I have come across a curious anomaly in HMRC's statistics. I am publishing this commentary in the hope that an explanation is available that I have missed.

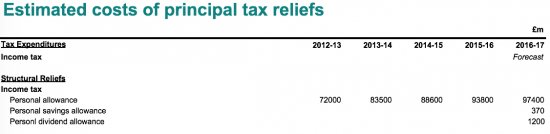

Amongst the statistics that HMRC publish is data on the cost of tax reliefs. This is available here and here. I am, in particular, looking at the cost of the basic personal allowance, which according to HMRC's data has changed as follows over the last few years:

I will look at 2015/16 as we have reasonably reliable data on the number of tax payers in that year and data is not distorted by additional reliefs. The last reliable estimate of the number of taxpayers is that there are about 30.7 million taxpayers (table 3.5).

Dividing the cost of the personal allowance is not a statistically accurate thing to do for reason I will note below, but is still a useful heuristic exercise. If done the £93.8 billion cost comes down to £3,055 for each taxpayer. HMRC says in note 30 to the table that:

The costs of the personal income tax allowances do not cover individuals who are not on HMRC records because their income is below the tax threshold

In other words, it seems that the cost is only that attributable to people who actually pay tax: they do not attribute a cost to those who are economically active but who do not pay tax, which in my estimate (I'll be publishing more on this soon) might be about 6.4 million people in that year. If these people were included the cost would reduce to £2,528 a head.

It's important to note that the personal allowance was £10,600 in 2015/16.

The basic rate of tax was 20%.

This means that for the basic rate tax payer the tax relief was worth £2,160.

For those earning over £100,000 (near enough for these purposes) the personal allowance was withdrawn. It appears that this impacted approximately 779,000 taxpayers (table 3.4). This meant 3,849,000 taxpayers effectively got two personal allowances compared to the basic rate taxpayer (same source).

The net effect of this is that to estimate the impact of all this the value of the personal allowance at basic rate should be multiplied by 33.77 million (30.7 — .779 + 3.849). That comes to £72.9 billion.

But HMRC claim the cost was £93.8 billion. That is an additional cost they have found of £20.9 billion. That is a personal allowance for an additional 9.7 million people if they all had income to use the whole allowance, which is extraordinarily unlikely. It is also very definitely more than the number of economically active people who do not pay tax.

Now, I stress, there may be something glaringly obvious that I have got wrong here, so I put it put for discussion and comment. But if I am right then the quality of these estimates has to be questioned.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Is the £20B cost due to the 40%ers Richard?

You will note I allowed for that in the calculation

“it seems that the cost is only that attributable to people who actually pay tax”

That’s a mistake – for example last year I paid no income tax ( earnings just under £10k ) but I most definitely was on HMRC records and NI, both kinds, was collected.

But as I point out, it is unlikely that there are more than 9 million people like you

It is also a wholly random statistical exercise if there are

And HMRC could not also know the value supplied in each case so the explanation would reveal gross estimation if that were the case

It looks like I have to hold your hand here Richard.

I’m not claiming that there are 9 million people exactly or vaguely like me – I worked full-time for 7 months and relaxed the other 5, coming in with income below the personal allowance.

What I am claiming is there could be many millions of people who are on HMRC records but not paying income tax.

Consider that there are close to 9 million part-time workers in the UK, many of whom will be working 16 or 24 hours to maximise the value they get from their tax credits claims. And why would HMRC bother to have them on their records – because RTI among many other reasons.

Some of those 9 million part-timers will be paying PAYE income tax, and some of the full-timers won’t be.

I have explained that I know about these people: there are 6.4 million of them

Even if they were all in HMRC records a) the assumption they use their personal allowance to the full is wrong and b) there aren’t more than 9 million of them – I’ve checked the data and will publish it soon

So, politely, there is no need to be condescending because I have covered that angle from more than one direction

I think there’s no need for snippa comments, but it’s certainly of note that what HMRC have provided really are estimates of the vaguest kind. The ratio of the yearly cost to the yearly personal allowance is identical for each of the 4 years. It seems no adjustment has been made for changes in the size of the labour force or spread of incomes, just one value back or forward fitted for the other years.

It would be interesting to know the number of pensioners who are paying income tax of that 30.7 million, the number of workers in a given year (31.8m at any one time now according to the ONS), and as Ghislaine implies, the number of workers and pension recipients who have taxable income but are not paying income tax in any given year due to being below the allowance.

When I get time I will publish the latter

Your point on a fixed ratio is one I had not noticed

Now, I stress, there may be something glaringly obvious that I have got wrong here

How refreshing – and isn’t it a pity that this laudable principle isn’t more generally applied?

Well done and thank you.

Could be accounted for by the people earning between about £31K and the higher rate threshold, who would pay some higher rate tax if there were no allowance. So they cost HMRC more than £2,120, but less than double that amount.

That is allowed for in my estimate

Part of it will be attributable to all those people that aren’t higher-rate taxpayers because of the personal allowance. If there was no personal allowance you would be a higher rate taxpayer once your income exceeded 33,500 rather than when your income reached 45,000 and those people gain more than 20% as a consequence. HMRC figures suggest that around 27% of taxpayers would be higher rate taxpayers in that case.

Based on HMRC figures I think the 11% of taxpayers that would now pay the higher rate (around 3 million of them) would pay another 1k on average. So that explains about 3 billion.

A drop in the ocean compared to the 20 billion you were looking for, but it goes some way to adjusting the figures.

That’s an interesting idea

That would, if true, explain around £11 billion

But it’s an extraordinary assumption to make that parliament would shift the starting point for higher rate tax down if there was no PA and it should be stated

There are already examples of people paying higher rate tax on everything over 33,500 because they don’t have personal allowances. Those examples being people whose allowances have been phased out because they are over 100,000 and those individuals that are claiming the remittance basis and don’t get a personal allowance as a consequence. So that is the way that the legislation already works.

I have allowed for this in the calculation – there are 779,000 such people

I calculated 20% of £10600 as £2120.

Apologies for a typo

No worries Richard.

Running that through the calculations makes the difference £22.1 bn

Are HMRC just assuming that everyone that could work would pay tax on their personal allowance, even if they don’t earn enough? Or is this the tax not paid by pensioners due to their personal allowance?

It’s not clear

Only one thing is: this is not good enough