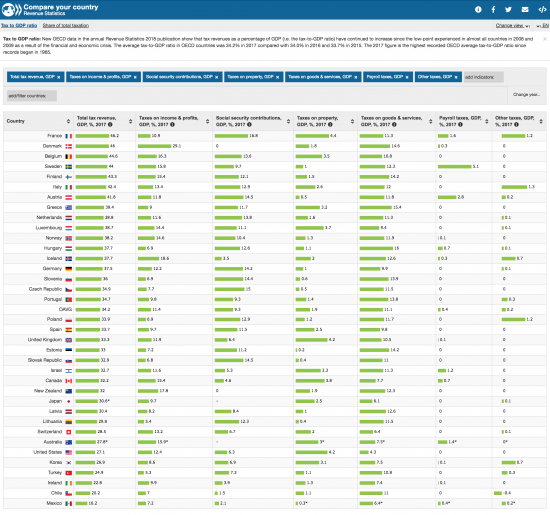

The OECD has just published new data on trends in tax revenues in 2017. This is how the countries stand (click for a larger image and then click the resulting image again to get full size):

The UK is much less lightly taxed than, say, Germany, the Netherlands and France.

As the OECD notes:

The OECD average tax-to-GDP ratio rose slightly in 2017, to 34.2%, compared to 34.0% in 2016. The OECD average is now higher than at any previous point, including its earlier peaks of 33.8% in 2000 and 33.6% in 2007.

An increase in tax-to-GDP levels was seen in 19 of the 34 OECD countries that provided preliminary data for 2017, while tax-to-GDP levels fell in the remaining 15 countries. Tax-to-GDP levels are now higher than their pre-crisis levels in 21 countries, and all but eight have experienced an increase in their tax-to-GDP ratio since 2009.

Worryingly, the trend is seen most markedly in indirect taxes, which tend to be most regressive and so unfair:

Consumption Tax Trends 2018 highlights that value-added tax (VAT) revenues continue to be the largest source of consumption tax revenues in the OECD, and have now reached an all-time high of 6.8% of GDP, representing 20.2% of total tax revenue, on average in 2016.

After experiencing an upward trend since the economic crisis, standard VAT rates stabilised at 19.3% on average in 2014 and have remained at this level since. Ten countries now have a standard VAT rate above 22%, against only four in 2008

The questions are obvious. The first is whether our light taxation is worth it: we are getting dire services and poor social protection as a result.

The second is whether there is anything like tax justice as yet: the tax burden is heavy on those least able to pay.

Third, the question has to be asked as to why such large disparities between states exist. That is an issue I will be returning to.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

If tax does not fund spending, then why do we get poor services as a result of having low taxes?

If we refuse to recover tax and want low inflation low services must follow

what do you mean “recover tax”?! if it is just removing excess liquidity to prevent inflation then would it not be “extracting” tax no?

why should every country be the same?!

I have explained this so many times on the blog so I will not do so again

Read The Joy of Tax

Search the purpose of taxation by me

Unlike the UK where it is funded by central government, most comparable European countries have universal healthcare systems funded by mandatory insurance contributions. It would be interesting to know if these contributions are included within “taxes” for the purposes of this analysis. If they are not, the difference between the UK and those comparator countries becomes even more stark.

They are not

Thanks for clarifying that Richard. Given your reply, the amount the UK spends on the NHS should be deducted from the numerator (the tax collected) in arriving at the percentage of GDP that is collected in tax. We would then be comparing like with like when viewing the UK alongside comparable European countries.

I don’t know the numbers but suspect this would move the UK from the “seems a bit low” category to the “sticks out like a sore thumb” category.

The OECD are getting a bit boring with their data. It’s the same year after year, and their researchers based in Paris on their tax-free salaries ( yes ) need to up their game if they are to be relevant and interesting on tax.

We’d like to know the tax tax burden on the bottom 10% of incomes in comparison to the top 10% in the countries they study.

We’d also like to know if they are studying the taxes which are genuinely regressive in their design, such as VED, television licence and in particular Council Tax in the UK. Are these regressive in design in other countries? We don’t know.

And how many people are being taken to court each year for unpaid taxes? In the UK it’s over a million a year and they are not the sort of people in the top half of the income distribution. Can the system be designed better to avoid this?

The OECD don’t tell you, because they don’t care about you and me. They just want to sit in their Paris offices with their subsidised transport to work, and tax-free salaries and milk their contributors.

I have to say I know their tax team

I don’t believe you

Have you seen their work on inequality?

The OECD has faults, for sure

But let’s no0t abuse some overall well motivated people we would find it very hard to do without

Think of the layers of bacteria on your teeth. The inner ones clinging to your enamel have no direct contact with the resources they feed on. The outer layer feed this in (are ‘taxed’). The inner ones can control this by withholding a vital protein only they make. MMT’s ‘discovery’ that spending is possible before tax comes in is less important than the control aspects of tax and redistribution in a complex and layered society in which money is linked to pernicious self-interest, which like bacteria can destroy (by pollution) the substrate necessary for life. The planet in our case. Social mice ‘kings’ tax by keeping most of the resources and others in poverty. Weak males can be taken out of this poverty and trained to beat the king. Sadly, this does not establish democratic paradise. Humans like to think we are very different, almost entirely on ignorance of biology. Even forests will protect their weak for eventual mutual benefit. I’d like to see a money-tax system argued in terms of a very different way of interdependent living and a shift to projects that bring their own ‘welfare’. Monetary policy and even redistributive taxes that remain just that – policy – are not enough. They need to be on Green Street.

A few weeks ago an article in the FT argued something like because we can’t raise the taxes to pay for the NHS (Care also comes up in this kind of argument, as do pensions – it’s the Tax and Spend syndrome) then we need to move towards a system such as operated by Japan or some of Europe (as mentioned above) where we take out insurance to pay for our health and/or care. What do you think?

How many times have I said to say this is absurd?

And inequitable

And a simple shifting of the tax burden onto those least able to pay?

The size of the UK’s tax take is sufficient to even out fluctuations in the business cycle (especially the business investment cycle, which is the most variable component of effective demand ) and to generate demand for the currency.

The other considerations are promoting social equity, fostering environmental sustainability, and achieving socially valuable policy goals.

Rather than rely heavily on taxation to even out pre-tax disparities in income and wealth, it would be much better to minimise inequality at its source: at the pre-tax stage.

Workplace relations policy, wage determination policy, industry policy, financial sector regulation (to reverse the financialization of the economy), housing policy (to eradicate tax advantages from investing in real estate), abolishing student debt, maximum income limits, and maximum net wealth limits are the key policy levers for minimising pre-tax inequality of income and wealth.

Japan has a lower tax take than the UK but Japan’s degree of inequality of income is as low as that of the Nordic countries (which along with France, Belgium, Italy, Austria, Greece, Luxembourg have the highest tax takes).

The difference?

Japan makes excellent use of policies that minimise pre-tax Income inequality.

It is better to prevent inequality from arising in the first place.

What is the point of permitting massive pre-tax inequality and then generating resentment by “taking” a very large share of what people think is rightfully theirs?

Agreed

Tax can only do so much

With money systems driving inequality we can see many people are held back in poverty. This extends to children failing to thrive in education due to malnourishment, despite (as far as we can tell) having the right pattern of genes for this kind of success. Tax and redistribution could do a lot to change this, and specifically spend more in the UK and hen tax appropriately. Pragmatically, I’m happy to leave this with Richard, if not for our woeful politics and ideology. Many of the ‘debates’ we have on nature-nurture are massively out of date, impacting into what we consider fair – crass notions of survival of the fittest and IQ are examples. Science has been a crass example of goon-biology itself, dominated by males. We should have seen as many women as men given equal ability across genders in the subjects we now know. Money-tax systems in abstract give too much opportunity for stress signals from poorer groups to be received in expert denial. The ‘logic’ of any systems viewpoint should be defeasible through such signalling. Ant algorithms, admittedly in our hands, can plot the complex flight path to Mars. Meanwhile, “we” can’t even accept signals from a UN rapporteur or good sense from a tax professor. if I was dealing with a eusocial insect community in this state, I’d be looking for a parasite influence (or trait groups of genes), if a herd farmer, lurking predators. The human element in abstract money-tax is still some sort of fictional only self-interested individual. Even monkeys and chimps will down tools when pay is inequitable (experiments with cucumber and grapes). Good sense proposals seem to me confronted with lack of reason like relishing women are weaker than men, chronic myths from economic homily like comparative advantage, over-individualism and secretism on privilege concealed by meritocracy. One obvious ‘block’ to a good sense money-tax system is it could produce (in current groaf-oaf economics) a whole planet of equality consuming like the USA – snagged by the need for 5 planets to do this on. Good sense money-tax thus needs good sense green. Good sense money-tax-green isn’t the end when one considers lack of real peace and understanding what science tells us of the human condition (e.g. know biology to prevent unconscious biological reductionism, know how not to be reductivist economists like Marx and neo-liberalists). Mostly, I believe there are no public arguments other than fine-tuning against money-tax-green. The problem is secret imperialism, prepared frames of ideology and what isn’t being said. The Tories are getting away with saying (effectively) “poverty jawbs are a way out of poverty”. Good grief!

” if I was dealing with a eusocial insect community in this state, I’d be looking for a parasite influence (or trait groups of genes), if a herd farmer, lurking predators.”

Indeed – and you wouldn’t need to look far to find them in humanity. For a start, see George Monbiot’s latest in today’s Guardian: https://www.theguardian.com/commentisfree/2018/dec/07/us-billionaires-hard-right-britain-spiked-magazine-charles-david-koch-foundation

Conspiracy theory? I don’t think so and find it very worrying.

And of course there are many others, if less extreme.

This is not a conspiracy theory

This a conspiracy