There is much coverage of Nissan's decision to keep car manufacturing in Sunderland in the press this morning.

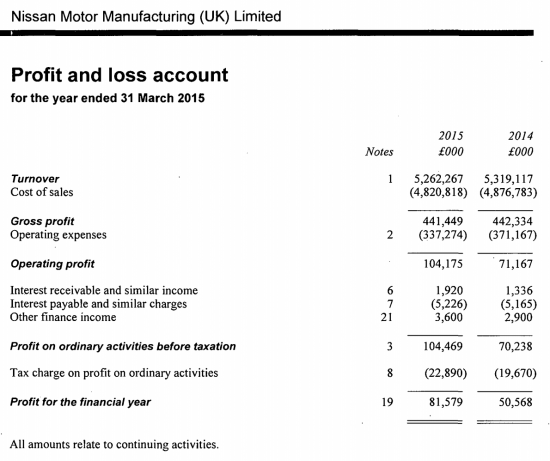

Less noticed is a story by Tom Bergin at Reuters on the difficulty of assessing the impact of tariffs on Nissan. This is the P&L for Nissan's Sunderland operation as far as Tom and I can see:

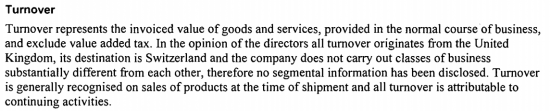

That's more than £5 billion of car sales. Then, however, read the notes to the accounts, which say:

In other words, not a single car from Sunderland is sold to anyone but Nissan in Switzerland. And not one goes to the EU, of which Switzerland is not, of course, a member: it is in the single market for goods (but not services) but is not in the EU.

So how does this impact on any deal? We don't know, but the suggestion is that there have been deals done to keep Nissan in the UK. I would suggest some questions are appropriate.

First, has the deal anything to do with tax? Is there an offer of a forward pricing agreement? If so, what right have ministers to offer such arrangements?

Second, is Switzerland a party to the deal? If so, how?

Third, is there a tariff compensation deal on offer? If so, what transfer prices are being used? Quite clearly the accounts noted above are an internal arrangement for Nissan and not the result of real market activity since all sales are internal. In that case what sale price has been accepted and to what scrutiny have the accounts been subjected?

Fourth, is there some opening being seen here with Switzerland where it becomes the entry point of choice for goods from the UK into Switzerland in a new era of tariffs? Might a new form of tax competition be opening?

Fifth, why is nothing 'on the record' as yet?

Sixth, who else will such deals be available to and why, or why not?

I want jobs in Sunderland, of course. But transparency is vital in the current environment. No one is suggesting Nissan are doing anything wrong, but the government needs to explain what is happening. And soon.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Perhaps having: “We send the EU £350 million a week. Let’s fund Nissan instead. Vote Leave.” would have been more appropriate for Leave to have had plastered across the side of their campaign coach.

Would have maybe been nearer to the truth.

This deal is for one of the three japanese car manufacturers in the UK. Will the others not want similar treatment? Then what about Bentley, Rolls Royce, Jaguar, Land Rover, Morgan, Lotus, McClaren? When will the subsidising of these private companies with public money, or the deal making to avoid paying for the education of the people they need to buy and build their products end.

The countries SME’s cannot continue to subsidise their own demise.

I think that’s called hitting the nail

Fascinating analysis, Richard. As my brother-in-law works at the Sunderland plant I have some interest in what goes on there. I doubt you’ll get any answers to your questions though, appropriate and timely as they are, as I strongly suspect that everything will always be covered by the slogan we’ve heard so far: to disclose anything will undermine our bargaining position. This excuse for secrecy already reminds me of the equally dubious ‘commercial confidentiality’ refrain that we hear anytime someone tries to find out anything about a contract between government, government agencies, local authorities, and so on and the private sector. Unsurprising that the source of this excuse for secrecy, and indeed the people who frequently persuade public organisation to use it, are the hoardes of ethically challenged individuals who work for the big four.

Agreed Ivan

Let’s us know if your brother-in-law gets the heads up on the Nissan deal. As Nissan directors, the French and Japanese government know by now it would be nice for us to find out.

Westminster is not allowed to negotiate or reach deals with any country, till article 50 has been triggered. It seems the Tories are being underhand, especially as nobody appears to want to be seen talking to them.

Hi Richard,

This 2012 article (a similar article ran in the Financial Times) argues that Nissan’s Swiss arrangement is tax-motivated. The UK entity is a contract manufacturer paid on a cost-plus basis by the Swiss entity.

http://www.thisismoney.co.uk/money/news/article-2230999/Nissan-sells-UK-cars-Switzerland-tax-ruse.html

On a related note, it looks as if a lot of that money that’s supposed to be coming back from Brussels post-Brexit could end up flowing out again in subsidies (tax or other) to large investors to keep them in the UK, doesn’t it.

Cheers,

Diarmid

Thanks Diarmid

Mutter mutter Transfer pricing mutter mutter. Smells of tax avoidance?

Who knows?

The Mail said so (see link above)

There was something on the telly last night about the difficulties involved in reimport into the EU of parts originating in EU and assembled in non-EU state. I don’t know if this has any bearing on the case of Nissan. But thanks for this very interesting blog, Richard.

I am sure a lot is being said that is uncertain

Ed Miliband’s reference to Kremlinology is apt for trying to unravel this pantomime. If the UK resides outside the common tariff area that would change the terms of Nissans’ Swiss arrangement. Also, Ireland found out recently corporation tax ‘subsidies’ can fall fowl of anti-dumping regulations so why would Nissan be confident that tariff subsidies would be acceptable to the EU or WTO? Greg Clark did make a reference to two initiatives; Help with R&D investment for electric cars and help for infrastructure upgrades for plant expansion in Sunderland. Those kind of initiatives are likely to be permissible within the framework of the Single Market. If the Government hasn’t assured Nissan they are intending to stay in the SM they’d do well to spread rumours that they have. Unless they want to open the gates to corporate shake-down of the taxpayer.

Although I also agree that it is good to seen Nissan stay here (albeit they are talking of redundancies I believe) this really seems like a policy meant to manage perceptions to me.

And it just goes to show what politicians can do if they want to – even if the need is to appear to be seen to be doing the right thing. If only they thought so creatively when it matters to others outside of the party and when the country needs new way of thinking other than that we’ve had for the last 4 decades or so.

Compare & contrast – Vestas’ income statement can be accessed on the FT.

2015: Euro8.43bn T/O profit before tax = Euro925 i.e. around 12% of T/O. Vestas, like Nissan makes things – but Nissan has a t/o vs profit of 1.7% – Maybe Nissan’s accounts should be proposed for the Booker prize for fiction. Sony in the 1970s and 1980s paid no tax in the Uk – despite having a £400m t/o and extensive manufacturing operations – is that the sound of transfer pricing that I hear – in the distance.

You say Sony Turnover of 400m. They could have made a net loss and therefore would not have paid any corp tax

I have the advantage on you since I could see tranfer pricing taking place before my very eyes in my budgets for running Sony factory services. They made a net loss due to transfer pricing (in this case people) that was anything but fair. There are 1001 ways for non-UK companies to slice & dice & reduce UK tax obligations to zero. Many/most/all do it – and a mix of HMRC and politicos turn a blind eye – shame on them.

I’m sure that’s “million” pounds, not “billion”.

No

Billions

The figures relate to £’000 already

Then Wow!

Agreed that it looks like a contract manufacturing P+L although a 2% (or less) operating margin looks very thin – perhaps indicative of HMRC’s usual level of competence in TP matters. Is it a competence thing or something less publishable?

I couldn’t possibly comment

The cars are not physically shipped via Switzerland though are they. Title may pass to the Swiss entity but the cars are still EU origin cars shipping to other EU countries and therefore tariff free?

Are they?

The spectre looming over this is that ‘State Aid’ – and any undertaking having the effect of an indirect subsidy – is forbidden under EU law.

That’s costly while we’re still in the EU, and will attract far harsher penalties under our post-Brexit trade agreements.

Yet another advantage has been handed to the EU team in our Brexit trade negotiations: “Conclude the issue of illegal aid to motor manufacturers with a one-off exit payment or we take it to the WTO as a pre-empting dispute that block all agreements on automotive trade”

I wonder what Toyota, Honda, Tata, Ford and BMW are doing right now.

The laughably inept negotiators of Team Brexit may well have walked themseves – and us – into a blackmailers’ auction.

I agree

I have been thinking about this, as retired inspectors of taxes are wont to do, and I can certainly see red lights flashing; I don’t think the BRexiteers have any idea of how to cut a deal, and, indeed, that pesky thing called ‘transfer pricing’ is most definitely in play.

Ignorance seems to be the prevailing note…

Indeed

Funny old deal though. Switzerland is not in the EU, or the EEA, but is in the EFTA ( and the Schengen Agreement). It is, at the moment, part of the “single market”.

But: they don’t want the “freedoms” that go with that, so they may soon not be in the single market.

Musical chairs time soon?