Tax Justice UK - which is affiliated to but not the same as the Tax Justice Network, and whose advisory board I sit - was featured on the BBC' Countryfile last night talking about the thorny subject of inheritance tax reliefs. Great work by them, I say. And this is their blog post on the issue. I won't paraphrase it:

Politicians are giving some of the wealthiest families in the UK generous tax breaks, money that cuts into the cash that could be spent on doctors or teachers.

Tax Justice UK's new research finds the government is handing out up to £666 million a year in inheritance tax reliefs on land and business property to families who are already well off.

​

Inheritance tax is unpopular, but most people don't own enough to pay it since every couple can pass on up to £950,000 of their wealth tax-free.

Our research shows that if you're very well off there are additional ways of cutting your bill.

​

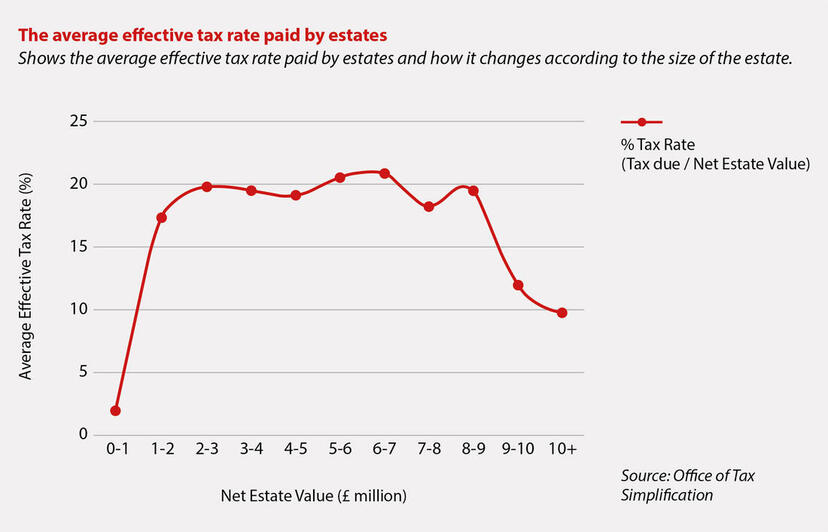

This graph taken from the Office for Tax Simplification gives a sense of how the effective inheritance tax rate goes down for the really wealthy.

Part of the reason the rate drops is the tax reliefs that are available. Agricultural property relief reduces inheritance tax at a rate of up to 100%, while business property relief reduces tax by between 50 and 100%.

The idea is to make it easier to keep farms and businesses in the family after death. On paper farmers and family businesses often look wealthy - they own lots of land or buildings - but might have limited amounts of cash to pay any inheritance tax. But these reliefs are expensive - costing a billion pounds a year.

So who's actually benefiting from this tax break? Tax Justice UK asked HMRC and what we found is deeply worrying. Up to £666m annually is going to already wealthy families. In 2015/16 - the latest years we have figures for - over 71% of the tax break went to families with farm and business property worth over £1m. At the very top, 51 well off families with business property assets shared roughly £6.4m each in tax breaks.

For more detail read our report: ‘In Stark Relief: how inheritance tax breaks favour the well off', which you can find here.

Beyond the fact that these reliefs give an unfair government subsidy to the already wealthy, this is driving up the price of farmland. Estate agents are marketing agricultural property as a tax efficient place to park money. Big money is buying up land, hoovering up farming subsidies and on top of that getting a massive tax break. This has a big impact for ordinary farmers who are struggling to buy farmland. Recent research from Guy Shrubsole has shown how deeply unequal land ownership is.

At the very least the government should cap the amount of relief that can be given out and a range of think tanks have suggested further reforms. Any reform should be part of a broader look at the subsidies and tax breaks that landowners get.

When it comes down to it politicians have to make choices about priorities. Choosing to give tax breaks to wealthy families, comes at the expense of longer wait times to see a GP or larger class sizes and less money to invest in the future of the country.

The UK's wealth is spread deeply unevenly, with knock on effects on people's life chances. Tax Justice UK's vision is for a society where there is sufficient investment in public services to pay for the roads, schools and public services we all use, and deserve. We believe this vision is shared by the majority of people in the UK and that delivery of such a vision will require boldness and a new approach. It will mean taxing many of us more and taxing the wealthiest the most.

This new report puts into stark relief the unfairness at the root of the UK's current system of inheritance tax reliefs and sets out steps the government could take to reform it.

Read the report here.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

People I talk to still think that the wealthy should keep their money because of ‘trickle down mythology’ (I will not use the word ‘theory’).

We still have a lot of work to do to convince people that tax is useful, especially as they are still paying it as our public services are ran down.

I understand from local lawyers where I work that a certain leading British inventor and businessman is buying up lots of land in Lincolnshire perhaps for this very reason.

He’s mentioned in Guy Shrubsole’s book ‘Who owns England ‘ which I’m currently reading and can thoroughly recommend.

Speaking as a small farmer who at first glance should benefit from having a chance to buy land at sensible price I also see problems that need thought through.

Progressive farmers who are running their farm as a business usually have a lot of debt in relation to the profits generated. Currently this debt is available at 2.5% – 4.0% for a lot of things because it is secured on land that is considered a stable and valuable asset. Making tax changes that drove down land prices would destroy many

farmers as collateral damage to getting more tax from the really rich. You need to be sure that the rich don’t just move their money somewhere else before doing this.

For example a common enough situation would be to take a 100 cow dairy farm who inherits land worth one million on paper has £500,000 of borrowings and makes £60,000 of profit before bank interest in an average year after working 80 hours a week. Currently he would be paying £15,000 interest and keeping £45,000 before tax to live on an reinvest in the farm. If land started falling in value due to tax changes etc and banks lost confidence and charged 8% instead he would now only have £20,000 before tax to live on and reinvest for 80 hours a week. It wouldn’t take much in this position to put that farmer out of business.

Interesting point – but in that case it implies that the land has already been paid for

So what is the borrowing for?

Get your stinking hands off our money. The idea of a death tax is abhorrent. If the government was more efficient we’d be far better off and wouldn’t need to tax people because they had had the misfortune of kicking the bucket.

Tell me what your problem with government is Bob

And why you think inequality is good