The Corporate Europe Observatory has published a new report today showing how the Big Four are embedded in EU policy-making on tax avoidance, and concludes that it is time to kick this industry out of EU anti-tax avoidance policy.

The full report is available here and the summary briefing is available in English, Deutsch, Español, and Français.

As it notes, EU policy towards corporate tax avoidance is informed by an advisory system littered with conflicts of interest. Despite all the evidence — from the various tax leaks, scandals, and parliamentary enquiries and reports — of the role the 'Big Four' global accountancy firms play in facilitating, encouraging, and profiting from corporate tax avoidance strategies, they continue to be treated in policy-making circles as neutral and legitimate partners.

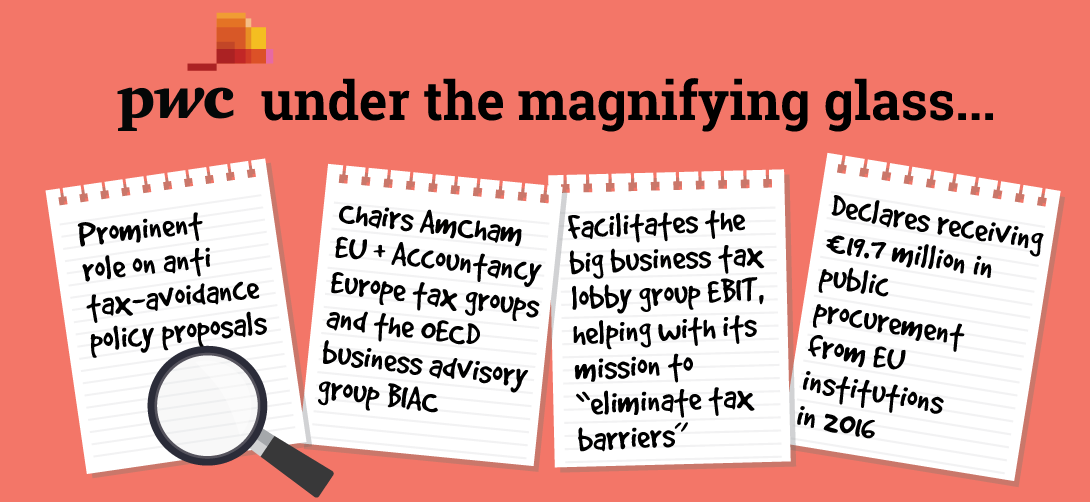

Advisory groups giving the Commission 'expert' opinions on its tax policy are populated by both corporate interests and members of the tax avoidance industry. At the same time the EU is paying millions for private ‘expertise' in the form of tax-related policy research from the Big Four. The tax avoidance industry, particularly the Big Four, also have ‘informal' channels of influence, using lobby vehicles like the European Business Initiative for Taxation, the European Contact Group, Accountancy Europe, and AmCham EU. And a normalised revolving door between the Big Four and EU institutions perpetuates a shared culture and ideology.

The lobbying and influence of tax intermediaries like the Big Four (and the multinational corporations they sell tax avoidance schemes to) is illustrated by two EU case studies: on new transparency rules for tax planning intermediaries, and on public country-by-country tax reporting, a proposal which is yet to be agreed by the EU institutions.

This report concludes that it is time to kick the Big Four and other players in the tax avoidance industry out of EU anti-tax avoidance policy. The starting point for this must be recognition of the conflict of interest in allowing tax intermediaries to advise on tackling tax avoidance. Only then can an effective framework emerge to ensure public-interest tax policy-making is protected from vested interests.

I have some considerable sympathy with the findings.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Excellent work – I knew that the Big 4 influenced policy but not how.

Personally I find this outrageous. It’s like letting the inmates set their own tariff AND run the prison.

PVSR says: Personally I find this outrageous. It’s like letting the inmates set their own tariff AND run the prison.

Me too. Surely there’s a complete conflict of interest here. How the hell have the big 4 been allowed to influence tax policy which they’ll then charge a fortune to sell on to clients to save an even bigger fortune whilst auditing their books at the same time? Nice work if you can get it.

Anyway, the main reason I’m replying to you is that I spent ages composing a very heartfelt reply on another thread to your good self (the VAT fraud one) only to find out the computer says no: Comments on this thread are now closed, or something.

Blimey, that happened quick! Still this is a fast-faced blog. I was contemplating trying to muscle in my previous reply to you on this thread but, try as I might, I can’t think of a relevant angle to include it. I’d probably be moderated otherwise. I’d moderate me for bare faced cheek if nothing else.

As I’ve never been moderated before (as the bishop said to the actress) I’ve settled for copying it instead and will try and include it in on a relevant thread later on. Serves me right for not being quicker off the mark.

I shut comments simply to keep the volume to a level I can manage

Sorry — it’s really annoying being human

Sandra Harvey says:

” How the hell have the big 4 been allowed to …..”

Well, obviously they are the experts in their field so the only people qualified to staff the regulatory authorities……

Sound familiar ?

We know there are considerable vested interests who will try to avoid this report.

Which parts of the EU might to promote this report and bring about change?

The parliament

And maybe DG Tax

This strikes me as a statement of the bleedin’ obvious. Without intending to be judgemental in any way, the Big4’s duty is to their clients and many of those clients engage in tax avoidance/planning (call it what you will but “ducking and diving” in plain English). It would be a dereliction of this duty if they were to assist tax policy makers in clamping down on such behaviour.

It also appears from this report that in some cases the Big4 are charging fees for the technical assistance they provide to tax policy makers. This is completely unacceptable. The Big4 should decline any such engagement on the grounds that they are conflicted.

If you took the Big Four out however would our poor civil servants cope? Especially, when they were looking for a new job with better pay and prospects.

If the EU need detailed tax advice who are they supposed to consult?

Tax authorities

Civil society

Other accountants

Taxpayers

given that “taxpayers” voted for brexit I’m not sure how valuable their input into tax laws might be !

Well, that’s very encouraging.

Somebody else has noticed, at last.

seems to be catching on:

http://www.abc.net.au/news/2018-07-12/richard-brooks-accountants-who-broke-capitalism/9971084