I have already written this morning about the Institute of Director's wish to abolish corporation tax altogether and to shift the cost onto income tax, national insurance, VAT and council tax. This is nothing short of a demand that ordinary people pay more tax and companies and those who own them pay less.

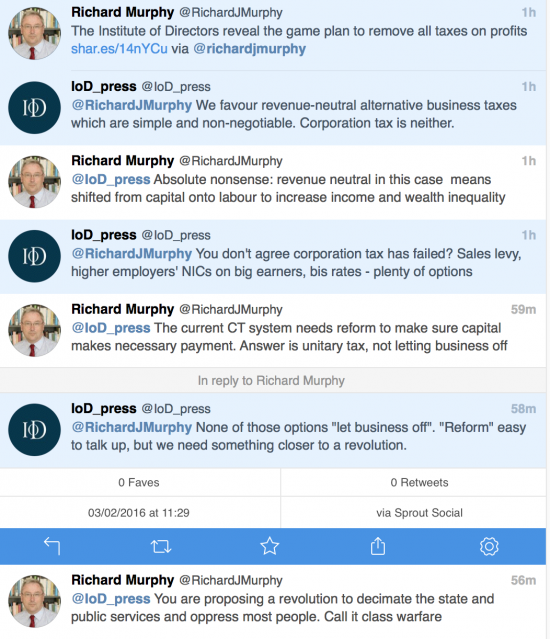

I tweeted the blog out, as usual, and the IoD responded as follows:

They were clear: the burden would shift as I suggested. Small business would pay more? Those on middle pay would suffer as their pay rates were oppressed by new NIC charges and we'd all suffer sales taxes.

And their response when I pointed this out? To demand a revolution.

I think I was right to suggest that's little less than a declaration of class warfare.

And that really worries me.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Sounds like it is time for a windfall tax on all money deposited in UK governed tax havens – it’s only right and proper to deal with all historic avoidance and evasion this way!

Agree on unitary taxation (no surprise the IoD is lobbying to reduce taxes on capital)

Richard you need to get behind land value tax. That’s they key to move taxation away from work and consumption.

I back LVT

But it can never do more than replace council tax

It is no panacea

In which case I don’t think you back LVT Richard.

If you say ‘backing’ is believing it is the solution to all problems I emphatically do not

Indeed, I consistently argue against any such suggestion: it is wrong at every level I can think of

Oh dear, Richard. LVT can replace Council Tax, Stamp Duty Land Tax, Business Rates, Section 106 Agreements and Community Infrastructure Levy immediately, and still leave half of the potential revenue to reduce VAT and basic rate Income Tax over time.

I was just about to support you here by recalling Radio 4’s Moneybox yesterday where the astute woman from IFS told the bloke from Adam Smith Institute that CT was not a tax on capital – which the georgists seem to believe. She later added the most relevant comment about Business Rates: that it is good in taxing land but terrible in taxing property (capital).

CT is a tax on capital

I say LVT can replace those things (but not SDLT)

And it definitely, unambiguously, will not reduce VAT or IT

Just can’t be done Carol: it’s that capacity to pay thing that matters and LVT is no indicator of that

Richard, you have obviously not bothered to read our paper A STRATEGY FOR REPLACING COUNCIL TAX AND BUSINESS RATESWITH A LAND VALUE TAX http://www.labourland.org/wp-content/uploads/2015/09/JonesWilcoxLVTpaperFinal-V2.pdf. Initially Council Tax and Business Rates are replaced by LVT on a revenue neutral basis for each local authority.

The most ‘unaffordable’ residential areas also have the highest percentage of rentals. Our strategy puts the tax on owners – with a higher rate on landlords, since they are businesses and should be paying the much higher rate property tax charged on other businesses.

I do not know how you can support the continuation of Business Rates which are, partially, a tax on working capital (unlike CT) and they are killing town centres.

And SDLT is a stupid tax which just hobbles the market. As for Section 106 and CIL, they are just there to be avoided – by not building the houses we desperately need.

I support LVT to replace all council tax

I have always said so

And in the Joy of Tax I propse how to replace SDLT

We are on a wavelength

Not to mention when the government attempts to cut tax credits while reducing inheritance tax – that’s class war.

It’s already begun Richard.

Like big business in general, the IoD knows that it’s pushing at an open door with this kind of suggestion, Richard. This government’s commitment to advancing the interests of the 1% is beyond question, and so, unsurprisingly, those who campaign for the elite are taking every opportunity to push the inequality agenda as far as they can. I’ve no doubt that there are plenty of signals coming from within government that corporation tax is a dead duck but that to “legitimise” changes the government need plenty of negative reports, investigations and complaints from interested parties (ie. big business) to which they can respond.

Big business (aided by the tories) seems desperate to move our attention away from the fact that they benefit massively from ‘corporate welfare’ as John McDonnell has coined it.

The recent ‘debate’ about taxing profits and now the above, must not mean that these groups set the agenda. Another great reason for the common people to be educated in the whole economic system and how the powerful manipulate it.

Also, groups like the Taxpayers Alliance should be sued under the trades descriptions act!! They certainly don’t represent this taxpayer!

And not in my name either. Tax Doddgers Alliance is a better description.

Something for nothing, the real attitude of the wealthy,cutting inheritance tax, corporate welfare, privatization of state assets and ending of all social benefits to the poor!.

Just wait: Next thing they’ll be moaning to the gov about losing car sales:

http://www.bbc.co.uk/news/uk-35476904

The change from Disability Living Allowance to Personal Independence Payment has been one of the cruelest things the last coalition government did. The Lib Dems in particular should be ashamed of themselves (we know the Tories feel no shame in inflicting harm on the weak and poor).

By changing the definitions and eligibility requirements for PIP in the Welfare Reform Act 2012 the government moved the goalposts so much for all disabled people that with one fell swoop hit many of the most vulnerable people in our society with a massive kick in the teeth.

The combined loss of DLA benefits, motability aids, carers allowances and a whole host of related benefits for millions of disabled people has for some reason stayed remarkably below the radar of UK politics. Sadly I believe the organisations that supposedly represent them dare not raise their heads too far above the parapet for fear of further cuts in government support.

There is such a climate of fear amongst all those who are dependent on the state through no fault of their own, that this country is starting to become a dangerously uncaring society which history shows is the start of a very slippery slope towards misanthropy and fascism.

“The history of all hitherto existing societies is the history of class struggles.” Line 1, chapter 1 of the Communist Manifesto.

What do you think of Lord Lawsons suggestion of a corporate sales tax?

I wrote about it a week ago – search the blog