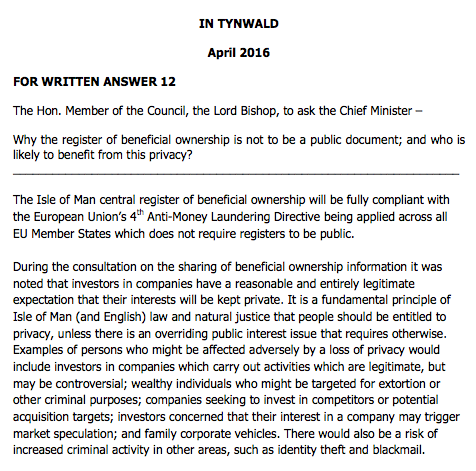

The Bishop of the Isle of Man asked an interesting question in the Isle of Man's parliament - the Tynwald - yesterday (in which he sits) and got an equally interesting answer. The exchange was as follows:

The Bishop clearly understands both accountability and responsibility, and the relationship between the two. That fact is implicit in his question. The response indicates an appreciation of none of those things.

First, of course there is a right of privacy. I have said so of late in debates on whether tax returns should be publicly available: as yet this is something the UK is not ready for even though there are obvious advantages that might arise from their publication. But this is an issue that concerns what I called 'warm bodied people'. They're easy to identify: they're the walking, talking variety of people who need to be defined for this purpose because we also have legal people. The latter are, of course, companies. These have a separate legal existence from their members for whom they are neither agents or representatives and are as a result utterly legally distinct.

No one need be a member of a legal person (or company). Less still does a person have to form such an entity. But if they do then not for one moment are they and the company legally synonymous. It is precisely because they are different that many will wish for a stake in such an organisation: the difference means that in the event of the company needing to default on its obligation to pay its debts the owner of shares within it will not be liable to pay.

Distinct they might legally be then, but devoid of a relationship they are not. As the Bishop understood, such a mechanism can quite clearly be used to hide the true identity of the persons directing but not owning a trade, and we are well aware that this has been massively abused for tax purposes.

That is why privacy cannot be afforded to companies. Privacy, when granted to companies, is not the same as when given to an individual. You may deal with me in person without knowing of my finances (although credit checks are possible, and of course) knowing that come what may to the limit of my assets, and to some extent of my earnings, I am responsible for paying you. In that case personal privacy does not remove my responsibility.

But in the case of a company it does do just that unless we take steps to prevent this happening. In exchange for share capital of a pound or two a company that is granted privacy (through the right to use nominees directors and shareholders, for example) actually acquires something very different, which is anonymity. That anonymity permits the negation of responsibility. This is my key point. And this denial of responsibility cannot, as the Isle of Man seeks to suggest possible, be equated with personal privacy. In the case of personal privacy responsibility remains implicit: in the case of companies it does not. For that reason they are fundamentally different. This is why corporate responsibility created though the disclosure of ownership (shareholdings), control (directorships) and capacity to pay despite limited liability (accounts) is essential on public record.

The Isle of Man gets this as profoundly wrong as the accountant who debated the issue with me on Radio 4 did last week. The excuses they offer for privacy in companies ignore this fundamental point and they then just make things worse.

So, when they say those who undertake controversial acts deserve and anonymity they effectively endorse irresponsibility.

And when they suggest that those with wealth must be protected they firstly deny that wealth carries with it responsibility. Second they ignore the fact that identifying people with wealth is really not hard without access to accounts: such people usually live in the biggest houses, drive the largest cars and habitually display their status. No one need to check their accounts to find out they have money and there is not the slightest evidence that anyone has ever presented that this has been the only source of evidence in an extortion case. To put it another way, this suggestion is just untrue.

After which the claim that anonymity might be used to disguise a person's activities in markets is at least honest, except that what it actually very obviously does is endorse cheating. It also endorses the the denial of information that economic theory makes clear is the only basis on which efficient markets can exist - which is the availability of open and transparent information. This argument does then not only embrace a quite specific and pernicious form of corruption, it also evidences no faith in free markets.

After which the claim resorts to suggestions of blackmail, which is a duplication of the previous claim on extortion (at which point one begins to suspect that the author of this response is getting a little desperate) whilst a reference to identity theft is dropped in for good measure. And yet corporate anonymity is itself the ultimate form of identity theft: by denying identity it ensures those with whom a company may trade any chance of knowing what it really is and what its capacity to trade might be.

These then are lame excuses of which the Isle of Man should be ashamed. They endorse cheating, they deny truths and they are intellectually flawed. And yet they are the foundation of the Isle of Man's continuing role as a tax haven or secrecy jurisdiction.

The Bishop comes out of this well.

The government in Douglas does not. It should hang its head in shame for using such arguments to justify the abuse that it still permits.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

How would the IoM determine if there was an “overriding public interest”?

Presumably they would respond to a request for sight of a secret document; if so this would imply that they would not know whether historical registrations were against the public interest until someone made such a request.

It would also imply that there is no public interest test on registration.

And since auditors have no public interest obligations and, in any event, take the view that secrecy overrides all other financial reporting requirements opacity prevails.

I think the Tax Justice movement needs more than Bishops to make the point.

A man who, by definition, thinks the earth is 4000 years old and believes in a supernatural superbeing can hardly be taken seriously when the opposing view of tax behaviour is said to be flawed. Especially given the preferential tax treatment of the church.

Gas he said that?

Is any UK bishop a creationist?

You don’t know any actual Christians do you?

Great response

What nonsense. I don’t have a directorship or ownership,beneficial or otherwise but did I then I would be tempted to pack up and go on the dole should my details be made “public”. This jealous greed by frightened Champagne Socialists like you makes me sick. Is there a public list of journalists? Is the list of people claiming benefits publicly available because I heard a rumour that the guy above me who has a BMW is claiming benefits. Where’s the list?

I notice you are using what is almost certainly a fake name

Maybe you are unaware that the UK will have such a list from June this year

You can, at least in some small part, blame me

I nearly fell on the floor laughing at this comment. I presume this was supposed to be parody?

I think the fear is on your part. Have you ever lived on jobseekers allowance? Really – what nonsense.

How extraordinary that you think a desire for honesty rather than criminality and corruption equates to jealousy. You should be comforted to know that HMRC has hundreds of people searching out benefit cheats but only a few looking for wealthy people avoiding tax.

AliB. Then that’s clearly wrong and certainly doesn’t bring me any cheer. But I am saying this horrible tabloid like wish to know everyone’s private details is wrong. If a company owes you money then you or your lawyer sgould be able to go to companies house and know the directors. And obviously when a company pays money to a director or shareholder I assume in the UK that is also listed in the records available to those with a need to know. I believe most journalists wish for a public list so they can make column centimetres of junk about, “local vicar had thousands offshore” etc. etc.

Just go and look at Companies House on the web and stop wasting our time

Where are they hanging this list? And which list are you referring to?

Companies House

Try the beta service – totally free

Well if it’s filed correctly at companies house and not on the first 32 pages of The Sun I can’t see what more you want. Are the home addresses of these people going to be in the public domain for every stalker and crank to peruse? I suppose ysome people will want yellow crosses painted on their doors? I feel a register of anyone seeking this information should be kept and correct ID too. I’m glad I’m neither wealthy or famous but perhaps politicians could be more transparent…but how much will protecting them cost? I’m told certain ministers have protection for life.

Do you know we also have an open access register of electors?

And land registry?

And much else

Do you have any clue in fact how the real world rather than that of Ayn Rand works?

Will we ever find enough people of good will to come together and put an end to this cheating, truth denying, intellectually flawed drivel?

Or does the problem lie ingrained in human nature?

Perhaps humanity must learn to cooperate, not only with each other, but with God.

Humanity is co-operating with a God David.

And that God is called MONEY.

PSR – I appreciate where you are coming from, but I don’t think money is a god.

It’s an idol.

The neoliberal golden calf of tax havens.

I would be the last to deny the world will ever change, but all I’m saying is, unless we had an army of Richard Murphy’s, we might just need some help from above.

So democracy in the IoM is literally decided by the ‘overriding public interest’ is it – an interest that seems defined by those who are keen to keep secrets anyway?

They IoM Governing bodies are in denial that there is indeed public interest.

Wonderful – makes the EU structure look like double devolution!

On the matter of off shore money storage – I remember that when Michael Lewis wrote his books on the machinations of the financial markets (Liars Poker etc.,) he was reportedly surprised and disappointed that it seemed to act as booster to recruitment in the sector rather than treated as an expose of some very dodgy behaviour.

I do hope that the public interest being generated is one of censure rather than that of inspiring others to do the same!

http://www.ft.com/cms/s/0/da5d1e8a-0703-11e6-a70d-4e39ac32c284.html#axzz46T1yZLHW

“Ministers from Jersey and Guernsey have been given the green light to attend Labour’s annual conference this year despite Jeremy Corbyn’s criticism of offshore tax havens.”

Perhaps IoM too? Attendance would presumably mean a stall – or maybe a fringe. Either way they will receive a great deal of flack. Look forward to seeing you there, Richard;o)

They were all there last year

I met them all