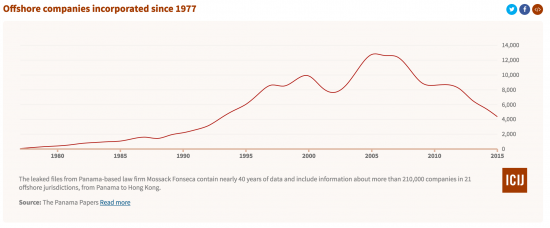

For me one of the most fascinating pieces of data to come from the Panama Papers was this graph from the ICIJ investigation:

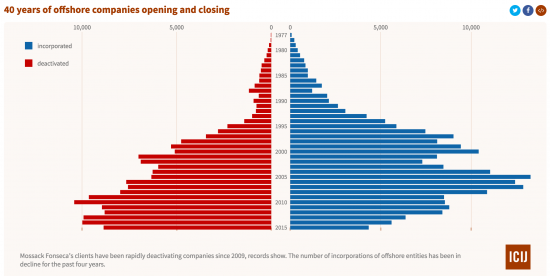

What this shows is the number of new offshore companies incorporated by Mossack Fonseca each year. The peak was in 2005, It is clear that that the economic downturn from 2008 had a major impact. But what is also clear is that there has been no recovery: the trend is inexorably downward and other data shows that the number of companies being dissolved now doubles the number of new ones being formed:

So what is happening? There are a number of possible explanations.

First, Mossack Fonseca is losing market edge, but that would not explain its closure activity, which is still a client service.

Second, it is the economic environment: there is not enough money to be made to make it worth hiding. When land dealing and other speculative gain is, however, driving most growth that seems unlikely.

Third, there the possibility that the campaign against tax havens is working. This really got going at the April 2009 G20 summit, at which I was present and where I was involved with a lot of pre-Summit activity. We did not get all that we wanted from that meeting. In fact, a lot of what was put in place was window dressing at best. And yet, what is clear is that thereafter there has been no recovery in the scale of tax haven activity.

I do not believe that this is all because of compliance activity by tax authorities. There is little evidence of that. So what actually had the impact? I suggest it was the increase in reputational risk. And that came from civil society, journalist and political pressure from the likes of Margaret Hodge. I can't prove that of course, but large companies are telling me the same thing now: they cannot afford to be seen to be in tax havens.

And that is why the Panama Papers leak is important. It has massively increased the perception of risk from using offshore. The appeal will be going down, no end. This will not stop the abuse but it helps increase the speed of travel in the right direction. I am not satisfied that is enough, of course, but it helps.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

My view is that the money has already been dealt with. Put another way parents have already formed the structures and children don’t have the cash to put away. Living in the World, UK or US for example is more expensive than it has ever been over the past 20 years. The deactivation is caused by people dying and family wealth split to help children.

It is entirely possible that Mossack Fonseca are losing their market edge, and that these closures represent their clients’ decision to conduct their business elsewhere.

Does the ‘spike’ coincide with a serious compliance event or prosecution at a major ‘feeder’ bank? Or a cross-border regulatory disclosure agreement with (say) Switzerland?

It’s also possible that a particular subset of their clients are cashing-out and retiring: can you think of any exemption, disclosure facility, or amnesty that might account for this?

I have every confidence that Mossack and Fonseca conduct these closures with the exemplary professionalism and integrity that underpins their reputation; and, in particular, that they are diligent in ensuring that their clients are in full complance with all regulatory requirements for document retention and disclosure.

They will, quite rightly, pour scorn and disapproval on their ethically-challenged competitors, who are rumoured to resort to indiscriminate incineration and the use of specialist IT consultants who ensure that no unauthorised electronic copies might exist: a company wound up by Mossack and Fonseca will be wound up properly.