The European Union is claiming this afternoon that it is going to demand country-by-country reporting from European multinational corporations in the future. How do I know? Because it is going to publish this:

I have to report that this is not true. As the person who created the idea of country-by-country reporting I can tell you that what they are suggesting is nothing like a system worthy of the country-by-country reporting name.

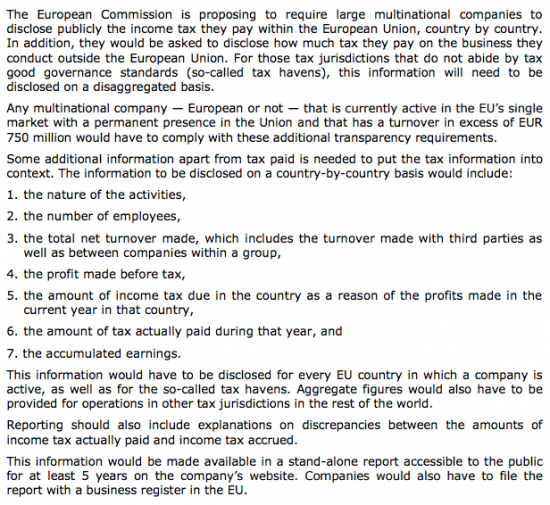

This is what is being proposed (in summary):

So what is missing? Let me offer a long list:

- There is no requirement to list all the jurisdictions in which the multinational corporation works. This is ridiculous. Of course they know where they work. Why not say so?

- There is no requirement to publish the names of all the subsidiaries working in each jurisdiction. Why not? There is an obvious need to be able to identify a company were it trades.

- The turnover figure includes both third party and intra-group sales but will not split them - so we have no idea how much tax risk there is in the intra-group transactions

- Why not employees pay as well as their number?

- How is net profit before tax calculated? Is if the figure in the group accounts for the jurisdiction or is it the local consolidated total. We are not told

- Tax paid is a nebulous number. We need a split between the current and deferred tax charge and then tax paid

- Accumulated earnings is I suspect meant to be a proxy for investment but ignores share capital and it would be vastly better to have data on tangible capital

But worse:

- We will have no data on developing countries who are meant to benefit from this disclosure

- The USA has killed all disclosure for anywhere out side the EU

- The EU has a very poor track recording in preparing tax haven lists

- If a tax haven is part of a larger state - as Gibraltar is part of the UK for EU purposes - then it appears data will not need to be disclosed for it. This will also apply in the Netherlands

- Most tax haven data will not be disclosed under these rules

- We will simply not be able to use this data to extract useful data from the accounts - and we will not even know if the information we will get will usefully reconcile with those accounts

There are other weaknesses - I am off to Sky to discuss them on air now.

But this is a disaster in the making that is, I suspect, designed to undermine the credibility of country-by-country reporting.

And yes, I am angry. Just for the record. This is the financial world denying people what is needed in the public interest. And this is no longer acceptable if society is to survive in anything approaching a democratic or accountable form.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I’ve probably missed your Sky appearance:o( Alex Cobham on BBC News did not show anger – it’s needed.

I did show anger

‘This is the financial world denying people what is needed in the public interest. And this is no longer acceptable if society is to survive in anything approaching a democratic or accountable form.’

But the ‘financial world’ has no interest whatsoever in the survival of society in a democratic or accountable form, as you well know, Richard. Neo-feudalism is the aim. And it is both ironic and deeply disturbing that while the fallout from the Panama Papers is in full flow we here have an example of the extent to which the ‘financial world’ can capture and turn to its own end a powerful and supposedly independent transnational governmental body.

We do know that

A lot of people still do not

I hope I revealed my frustration on air

This will also apply in the Netherlands

and quite possibly Portugal (Madeira)…

And EME may even interpret it as applying to the Crown Dependencies I suspect

You usefully make a distinction between current and deferred tax and then between tax paid.

Doesn’t the reference to the ‘amount of income tax due (ie arising and payable)in the country as a result of the profits made in the current year in that country’ refer to the same thing as your ‘current’ tax and exclude deferred tax which as is known is simply accounting ‘smoothing’.

If so then the disclosure requires the current tax charge on the profits in that country in the relevant year and also the amount actually paid in the relevant year. What more is necessary?

Do you want also a disclosure of the deferred tax figure and if so why?

I want data to reconcile with the accounts