These are the slides for the talk I presented in Beirut this afternoon:

Locating tax risk - the way to tackle illicit financial flows

1 There are illicit financial flows

- This is a fact

- It's also true we will never stop them entirely

- This means everything we say today is about risk mitigation

2 The questions we need to address

- What are the risks?

- How do they arise?

- What can actually be done about them?

- Why is it worth tackling them?

- Why is it worth expending political capital on this?

- What are the tools we need to use?

3 What is tax for?

- It is assumed that pays for government expenditure.

- This is at best only partly true

- Government spending can also be funded by:

- Borrowing

- Aid

- Local currency creation

- So while may have an important role in the funding cycle of government that is not its only use

4 Tax has other uses:

- Creating macroeconomic control of an economy

- This is through fiscal macroeconomic management

- Underpinning the value of the local currency by requiring its use to settle tax liabilities

- Income and wealth redistribution

- Repricing market failure

- Incentivising socially beneficial activities

5 The Joy of Tax

- Put all these facts together and you have what I call The Joy of Tax

- Tax is the single most powerful peaceful instrument a government has to shape the society that it controls

- The challenge of illicit financial flows is that they undermine any government's chance of achieving that goal

- The big challenge of illicit financial flows is not then the money alone - however important that is

- The big challenge of illicit financial flows is that they challenge the ability of the state to deliver a whole range of policy options that it wants to create on behalf of those who live in the jurisdiction for which a government is responsible

6 How to tackle this?

- The choice to date has been to blame some now familiar villains

- Organised crime

- Those who are corrupt

- Multinational corporations

- Tax havens

- The response is

- Anti-money laundering measures

- OECD BEPS

- Country-by-country reporting

- Calls for unitary taxation

- Trust me, I buy them all

- But the time has come to go further

7 We need new tools to identify and tackle tax abuse

- There are two key new tools:

1.Measuring tax gaps

2.Undertake tax spillover assessments

- These require political will

- And they require funding - if necessary from the IOs to help achieve this — which is something I am explicitly calling for

8 The tax gap (1)

- The tax gap is a measure of the tax that could be but is not collected by a government

- All countries have a theoretical tax yield they could collect based on current GDP and law

- They don't get it because of the tax gap, which comes in five parts

1 The cost of tax bases not taxed, such as wealth (A)

2 The cost of tax allowances and reliefs a government grants (B)

- Take these two off the theoretical tax base calculated on GDP and you get the technical tax yield. Then deduct

3 Tax evasion (C)

4 Tax avoidance (D)

5 Tax bad debt (E)

- And you get to tax actually paid

9 The tax gap (2)

- The tax policy gap is

- Tax bases not taxed + tax reliefs given away

- = A + B

- The tax compliance gap is

- Tax evasion + tax avoidance + tax evasion

- = C + D + E

- The total tax gap is:

- Theoretical tax base based on GDP

- Take away A + B + C + D + E

- = Tax actually paid

- Every government had to know these figures, I suggest, or they're not in control of their economy

10 Tax spillovers

- Tax spillovers assess the likelihood that one part of a tax system causes harm to another part of a tax system, either domestically or internationally

- Tax spillovers happen domestically and internationally

- They involve all taxes, but especially direct ones

- And they involve the administration of tax as well as the taxes themselves

- The IMF has tried to appraise them quantitatively but this has proved to be very hard

- Professor Andrew Baker of Sheffield University and I now propose a qualitative measure

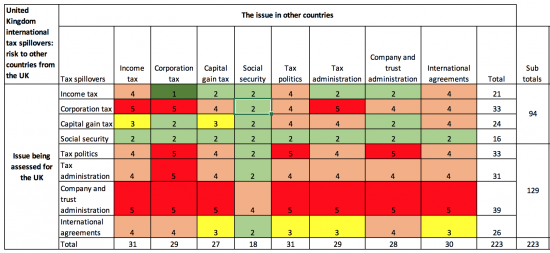

11 Qualitative tax spillovers - the assessment grid

12 Qualitative tax spillovers - the process

- Four domestic taxes and four tax admin systems are marked for the risk that they create domestically first and internationally second

- Then the domestic tax system is appraised for the risks imposed on it from elsewhere

- The higher the score the bigger the risk

- The colour coding simply helps identify the big risks — they are in red

- The process is designed to identify the biggest targets for reform

13 Qualitative tax spillovers —our suggestion

- It's our suggestion every country could and should do a qualitative tax spillover assessment

- Then they will know what reform is really needed

- And how effective it might really be

- This is the way for all countries — and not just OECD ones — to reclaim the agenda on this issue

- We think it's time to use a systematic tool for each country to create its own demands for reform

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

This is really straight-forward stuff – which I mean as a compliment. Too many have us “integrating the penguin” by line two! The framework is, of course, only simplexity after the hard work of putting it together. This leads me back to why good sense is being seriously resisted, especially as Gresham’s Law is a clear operator – letting the fraud in is a slippery slope mediating against honest finance and trade.

The problems come at the real-world dirty-hands level. We do monitor beyond what people declare with stuff like control theory models (both openly and secretly). Hard to say more – there was a view that making finance systems more honest would just lead to new gaming more difficult to spot. Most of academe operate ruthless exclusions to make their models work in peer review – and this is one reason they don’t transfer any further. We actually know a lot about the dirty old world, so it’s hard to see why we don’t see much attempt to model it. Truth to power is already mediated by the govern-mentality of knowing how quickly implementations that would make the system transparent are resignation letters. The standard attack is naivety – particularly galling. The existence of such as Richard’s scheme and failures to adopt good sense might tell us a lot about the real nature of political failure. Fingers-crossed for good outcomes here.

I am pleased to report real interest from several governments

Which may come to nothing, of course

I will go back to listen to my bees. They seem to develop conscious learning. I leave you with this hope on the international community!