It is my habit to mark successes for tax justice. I see no reason why not. If campaigning does not change things it is not worth doing. Change is what seeks to create and so noting it is wise.

HMRC's latest data on trusts marks what, I think, is a tax justice campaigning success. Trusts have long been the focus of tax justice attention. John Christensen and I drew attention to the problems that they create in the Tax Justice Network's first statement of goals in 2005, entitled ‘Tax Us If You Can'.

The title was not by coincidence: the whole point for focussing on trusts was that we were aware that they could be used for tax abuse. On and offshore they provided enormous opportunity for anonymity, a lack of accountability, a denial of responsibility and in some cases blatant non-compliance with the requirements of tax law.

We did not say the trusts were all bad. They are not. They can be used for charitable purposes. They can protect the assets of vulnerable people, including the young. In some cases they are the right way to hold the ownership of an asset for the benefit of a group. None of this is disputed.

But, in exactly the same way that limited companies can provide benefits and can also be vehicles for commercial and tax abuse, so too can trusts be abused. As we said in 2005:

Trusts are a principal vehicle of tax injustice:

They are used to hide wealth from tax.

Discretionary trusts hidden behind nominee trustees create a secrecy space that is hard to regulate.

In common law countries, trusts are equivalent to secret bank accounts. This is a valid complaint of those countries that are being asked to remove their banking secrecy laws.

Incredibly, charitable trusts own many of the offshore ‘special purpose vehicles' that are used by so many companies as part of their international tax planning. This is an abuse of the concept of charity.Trusts have been widely abused and they clearly need to be better regulated. They serve useful functions in such areas as:

The promotion of genuine charities.

The protection of children and the disabled who are unable to look after their own affairs.There is no reason why every trust should not be required to disclose on public record the following:

who created it

what the trust deed says

who the trustees are

who the beneficiaries are, and

in the case of discretionary trusts any potential beneficiaries listed in the settlement

trust accountsTrusts are given rights and privileges similar in many respects to those of limited liability companies. These rights and privileges should be balanced by a requirement for transparency and social responsibility.

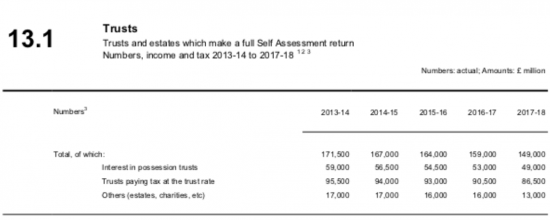

So it is good to note that we have won the argument for trust registration: it will begin in 2020. And, second, over the period that we have been campaigning the number of trusts in use in the UK has fallen significantly. The latest HM Revenue & Customs data shows this:

The number of trusts is declining, markedly. I would suggest that is because there use for abuse is also falling. And those who have dug a little deeper have shown that the trend is continuous. As International Investment notes, in 2005 when John and I wrote there were supposedly 220,500 trusts in the UK. The latest data is some 32.5% lower.

I and not suggesting that the abuse of trust has ended: I am sure it has not. I am not saying that all those that remain have a genuine social purpose. Again, I suspect that this is not true. But there has, undoubtedly, been a massive change in social culture. Tax abuse using trusts has declined. And new rules on trust transparency are discouraging those who have used them to hide their activities to create unlevel playing fields in the UK economy that they have been able to abuse for commercial advantage. This is good news. I welcome it.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

It is good news but my worry is that with BREXIT breathing down our necks and in a No Deal scenario especially, those who rely on Trust methodology will simply stop hiding their money because they won’t have to! They can can just keep it here in the low/no tax post BREXIT economy that beckons via Johnson & Farage with its ‘free ports’ etc.

It could happen.

I only remember what Nicholas Shaxson said at the end of the Prologue of “Treasure Islands”: “The offshore system is in very rude health … and growing fast”.

Things are changing I suggest

Much has happened since that book was written

Golden rule if you want to be an accountant and keep your integrity intact – account for the substance not the form.

Golden rule if you want to be an accountant and make lots of money – account for the form and not the substance.

So true….