The Scottish Herald newspaper had an excellent article on Scotland as a tax haven yesterday which also focused on one of my continual concerns, which is the near total incompetence of the UK's Companies House, which is based in Cardiff. As the Herald noted , the issue of concern is the Scottish Limited Partnership. These are not partnerships as usually recognised, and nor are they the same as English limited liability partnerships (of which Tax Research is one). As a Scottish firm of lawyers says of this type of entity, the advantages are:

As the Herald noted , the issue of concern is the Scottish Limited Partnership. These are not partnerships as usually recognised, and nor are they the same as English limited liability partnerships (of which Tax Research is one). As a Scottish firm of lawyers says of this type of entity, the advantages are:

Separate legal personality: this is a unique trait of the SLP which is not enjoyed by limited partnerships constituted elsewhere in the UK. It means that the SLP itself can own assets, enter into contracts, sue or be sued, own property, borrow money and grant certain types of security.

Tax transparency: this means that the SLP is taxed as though it did not have a separate legal personality. No tax is payable by the SLP itself. Instead, the UK tax authorities (and other foreign tax jurisdictions) look through the partnership structure and partners are taxed on their share of partnership income and gains arrived at in accordance with their profit-sharing ratios (which can be different from the ratios in which capital has been contributed). The hybrid status of separate legal personality coupled with tax transparency offers the best of both worlds in a way that limited partnerships incorporated in other jurisdictions cannot.

Limited management participation: the legal requirement that limited partners may not participate in management makes SLPs ideal vehicles for multi-party investor structures where management and control rests with the general partner or manager appointed by the general partner.

All upside on rights and no down side on obligations like paying tax then, because if the partners are not in the UK nor is the tax bill: it's pretty much as simple as that. This is tax haven UK at work. As the Herald noted, tax planners have noticed:

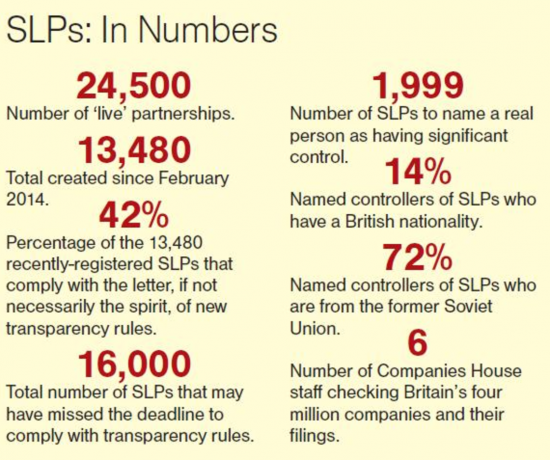

The number of Scottish Limited Partnerships has mushroomed. Not that Scotland is to blame though: the Scottish parliament has no control over Scottish company law (which is absurd). The administration of Scottish Limited Partnerships, most of which appear to have a somewhat scant regard for company law requirements, takes place at the UK's Companies House in Cardiff. And as Roger Mullins found when an SNP MP Britain's Companies House, has just six civil servants policing the accuracy of filings for more than four million UK firms.

This is a theme that I have visited before: see this report. There is in effect no company regulation in the UK at all now. It's true that documents must be filed, but no one gives a damn what they say and there is no chance of getting them corrected if wrong. What is more, if they are not supplied then the standard action of Companies House is to assume that the entity is no longer required by its owners and to then 'strike it off'; i.e. dissolve it without trace. This, of course, is just what anyone permitting any form of crime, including money laundering and tax abuse would want. It's as if the UK goes out of its way to set up the 'no questions asked' option for their use.

Why go to more esoteric, and sometimes better regulated, tax havens to get a company when the perfect solution is here in the UK? The absurdity of this situation is staggering, and the likely loss phenomenal. I estimated that the abuse of companies of all types cost more than £20 billion a year in tax loss when I last looked at the issue, and suspect I was cautious. But austerity says that we cannot look at the issue. As errors of judgement go this one is off the scale.

And in the meantime Scotland should be given the right to close down the tax abuse done in its name.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Off the top of my head, I recall reading that SLLPs came into being around 1905 through a bill passed at Westminster. As a result, it cannot be repealed by Holyrood, only by Westminster. It is certainly not in the Scottish Government’s power to effect changes in SLLP legislation and I know occasional questions by SNP MPs have produced no action from the UK Government, so I agree with Richard’s conclusions about UK being deliberately promoted as a tax haven and the ineffectivenes of Companies House to monitor corporate behaviour. Indeed, with only 6 employees, they can scarcely be able to open all the correspondence they receive, never mind action it swiftly.

I go back to my point in a previous post on GERS about government inertia: the Companies House issue is an obvious case of an administrative problem which could be solved simply and quickly, but the failure to do so results more from lack of political will (i.e. being a tax haven suits the UK Government just fine – just don’t ask too many questions!) than from matters of cost.

I also feel the Scottish Government could and should have been more proactive in highlighting the SLLP issue. They may be legally powerless to eradicate them, but they are part of HM Opposition at Westminster and could have been tabling questions, private members’ bills etc on virtually a daily basis. They wouldn’t have got anywhere, but their sheer nuisance value would have shone a light on a corner of UK that the UK Government would clearly prefer to keep dark. This alone might have forced the Government to act.

While SSLP scandals regularly make it on to the front pages of the better Scottish newspapers, I get the impression that English dailies give them less attention. There is considerable reputational damage to Scotland and its government through the occasional press articles linking SLLPs to massive money-laundering schemes, which, I suspect, also suits the Westminster Government just fine. Spoiler Alert: I’m not a lawyer (as I’m possibly about to demonstrate), but surely the Scottish Government could find the legal means to amend Scots Law to make the registration of SLLPs in Scotland illegal unless their legitimacy is established?

Ken

You are right on this.

I wholeheartedly agree with para 2

I do feel Roger Mullins did well on this at Westminster – and is continuing when now out of office. He was a valuable voice on this and other issues

I would hope the Scottish government could do more, as you suggest though

Richard

If what is described here as the modus operandi and staffing levels, Companies House is by default, at least, aiding and abetting fraudulent activities many of which may well be criminal?

Alongside the destaffing of HMRC it’s a wonder ‘we’ have any tax income at all.

[…] comment was made on the blog yesterday in the context of Companies House only employing six staff t9 check […]