I am by nature an optimist. I temper this by never hoping for too much. But I undoubtedly live in hope. Until it comes to 2019, that is.

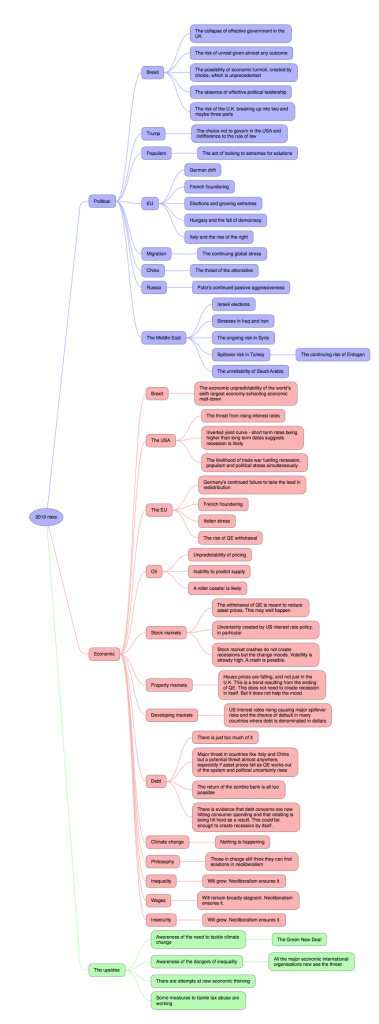

I promise, I tried to be upbeat when thinking about the coming year. There is a section for being so in the mind-map that follows. But I overwhelmingly failed. Of course, all predictions are wrong and my sense of foreboding may be misplaced. But I doubt it. 2019 is going to be horrid. Let's not pretend otherwise. This is why (click on the mind-map to open it in a separate page and then click it again for a large version):

For those who want the laid out version, this is it, but it's not as easy to read (in my opinion).

2019 risks

- Political

- Brexit

- The collapse of effective government in the UK

- The risk of unrest given almost any outcome

- The possibility of economic turmoil, created by choice, which is unprecedented

- The absence of effective political leadership

- The risk of the U.K. breaking up into two and maybe three parts

- Trump

- The choice not to govern in the USA and indifference to the rule of law

- Populism

- The act of looking to extremes for solutions

- EU

- German drift

- French floundering

- Elections and growing extremes

- Hungary and the fall of democracy

- Italy and the rise of the right

- Migration

- The continuing global stress

- China

- The threat of the alternative

- Russia

- Putin's continued passive aggressiveness

- The Middle East

- Israeli elections

- Stresses in Iraq and Iran

- The ongoing risk in Syria

- Spillover risk in Turkey

- The continuing risk of Erdogan

- The unreliability of Saudi Arabia

- Brexit

- Economic

- Brexit

- The economic unpredictability of the world's sixth largest economy schooling economic melt-down

- The USA

- The threat from rising interest rates

- Inverted yield curve - short term rates being higher than long term dates suggests recession is likely

- The likelihood of trade war fuelling recession, populism and political stress simultaneously

- The EU

- Germany's continued failure to take the lead in redistribution

- French floundering

- Italian stress

- The risk of QE withdrawal

- Oil

- Unpredictability of pricing

- Inability to predict supply

- A roller coaster is likely

- Stock markets

- The withdrawal of QE is meant to reduce asset prices. This may well happen.

- Uncertainty created by US interest rate policy, in particular

- Stock market crashes do not create recessions but the change moods. Volatility is already high. A crash is possible.

- Property markets

- House prices are falling, and not just in the U.K. This is a trend resulting from the ending of QE. This does not need to create recession in itself. But it does not help the mood.

- Developing markets

- US interest rates rising causing major spillover risks and the chance of default in many countries where debt is denominated in dollars

- Debt

- There is just too much of it

- Major threat in countries like Italy and China but a potential threat almost anywhere, especially if asset prices fall as QE works out of the system and political uncertainty rises

- The return of the zombie bank is all too possible

- There is evidence that debt concerns are now hitting consumer spending and that retailing is being hit hard as a result. This could be enough to create recession by itself.

- Climate change

- Nothing is happening

- Philosophy

- Those in charge still think they can find solutions in neoliberalism

- Inequality

- Will grow. Neoliberalism ensures it.

- Wages

- Will remain broadly stagnant. Neoliberalism ensures it.

- Insecurity

- Will grow. Neoliberalism ensures it.

- Brexit

- The upsides

- Awareness of the need to tackle climate change

- The Green New Deal

- Awareness of the dangers of inequality

- All the major economic international organisations now see the threat

- There are attempts at new economic thinking

- Some measures to tackle tax abuse are working

- Awareness of the need to tackle climate change

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Part of the French floundering, as you aptly describe it, has kicked off from Macron’s regressive shifts in tax policy such as cutting the wealth tax. I wondered whether Macron type tax “reforms” were influenced by Chamley-Judd type reasoning, giving a belief that cutting taxes on capital leads to more investment and so greater societal prosperity in the long run. I’ve been told (by non-economists) that essentially no real economists nor economic advisors believe the Chamley-Judd result that cutting taxes on capital leads to more investment. Do you have a view as to whether many economists accept the Chamley-Judd result?

It depends where you are on the spectrum

Neoliberals are utterly convinced

The evidence does not support it

Stone,

“a belief that cutting taxes on capital leads to more investment and so greater societal prosperity”

Is utter nonsense. The most recent and undeniable proof is in Trump’s corporate tax cuts being wasted in a binge on parasitic, cannibalistic, historically massive share buybacks.

https://www.washingtonpost.com/business/economy/beware-the-mother-of-all-credit-bubbles/2018/06/08/940f467c-69af-11e8-9e38-24e693b38637_story.html?utm_term=.6c053dbfb4a2

https://www.vox.com/policy-and-politics/2018/3/22/17144870/stock-buybacks-republican-tax-cuts

BTW, Richard,

I am surprised that didn’t appear in your list. I’d be less wary of the typical news bulletin concerns about ‘trade wars’ and ‘interest rates’ and perhaps consider why it is that relatively low and historically normal interest rates should be considered such a problem. The buyback bubble is the main game now as far as the US and global repercussions are concerned.

But, apart from all that – Happy New Year.

Marco Fante muses:

“……consider why it is that relatively low and historically normal interest rates should be considered such a problem. ”

Sclerotic thinking has to be the answer doesn’t it?

The traditional response to financial crisis, market crashes, recession etc…in its various guises has been to chop interest rates, and the orthodoxy says it has to be at least a three percent rate cut to be effective. There is absolute terror at the prospect of a negative headline rate so the target rate ‘has’ to be at least three percent, and preferably higher. The FED appears to be creating the very problem it intends to be able to ‘solve’.

No. Of course it doesn’t make sense, but when was that ever a consideration. (?) Or am I missing something ?

Difficult to disagree. Forewarned is forearmed. Nevertheless ….. https://www.youtube.com/watch?v=5Qk9o_ZeR7s 🙂

Take a bow Bing….

The list for the most part could have been written for 2018 and most people have worked hard, enjoyed the World Cup, enjoyed brilliant summer weather, enjoyed their holidays, evenings down the pub and currently enjoying Christmas..at the start of every year since I was born a grim picture would be painted. Faults exist though people by nature are stoic and optimistic and do their best to enjoy themselves. Life is too short to do anything different.

Complete nonsense

That was not the 2018 list, or anything like it

In reply to ‘Jim’s’ apparently complacent (or perhaps fatalistic) assertion that 2018 looked nearly as bad…. and that all years do, I think …

…..”Complete nonsense” is a little dismissive. Much of what you have on your list for 2019 was planted in 2018 and the years and decades preceding. (personally I don’t see a World Cup soccer contest as much of a compensatory blessing !!).

“That was not the 2018 list, or anything like it” Hmmm…. some of it was there. It’s just taking a long time to play out. And much of it is undoubtedly a year closer to some degree of resolution. Some of those resolutions will be very messy indeed. But I have some sympathy with the positive aspect of his comment that it is the little things in life which we can seize and enjoy that will as ever (we hope) keep us sane in a very crazy world.

Some of your 2019 list will still be waiting to bite us on the bum a year hence…..well I hope so or we’re going to have an extremely ‘interesting’ year with some massive casualties.

This morning I can see enough sky between the cloud cover to be starting a new year with a degree of optimism.

I intend to be assiduously gathering rosebuds while I may. Even if as last year they prove to be an endangered species in very short supply. 🙂

If I recall correctly, 1939 and 1949 were not very good either. As for 1959 we got Macmillan, oh dear. Then in 1979 Ms Margaret Roberts, or Mrs. Thatcher as we called her then in those primitive times. 1919 according to the history was one of major botches. And as for 1929………

Precisely…

2009 was not too hot either

[…] Richard Murphy has posted a rather gloomy blog entry, outlining many of the things going wrong in Europe and America. He points, among other things, to Brexit, populism, growing inequality and economic and political instability. 2019, he thinks, ‘is going to be horrid’. While I can’t gainsay any of the grim predictions he offers, I think there are other grounds for optimism, mainly from the developing world. […]

Awareness raising has long been a kick it into the long grass euphemism. That we have May following ‘Chapter Six Political Management’ (of Mein Kampf) without this being challenged in Parliament and media is a a sign of the times. We need to find a way to get constitutional control over what is now a very fixed elite and in a manner that doesn’t just produce another one. I think we have to confront the myths like democracy, education and a free press in order to get them working. Currently, our smugness in regard of these myths prevents us seeing what is really going on and the necessary fixes.

The universe and our planetary world part of it runs on the basis of information. Our problem as human beings lies in not sufficiently understanding this. So we recognise the benefits of price signals in markets but we don’t yet understand in sufficient numbers the control of capital by the few as information which is increasingly leading to undemocratic outcomes.

Interesting use of colour.

Blue, Red and Green.

The proportions are overly optimistic of the green sector.

I know that’s not what the brain map really shows, but it is a curious, and perhaps, telling coincidence.

Hard to disagree with your dismal prognosis.

…and a Happy New Year to you too !! I’m going back to Facebook to find some nice fluffy kitten videos. 🙁

🙂

Sorry PSR

Apology accepted.

I have about 6 rather meaty books to get through already this year so I think I’ll leave Andy to take the lion’s share of the smileys:

‘This Blessed Plot’ (1998) – Hugo Young (on this already – fascinating look at how the UK never really took the EU seriously from its conception).

‘Trade, Development & Foreign Debt’ (2009) – Michael Hudson

‘…and Forgive Them Their Debts’ (2018) – Michael Hudson

‘Building & Dwelling – Ethics for the City’ (2018) – Richard Sennett (about buildings and urban design – NOT The City – about my line of work really).

‘On The Political’ – (2005) Chantal Mouffe

‘The Politics of Financial Risk, Audit & Regulation’ (2018) – Atul Shah (now it is £15.00 and affordable).

There’s enough there to keep me occupied until maybe a better year (will it be 2020?) comes along.

Happy New Year all – including those I disagree with.

Happy new year PSR

PSR I commend your choice of reading during the coming year, particularly the two works by Michael Hudson. His … and Forgive Them Their Debts is a magnificent book. It will IMO be judged as one of the great classics in the tradition of Marxist scholarship.

Hudson theis takes us away from the simplicities of the earlier views of ancient societies as portrayed for example by Fredrick Engels in his Origin of the Family, Private Property and the State. … and Forgive Them Their Debts lays bare the dynamics of the political economy at play in Suma and Babylonian society many thousands of years ago. At that time, it was clearly understood that the creditor class (the 1%) unless kept in check would operate to the detriment of the general good. In those times the rival to the creditor class in their quest for money and power was the state represented by the king and or the temple. By the regular proclamations of Jubilee (debt forgiveness) the creditor class was prevented from getting too uppity by the simple act of taking away the bulk of their wealth.

In nineteenth century Britain John Snow by the application of the scientific method discovered that to eliminate the frequent outbreaks of the deadly cholera epidemics it was necessary to keep the pathogens of that disease out of the supply of the drinking water. A solution found in the better design of the national sewage and plumbing system.

In our 21st century when we implement the New Green deal and commit to spending the £billions necessary to repair the damage to our economy and society by misspent years of New Labour and Tory rule we will also need to keep the financial pathogens (the banksters) separate from the circular flow of money within our economy. A solution to be found in the better redesign of the information system at the heart of our democracy. And a Happy New Year to you and everyone also.

Thanks John

And thanks for the New Year reading list PSR – all noted. Perhaps you could provide us with summaries?!

A couple there on debt – can I add Adair Turner’s Between Debt and the Devil which I’ve just finished. He ends up arguing the case for state creation of money rather than banks. The case for QE perhaps, coming from a City ‘grandee’ – not quite what I’d expected but welcome.

I have my doubts on this – it is the ghastly Postive Money line

Robin

I’ll do my best – I am currently gearing up to run our annual rugby mini festival as a volunteer in April this year so please bear with me (hectic stuff). I’ve also still got very nasty cold which will not go away.

With a full time job to hold down, I certainly cannot match Richard’s prodigious output in the arena of socially progressive discourse. I gave that up a long time a go.

Happy New Year to PSR – Richard and family – and everyone else who reads this blog.

Thanks Jeni

And to you and everyone else

I don’t see the UK breaking up into two and maybe three parts as a bad thing. In fact, it’s a much needed thing. A long overdue thing. Here’s hoping.

And Elizabeth Warren has just announced her intention to run for the Presidency of the USA in 2020. So there’s a glimmer of hope.

However, can’t argue with any of the other stuff you mentioned. Aaargh. It’s going to be a rough year, and one that is likely to produce lasting consequences.

But anyway …Happy New Year (in the traditional sense) and thanks again for keeping us so well informed, Mr Murphy.

Thanks for providing the laid out version Richard, it may not be easy to read but it’s readable on my little machine.

It’s difficult after all that to wish everyone on the blog a Happy New Year, but still…if we all “cultivate our garden” a little more kindly, let’s make the most of it.

May good health&love be with you all.

Richard’s list is pretty agonistic. I’ll be leaving Mouffe aside on signal to noise ratio. Science already accepts ‘agonistics’ in the notion of co-evolution and non-commutative geometry. What we need to escape is rhetoric performed as communication of control or Sophist entertainment unlinked from free reality. Good luck in the New Year all.

archytas says:

” Good luck in the New Year all.”

I’ll hang on to that ….I understand that bit 🙂

‘Back at ye’, Archytas. (as I’ve learned to say this year). Good Luck may be the only thing that saves us all this year.

Well, last night we had some friends around and the husband just happens to be BREXITer but also a Daily Mail reader.

I ran the whole gamut last night of ‘Why do we tolerate Muslims?’ to ‘The public sector is too big’ and ‘We can’t tax the rich because they create wealth’ and ‘Human beings compete with each other all of the time’.

I took most of it patiently and good naturedly in my stride but every time I put forward an alternate view, he just brought something else up – changed the discussion (so effectively there was no discussion – just the opportunity for him to mouth off with what he saw as facts like ‘the highest employment levels ever’ without wishing to entertain in-work poverty).

This is a man by the way who works as part-time lorry driver whilst his wife has a highly paid job (£50K plus) earning below taxable pay. He spent a lot of money learning to be a pilot in the early 2000’s but then could not find the work that he spent so much money hoping to get.

Anyhow, he went off in huff and didn’t even wish me Happy New Year so somehow he didn’t feel that he had it all his own way. Not the best way to see out the year. I’ve suggested to my partner that next time they come around I will make myself scarce.

But there you go – such is England these days. Dearie me.

What was it you were saying about 2019 Richard?

Hmmm…………………………

🙂

@Pilgrim

“Not the best way to see out the year.”

Sounds perfect to me. Pissing-off a Brexiteer, Daily Mail reader. Two birds in one convenient package. And 2019 could be positively improved by not seeing him again. That would go some way to offset Murphy’s dismal prognostications for the year ahead. 🙂

And you won an eleventh hour smiley !!

10/10 for effort and keeping your cool though PSR. Its not easy.

Its the well educated and better off that I find the hardest. They do not have the excuse of being unaware of the consequences, though there’s none so blind…. And they will suffer the least. At least with those less well off who might legitimately see themselves as left behind, one can empathise with their frustrations and why they might have voted as they did. Even if that will probably make their situation worse

We’ll be talking about this for years I fear

Robin

So far in ‘This Blessed Plot’ , Hugo Young has enlightened me about the following (I’m now up to Chapter 4 and in the era of Harold MacMillan):

1. Churchill’s post war enthusiasm and support for a united Europe (he called upon Europe to do it) never saw the UK as part of it – it was something Churchill saw the sense of for the continent only. The Europeans misinterpreted this as the UK wanting to be part of it. This was never the case.

2. The UK at this time was losing its empire (Suez was the nail in the coffin apparently that we were now a smaller country), had huge financial pressures and were trying to form the Commonwealth as a means to clinging on to a ‘sterling zone’ to maintain the value of the pound given the debts it had accrued and loans it had taken out. So a European focus was not a priority. The UK wanted to be part of the bigger world – it wanted to ‘belong to everybody’ (the U.S. included) and this attitude went from the post war Labour government to the Tory governments of the 1950’s.

3. The lack of enthusiasm for a united Europe was certainly held amongst those in high office in Labour and Tory administrations, so the UK often sent lower officials to the early talks who were not empowered to do anything but pour cold water or ‘um and ah’ about the European idea not only because of not wanting to be involved but also growing fears that such a united Europe might deleteriously affect UK economic output and competitive capacity as the continent recovered from the war.

4. Interestingly, the officials who were sent over there as delegates (Ministers of State did not want to get involved – sending out a very negative message) increasingly were won over by the idea as well as grew personally more supportive of it – they took the French and Germans for example seriously. There were also members of the Civil Service who felt that we were making a big mistake. But this mixture of what might be called ‘the far sighted’ and ‘the converted’ were not being listened to in the 1950’s and early 1960’s by those who had the power.

5. The European attitude to the UK’s eventual putting its cards on the table NOT in favour of the proposals (something the UK (converted) officials involved were ordered to do by Ministers who never turned up) was one of dismay and frustration because they felt that the UK HAD to be involved – UK involvement gave the whole thing legitimacy as far as France was concerned. The Europeans took us really seriously but we had no intention at this time of getting involved.

Although angry, the Europeans pressed on because the devastation they had suffered (so misunderstood in the UK except by those few Brits who ventured over there in the immediate post war period) gave them no option but to avoid war happening again through the peace dividend of a united Europe. This pressing on (1) made post war UK even more unsettled and threatened as they expected the idea to fail and had indeed worked to undermine it but (2) also emboldened those in the UK who took the Euro zone seriously and whom would play a pivotal role in us getting involved later (but when the damage to our credibility was already done).

To be honest, this is really shameful, duplicitous behaviour towards people by the UK – some of whom we called ‘allies’. Young’s interviewees copiously record their regret even this early in the book and some claim that they were positive when at the time the official record shows that they stood in the way.

6. It is interesting to note that Young (talking about up to the end of 1964) is critical of the Tory administrations of this 50’s/60’s period who had under invested in industrial policy and had focussed on financial investment policy instead so that by this time UK manufacturing output had actually declined against rising output in both France and Germany rendering us somewhat vulnerable and making the decision not to join in even more salient.

From what I have read so far Robin and what we know as of 2019, we are looking at something that is approaching a tragedy of Greek – nay – Shakespearian proportions. It is a fantastic story that would be even better but for one thing: that it is true – near as dammit a well researched comprehensive historical record of what actually happened in our country’s early days of EU development.

It’s the best £4.52 I’ve ever spent!

I will try to talk about the next chapters in the same way I did this one if that is OK and I am writing at a heck of a pace so please forgive the bad English/typos.

Well Robin, his wife is a physicist educated at Exeter University whom I’ve heard say she resents her taxes being used to pay people for doing nothing and also believes in absolute competition.

It is her who is in the over £50K bracket and therefore insulates the Daily Mail Male that is her hubby.

We know another physicist educated at the same University who thought that as result of BREXIT, people should have an IQ test before they are allowed to vote (sod a decent education for all then?) !! He also insists that life is getting better for everyone in the Pinker mode (actually I fear that it is not – some are losing and others are gaining in the 99%. I would not call that progress. Why should some lose in order for others to gain? It’s just a redistribution of exiting wealth – not new wealth).

Thank you PSR – a gent and scholar as ever. Not a lot wrong with the English either!

Well worth the money by the sound of it. Im busy ploughing through papers on Universal Basic Services – combined with the Green New Deal, they might answer a lot of the questions often posed here. Just have to persuade a few political parties to buy into them – not inconceivable. If SNP, Greens, LibDems and much of Labour were on 80% the same page, what could be achieved…

Perhaps our current politics mirrors the current state of society – tribal and divided. So we have to find ways of tackling the unhelpful divisions in both. A Jo Cox strategy. Needs all hands to the pump. More players on the pitch and fewer spectators…

If only….

Pilgrim Slight Return says:

Re ‘This Blessed Plot’ ,

….” Churchill saw the sense of [a united Europe] for the continent only. The Europeans misinterpreted this as the UK wanting to be part of it. This was never the case.”

Typical of his class and arrogant demeanour. Happy to prescribe for others what he wouldn’t himself touch with a bargepole. Also classic hubris to assume that a united ‘rabble’ of mere Europeans could ever be Greater than his rapidly diminishing Britain. History would not be nearly so kind to Churchill had he not written it himself (as he wryly observed). And the national pomposity survives in Brexit ambitions firmly based on Churchillian fantasy.

“2. The UK at this time was losing its empire (Suez was the nail in the coffin apparently that we were now a smaller country),”

Hmmmm…..I suppose ‘nail’ …….but superfluous since the Empire coffin lid was firmly screwed by the fall of Singapore. No way was even Roosevelt going to give that back, let alone those who followed.

@PSR

My apologies for churlishly failing to compliment you on the precis.

Saves me £4.02 aswell. I can now contentedly wait for a copy in the local Sally Army shop for 50p. 🙂

Happy New Year to all. @PSR thanks for your comments on the State the other day, to which I was unable to reply. I don’t think we disagree on much, as most of what you say I am in agreement with – except about the State. Now, do I make a further point, perhaps about how the State is much more than the sum of the human life within it and becomes almost a kind of animate object itself or do I bite my tongue and have another glass of cava? On this day of goodwill, (being as I’m in sunny Spain) I think I’ll go for the cava, por favor.

Can I add a book to the reading list? “Against the Grain: A deep history of the earliest states” by James C Scott, political scientist and anthropologist in which he challenges the received wisdom of the standard civilisational narrative.

Graham Hewitt says:

” do I bite my tongue and have another glass of cava? On this day of goodwill, (being as I’m in sunny Spain) I think I’ll go for the cava, por favor.

Can I add a book to the reading list? “Against the Grain: [….at last ! a book about something interesting: grape alcohol 🙂 but my hopes were too quickly raised, only to be instantly dashed by the subtitle…] A deep history of the earliest states” 🙁

Thank you Mr Hewitt.

You are not ‘von Hayek in disguise’ obviously but I think that when we discuss such things it’s like walking along the edge of a razor these days and I just hate to think of people going down the libertarian route and falling for all their guff. It’s a quick descent into rampant individualism. Von Hayek’s dour and negative anti-Statism was apparently driven by what he saw in inter-war Germany and the rise of Fascism. And he failed to see how it was individualism and exceptionalism that actually can turn a state bad. Stupid man. He ought to be stripped of any Nobel prize in my view.

In the final analysis concerning the State or any other body or institution of it – it is how it is monitored – the checks and balances that exist. But monitored against what?

As regards merrie olde England – what is our state for? We need to nail that down as a bunch of humanistic principles (as part of a new constitution perhaps – Prof Murphy has discussed this at length and a certain Prof Spicker could also add more?) and then move onto making it happen and use institutions to stand guard over it.

And part of that institutional framework has to have the voter at the heart of it – helping to enforce ‘the deal’ between the State and the individual (who as many individuals living together form something called a ‘society’).

But let us not get too idealistic here.

Firstly – using the phrase ‘society’ does not ignore the fact that there are many different opinions and viewpoints about life. Society = Variety. We must not forget that because it negates proper politics which is always about compromise between factions/variety and should aim at win/wins (something I think modern politics fails at continuously as it seeks to destroy opposition).

Secondly – The State as a concept is not omnipotent, nor is it perfect – it is a vulnerable because it is made up of us – human beings. Individuals with agendas can and do get in and mess it up (as happened in my view with Thatcher from 1979) – change it and make it worse.

This is why we also need PR so desperately to get away from the orthodoxy that ruins so many lives.

So there you are Graham – some ideas to hopefully ease your mind.

First day not too bad. Happy New Year to Richard and all his merry band of contributors.

Just one resolution, which I’m about to start: get out and walk. Don’t expect to be turning the corner with the (current) PM, though. Rather head for the hills.

Two walks in to today already – the dog is looking more tired than me

I dog years he’s the older of us two now

My solution to the EU exit empass/division –

I propose the PR referendum..

To hold a new ballot but not a ‘this or that’ ballot but a here are the options A,B,C,D.. vote for your 1st 2nd 3rd.. choice referendum

This way no-one has to ‘nail their flag’ to only one choice..

all options could be debated and their nuances assessed.. the result would not be; just over half of you want this ‘will of the people’ nonsense..

but most of you seem to want this..

a truely European way of decision making..

and the result would then reflect all shades of the argument and the true will of the people

I wish Simon

I wish….

Have a good new year

Simon Atyeo says:

“My solution to the EU exit impass/division —”

May heaven preserve us through the decade that will take….to reach a decision that fails to match the fantasy desires of the majority of the electorate.

Brexit needs knocking on the head. It was an interesting excursion, now let’s stop it. Rescind article 50 and get on with our lives. If there was anything at all to be gained from Brexit it should have become apparent long before now.

A smiley!

Aaaah….thanx!!

Things have to get worse before they get better – the end of neo-liberalism ensures it.

[…] I have made clear, there are a great many reasons to be worried about the economy and related political issues in 2019. The sense that we are in limbo waiting for something to happen appears pervasive to me. The […]

[…] I have made clear, there are a great many reasons to be worried about the economy and related political issues in 2019. The sense that we are in limbo waiting for something to happen appears pervasive to me. The […]