exception). And it is a tax that is meant to be neutral on imports and exports. There are detailed arrangements in place to make sure that goods and services imported are subject to the tax and those exported are not. The rules are not perfect, but they work, overall at present. And what that means is that if supplies are made to end consumers in the UK then they should be subject to VAT. And if they are not made to end consumers in the UK then they should, at the end of the day, not give rise to a charge.

In this context there should, logically, be no additional net VAT due in the UK as a result of any DPT action. How the determination that a supply was being made for VAT purposes in the UK seems to be entirely independent of the DPT and corporate residence rules: distance selling is a well-known VAT concept that appears unaffected by any DPT charge, as far as I can see.

I admit I can see how it is possible that business was relocated into the UK within group structures as a result of DPT. I believe such reorganisation to be possible. And more VAT might appear to be charged as a result. But I very strongly suspect that the resulting supplies were not to end consumers: they were most likely business to business transactions, and quite possibly in the same group. In that case it is also highly likely that the additional billing would give rise to an equal and opposite input tax VAT reclaim in anther entity, or to an eventual export with VAT being due.

My suggestion is, then, that this claim may well be deeply misleading. Unless it is being suggested that DPT discovered previously VAT undeclared distance selling to UK consumers that was not on HMRC's radar (and I think this unlikely, and it would also imply that tax gap estimates were seriously wrong) what has actually happened is that more VAT has been billed, and also recovered as input tax within the VAT system and the net real recovery is vastly smaller than HMRC claim. If that's the case the suggestion that this is a 'factsheet' might look seriously misplaced.

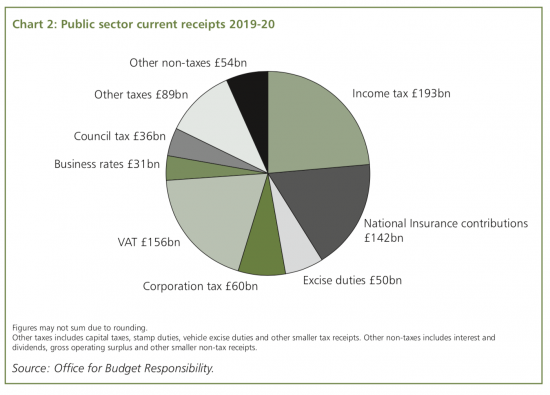

The second very odd-looking claim is that the most complex businesses are responsible for 40% of the country's tax receipts. This is roughly what UK tax revenues are expected to be this year:

You could claim business pays business rates and corporation tax, and I would broadly agree.

You cannot claim it pays most of VAT, because it is designed to make sure it does not.

It does not pay income tax, although its employees might.

And no one seriously thinks it pays any national insurance: gross wages are simply reduced to cover the employer's contribution.

Excise duties are passed on to consumers.

So the claim that big business contributes £251bn of tax receipts is grossly misleading: it merely acts as agent to pass much of this on. They do not pay it. Again, then, this is a false 'fact'.

HMRC have, I suggest, a lot of explaining to do.

+++++++++++++

Subsequent to publishing the above HMRC's press office asked me if they might have the right of reply. I agreed. This is what they have said:

An HMRC Spokesperson said: “The publication highlights that Diverted Profits Tax (DPT) is encouraging businesses to change their behaviour, structures and policies, and is securing additional money for the UK's vital public services.

“As a result of our DPT work companies have agreed to restructure, with economic activity being billed through UK VAT registered companies rather than offshore entities. In future UK VAT will be charged and collected, where previously that was uncertain.

“Large businesses account for around 40% of the UK's total tax revenues each year, both in respect of their own tax liabilities, but also collecting revenues — VAT and employment taxes — and paying across to HMRC. This highlights the importance of HMRC's related compliance work in ensuring they fulfil all their obligations.”

I have three comments.

First, if HMRC really cannot be sure that £2 billion that should have been billed by our largest companies was billed here then I suggest that their management of the tax system is more worrying that even I have dared presume, and their tax gap estimates have a much greater margin of error inherent in them than they ever admit.

Second, the claim that large businesses account for 40% of tax remains wrong: they don't account for it, they merely act as paying agents for it.

Third, it would be great if they would actually answer the questions: there has been no attempt to do so here.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

“no one seriously thinks it pays any national insurance: gross wages are simply reduced to cover the employer’s contribution.”

So in reality, the BASIC rate of tax/NIC on individuals earning less than £50k in 2019-20 is 20+12=13.8 = 45.8%. And the additional rate is really 45 + 2 + 13.8 = 60.8%. And the ‘marginal’ rate on those earning between £100k & £125k is 60 + 2 + 13.8 = 75.8%.

I wonder if people realise?

They don’t

That’s the con trick

You’d need to include the employer NICs on both sides in that case – eg. (20+12+13.8)/(100+13.8) = 40.5%. And for larger employers also add the 0.5% apprenticeship levy. That might make sense where for example you have a defined pot of money, out of which all of the pay and related expenses has to be paid.

And then, in most cases, the employee’s wages (and employer NIC) will be deductible against the business’s profits, so for example, saving a company 19% of the 113.8, that is 21.6. If employer NICs reduces pay, does the tax deduction for the wage bill increase the amount paid?

Re the last, there has not the slightest behavioural evidence that it does because the tax is only on the residual and reflects economic substance. Only the most marginal of decisions would be altered by that equation

I agree that the VAT issue is most likely as you describe, otherwise we would have seen either more VAT cases at Tribunals or more recoveries from prior years. These would have found their way into the public arena. Neither seems to be plausible.

I differ on the employer’s NI front – my view is that employers do pay this – yes it is all part and parcel of wage costs but if the consumer pays VAT, then employers pay the employer NI.

I agree that the factsheet is perhaps misleading, but I guess that when HMRC are saying :’The 2,000 largest and most complex businesses in the UK are responsible for around 40% of the country’s tax receipts – in 2018 to 2019 this was £251 billion’ They are not talking about how much the large businesses contribute, but that they handle that amount of tax related money. Making the case that compliance in the large business arena has significant impact on govt finances.

HMRC have asked for a right to reply and I am awaiting their commentary

A point that is often missed here is that business are required to act as unpaid tax collectors, with huge amounts of income tax and NICs collected almost automatically through PAYE, and VAT monthly or quarterly. And of course they are first in the line of HMRC’s fire for interest or penalties if something goes awry. Just another cost of doing business.

I’m struggling with the maths in the “fact” sheet. Tax receipts are £193 + 142 + 50 + 60 + 156 + 31 + 36 + 89 billions = £757 bn. So 40% would be £302.8bn. £251bn is about a third of that, not “about” 40%. The difference is “only” £50bn, but that is similar to the entire amount of corporation tax payable.

Let’s see what they say

They suggest they are providing a response in emails to me provoked by the piece. I did not send it to them

They are probably comparing the £251bn with HMRC’s 2018-19 tax receipts (£627.9bn, of which 40% would be about £251bn) rather than projected public sector current receipts for 2019-20. From HMRC’s annual report it was IT 194, NICs 135, VAT 135.6, CT 53.5, hydrocarbons 28 and others 81.8. That seems to exclude council tax and business rates, which accounts for half the difference, so some other taxes – some excise duties? – must be left out too.

See the response from them I have posted

Not really a reply to your questions is it. Does their £2bn of extra VAT charged by UK suppliers take account of the potential for business customers to recover it? Does it take account of the need for UK VAT to be charged on many supplies made to UK customers by non-UK suppliers: on goods imported to the UK, on supplies of services treated as made in the UK (eg in relation to UK land), or under the reverse charge on services received by UK business customers? How much net additional VAT was received by the Exchequer, after recoveries?

It seems to me they are trying to justify the trajectory of net DPT recoveries, from £138m in 16/17, up to £219m in 17/18 and down to a paltry £12m in 18/19. The answer to that (which to be fair was said by commentators at the time DPT was introduced) is there was never really an intention to raise much tax payable as DPT – and even it its height, £200m is a drop in the ocean – the new tax was intended to change behaviour. A signal, like the digital services tax. The DPT has been described with some justification as a “transfer pricing reserve tax” – as in broad terms, if a business gets its structuring and pricing right, the DPT falls away. And that is what we are seeing.

It occurs to me tat the £2 billion may well be Amazon and eBay based reforms…

If so that is really misleading

But the amounts are similar

[…] Source:Â taxresearch.org.uk […]

That reply is an insult to the intelligence.

I haven’t had a single client pay dpt since it was introduced and I advise multiple international clients at a big 4 firm. All it achieves is additional compliance work as we have to evidence the net result to zero every year

If dpt had raised more than 500m I would be amazed!