Peter May has a fascinating post on the Progressive Pulse blog. As he notes:

It was almost a year ago that I originally wrote to my MP to ask him to enquire of the Chancellor ‘Where does money come from?'

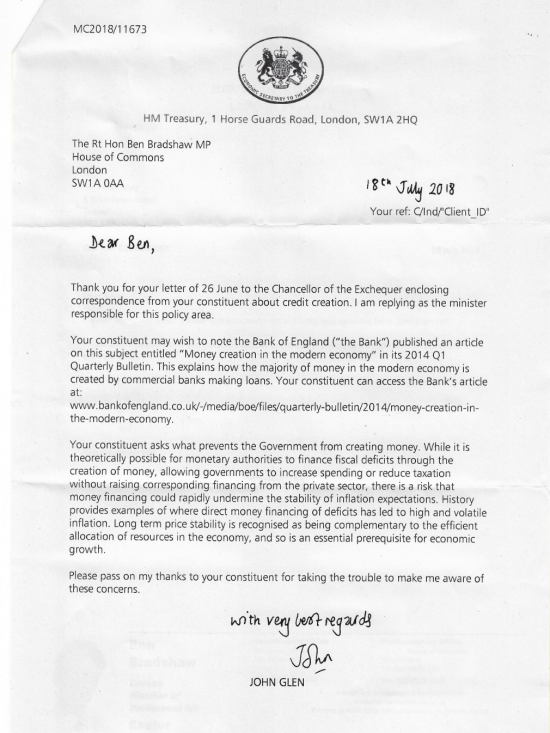

I have, at last, received a reply:

As Peter notes:

It reads rather as though the writer, John Glen, Economic Secretary to the Treasury, has received intensive training from the Ministry of Circumlocution. Or maybe that's just the way they teach them at Oxford.

So we get: ‘While it is theoretically possible for monetary authorities to finance fiscal deficits through the creation of money, allowing governments to increase spending or reduce taxation, without raising corresponding financing from the private sector, there is a risk that money financing could rapidly undermine the stability of inflation expectations.'

Which is just the old canard that printing money causes inflation.

More importantly, he adds:

But, interestingly, this is the sole argument against government money creation.

And when the letter continues: ‘the majority of money in the modern economy is created [my italics] by commercial banks.' it indicates that the rest of the money is created by the government itself, of course.

But what Peter notes is that:

So the Treasury knows there is a Magic Money Tree but through involuntary (or voluntary) intellectual blindness misunderstands the role of tax in preventing inflation.They have already admitted in this letter that tax is not required to pay for anything.

In fact, all that they have not noted is that the role of tax is to cancel the money the government has created, meaning that the tax yield and not the interest rate is now the primary tool for the control of inflation in the UK.

This is important. What we actually have here is, as Peter has noted, an admission that the government can create money at will. So the 'magic money tree' exists, as a matter of fact. But what we have not got is an admission on the role of tax in this equation.

What that suggests is that the role of tax in controlling inflation has to be the next argument brought to the Treasury's attention.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

But the letter still contains the seeds of doubt linking money creation with inflation so it will be waved by the MMT opponents as a cautionary letter. Battle not over.

But money creation does cause inflation without taxation

That’s what tax is for

“.. That’s what tax is for.. ”

Well, yes and no. The primary role of tax is to drive use and acceptance of the currency. Clearly tax can also be used to curb inflation, but MMT academics prefer to include tax as just one means of regulating the economy.

The Job Guarantee is likely the most important, since it..

1. acts as a price anchor for a key commodity in the economy – labour.

2. is an automatic counter cyclical fiscal measure

3. as 2., it is much faster acting than any ‘manual’ Functional Finance control mechanism. Whereby what it may lack in fiscal size, it likely more than makes up in its precision and timing of operation.

Richard, I tagged you a few days ago to read a piece by Warren Mosler and Mathew Forstater, don’t know if you noticed? If you haven’t read it, you and all other MMT advocates should do so and absorb its content. It’s probably the most important MMT piece I’ve read in 9yrs of studying and writing. (Or on macro economics generally.)

Warren and Mathew explain the money circuit and Gov’s role within it. Here’s the piece…

http://moslereconomics.com/mandatory-readings/a-general-analytical-framework-for-the-analysis-of-currencies-and-other-commodities/

I disagree with others in MMT on the issue of emphasis here

I also think the paper you note reflects thinking that may now be 20 years old and that has developed since then

But his letter remained vague on that point. Can you afford to send a free copy of The Joy of Tax to every Labour MP?

I wish….

Rod White says:

” Can you afford to send a free copy of The Joy of Tax to every Labour MP? ”

Fuck that for a game of soldiers. If they won’t pay for books they shouldn’t have allowed the closure of all the public libraries.

Richard,

That piece by Warren and Mathew states at the bottom that it was ‘updated’ just a few days ago. Also, the monetary system of US or UK has not changed in any significant way since it was written.

Warren is absolutely precise in the piece. As is Professor Forstater. Surely you have read enough of MMT by now to know that Warren has never been challenged on anything he has stated on the monetary system? Knowledge derived from first hand experience of operations, up to and including central bank and Treasury operations.

It’s how the money circuit works. That should be the basic knowledge foundation for all ‘macro’ economics. Any ‘macro’ discourse that cannot reference the money circuit operations and market functions is founded on nothing, and worth as much.

If you think it wrong somewhere, please cite it and quote it, and write a blog with your argument? I’m sure we can get Warren to respond?

You cited it to say I was wrong in tax

I think it does no such thing

In my opinion tax has the role I suggest for it as its primary function in MMT.

You can disagree but that’s just opinion. The article does not prove or disprove it.

Inlai atrongly recommend dropping the language you’re using. It’s aggressive and cult like. MMT very definitely does not need it and suffers from it already.

It’s why Bill Mitchell does it no favours. Stephanie Keaton succeeds by avoiding it. I suggest all MMT people follow her example.

The Conservative party prefers mass unemployment as their tool to tackle inflation rather than taxation.

How can a government determine when to stop printing money? Is it full employment or is it down to the inflation rate? Aren’t both of these indicators lagging so that any government which wishes to use MMT will invariably overshoot their economic targets?

It’s called judgement

That is what is always used

And sometimes they will get it wrong

But making an occasional misjudgement when using the right model is a lot better than making the misjudgement of using the wrong model

Jim

Making fiscal policy adjustments is an ‘iterative’ process, regardless of what method is used.

Right now, a largely fraudulent basis dominates macro policy thinking, not least the intellectual fraud of Gov faux ‘money’ constraints, need for ‘borrowing’, tax as ‘revenue’, And all the rest of the mainstream claptrap, much of which is ‘micro’ masquerading as ‘macro’.

It’s hard to see how even a poorly executed (politically butchered ?), but MMT informed, job of fiscal policy adjusting could do a worse job?

But as mentioned in my comment/reply above, the greatly enhanced automatic stabiliser and price anchor function of the Job Guarantee ‘buffer stock’ should not be underestimated, as a vast improvement over the present methodology (if it can even be dignified by such a term).

Let’s just remind ourselves that few, if any, economists dispute the reality that at least half of the real unemployment and under employment, in any country, is hidden by ‘official’ (narrow) measures of it.

That is a massive waste of real resources, and forgone real output, by any stretch of the imagination. Compounded, year on year. We’re into £100s of billions, in UK, just in the last decade. (Andrew Haldane at BoE made some effort to quantify it, and bring it to public attention. Naturally, the concept was ignored.)

Sure, a macro economy is inherently an unstable system, with lots of pro cyclical feed backs and few stabilising, negative, feed backs. But I don’t see how we could do a worse job if we tried.

I suppose conversations between Peter May and his MP, Ben Bradshaw, are private but wouldn’t it be interesting to know what the MP made of the correspondence?

Did he ask Peter what was the point of the question?

Did he spot the Magic Money Tree in the answer?

etc …

@George S Gordon

“Did he spot the Magic Money Tree in the answer?”

In fact he hasn’t personally engaged at all in my questions, but he professes not to be an expert in economics. Hope to attend a speech he’s due to give next month, when I shall try and tell him he doesn’t have to be!

Meanwhile I’m just grateful he’s been very dilligent in actually ensuring I got a reply in the end.

Indeed. Excellent work by Peter. The PM can no longer deny the existence of the magic money tree as that would contradict the Treasury Secretary.

I have no doubt that Treasury politicians understand money ‘creation’, they just do not believe that extra spending is going to produce the outcome they desire (namely enhancing the wealth of the already wealthy). But they need to be honest about this and not hide behind the ‘no money tree’ myth.

Agreed

The Biblical Text of Neoliberalism for public consumption, ‘Government is just like a Household’ has just been found out, even by the priesthood. I recommend everyone circulates the link to this letter to their MP, MSP etc.

I also wish to record my grateful thanks for this to Peter May especially, (and to Ben Bradshaw MP): spectacularly well done!

Thanks for this. There’s another neoliberal myth doing the rounds that the tax burden of central government is 34% of GDP, or some similar number. If spending money can be achieved without imposing costs, then it follows that the tax that is returned is without cost, so the tax burden is zero.

It’s a bit like a bicycle pump. I can design one for you with a pump volume anywhere between 20% and 60% of the overall volume of the tool, but the air itself that goes into it is cost free. Likewise taxation as a ratio of GDP is a meaningless concept when it imposes no burden or cost.

There is an exception for the description of how we finance local government through Council Tax and Business Rates ( 10% of GDP perhaps ) as they cannot create their only money, but the central government figure is just phooey.

Interesting idea

But you do ignore opportunity cost (and gain) of course

That is what we should be discussing

Once govt. start admitting taxation’s the key to flooding the country with necessary money without its being immediately precipitated into hyperinflation, it raises interest into and awareness of how those forced to pay taxes are having to do so to preserve the value of the currency for those who, having access to tax havens, don’t. Perhaps a better understanding of this might finally ignite the rage necessary to bring about the end of this situation. Little wonder then the Tories are so against education for the masses.

Agreed

My reading of the reply is this in plain English:

“Current thinking guiding the treasury is that the printing of real money by the elected Government would undermine the expected growth in profitable debt for the financial sector and the 1% who fund such lending and live off the returns”.

That’s how I bloody interpret it.

As for the tax issue, I find that it is people on fixed incomes who worry about inflation caused by MMT. If you mention tax, they will just worry that the tax on their income AND inflation will reduce the value of their pension income.

What can we say to allay their fears?

I’ll try to add that to my list

Thank you very much!

@PVSR I missed the chance to appreciate your comment the other day in response to my comment on “Fairness & Inequality”. Thanks, nicely put.

Another view why tax is an essential stabiliser to an economic cycle (circuit).

1) In electronics; sending some of the output signal of an amplifier to its input is essential to make the amplifier circuit function. Its called feedback control or stabilisation. https://www.allaboutcircuits.com/textbook/semiconductors/chpt-8/positive-feedback/

2) Feedback is essential for biology to function. “In essence, it is the control of a biological reaction by the end products of that reaction.”

https://www.britannica.com/science/feedback-biology

Abraham Lincoln understood that tax did not fund spending – “The government should create, issue and circulate all the currency and credit needed to satisfy the spending power of the government and the buying power of consumers.”

https://mikenormaneconomics.blogspot.com/2009/10/abe-lincolns-monetary-policy.html

@ Tony_B

Thanks for the links. You’re absolutely right, of course. Even if you over-simplify it down to Predation versus Anti-Predation for energy survival purposes it makes sense for human beings to recognise that for most ideological concepts in the areas of economics and monetary systems there will be a reaction, a feedback, which may have negative or positive consequences for survival. At this stage of human evolution there would appear to be an arrogant bluster factor operating that stops that recognition operating. It’s a bit like the collective “mobbing” activity birds engage in but pointless! Obviously it’s the fear of standing out from the crowd and a case where our ultra-social natures as species works against us.

I’m not sure whether this should be here, or with your earlier post – The Right Answer to “How are we going to pay for it.”

I was impressed with your patient reply to Snailmailman’s attempted insult, and this prompted me to think that this could be the basis of a simple explanation to people who do not understand that the nation is being fed a lie by this government about the need for austerity.

Using, mostly your words I took the liberty of rewriting your script to produce a one sheet explanation.

Remember, I am not an expert, being merely a retired agricultural engineer, who has a habit of seeing things in simple terms.

It seems to me that this could be the basis of the argument to change the narrative that the government is pumping out. I am sure there are experts who could improve on this , if thought worthwhile.

_______________________________________

HOW THE MONEY SYSTEM WORKS

Yes, there is a magic money tree, which the government has within its power to use

for the benefit of us all.

a) Money created by the government is not printed,

b) it is a promise to pay.

c) This requires someone to receive it.

d) That someone works in exchange for the money,

e) which adds value to the nation, (e.g. extra spending on the NHS)

f) and pays tax on the money earned,

g) whilst increasing their spending capacity,

h) which increases the income of others, so that

i) they pay more tax.

j) This proceeds until the multiiplier effect is delivered in full

k) quite possibly yielding 100% or more return to the government on the spending made.

l) This is how it works until we reach full capacity.

Are there any flaws in this thesis?

The simple answer is NO, because it is a statement of fact? We just need a government with a will to do it.

BUT, any problem caused by our government allowing companies to not pay tax by offshoring, could easily be fixed, if they had the will.

_______________________________________

It would be nice to think that every member of the Labour Party could see something like this.

I think it could be tidied further but that’s good

But I can still hear the question – but where is the money going to come from initially? People think that the government has to borrow it. The logic that exists at the moment has been planted by politicians like Thatcher & Reagan and even Obama that the government has no money of its own. With current logic humankind would not have even got started because there was no money to get them on their feet to go hunter-gathering. The enclosure acts have not helped by placing so much property in the hands of the few that everyone else thinks that they can only survive because those ‘that have’ are being generous by lending to the government. It’s a deep deep problem and I’ve failed to get the idea over to highly educated people.

I like David Lucas’s items a to l. But I am not sure how much

“b) it is a promise to pay.”

helps. Can we be more precise? Who promises to pay what to whom? As it stands I find “A money is a promise to pay” difficult to understand.

It’s a contract for value

One thing which seems obvious from all this is that in instances where a government can run a deficit without driving inflation (creating and spending more money than it receives in taxes to balance out) they are denying the public the benefit of huge amounts of free infrastructure and services. We know from QE that in the right economic conditions huge amounts of capital can be created with little to no impact on inflation. So why not have ‘green QE’ as a standing policy to the tune of whatever we can get away with without significant inflationary consequences?

I wish I knew the objection to that – barring the fact that the private ownes of capital want all the returns for which they are not willing to take risks

Not entering the Economic Secretary to the Treasury’s argument of course are that hyper-inflation of house prices since the early 1970’s should give cause for stopping commercial banks creating the nation’s money following the silly logic of his argument.

Secondly, he is oblivious to the central argument of Keynes’s 1936 “General Theory” book that the private sector rarely optimises demand and therefore employment in an economy because of the “uncertain risk” factor in investment.

Thirdly, he obviously doesn’t understand that a primary function of government is to ensure that the country’s payment settlement system functions smoothly and for that the government creates treasury securities from nothing. He probably doesn’t even understand that reserves are a special form of treasury security or bond. This vitally important information is readily available to the Economic Secretary to the Treasury for a very low cost. For example, Brian Romanchuk’s book “Understanding Government Finance.”

It beggars belief particularly in the context of the UK’s economic decline in comparison to Communist China’s rise (It passed the United States in purchasing parity power terms in 2014 to become the world’s largest economy) that people like John Glen don’t bother to be curious why this has happened. Obviously, like Soviet Russia, China in the immediate aftermath of its revolution shut down private sector commercial banks and discovered the economy could continue to function after a fashion purely on government created medium of exchange created from nothing. Naturally it very effectively used this knowledge and continued with government created money when it switched to free market capitalism. Not merely did it use this money creation power to build infrastructure to support its Industrial Revolution but provided direct government subsidy to its emerging industries including state enterprises through state bank loan write-offs and loan roll-overs. This clearly benefitted its export industries which have provided a vast number of jobs for Chinese people as agriculture became industrialised too. It even figured out that money has no inherent fixed value and that by forcing foreign currency exchange through state owned books it could A] stop foreign currency speculators in their tracks but B] adjust the national currency value to achieve price point in global markets.

With monetary illiterate individuals like John Glen in positions of power it’s easy to understand why the UK’s stagnated since the resignation of Hugh Dalton as Labour Party Chancellor in 1947. He did understand how modern fiat currencies work.

Well argued, but I still think Glen’s letter is usefully revealing.

Richard-I think the title of this post is a bit deceptive (but worthwhile using to attract attention!). There is no real admission that Taxes don’t fund Government spending, rather that the Government could just create the money without corresponding Tax credits and bond sales. So the letter is just the usual mainstream response with the usual monetarist guff about stability (as if we have stability!)

In fact, I think it is fair to say that MMT shows that the PRESENT set up is still money creation ex nihilo disguised by a circuitous accounting process. So the Government is creating money all the time when it spends.

As for the inflation argument, the risk of significant inflation must be pretty close to zero in an environment of massive household debt. People will want to pay off debts as a priority which cancels that money so you could pour billions in (in a very carefully targeted way of course!) with no inflation consequences I would suspect. Even if there was some inflation, that inflation could be more than compensated by reduced house prices and a host of other services that could reduce costs.

We know that private debt causes financial crashes and has manifestly done so over the last 100 years. John Glen is talking ideologically skewed nonsense when he talks of ‘efficient allocation of resources’, of course- a bank system that has blown a land and housing bubble for 40 years an ‘efficient allocation of resources’?

Has Bradshaw challenged the baked in ideology of that letter? I somehow doubt it!

Simon

See Peter May’ response re Bradshaw

And I think the letter more useful than you imply – even if a little reading between the lines is required

We make progress through such steps

Best

Richard

I do not argue with the relevance of the comments of Schofield and Cohen, but I do think their appreciation of what has just been conceded is somewhat ‘undercooked’. Success is not often marked by the conversion of opponents; it is realised almost unnoticed by grudging retreats, by smoke, mirrors, deflection, prevarication – and in the end the attempt to steal MMT’s clothes. It may yet happen.

Win the field; ‘triumphs’ ended with the fall of the Roman Empire. This applies ‘a fortiori’ to intellectual triumphs; the very, very best you can expect is silence.

That is my view

But John, I don’t think anything has been conceded that hasn’t been mentioned before and is out there in the public domain.

Greenspan admitted it: http://www.youtube.com/watch?v=jB0lcX-GtOU

Draghi admitted it: http://www.youtube.com/watch?v=_fF3pNTtmfc

This letter goes no further and then blathers on about standard neo-liberal ideology by saying that the main thing is inflation control when what he really means is unemployment and poor quality, insecure jobs act as a price control.

I don’t see any chinks in the neo-lib armour here. But it is valuable that M.P’s come across members of the public asking these questions and I think this will happen more and more, or at least I hope so.

Each admission is a decided chink

This is how change happens

I would say to Schofield and Cohen; contemplate what has been conceded. Then turn the screw on what hasn’t been conceded; because the Treasury has conceded a crucial point fundamentally at odds with Conservative neoliberal ideology. They are in no position to defend their economic case; now is the time to raise with them the issues you have identified, and roll them back, out of one indefensible redoubt into another, equally indefensible. Expose the wholesale contradictions which they have now invited. They can now be challenged on MMT’s ground, and with their primitive ideological baggage of snake-oil potions, they are ill-equipped for the task.

Agreed

@ John S Warren

“under-cooked” response hmmm…? Well before Mark Carney departs perhaps an “ever so subtle approach” could be organised to get him to concede in principle the government does have a Magic Money Tree. Then his successor could be asked to expand the 2014 First quarter Bulletin to include this fact and how exactly the government’s Magic Money Tree works in detail. Carney did make a concession of sorts to Caroline Lucas in 2014 on “money printing” so he has form for honesty:-

https://www.carolinelucas.com/latest/financial-times-mark-carney-boosts-green-investment-hopes

Perhaps Caroline Lucas could be persuaded to have another go.

I can ask her

I might have had something to do with the last request….

@ Richard Murphy

I suspected you might have been talking to Caroline. It’s clearly very obvious that the BoE’s 2014 Ist Quarter Bulletin is incomplete since it doesn’t cover government money creation (except if you’re exceedingly good at reading between the lines). It’s the least the nation deserves to have a complete and coherent model of how the nation creates its money. It can then fire on all cylinders for the first time after 1947 assuming also the “Zimbabwean” house price hyper-inflating bankers are put on a lead !

People have to stop thinking they have discovered a near nirvana. Anyone who has studied economics will knowva fiat currency backed Government can not default on its obligations and can creat money / print money at will. That is not the issue. The discussion is on the consequences of money creation, PQE or whatever term you want to wrap it in. The consequences are obviously inflation and FX, which to an extent feed in a loop. The discussion extends also to the amount of monetary control a Government should have, particularly in light of how power concentrates in the hands of a few through the parliamentary process. This is pertinent as I hear very few positive soundings for politicians on this board.

As it stands there is near zero trust to give the magic money tree in its entirity to a political entity.

What most of the posters on here are ultimately unhappy about is the control of the money supply is not entirely in the hands of the state and isn’t loosened sufficiently to hit full employment. So it is the role and size of the state, the trust we and the international community has in the state (as they will immediately inpact on the currency which may inflationary consequences) and how the state can control the labour market and productivity.

As I have already said you really believes and trusts politicians?

Nathan

So you do not believe in democracy. What do you believe in?

And you do not believe tax can control the money supply. Then what do you think can?

And you think a government aiming for full employment by growtyh in incvestment will suffer an FX crisis? Why?

And who is this ‘international Community’ that has no faith in democracy? Might you tell us who they are?

As it stands all you have said is utterly incoherent

Richard

So you do not believe in democracy. What do you believe in?

You spent a large proportion of your time being heavily critical of policy makers..do you want to empower them further? Yes or no?

And you do not believe tax can control the money supply. Then what do you think can? ….Tax is one of many levers controlling the money supply. I never suggested otherwise so why raise it?

And you think a government aiming for full employment by growtyh in incvestment will suffer an FX crisis?Why?… Why will international investors want to own a currency where the supply is mandated to open ended. I am afraid the FX markets will not view populist driven government expenditure as having the “multiplier effect” you desire. So the expectation of growth in the economy will not offset the increase in supply of Sterling vrs other currencies…you are on record as saving you expect a currency crisis if Labour were elected. So imagine Labour elected mandated to print and spend. ( it ain’t going to blow over in a few days)

And who is this ‘international Community’ that has no faith in democracy? Might you tell us who they are?..it isn’t having no faith in democracy it is a government with a populist driven agenda to print and spend. Who is the international community? We’ll multinational PLC concerned about “being crowded out”, concern as to property rights and increases in tax.. that’s for starters

As it stands all you have said is utterly incoherent

So you do not believe in democracy. What do you believe in?

And you do not believe tax can control the money supply. Then what do you think can?

And you think a government aiming for full employment by growtyh in incvestment will suffer an FX crisis? Why?

And who is this ‘international Community’ that has no faith in democracy? Might you tell us who they are?

As it stands all you have said is utterly incoherent..what I said wasn’t “utterly incoherent” as it raised perfectly sensible questions by your good self.,

I have posted this but have not got a clipyecwhat you are saying

I asked questions

It would appear you have no answers

I am nit surprised

Nathan you’re out of your depth.

Do some reading and thinking (you remember thinking ?)

In the meantime stop posting bullshit and wasting people’s time and temper.

Please.

“Anyone who has studied economics will knowva fiat currency backed Government can not default on its obligations and can creat money / print money at will”.

Notice that this is a bald assertion, with no credible source offered. Indeed it is remarkable how obvious this proposition is, when it is equally obvious that economics has been in denial about MMT for decades; and has offered precisely nothing (absolutely nothing) to challenge the neoliberal declamation that ‘Governments are just like households with regards to budgets’ hypothesis. It is the fundamental unchallenged authoritative fact about the economy delievered by Government day-in-day-out, for decades; and the discipline of economics, outside MMT has been silent. Where on earth have the keepers of the ‘obvious’ been? Certainly not doing usable economics; but let me guess; oh yes, peddling fractional reserve banking.

This kind of apologetics for failure reminds me of the list of those very few economists who forecast the Crash. It is very short, and is made up almost exclusively of MMT economists. According to mainstream economics there were none at all who forecast the Crash; but that is because they did not read or believe MMT, and that is because their monetary theory was fundamentally wrong, and their reliance on over-theorised microeconomics is deeply flawed and empirically unsustainable. All the neoliberals can do is go back to the drawing board; or better, just retire. Now, the list of those mainstream economists with 20/20 foresight is almost as long as the list of mainstream economists; it is far too long. It is absurd. Economic history is hastily being rewritten by failures. It doesn’t wash: this parrot is definitely dead, and – fortunately – beyond revival.

Something I have come across – from a somewhat different perspective to those normally mentioned here – is http://www.jdawiseman.com/papers/finmkts/UK_GBP_default_de_facto_impossible.html , which quotes, if not chapter and verse, Act and clause on how it may be done.

Thanks

@ Nathan

Your argument doesn’t make a great deal sense. Your argument appears to be money invented as a “caregiving claim” mechanism is much more volatile than nitroglycerine and neither government or the commercial banks should be allowed to use the mechanism and we should all revert to hunter-gatherer bartering. If you stood for election on that platform I don’t think you’d get many votes!

I think Nathan is just repeating the standard neoliberal/libertarian argument that politicians cannot be trusted and regulation cannot work. I think we need to tackle this argument. And we need to win this argument even more urgently than the one about taxes and money. In essence, the neoliberal/libertarian argument is anti-democratic and democracy is under attack from a lot of sides. So we also need to think about how to reform democracy. And looking at voting will not be enough. Also the way deliberation works needs to be reconsidered. And transparency and participation will play a major role.

@ Nathan

“As it stands there is near zero trust to give the magic money tree in its entirety to a political entity.”

If sufficient of the British public was monetary literate there’d also be zero trust in both politicians and bankers for “Zimbabwean” style hyper-inflation in UK house prices since the early 1970’s. So what’s your argument?

On the topic of inflation there was a comment from a financial analyst that low inflation over the past 30 years is completely due to the enlightened actions of central bankers and nothing to with the super abundance of commodities available.

The huge increases in M1 and M2 over the past 40 years demonstrate that MMT is no threat to inflation.

I am at a loss to understand why everyone is so keen to use the term “Magic Money Tree”. It is typical of the catch-phrase thinking of MMT’s opponents (a slick acronym and ‘put-down’ combined). The idea is devoid of content (the facts are of no interest to neoliberal propagandists), but the term “Magic Money Tree” has potent popular appeal; it produces all the right Pavlovian responses neoliberals want to induce in the public; and it costs them precisely nothing.

I understand the desire to return the favour in kind to neoliberals/Conservatives for using it, but the popular public connotation associated with the term “Magic Money Tree” is now set in stone. As Nathan’s frankly incomprehensible arguments above reveal (sorry Nathan, but there it is – and I don’t think I am alone), once ‘Magic Money Tree’ is the reference point, the real economic issue is completely irrelevant; what holds the public attention is the carefully programmed and invoked sense of irresponsibility which the term deliberately connotes. What neoliberals wish to achieve is a popular public connotation of ‘irresponsibility’ tightly conjoined with the term ‘MMT’. Populism of this kind is all neoliberals have as an argument, because their economic theory is exploded. This is classic Ministry of Disinformation propaganda. So why indulge it?

““Magic Money Tree” is a bit of British tabloid drivel that is not generally found in international discourse or the discourse of other nations.

Most cliches are temporary in nature and this one is often prone to backfire anyway. In future you will likely find find that is just another forgotten and dated meme.

I wouldn’t go beating it up into such a big problem if I were you.

I think you underestimate the power of imagery conjured by a well-honed phrase which finds resonance in the lives and minds of many. We need to “take back control” of the language.

Re the Magic Money Tree (Arbor pecunia magia) sometimes names intended to ridicule take on alife of their own.

Both Methodism and Quakerism started life derided and mocked by their names and rose above the name-calling.

The Magic Money Tree may do the same – a rose by any name….. (Taxation supplies the compost to keep it fed)

In similar vein the trickle-down counter policy of feeding cash into the bottom of the economy instead of confining it to the top end is called ‘Helicopter Money’ by its critics because it produces such a chaotic image of people scrabbling round the streets fighting over currency notes that it is difficult to take seriously…yet it is precisely what must happen if we are to fill the gaps between price and value in the asset markets without there being a catastrophic crash.

There will be a catastrophic crash. Again. it is only a matter of time.

We’ll probably call it an ‘overdue market correction’….a rose by any name.

“Magic Money Tree” is used in the UK with great popular political effect; that is why it was created and exploited (by professional propagandists), and so tenaciously exploited by Conservative politicians; who do so with deliberate purpose. The term works politically, and it has not been effectively challenged by mainstream economists. Your advice that it is “not generally found in international discourse or the discourse of other nations” is complacent and frankly misses the point. No doubt the same observation could be made, mutatis mutantis, about the Daily Mail. So should I rest easy in the knowledge that the Daily Mails’ influence on British political discourse doesn’t matter? I would not recommend such a loftily supercilious conclusion – if I were you.

Your remark is, perhaps a reminder why the political impact of MMT in Britain has been so limited. We are not good at disseminating the idea of MMT through the wider public. Our opponents deftly exploit the plausibility of a bad idea, and even manage to make it appear virtuous; with great economy of words and means. This requires imagination and ingenuity of a particular kind (the advertising industry and the intelligence services understand this well and value these skills highly). Where is our imagination and ingenuity?

One of the things I thought was interesting, to say the least, about the Bank’s reply was the word “theoretically”.

Because its use implies that the Bank currently doesn’t create money and that if it did, inflation would increase and worsen the economy.

How frightful. How untrue.

I didn’t see the original but interesting the letter begins with reference to “credit creation” rather than “money creation”, immediately suggesting that there must be borrowing involved.

Wonder how the BoE can create £127 billion through the TFS in such a short time, without impacting on inflation when the public is the ultimate borrower (and an actual borrower), yet a government can’t be a user of such funds because of inflation.

“the majority of money in the modern economy is created by commercial banks.”

I understand that commercial banks create money by credit. But in the end the money has to be paid back (even with interest). So in the longer run this should cancel out. Is it true then that the role of the commercial banks is not so much to create money, but to act as a flexible mechanism of fine tuning the current amount of money in circulation? Or is it possible for commercial banks to significantly increase the amount of money created over longer periods? Or does this require the central bank? How does the central bank interacts with the commercial banks?

I am rsonally think they fine tune within government set limits

@ Rob

True, I never mentioned credit creation as such.

That’s partly why I talked of the Ministry of Circumlocution – because I think there is a lot of technospeak, using words of four syllables where one would do and which Glen might perhaps be hoping will not be properly understood?

But I took ‘credit creation’ to mean that he was treating issuing money as in effect, issuing credit for future tax payment.