I noted yesterday that the suggestion that Google, Facebook and other tech companies should pay tax on their turnovers would give rise to all sorts of problems, almost certainly be regressive, and be a move in the wrong direction on corporation tax reform. I suggested an Alternative Minimum Corporation Tax as an alternative where, in effect, tax be charged at a reduced rate on the global weighted profits that would appear to arise in a country if the local tax paid appeared to be inappropriately small, probably because of the use of tax avoidance activities. Some people asked me for a worked example, so I have done one.

I have taken KPMG corporation tax rate data for 170 countries. I have added population data from the IMF. The IMF did not have population data for some tax havens. I allocated them 100,000 each. I found population data for Syria and The West Bank from the CIA Fact Book (a reliable source) as the IMF did not have it. The result was population data for 96.7% of the world. Notable countries omitted from the sample were Iran, Haiti, Cuba, Puerto Rico, Kosovo, Laos, North Korea, Lesotho, Mali and Nepal. I checked GDP for the sample using IMF data and the states surveyed cover at least 98.5% of world GDP. I think we can call it comprehensive. I then weighted the tax rates for each jurisdiction by the proportion of world population that lived in the place to calculate a weighted average tax rate. The result is here: world CT rates.

The average corporation tax rate on that basis is 28.247%. I suggested a country use 80% of that for its AMCT but that would clearly be inappropriate in the case of the UK: you cannot have an anti-avoidance measure charged at more than you headline rate. So I suggest instead that 80% of that average rate or the headline rate be used. In the UK that would mean an AMCT rate of 15.2%.

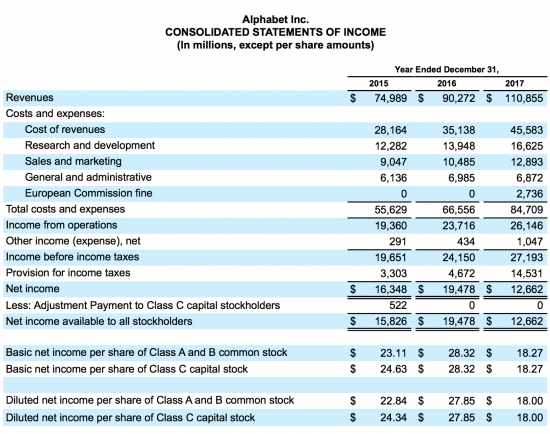

Now let's look at Google, or rather, it's parent company Alphabet. The Alphabet income statement looks like this:

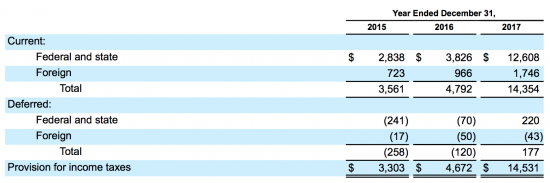

The tax note says:

The last data we have on geographic split of revenues comes from 2016 and was as follows:

In other words, in that year 8.64% of revenue was in the UK. I am assuming that remained true in 2017 when no data is available.

Google had 80,110 employees worldwide in 2017, and increase from 72,053 the year before. It had 2,943 in the UK in 2016. About 4.08% of staff are in the UK in that case.

So, using an average weighting for UK activity for Google of 6.36% (8.64 plus 4.08, then divided by 2) we would expect $1,536 million of income to be declared in the UK in 2016 and $1,729 million in 2017. That's, at average exchange rates, about £1,347 million in 2017 and £1,116 in 2016.

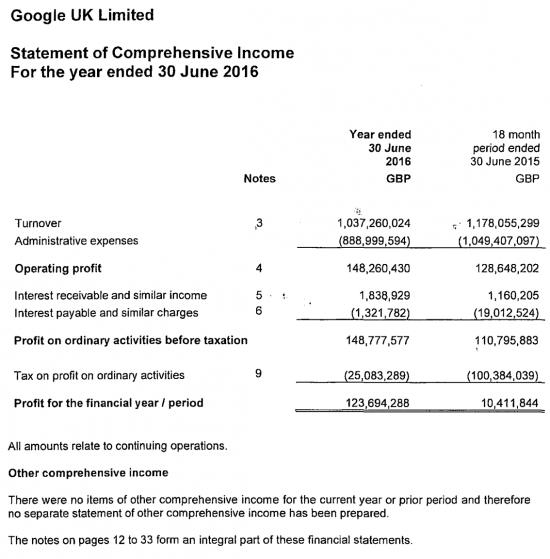

Now let's look at Google UK (it only has one such company, which does make life easier. The last accounts are to June 2016, which is inconvenient as they are out of date and for non-matching periods. We will have to assume they cover 2016. Its income statement is like this:

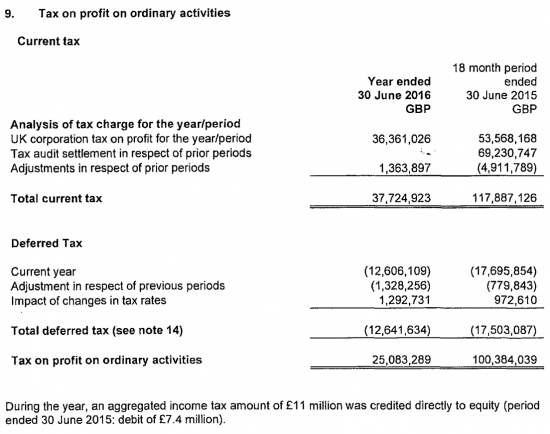

It's declared profit was £149 million. It's tax charge was explained like this:

I will use the current tax figure of £37.7 million.

At a rate of 15.2% on likely UK attributable profits of £1,116 million (which are low, because I have included a labour as well as turnover factor in the calculation) the expected tax would have been £169.6 million on this basis.

That sum less the £37.7 million paid, or a net figure of £131.9 million, would, I suggest, have been its Alternative Minimum Corporation Tax charge.

The calculation is rational, clear, on profits, wholly based on data, and is clearly intended to ensure that tax avoidance is defeated: avoidance that meant that declared UK turnover was some £4.6 billion less than expected.

I suggest that this is the right direction of travel for dealing with this issue.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I’m sorry but what you are suggesting makes no sense.

Google UK made a pre-tax profit of 149m but you are suggesting they pay 132m of tax. Basically all of their profits. Who is going to ever st up a subsidiary or business in the UK if it is going to have nearly all of the profits taxed away to zero?

And of course your analysis of “expected” income from the UK for Google is horribly simplistic. You can’t just assume that it is a proportional share based on turnover and the number of employees. Different employees in different places do different things and the revenue generated from activities in a country might have nothing to do with the number of employees there.

You can’t even use your “average” corporation tax rates. It makes simply no sense. For most companies in the world they simply don’t do business globally, and ceertainly not in all of the 170 countries you used. So why do tax rates in those countries have anything, or should they have anything to do with what tax is charged in any other country?

For example, a car manufacturer will produce its cars in a country, which costs a lot of money to do. It will export it’s cars all over the world and book profits in those other countries. What you are essentially saying is that you can’t net off the cost of producing the car against the overseas sales – the only thing that matter is revenue in a country and the number of staff. Which is ridiculous.

Your analysis is so oversimplified it wouldn’t stand up in the real world.

You rate ignoring the simple fact that the accounts are wrong

And in the real world people known that

And that’s precisely to tackle the issues you note – that profit cannot easily be attributed to a place so it is better to use a formula apportionment instead

I gave you sources

The next time you say what I write is nonsense when it reflects well established principles I will not be bothering to explain

Are you seriously saying that the accounts are wrong? At which point you are alleging fraud on the part of Google and it’s auditors?

And if so, what evidence do you have for it? I mean real, hard evidence rather than just claiming it because it suits your argument?

Isn’t it more likely that Google – an American Internet company – do a lot of their “production” work in the US where they are based, which means that costs of production are in the US but revenues for a lot of that work will show up outside the US. In fact, just like the car company example I gave you.

Are you seriously suggesting that companies shouldn’t be able to offset cost of production in one place against the sales in another? Because as it is you have described here a tax based on turnover – so revenue, not profits.

And are you also suggesting that doing a basic arithmetic apportionment of a companies taxes across its different geogrpahical locations is somehow going to be more accurate than the accounts of it and it’s subsidiaries?

I also note that after spending ages working out your AMCT of 28.247% you don’t actually use it for your calculation of Google UK’s supposed tax bill. Probably because it would give you the crazy answer of 252m – even at 80% of your AMCT. Which is of course DOUBLE Google UKs profits.

Of course, you have made the incredibly basic mistake of equating revenues with profits (to get to your lunatic figure of 132m), and then compounded it by claiming that a simple apportionment based on geogrpahical location can somehow capture a much more complex situtation in real life.

I am saying the accounts do not reflect economic reality

I have said so for years.

They don’t

Which is a widely acknowledged fact.

If you say accounts don’t reflect reality, do you think that your basic arithmetic approach, using only turnover and number of employees, will be more or less accurate?

Yes

You can’t make money without people and sales

They indicate economic reality

Is it perfect? No

Is it better than anything else? Yes

If you don’t agree suggest something better

I am all ears

Richard

“I suggested a country use 80% of that for its AMCT but that would clearly be inappropriate in the case of the UK:”

So you suggest a simple formulaic system and then whenever it produces a result you don’t like, you just ignore it. Hilarious.

And there isn’t a single low rate tax country that would cooperate. Why would they? They attract jobs with low tax rates, as is their sovereign democratic right. Why would they want this ruined by having to charge taxes they don’t want to charge?

As others have said it is a totally unworkable fantasy. That you are wasting your time on it suggests you have too much time on your hands or are becoming delusional.

What next? If you say you’d like to teach the world to sing in perfect harmony it’s ok as an advert but ridiculous as a suggested policy to create world peace.

I confess I was surprised the weighted average was so high, so I suggested an amendment

What do you do when you’re surprised by facts during a design phase of an idea? Carry on regardless? Why would you do that?

I have a very strong suspicion that something like AMCT will happen. I remember being told country by country was hopeless too. Now it’s the law in many countries. Your futile words fit a hopeless pattern of objection I have learned to ignore.

It’s a bleak world you inhabit, Shane Longe, where what we have is as good as it gets and there is no room for improvement.

I think I’d have to lie down and die.

That’s all very nice. But for Google and Facebook (less so Amazon and Apple) what is stopping them not only “moving” the “place of contract” to Ireland, but the “customer” itself, e.g. not selling its ads to UK (or German, France) businesses, but to their Irish subsidiaries etc? What if they would push them into buying via their US HQ, with US tax rate falling below most european rares, while still showing the ads to their European users?

We wouldn’t be able to use accounting at all anymore. We would need to force them to show us where their ads are displayed. And I’m m afraid this will be seen as “trade secret” in many countries. Also, there is no real possibility to double check, because ads in English would be understood in many countries, even French and German can’t be assumed to be only used in France and Germany… The only solution would be complete surveillance if data flows, which is not what any reasonable person would want to see either.

You are ignoring the concept of permanent establishment (PE) for taxation. This is a complex area, especially for what are in effect digital companies. But in effect it says that if an activity is managed in a territory then even if it is owned elsewhere it is taxable in the territory on the profits arising there.

Google et al have to sell. They do not do all of this on line: they have significant numbers of people doing so on the ground. The whole argument is about whether or not these people are the PE for tax.

I think they are: selling ads is the whole raison d’etre of these companies. They make value no other way. Their IT is useless without sales and valueless without them. So the sale is all that matters. I accept a fee for back office services – to the place where they really occur – is fair. But the argument is that the destination of the sale is key here. And I would contend – as do many – that tax law needs to reinforce this.

That is the direction of travel around the world. Until it happens what I propose is an interim step.

I agree with most of what you. And I wasn’t ignoring PE. But what would you suggest if Google started selling ads only to VW USA anymore, telling VW Germany they won’t sell them any ads. The ads would still show to people browsing internet from Germany, in German.

It would be a heck of troubles for authorities across Europe to show any activity from the local Google offices if it simply is not happening. Still the reason for the ads revenues would be German customers. But no cash transaction would happen at all in Europe.

Google won’t do that

Not if they want to make money

Listen to Warren Buffet: no one declines a profit opportunity for tax

When Google dictates the terms if is dead in the market

Maybe, of course, that would be a good thing

Let me add that even “virtual” PE definition by itself would help. What could work would be to define “ads shown to users in country A” as “sales destination: country A”. However right now it seems to me, that ads sold by Google USA to VW USA, are seen as sales inside USA, even if the ads are actually being displayed all over the world. So we would actually need a redefinition of “sales by destination” for ads. But this would still leave open the question of control, without putting everyone’s internet activity under constant surveillance (like the Chinese do).

And I know this suggest Google being able to force industrial giants into this, but I think in many countries they have got this market power.

But that’s easy: first VWs in the US are not the same as Europe or elsewhere

Nor, usually, us the marketing material

And Google knows where the end users are and targets accordingly

Now it could try to deny it makes sales and should pay tax

But at that point I think a crime could be created and a block on it imposed

No company should ever be above the law

And to add: I don’t think it is a widely acknowledged fact that accounts don’t reflect reality. You just made that up and have nothing to back it up with. You are claiming that thousands of companies, accountants and auditors are lying, and therefore committing fraud when doing so.

The whole Organisation for Economic Cooperation and Development Base Erosion and Profits Shifting process is based on that premise

If you want to engage in debate please recognise what is happening in the world

Like it or not, I do know something about this

The country-by-country reporting requirement of BEPS was, after all, designed by me

And it’s law in a great many countries now

So please talk sense or I will be hitting the delete button very soon

“And it’s law in a great many countries now”

Can you give a list?

Click on the BEPS tab here

http://www.oecd.org/tax/international-tax-co-operation-map.htm

That looks like most of the world

Richard

The Google figures shown at the top of this thread show up various phenomena, none of which should make comfortable reading for Rosemary, because they simply don’t fit her worldview.

In the first instance, the tax disclosures from the consolidated accounts demonstrate a pattern which I have long recognised in American MNCs – that if they have to pay tax, they prefer to pay it to Uncle Sam and not to the taxation authorities of other countries, however “friendly” those countries might be. The 2016 accounts show less than 50% of turnover arising in the US, yet only a fifth of the tax bill is paid abroad. The 2017 picture is probably even more stark. And before anybody jumps down my throat and accuses me of confusing turnover and profitability, let me assure you I’m not. Are Google’s US activities really exponentially more profitable than those it undertakes elsewhere around the globe?

The next point is the most significant one for the UK. Unless there is either a UK PE of another Google company or the mother of all spikes in UK business in the second half of 2016, the accounts of the UK company reflect less than a quarter of the turnover Google has told its shareholders gets generated in the UK. That is worthy of comment. Bear in mind that Google is probably more concerned by the SEC than by HMRC, so there is every reason to think the consolidated accounts figure is accurate. And if less than a quarter of the turnover is being offered up to HMRC, it isn’t a huge jump to wonder how much of the profits actually earned here are through the UK company’s accounts.

The other point which jumps out at me about the UK accounts is the accounting date. Not only is it as far removed from the US parent’s accounting date as it possibly could be, but it has been changed to that date when it previously aligned with the parent’s accounting date. That is an odd thing to have done.

Thanks

All agreed

Rosemary, it’s a widely accepted fact in the UK tax industry in which I have worked for over 30 years that accounts of European subs of American and Japanese MNCs do not reflect economic reality. They are manipulated in order to reduce European tax exposures and Richard is completely correct on this. You won’t find big 4 audit firms talking about it

as they receive massive fees from advising on the best ways to achieve this “tax minimisation”.

Another point that Richard hasn’t mentioned is that Luxembourg, the richest country in the EU, when under the premiership of Carl Juncker, current head of the EU commission, happily facilitated the tax rape of other European tax jurisdictions like UK, by enabling this manipulation for US companies through Luxembourg.