As the FT notes this morning:

Mark Carney said the Bank of England would consider making it harder for lenders to extend credit, in order to prevent a recovery fuelled by historically low interest rates from becoming dangerously unbalanced.

This is good news: credit bubbles precede crashes.

But there is more to it than that. Note this too, from the Guardian:

House prices in the south-east and east of England will jump by more than a fifth over the next five years, as growth ripples out of London into the capital's hinterland, but will remain subdued in much of the rest of the UK, according to estate agency Savills.

Savills predicts that the average UK house price will rise by 5% next year, but then slip back to 2.5%-3% a year until 2020, as tighter mortgage criteria and rising interest rates hold back home buyers. Its figures suggest that the average UK home will go up in price from £205,000 today to around £240,000 in 2020.

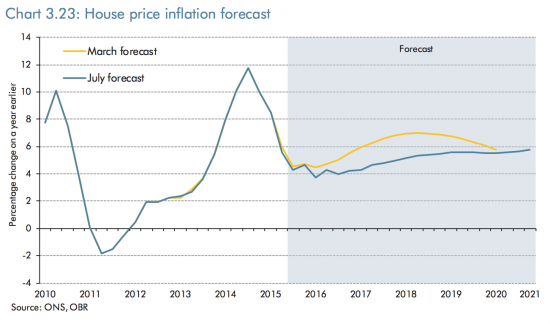

Then note this chart from the Office for Budget Responsibility forecasts in July, relating to house price growth forecasts:

The forecast is for a steady increase in prices, rising to 6%, fuelling an increase in demand for credit, of which domestic mortgages are by far the largest part when it comes to households, as the OBT admits.

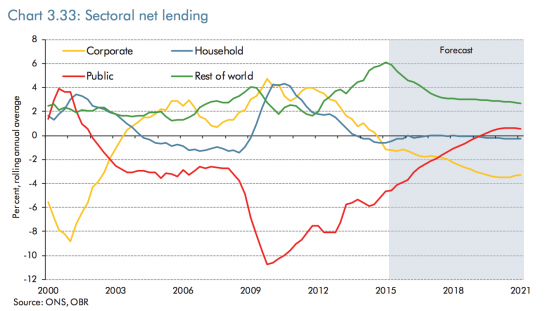

That's important because the OBR forecast that George Osborne was going to balance his budget in 2020. This they showed in their chart of sectoral balances:

I explained the significance of this chart in depth here, so I will not do so again. Suffice to say now that for the government to balance its books (the red line) others have to at least borrow as much as they have done before (households, the blue line) or borrow more (green and yellow lines for overseas factors and business respectively). If any of the corporate, household or overseas assumptions do not hold true then the government does not get to balance because every saver (the government in this period) requires there to be a borrower to balance the equation as a matter of simple double entry.

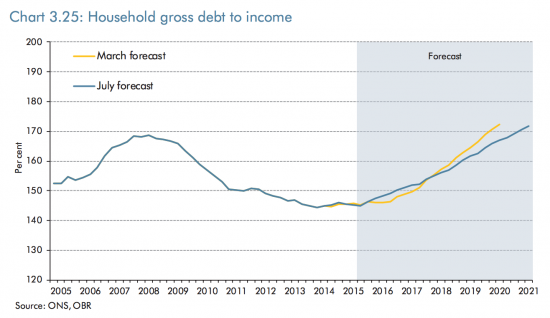

Now it looks as though households don't figure much in this equation, but to just keep households at the net non-savings position shown the OBR have to make this forecast on the growth of household borrowing:

Admittedly, as is clear, they slightly downgraded their forecast in July this year, largely because of house price concerns (they think unsecured debt, mainly relating to cars, will rise rapidly). But the forecast is still that household debt will exceed pre 2008 crash levels, and as the OBT admits, that happens in large part because of its house price increase forecasts.

Now suppose those house price increase do not happen, first because Mark Carney is going to restrict credit and second because estate agents do not foresee the demand or by some combination of the two. We should celebrate both of course: reduced debt reduces risk. Reduced house price increases makes housing more affordable. But it also means that it is likely that in net terms households will save. And if they do that George Osborne cannot balance his books.

And that is what has not been pointed out about Mark Carney's comments, yesterday.

And yet it is in many ways the most important political point to make about yesterday's Bank of England announcements: they're going to make life harder for George Osborne, and rightly so, but that should be explicitly acknowledged.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

But didn’t he say that the deficit was going to be paid off by now from 2010? Of course, that didn’t and couldn’t happen because due to falling spending, he had to borrow in order to stop the bottom falling out of the economy.

Trying to pay off a deficit and run a surplus is near-impossible anyway. To set a target saying you will pay off £90 billion in five years is pure insanity.

Sorry to be a bit pedantic but you can reduce a deficit or pay off a debt but you can’t “pay off a deficit”.

Having said that, you are quite right to suggest that the UK running a govt surplus is a “near impossibility” under present circumstances. This is largely because the external deficit in trade and other international payments is approximately 5%. So the government has to run a deficit of 5% just to keep things all square in the economy.

Forcing the deficit to below 5%, as has recently happened, is forcing the economy into recession.

Bit late in the day restricting credit for mortgage lending by about fifteen years-as a result houses can now NEVER become ‘more affordable’ because even if there were no increase from now we are talking about 40-60% income going on housing when anything above 25% was considered unsustainable.

Richard-what can Carney do to limit this lending for mortgages? There’s nothing in the tool box is there-Parliament could have done something but hasn’t due to free-market-fundamentalism. Nothing can be done with interest rates. The low mortgage rate is meaningless in relation to such absurd prices.

As you have explained before, it’s nonsense to say that a responsible government should run a surplus. But let’s pretend for a moment that it’s something we should aim for — what can ordinary people who are concerned about the deficit do to help?

What you’re saying is that every pound people save or pound they pay off from debts, regardless of how many millions they might pay in tax, is effectively increasing the deficit by one pound. So people who say the government should run a surplus who have a savings account are being hypocritical, and for these responsible people the best way to help clear the deficit is to spend all their savings and then borrow as much money as they can and spend that, because each pound of savings or borrowed money they spend effectively reduces the government deficit by one pound.

Companies then borrow more to spend on meeting this increased demand, spending less on government debt, thus closing the deficit. Although of course this is only the case if the responsible people spend within the UK economy, as spending it on foreign goods/services only increases the trade deficit rather than reducing the government deficit. And as this borrowed money would gradually be paid back, they have to keep borrowing more money, year after year, to keep the government in surplus.

Would there theoretically be any way for our government to close the deficit by heavily incentivising investment so that companies borrowed more to invest, spent less on government debt, and thanks to the extra investment exported more (lowering the trade deficit)?

Or would it only realistically be possible to close the deficit if as a nation we gave up saving and took up borrowing on a much bigger scale?

We have given up saving “as a nation”!

The govt’s deficit is more than entirely accounted for by the external deficit in trade.

http://www.3spoken.co.uk/2015/10/uk-sectoral-balances-q2-2015.html

So if you ask the question “what can ordinary people who are concerned about the deficit do to help?” the answer has to be ‘cut down on imports’.

The trade gap is still a form of saving of course. The big exporters don’t want to spend all the pounds they earn selling us stuff.

I’ve mentioned on a previous post that we should watch out for the return of the phrase “credit crunch” as a sign of impending doom. The FT article suggests that crunching credit is exactly what Mark Carney has in mind.

House prices have risen, not because incomes have increased but because interest rates have fallen and lending into the housing market has been excessive. Prices have also risen, as demand as risen, because there is an expectation they will rise further. There’s been a bubble in other words.

Well its too late to stop that now! So there’s no “good news”. The bubble will burst and we’ll have our crash.

What can stop it? Higher inflation and bigger deficits maybe. Just the kind of policy options the govt is ideologically opposed to. It’s going to be dire!