I have noted the concerns the Bank of England obviously has about the stability of the personal debt market on a number of occasions now, the most recent being yesterday. One element of this market seems to be causing particular concern, and that is the individual car leasing sector.

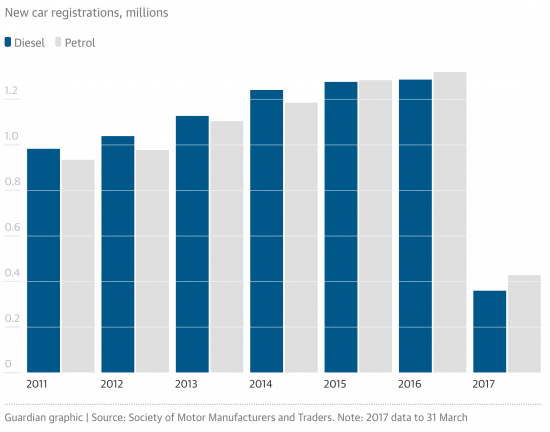

Based on Society of Motor Manufacturers and Traders data the Guardian published this information on new car registrations in April this year. It is good enough for the analysis that follows:

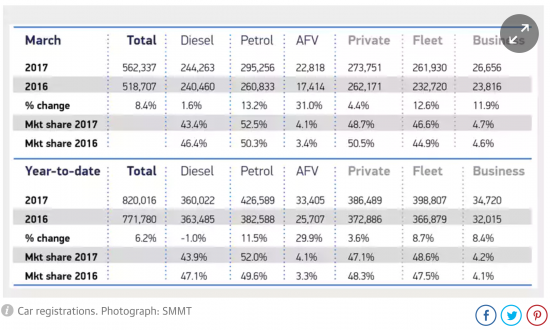

That is more than 2.5 million cars registered a year for each of the last three years. To get a feel for the break down of the market this data is relevant:

The market is roughly half private and half business. By far the biggest selling car is the Ford Fiesta. It does not matter who buys the car, however; the vast majority are now acquired on a leasing contract at a fixed price per month (subject to agreed restrictions) over a fixed number of years with the option available to hand it back at the end of that period. So why is the Bank worried?

Presume that after deposits are paid (and these varied) the average financing is £12,000. That may be high for a Fiesta, but Mercedes also get in the top 10. And then assume the lease term is three years. And assume the residual - which is what the car will be sold back into the market for - is £8,000. I will be candid, the precise numbers do not matter.

So, what's the risk? Why the worry? Obviously there is a fear that more than anticipated contracts fail now. But so what, you might ask? There's been a deposit paid and the car is returned for sale, so is this much of an issue? The answer is yes, but not because of the costs of the individual contract failing, although that can be pretty bad news for the defaulter and deny them a line of credit they might need in the future which will massively increase their cost of living . The actual risk is systemic. And that is because of too many contracts fail there will be too many cars dumped too quickly on the second had car market without a supply of new buyers and residual values will fall, significantly.

Suppose the residual value of each contract falls by £1,000 as a result of lessors having to dump cars onto the market in greater numbers with fewer people having the credit available to buy them because some will have already defaulted on their car leases and others will be denied credit because the Bank is demanding much tighter credit checks. I think this is entirely plausible. The current lessee will not suffer the loss in this case: the loan financiers will. But that may be a loss on maybe 6.5 million contracts right now, or a write off of £6.5 billion. And in some cases the residuals may fall by much more than £1,000. The exposure is big then: that's already more than half the sum the bank of England are demanding be put aside for exposure in this market. Frankly, it could use all that demanded provision with ease because, I stress, the risk to financiers is not just on the bad contracts, it is on all contracts in this case.

And there are knock on effects. New leases will rise in cost and demand will fall, partly for that reason and partly because credit is going to be tighter because the Bank demands it. But that will turn into a fairly rapid reduction in demand for cars, and we do make quite a lot of them in this country. This, then, quickly becomes serious: the unwinding of debt could escalate into a quite sharp downturn driven from this sector. A fall in confidence because people cannot have the car they want could also spread rapidly.

By itself this sector can't pull markets down, although it can seriously hurt them. But by itself it can make the country feel uncomfortable when it is already feeling edgy. The Bank of England is right to be worried. So am I.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Do we have any data for the current level of car finance defaults?

There’s plenty of data for mortgage possessions ( all time low ) and for tenant evictions ( currently high ), so why not for motor loans.

Off hand, no

Mercedes at the moment arent doing to badly, only a few have overextended their credit. Its the underwriters who do the hard work, working out who can afford the cars. Some blame the dealer which is rubbish. Obviously the debt isnt held by the car companies but brought like the sub prime issues. The secondary issue, car companies only make money on finance not selling cars.

Are there not some balancing factors? If all those people start buying second hand cars at the end of their lease then it’s likely to force up prices making leases a little more attractive again.

I point out in the blog why that may be hard for some to achieve

I am confused, not a new phenomenon for me vis a vis economics.

If x millions of cars are on these contracts what happens anyway when they appear back on the market in three years??

Even if the x millions are distributed over time their arrival on the second hand market will have an effect.

This scheme of leasing vehicles sounds and looks like a variation on a ponsi scheme, to me.

You are right to point out the impact on the second hand market. There is a certain demand for cars (whether new or second hand). Demand cannot keep on going up. If offers are tempting it will pull forward demand and entice a greater proportion into the new market as opposed to second hand.

But as you say at the end of 3 years the cars are still there and there will be an oversupply of perfectly serviceable second hand vehicles so pushing the prices of these second hand vehicles down. This in turn affects the residual values calculated into the costs of the leasing contracts.

To be brief – fertiliser hits ventilator! Now factor in any contraction in the ability of people to afford the contracts they have taken out and you have speeded up that ventilator!

Spot on

The years of car sales increasing each year has clearly been facilitated by the availability of credit at rock bottom rates. Is anyone really surprised that this is at crisis point. Stories of shop workers on minimum wages driving expensive new German cars abound!

I’ve noticed an extraordinary build up of SUV’s in the last year and would assume most of these are on PCP’s. People are going for these Sherman tank sized leviathans like nobody’s business.

If this debt is spinning around via tranches of securitisation then the ripple effect could be big.

We’re living in an economic culture that has nowhere to go.

Who is going to buy all of these second hand internal combustion cars, when everyone switches to electric vehicles? (see the announcement by Volvo today)

And who will want to drive themselves when the AI gets good enough a few years hence?

Excellent questions

I’d say the majority of people will still want to drive themselves for some decades to come. This will be regardless of whether or not the AI technology is statistically safer than human driving or not. You can guarantee that people will look to the reports of rare incidents where AI failures have led to accidents/deaths and ignore the fact that human error is much more likely to cause accidents. Statistically, flying is much, much safer than driving, but you get people with pathological fear of flying who wouldn’t think twice about hopping into a car to drive hundreds of miles across a country.

Human beings aren’t very sensible in general. Ask any Tory voter. 😉

I would say that I’ll be happy to use AI-driven cars in due course but I’ll certainly wait a good few years for the technology to mature before doing so. Tesla’s marketing of their ‘Autopilot’ has been a bit iffy in my opinion and I fear that the race to market for the various competitors may rush things a little more than necessary.

Having spent three days in Toulouse this week which is gloriously (almost) car free in the city centre, I wonder what the sense is in relying on cars to boost our economy anyway. In line with the Green New Deal, shouldn’t we be shifting towards building better rapid transit systems that everyone can use at minimal cost? Our diesel buses in Cardiff chuck out terrible fumes. A shift to an industrial strategy that replaces these with electric ones would get my vote!

I agree

We need to rethink the car

What if an electric bike was given two extra wheels and a transparent cover and we would have an all weather low cost commuting vehicle smaller than at present and very low impact. In many cities commute times would fall

Where I live in Cardiff, 20 mph zones are in the process of being implemented. The drivers haven’t noticed yet but hopefully that will come in time. I do think this may be key to changing behaviour, as once the vehicles are slowed down, any manner of alternative ways of transportation open up – maybe even feet!

Always a worry: are we looking in the right places, or are we preparing for a repeat of the things that caught us by surprise, last time ’round?

Be that as it may, I hadn’t really thought about the destabilising effect of credit in a market where production ‘competes’ with re-use. There could be more of these.