As I have already noted this morning, rumours are circulating that Philip Hammond is considering a stamp duty cut for first time buyers of houses to ease the pressure on this not yet on the property ladder and increase the appeal of the Conservative Party to younger voters. In my opinion such cuts do not work.

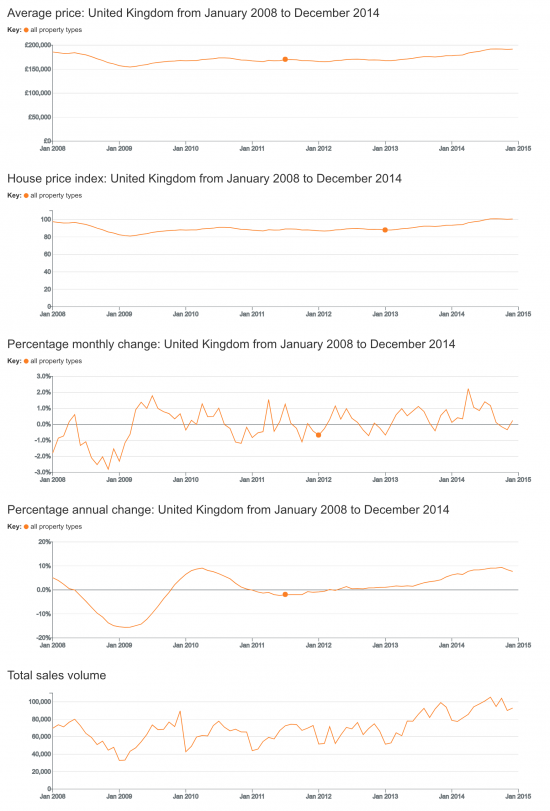

As evidence, take the cut introduced by Alistair Darling in the last Labour budget in March 2010. This reduced the stamp duty threshold for first-time buyers to stimulate demand. For first-time buyers only, the stamp duty rate was 0% for properties up to a value of £250,000 with all other bands and rates staying the same. The impact on prices can be plotted suing the government's own house price index:

Can you spot the impact? I suspect not, because there is almost none. Except, that is, when the deadline for withdrawal of the relief in March 2012 came along, when the ONS note this:

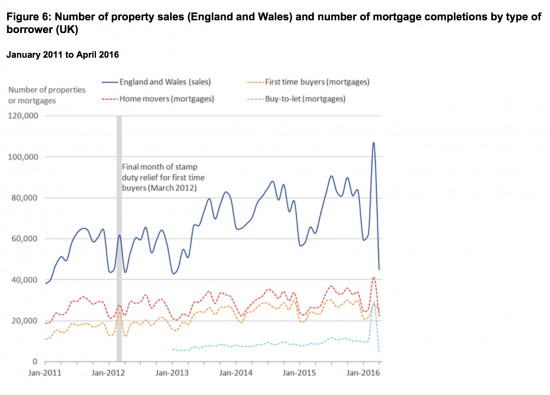

In March 2012 there was a flurry of activity to beat the new rate, followed by a lull in April 2013 and then what looks like a return to normal. In March 2016 the introduction of a rate hike - this time for buy-to-let purchasers - also induced a volume peak followed by a lull. But then things went largely back to normal.

To be clear, the house price index in March 2010 was according to the government 88.05. And in March 2012 it was 87.04, and the month after was 88.04. In other words, the stamp duty rebate, provided at a cost of £550 million, (page 120) achieved nothing in making houses more affordable. What it may have done is kept house prices up when the market would otherwise have let them fall. And the evidence is clear. Sales volumes were hardly impacted. Price changes wobbled around a norm as they always do. And overall prices were unchanged. As interventions go it was spectacular in its wastefulness.

Could that sum be better spent when it comes to housing? Most definitely.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

This is quite simply nothing but a misallocation of resources due to ideology.

It is designed to make the Tories look as though they care.

And some will buy it.

what is your proposal re housing? People’s QE Bond to then fund local governments to build?

Local bonds backed by PQE if required

But I prefer the idea that pension funds be incentivised to buy them

As a possibly at some point in the future to be first time buyer. It seems to me stamp duty will be a completely marginal consideration as to whether I am able to buy a house or not. That is to say it will only affect the timing of any purchase (ie. I might have to save for longer) But it is not going to affect whether I wish to buy a house or not.

However it seems clear to me that stamp duty is a very political issue for property owners, particularly two groups:

1) Buy to let investors 2) Parents who provide a large cash sum for children to help them buy a house.

For these groups, stamp duty rates are much more material and are seen in terms of the lump sum that they lose out on/have to fork out as a result of their investing/gifting.

So although it won’t benefit first time buyers, it will appeal to some of the groups that the tories traditionally have tried to appeal too (middle class investor-homeowners ).

And so in political reality it is not actually going to appeal to ‘young people’ as really all it will do is appeal to wealthy people in the older generation.

And in economic reality it will exacerbate the divide between those who can rely on parents to help fund first time purchases and those that can’t.

Time to end stifling stamp duty, says report: https://www.ft.com/content/0422bc4e-c944-11e7-ab18-7a9fb7d6163e. I’d like to know who those LSE academics are.