I was intrigued by a report in Business Insider this week that said:

"Big Four" accountancy firm PricewaterhouseCoopers (PwC) has predicted the use of tax havens by companies and individuals to avoid paying tax will soon become "unacceptable."

In an Asset & Wealth Management report released on Monday, PwC said the public was increasingly hostile towards those perceived to be not paying their "fair share" of tax, and that businesses would need to put more effort into tax transparency in future.

"In an era of mistrust of financial services, especially among the millennial generation, tax will become important for the brand," the report said.

"Being viewed as not paying a fair share of tax or using questionable tax havens will be unacceptable."

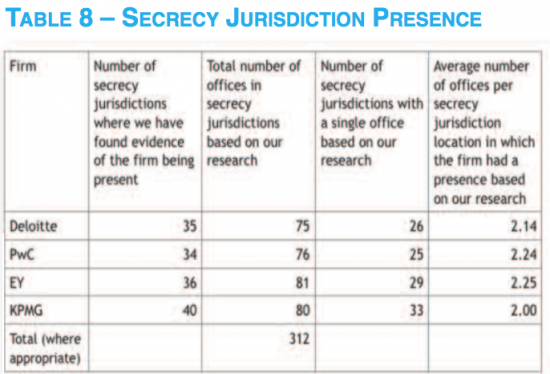

That's all well and good, but as I reported earlier this year in work undertaken with Sail Stausholm of Copenhagen Business School, PWC are in a considerable number of locations in the world, as this table shows:

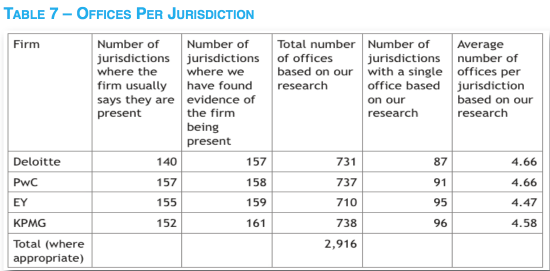

The consequence is that PWC operate in a majority of the 53 secrecy jurisdictions that we identified in the report, as this table shows:

If working in tax havens is so unacceptable now the obvious question for PWC is why are you so big in them in that case? And when are you leaving?

I will be happy to publish any response.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Notice the use of the word ‘brand’ and ‘milennial’ – the image is now beginning to bite, and smart young people are asking these questions. As to change, when will it come and how long will it take??? Depends on how long greed and profit maximisation rule accountancy as opposed to public interest and professional ethics and integrity. Those are not likely to change anytime soon.

I’d guess PWC, catching the drift of public opinion, are attempting to get the idea the party’s over into the Overton Window and thus break the news, indirectly through third parties, to their still expectant clients that the once great days of tax-dodging are behind them, and hopefully before anyone goes to jail for assisting it. “Look at the papers,”, they’ll say, shaking their balding heads sorrowfully behind their pince-nez, “full of rage and fury about companies and individuals not paying their taxes… no, the times we could assist in such endeavours are past, we’re very much afraid.” Being smart, they get the idea the jig’s up. They have the difficult job of getting that across to their greed-blinded clients now. This is them, beginning that.

No response yet.

Do you think I’m being a little impatient?

Like working in Apartheid South Africa became un-acceptable they will carry on until such time. Do as I say, in other words. Until then there’s serious client moolah to be made.

I think this one of those cases where short hand deceives us. PWC have said nothing. They can’t. They aren’t a real person. Someone at PWC, influential no doubt has said this, others in PWC may feel s/he is being unduly negative (or positive depending on your point of view). It would not be surprising if there were differences of opinion on this within PWC.

I am sure the fights within these firms must be obvious

There’s nothing to be too negative about here, at least not at this stage. This is a good sign and an indicator of change happening as it often does – one small step at a time.

There is ample to be negative about

Not walking the talk is ample reason to raise doubt

Ah yes but “the talk” as they see it is not their opinion. They are operating under the guise of professional neutrality as dubious as that may seem. They are reporting their perception of the public’s ‘mistrust of financial services’ and warning their clientele about current practices that ‘will be unacceptable’ in the future.

I would be surprised if they had an official company view on on tax avoidance (for or against) and I doubt that they ever will. That leaves the next step I suppose: to recognise their reported view of the public opinion and challenge them to state an opinion of their own. They will try to dodge that bullet of course but that’s no reason not to fire it.

you could try reading the PwC global tax code of conduct for some insight I suppose

I have

And then I noted Luxleaks

not really sure there are many fights are there? the firms are all separate partnerships in each country (bound together by some umbrella agreement).

If you take Cayman as an example, its pretty much market standard for US clients to use a Cayman partnership to invest outside the US, hence the need for the big 4 to have an office there. A partnership for UK purposes is transparent and thus makes no difference from a tax perspective. The narrative that all these offices exist in havens purely to facilitiate “tax avoidance” is ridiculous.

So using a no tax location has nothing to do with no tax?

If so, why are they all sure any tax would harm them?

Your claim is a barefaced lie

“So using a no tax location has nothing to do with no tax?”

It goes right to the heart of what’s wrong in fact, doesn’t it ?

There are two sensible and actionable activities that can be taxed. Occupation of land, and spending.

Both of these activities can easily (relatively easily ) be taxed within the national borders of the place where they are carried on. Land cannot be moved about willy nilly it is where it is, and where it is is where the tax is due.

It matters not one jot who owns the Dorchester Hotel if the value of it (the dis-benefit to the rest of the UK population to whom it does not ‘belong’ and who are excluded from that space) is taxed appropriately and proportionately. It would not matter much if the owners of the building decided to take it home with them to another country, the land would still be taxable or revert to the nation having become available for new development.

If the owners (Title holders) of the Dorchester Hotel chose to keep the building completely empty that would not be a problem to the UK economy providing that the tax owing was proportionate to it’s value.

Under current arcane rules I suspect that property taxes would be waived to some considerable extent were the property to be vacant, and furthermore there would be no taxable activity to charge. This would be a dead loss to the commonweal.

This unless I am mistaken was the basis of the domestic rates: the rateable value was calculated on the rentable value of the property. Now, that makes sense, which is probably why Thatcher and Co. wanted to change the system of local taxation.

Thatcher’s ‘Poll Tax’ was the complete antithesis in fact, and aimed to tax individuals irrespective of whether they held property or not. That skewing has never been reversed. Although Michael Heseltine tinkered with it, the Council Tax provisions maintained the deeply regressive quality of the original proposal and implementation.

It is symptomatic of the abject paucity of principle of the Blair/brown era that instead of even attempting to deal with this they chose to waste huge amounts of parliamentary time on an utterly ineffective ban on fox hunting. Fox hunting is alive and well the proper constituency of the Labour party is hanging on by the skin of it’s teeth.

Of course you can tax land and spending alone

But if you do inequality will soar because capital will be untaxed, as will higher incomes

Is that what you want?

If it is you are on the wrong blog

“Of course you can tax land and spending alone

But if you do inequality will soar because capital will be untaxed, as will higher incomes

Is that what you want?

If it is you are on the wrong blog”

I don’t see how that follows at all. Capital will be taxed by default. Or spent and taxed by consumption tax.

The capital will be collected as land tax from the Dorchester ‘owner’. If s/he wishes to live there alone the price will be extremely high. The billionaire owner will not long be a billionaire without generating some rent from the asset.

In the short term there will be some unemployment, because a hotel with no residents needs very few staff but combined with a redistributive system of UBI that will be a minor problem which will soon correct.

You can’t expect to operate a Luxury Liner on the hire charge levied on deckchairs.

What use is capital? It’s dead money if it is sitting in a safe. Why would you wish to tax someone for hoarding a big heap of waste paper? The benefit to the real economy would be in the land tax charged on the space occupied by the safe. It wouldn’t be viable to keep it there for very long. Cheaper to dump it or burn it in fact.

Andy

I think you need to read the Joy of Tax

This is profoundly right wing, trickle down language

Richard

My copy of ‘The Joy of Tax’ hasn’t arrived in the library yet. I literally cannot afford to buy one of my own because trickle down doesn’t exist.

QE is living proof of that (as if proof were needed)

Land Tax has very little to do with trickle down. Nothing whatsoever in fact.

Sorry, and I don’t have copies to give away

But you really are proposing exemption for capital from most tax

Land is not capital. The return is rent

“Sorry, and I don’t have copies to give away (I wasn’t fishing. Just saying)

But you really are proposing exemption for capital from most tax

Land is not capital. The return is rent”

So where does Capital come from?

Capital is the accumulated surplus of the excess return on labour appropriated by others

Anthony:

Re. this: “The narrative that all these offices exist in (tax) havens purely to facilitiate “tax avoidance” is ridiculous.”

What else does one do in tax havens? Take in a bit sun perhaps, a bit of fishing maybe or just shop for souvenirs?

well i think i just pointed out a reason for a big 4 to have an office in the Cayman Islands which has nothing to do with tax avoidance, but clearly that sort of observation is not welcome by some on here.

You did?

I am being serious: I did not notice it

You justified the use of a no tax jurisdiction

Richard Murphy says:

November 3 2017 at 11:23 am

“Capital is the accumulated surplus of the excess return on labour appropriated by others”

“Appropriated”.

Interesting word.

I’ll be thinking about this. I don’t have an instant response.

Is it really very surprising that PwC has offices in EU member states like Ireland or the Netherlands ? Or substantial other countries such as Ghana, Malaysia, Singapore, Switzerland, the UAE, or Uruguay? (By my count, they have just one single office in 25 of the 34 jurisdictions.)

You may just as well ask why they don’t have an office in the 19 other jurisdictions, such as Andorra, or Liechtenstein, or the Seychelles.

And the answer, no doubt, it that they have a sufficient number of clients asking for their services in some places to justify an office there, but not in others.

Surely you are not taking the populist / totalitarian route of identifying the adviser with their client?

Of course I am taking that line

Why not?

Do you really think PWC are independent of their clients?

Anyone know if there’s a place that lists all the companies that use tax havens to avoid tax? (I tend to use Ethical Consumer magazine as my go-to for which companies to support with my limited income, but it’s buried in with other information rather than a rating in its own right).

There isn’t

And I work with Ethical Consumer

I realise I was asking the wrong question. Looking at the list of companies in the 2010 report in the Guardian “Tax havens and the FTSE 100: the full list”, almost all of them operate that way. If one company in a sector does it, the others “have” to do it in order to make them “competitive”. Without legislative change, other than campaigning, the only thing we can do as consumers is use small, for example family-run companies – where they are available as an alternative. For utilities and transport even that’s not feasible.

There are choices amongst utilities

SSE and Coop Energy both have the Fair Tax Mark

“SSE and Coop Energy both have the Fair Tax Mark”

I don’t know about the Co-op, but irrespective of how either of them run their tax affairs, SSE operates an industry standard regressive pricing policy which is entirely unsuited to marketing a limited commodity and one which is a societal overhead cost.

The marketising of the energy supply industry encourages consumption by discounting for high usage.

That is crazy.