I have mentioned that I am speaking at an event today on Creating a Just Scotland. This event is part of the Radical Book Festival and is organised by Quakers. This is roughly what I plan to say (although I never deliver to plan):

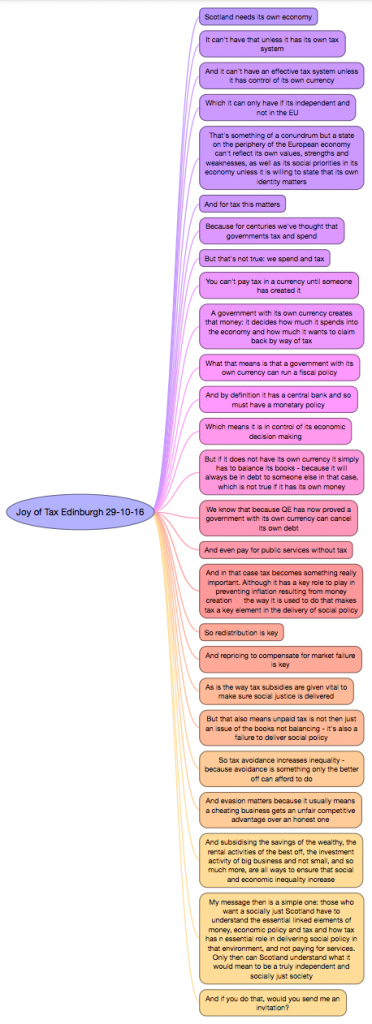

There is larger version here or for once, as there are no sub bullet points, it's easy to share here:

- Scotland needs its own economy

- It can't have that unless it has its own tax system

- And it can't have an effective tax system unless it has control of its own currency

- Which it can only have if its independent and not in the EU

- That's something of a conundrum but a state on the periphery of the European economy can't reflect its own values, strengths and weaknesses, as well as its social priorities in its economy unless it is willing to state that its own identity matters

- And for tax this matters

- Because for centuries we've thought that governments tax and spend

- But that's not true: we spend and tax

- You can't pay tax in a currency until someone has created it

- A government with its own currency creates that money: it decides how much it spends into the economy and how much it wants to claim back by way of tax

- What that means is that a government with its own currency can run a fiscal policy

- And by definition it has a central bank and so must have a monetary policy

- Which means it is in control of its economic decision making

- But if it does not have its own currency it simply has to balance its books - because it will always be in debt to someone else in that case, which is not true if it has its own money

- We know that because QE has now proved a government with its own currency can cancel its own debt

- And even pay for public services without tax

- And in that case tax becomes something really important. Although it has a key role to play in preventing inflation resulting from money creation the way it is used to do that makes tax a key element in the delivery of social policy

- So redistribution is key

- And repricing to compensate for market failure is key

- As is the way tax subsidies are given vital to make sure social justice is delivered

- But that also means unpaid tax is not then just an issue of the books not balancing - it's also a failure to deliver social policy

- So tax avoidance increases inequality - because avoidance is something only the better off can afford to do

- And evasion matters because it usually means a cheating business gets an unfair competitive advantage over an honest one

- And subsidising the savings of the wealthy, the rental activities of the best off, the investment activity of big business and not small, and so much more, are all ways to ensure that social and economic inequality increase

- My message then is a simple one: those who want a socially just Scotland have to understand the essential linked elements of money, economic policy and tax and how tax has n essential role in delivering social policy in that environment, and not paying for services. Only then can Scotland understand what it would mean to be a truly independent and socially just society

- And if you do that, would you send me an invitation?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

‘We spend and tax’.

I love it Prof Murphy. I love it.

To me this is the E=MC2 of fiscal policy – a major (re)-discovery that confronts an outright lie that has become received wisdom in societies the world over.

Sorry to sound so gushing but you are worth a Nobel prize for stuff like this in my view because you have the courage to say it as it really is.

I’d love to be there.

‘We spend and tax’. Fantastic. You’ve made my day so have a really good one yourself.

PSR

We had a great time in Edinburgh this morning, and bit was great to meet some blog readers

And thanks for your encouragement too

Richard

Looks like an excellent speech, Richard.

Wish I could have attended. Ahh Edinburgh-feeling nostalgia for my university town!

What that means is that a government with its own currency can run a fiscal policy

But if it does not have its own currency it simply has to balance its books — because it will always be in debt to someone else in that case, which is not true if it has its own money.

Please amplify: Are you saying the eurozone and possibly the indivudual US states qualify in this group ?

To give an example Italy was running a GDP black hole for decades before joining the euro . Why did it not just print more lira?

Again, does Japan not really have a public debt ( GDP) problem because it can in theory print unconscionable yen notes on a whim or alternatively sell JGBs at will to a traditionally compliant indigenous retail community thus arguing its debt is internal thus not a worry?

US states whilst not on that scenario ( each must trade in USD) have undulating debt positions with some ( Vermont, Delaware, Arizona) in vast credit whilst others ( alabama , Maryland, Arkinsas) on the verge of or in virtually declared bankruptcy. Will Washington bail them out if push comes to shove?

Thanks.

Sorry, but I am not sure what the question is

In a nutshell I venture the question is:::

Why do countries who are beholden to a supranationsl central bank find it impossibke to balance their books?

( Forget for the moment Japan and assume USA is comprised of 50 individual states with their own state laws and governance)

Because of sectoral imbalances

Look them up

Why didn’t Italy just print more Lira?

Because Larry, there has to be some sort of balance between the quantity of currency in circulation and the amount of economic activity. Too little money. we get deflation (US late 19th cent) too much and get inflation ( this might over simplify ). This is where tax can play a role.

You are correct in that the eurozone states and the US states can’t create their own money.The American states do get federal spending in the form of subsidies (agriculture is protected and subsidised ), military bases, some people receive federal pensions and so on. Eurozone states get some money from the structural fund but most will go to the poorer states -some of which are not euro users.

In the first part of the euro crisis Spain was borrowing at about 7% then the ECB decided to ‘what it takes’ and buy the bonds of the cash strapped countries. In both cases the poor bear the brunt of the book balancing.

I was pleased to meet you today in Edinburgh and found your talk very interesting.

I have to say that I do not recollect you saying that Scotland should not seek EU membership. Indeed , in response to a question , you said that you believed that Scotland could be a member of the EU without joining the euro.

I do not want to make pettifogging criticisms of those who are willing to expose their ideas to public scrutiny. I understand that the current political and economic situation facing Scotland and the UK is a complicated one and that no one has a complete set of correct answers.

I wonder if perhaps you might have inadvertently strayed into a rather isolationist position for Scotland, relying solely on the ability of Government to create money to deal with all economic difficulties.

Keith Macdonald

See another comment just made that addresses this point

Good to meet you

Good stuff Richard. Disagree with point four though. Scotland could join the EU and still control its own currency. The Maastricht might oblige Scotland to join the eurozone when the necessary conditions are met, but that can be delayed indefinitely.

Its been 22 years since Sweden signed up yet they are still using the Kroner and has no plans to change that in the near future.

Good point

“Which it can only have if its independent and not in the EU”

do you mean not using the Euro ?

The EU says joining the euro is a condition of new membership right now

“Which means it is in control of its economic decision making” — maybe one reason why your ideas are difficult to accept is the following. There was a time where inflation was a major problem and the lesson learned was to have an independent central bank with the idea to not allow governments to decide how much they want to spend … because they would spend in and uncontrolled way. Theoretically, the idea to control inflation by taxation makes sense … but spending is popular and taxing is not … so can this work? Can we invent mechanisms that make it work? I am not convinced that relying on the good sense of our politicians is a safe way to go … Best wishes, Alexander

So you believe in the power of bankers to curtail democracy

Some of us don’t

Some of us look at the disaster this has brought to the world economy and realise it was all so much better when the politicians were in charge, as all the evidence shows

Nothing recently has convinced me that adopting the Euro is a good idea although EU membership has been very beneficial. I think that the creation of the Euro was a bridge too far that can only be mitigated by making major changes to the way the ECB is ran.