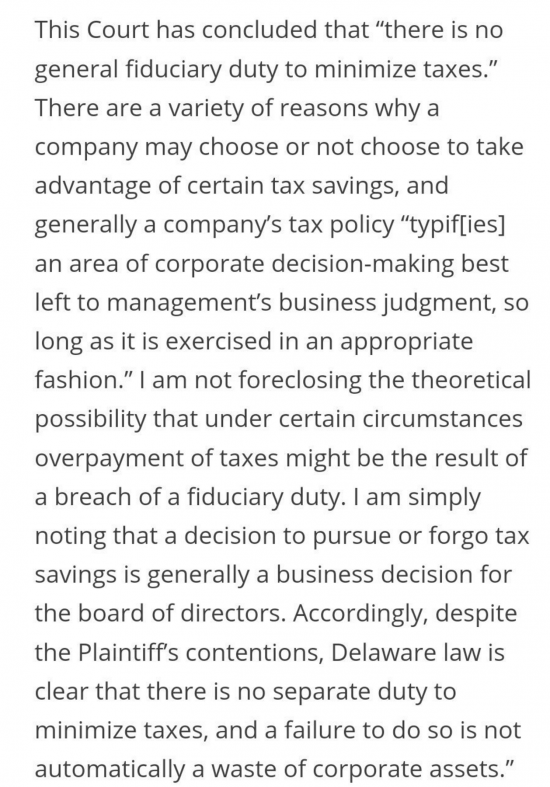

This blog is unashamedly borrowed from a tweet by Jolyon Maugham in which he noted a 2012 Delaware Court Ruling that said:

Given that Delaware is the place of incorporation of most large US companies it would seem we can now be quite confident of saying the same of US companies as well.

So that's another fiction kicked into the long grass.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Is this a bit of a straw man?

I have never heard of any suggestion of a legal/fiduciary obligation for directors to minimise their company’s tax. Can you link to any serious commentator who claims this to be true?

They are under the same legal obligation to minimise tax as Novak Djokovic is under a legal obligation to win a Grand Slam. They aren’t.

The point is that company directors and professional tennis players don’t need a legal obligation – the incentives are there for them to do it anyway. And those willing to have a go seem to float to the top.

Boris Johnson claimed it recently

It is widely stated

“Boris Johnson claimed it recently”

But Adrian asked

“Can you link to any serious commentator who claims this to be true?”

Politicians cannot be considered serious commentators on such matters. On all sides they just make noise.

But what of Adrian’s main point?

There is no specific legal duty not to overspend on raw materials nor for that matter not to pile up cash reserves and set fire to them but just as such actions would be bad management so would paying more tax than legally due.

As Adrian says, it is a strawman argument.

If a company incurred costs on machinery, did not claim AIA, and was then due to pay more tax than its cash flow could cope with as a result and so folded, would you not agree that this was a badly run company?

You might wish to present the straw man argument that politicians do not count

But it is bogus: when it comes to tax they very definitely do

Shall we argue in the real world?

Remember this throwback to 2012?

Eric Schmidt was very clear and bullish on the multinational corporations general view on paying tax and taking whatever legal steps offered by governments around the world to avoid it.

Google are not ashamed of avoiding tax, they are proud of it (that is capitalism after all he said).

They therefore deserve all of the negative press that they are getting at the moment (as do all the others who share this view).

Pity their share price and revenues aren’t taking a pummeling – why not you may ask – because they have a monopoly in online search and advertising (which is actually the bigger problem that still needs tackling)

http://www.independent.co.uk/news/uk/home-news/google-boss-im-very-proud-of-our-tax-avoidance-scheme-8411974.html