The Institute for Fiscal Studies finding that more UK tax is being paid by a smaller group at the top of the income scale resulted in some fairly predictable reactions in the media yesterday.

Economia magazine from the Institute of Chartered Accountants in England and Wales reported that:

UK increasingly reliant on super rich for tax income

This, of course, is not true. We are not reliant upon such people. They simply pay more tax because they are convulsing more than the rest of us.

And, we owe them nothing in exchange. As modern monetary theory shows, public services are not dependent upon our ability to raise tax: they are instead dependent upon our ability to find people to work in those public services. In that case the idea that we are, somehow, in debt to those who make large tax payments on their disproportionate incomes is factually wrong: instead those tax liabilities indicate the fact that we have not, as yet, got our tax system, or our economy, in good order so that the rewards are both government spending and economic activity are fairly distributed.

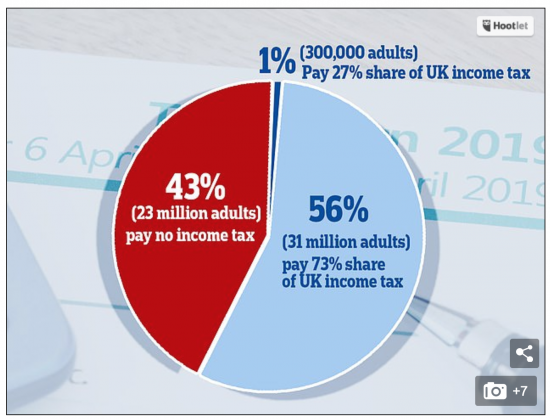

But, if Economia's comment can be put down to a lack of political and economic understanding then the comments made by the Daily Mail cannot be. They featured this chart:

And they then made the point that:

And they then made the point that:

Experts have warned the UK is not 'all in this together' as new research shows a record number of people - 23 million people - now pay no income tax.

Policy analysts warned of a threat to the 'contributory principle' that citizens have to pay in to the public purse to receive services from the state, and said it meant fewer people pushing for low taxes or value for money from government spending, since they themselves would not be footing the bill.

They added:

The group of adults who pay no income tax includes the unemployed and home-makers with no earnings, as well as retirees, and anyone who earns less than the tax free allowance.

I added the emphasis: the inclusion of the unemployed is wholly unjustified: officially they make up a tiny proportion of society, of course.

And the 'experts' who commented were all, mysteriously, from right-wing think tanks, like this:

Daniel Pryor, Head of Programmes at the Adam Smith Institute, said: 'These statistics put to shame the idea that the rich aren't paying their fair share - in fact, top income earners pay the vast majority of tax in the UK.

'Income tax hurts investment, economic growth and innovation, and it's good that many Brits on lower wages are paying less.

'This does, however, create a worrying political issue: fewer people having a direct stake in pushing for lower taxes or getting value-for-money from government.'

I very strongly suspect that there is an agenda in play here. I have long thought that the Tory plan to take people out of income tax was deliberate. I have always suspected that the intention was to claim that those who did not pay tax do not count, and that in the long term those on the political far-right would like to recreate a link between income tax payment and the right to vote.

The fact that there is little link between income tax payment and overall tax payment is something that those making these claims wish to ignore: those on the last levels of income in the UK very often have the highest overall tax rates because of the VAT, council tax, other indirect taxes and charges such as the BBC licence fee that they have to pay out of low incomes.

Those on the highest incomes also very often have the lowest overall rates of tax. This is partly because of the extraordinary range of allowances and reliefs that are available to them and because when you have very high income it is possible to divert large parts of your earnings to a company, and pay very low rates of tax as a result, and to generate capital gains, where rates are also far below those paid by most who work for a living.

These facts, for facts they are, are ignored by those who comment on articles such as this for the Daily Mail. There is good reason for that. Their agenda is to promote a falsehood, which is that the rich pay most tax when as a proportion of the incomes that is almost certainly not true. But, more worryingly, I think that they are now extrapolating that to not just a claim to unwarranted virtue, but a claim to sole participation in the control of society that is profoundly anti-democratic.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

How twisted is that?

“No representation without taxation” indeed!

The interesting feature of this is the exploitative use of propaganda; the timing, the methodology, the effectiveness. The use of media, of carefully targeted Pie Charts, of politically committed “think-tanks” that are somehow presented by all our media as quasi-official representatives of scrupulous impartiality or even disinterest; when they are not. The far Right is far more effective in the political use of all forms of modern media; everyone else is reduced to the position of the floundering responder; arriving too late at the scene. The far Right has already moved on to the next Pie chart, the next false narrative.

At the same time, the best response to this assault on common sense is not a narrative, an inevitably long-winded and complex argument. The best response is first, fast; and second, another Pie Chart; side-by-side. Either disproving the ‘evidence’ if wrong, or by presenting a Pie Chart of income distribution (the co-relative of tax due) – showing just how small is the income-share of the 23 million; opening a door on the challenging question how such an extreme distortion of economic outcomes can happen in a modern civilised society.

Cant you accept that different people have different skill sets that make them more or less valuable in the workplace?..a footballer, a brain surgeon, a mechanical engineer, a doctor, an architect…obviously the list goes on whereby a combination of natural ability, education and most importantly hard work and sacrifice give some people the opportunity to earn way more than the average salary…you seem to view this as almost immoral?

What a load of rubbish

I do not for a minute despise anyone’s ability

Or fair reward

But candidly, GPs are not worth what they’re paid (and I have been married to one); partners in large firms of accountants exploit their monopoly power; bankers exploit us all; as doo the bosses of large companies and so on, and on, and on

Whilst many of the most wealthy inherited what they have

I suggest you stop talking nonsense and explain why these are the only people with run away earnings incraeses

Well I paid over 3k for knee surgery recently, not because I am particularly wealthy but because it would improve my quality of life and what I needed wasn’t available on the NHS.. the surgeon will probably do 3-4 a day..nice work if you can get it !!!.. so the surgeon probably pockets 500k per year.. is he over paid or under paid? Probably paid the right amount as he pay relates directly to his work load and he is demand because of his skill and experience. This is the barrier to entry holding up his pay packet. This argument will resonate in many many industries, though I accept not all… I don’t agree with your comment about GPS btw but we are entitled to an opinion

Who trained the surgeon?

And all the support staff?

Think about it…

I actually touched on this with the surgeon..he like i think most who do private work, he works in the NHS so i suppose he is at least still repaying something back to the State although trainee medics make an incredible investment and sacrifice themselves..the pioneering work he does in his field is all funded privately of which he is obviously paid handsomely..so back to my point exceptional skill and exceptional endeavour brings high rewards..as it is in many industries

You are wasting my time

No one does pioneering work in private medicine

Please go and peddle your absurd fantasies somewhere else, because that is what they are

Surely the question has to be asked as to why these people need to earn half a million pounds per year which is over 1,398 pounds per day. What do they do with it? What do they spend it on? If they are so busy doing their vital work then obviously they have no time to spend it.

This is not envy on my part but looking at the sheer injustice subjected to others, on lower rates of pay, struggling to make ends meet. even though they may well work a lot more hours.

Come on Britain-fair shares for all.

This does of course throw up an interesting conundrum in the context of the implementation of higher tax rates (I would assume income tax and CGT) on the other side of the MMT equation to control inflation. (assuming we are not looking to implement this inflationary control via the more regressive taxes you identify, which would disproportionately punish the less well off).

The argument from the right is that higher tax rates will push the highest rate tax payers offshore. Whether this is a valid argument or not is open to debate, however if that did occur, surely the state’s ability to control inflation would be compromised ?

I imagine the only method to arrest this flight would be some form of legislation that either prohibited individual’s abilities to leave the country, or punitive charges if they chose to do so ?

The easiest solution by far is to eliminate allowances and reliefs at first and then equalise rates second

High rates as such are not required to achieve a lot of the goal

There are already quite tight tax laws on leaving the UK. I helped draft them….

The true story here is the widening inequality of income which means that 1% of people pay so much income tax *because they have so much income*. That despite the fact that many are paying the lower rates of tax on dividends compared to earned income, which also means no NICs. And many of those people will also have lower effective income tax rates due to reliefs they can claim, and significant capital gains taxed at even lower rates.

At the lower end, many people have been taken out of income tax in recent years now that the personal allowance has reached £12,500. We can argue about whether that is a good thing or not, but many of those will still be paying 12% NICs.

When you add NICs to income tax, the basic rate payable on earned income is really 32%, the higher rate is 42%, and the additional rate is 47%, (Plus the 13.8% employer payroll tax. Plus in many cases the 0.5% apprenticeship levy.)

In any event. income tax raises about a quarter of the UK’s tax revenues, so we have the 1% of people with the highest incomes paying a quarter of a quarter (or 6%) of the UK total tax revenues. Most of the other 94% is paid by other people, through VAT and NICs and council tax and all the other taxes.

Entirely agreed

And many of the power paid also pay student loans back, which is tax

That was your 500th comment here….

Why does not the Daily Mail take issue with the marginal rate of ‘tax’ on Universal Credit? For every pound earned over the threshold 65 pence is withdrawn from the benefit, surely a disincentive to work those extra hours to provide that ‘pathway out of poverty’, and a much higher marginal rate of tax than those on the highest incomes ever have to endure.

I think we all know why…..

They don’t care

501. On Universal Credit, as I understand it, the original proposal was for a much slower clawback rate, to make there was a stronger incentive to find work, but the Treasury insisted on a higher rate to reduce the financial impact. Penny wise and pound foolish.

The impact of pension allowance tapering for doctors is just as idiotic.

We know that overall the UK tax system is regressive, the richer you the lower you overall tax rate (as Andrew says income is 25% of the total). People on lower incomes are hit disproportionately harder by VAT, fuel and other duties, and property tax whereas people on higher income can exploit all the tax free allowances on pensions, property sales and capital gains.

The trouble is that it has been shown over and over that regressive taxation is bad for the economy overall and happens not because it is good but because the rich are able to buy power and thereby feather their own nests.

Agreed

I am distressed to learn that “a quarter of those in the top 1% (of income tax payers) in one year will not be there the next. After five years, only half will still be in the top 1%.” One wonders how these souls, cast adrift, are managing to deal with their loss. Or perhaps they have found ways of paying even less tax than they currently do?

This level of unfairness is appalling and a terrible indictment of political choices, made since at least Thatcher, and by parties of several colours, to swallow the “trickle down” economics mantra, the rising tide lifts all super-yachts. Your graph of the other day scotched this nonsense and showed quite clearly how those towards the top got richer while those below got poorer.

But how do we get back to those post-war days when “confiscatory” levels of taxation at the top dissuaded high earners from awarding themselves outsize pay increases, when the only 2 parties who are likely to form a government seem to think this level of inequality is just fine? When neither of them is interested in serious reform of taxation or the voting system which might bring in more radical voices?

Re the IFS, I note that they are asking for donations to support “Objective analysis of economic policy … [and] help us to improve public debate and government policy”. Well, they could start by getting up to speed with MMT and tax and stop making stupid statements like: “It is also a fact that this group (the 1%) is extremely important for the funding of our public services and welfare system, because it pays a large portion of our tax revenues.” As you point out, this is simply not true. Unfortunately, the IFS has oracle-like status and their cliches are lapped up by those on the right.

Thanks

Agreed re IFS

What is ignored when stating that 1% pay 27% of income tax is that those same 1% on HMRC figures enjoy 27% of total Income (for 2017 I believe). And since those are figures presumably declared on tax returns to HMRC then the 27% of income will not include anything ‘under the counter’ in a tax haven, etc. Or of course as Richard says anything that has been converted from Income to Capital. It is also worth noting that the same HMRC data shows that in 1977 the top 1% only had 7% of Income. So the poor hard done by over-taxed little darlings have seen their share of national income more than triple over a 40 year period.

‘UK increasingly reliant on super rich for tax income’

Oh dear, oh dear. Such lies………….

Shameful Richard.

Possibly indicative of how big the pie is at the top.

I thought I had heard some of these constructs before, and on re-reading Chapter 4 of The Joy of Tax, I realised I had indeed. Near the start of this, you quote from a paper published by the Institute of Economic Affairs in 2005 – “consent to taxation can only be obtained by the taxpayers casting one vote for every pound of tax they pay; you have more say, the more you pay.”

I thought neolib ideas were designed to take us back to Victorian times. I was wrong. Clearly it’s the Mediaeval Dark Ages they’re harking back to. The real Road to Serfdom is the one indicated on neoliberal GPSs, not the one to avoid.

You know it better than I do…

I’m glad that you have written this, Richard. You mention the Daily Mail but I heard, at some points word for word, this material on BBC Radio 5 Live. Income tax was described as the ‘main’ tax. The listeners were being asked ‘how they felt’ about such a situation. Just saying.

It’s 27% of all tax

So 6%, maybe, of all tax is paid by the top 1%

One of the problems we have is that outfits like the IFS have a faux veneer of impartial objectivity.

When this stuff gets into mainstream media it is designed/intended to look as if it is presenting ‘official’ information. I guess a straw poll of voters would show that a majority of voters think this is a government body which speaks with authority on the subjects it covers, not an independently privately funded right wing propaganda ‘think tank’.

[…] And that helps explain the growing concentration in tax paid by the very wealthy. […]