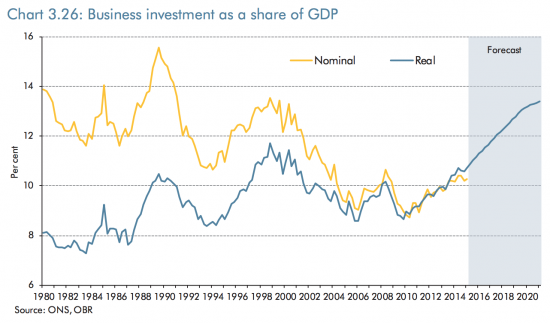

As I have long explained, if the government is to run a surplus within the economy somebody else has to borrow. That's basic double entry book-keeping at play at a national level. It's a fact that cannot be ignored or denied. What that also means is that if the government is to clear a big deficit somebody else has to borrow a lot more. This fact is reflected in the following chart from yesterday's Office for Budget Responsibility forecasts:

The bottom, red line, is government borrowing. The grey area is the forecast. And the requirements for a government deficit are:

1) Households stick with much higher lending then they did from 2009 to 2013

2) The overseas sector borrows much more in the UK (which effectively requires a significant improvement in the balance of trade)

3) Business borrows heavily, which goes against a trend that has been persistent from at least 2001.

Unless those happen as a matter of fact George Osborne will not clear his deficit.

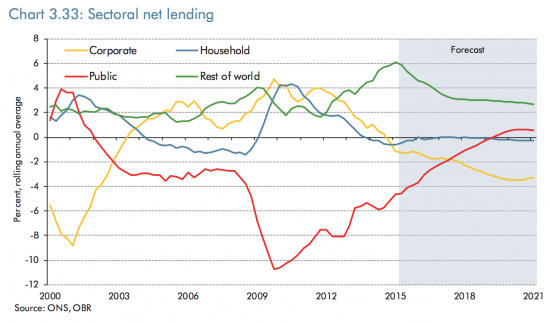

It's important to note that he has missed all his previous forecasts on deficit reduction and I have to say I think he will do so again. To illustrate the point, the apparently innocuous flat line on personal borrowing requires substantial increases in household debt, as this OBR forecast shows:

First, that implies a massive change of behaviour for which there is no evidence right now. Second, the resulting ratios imply dangerous levels of borrowing in the household economy that exceed pre-crash levels. The implications are obvious.

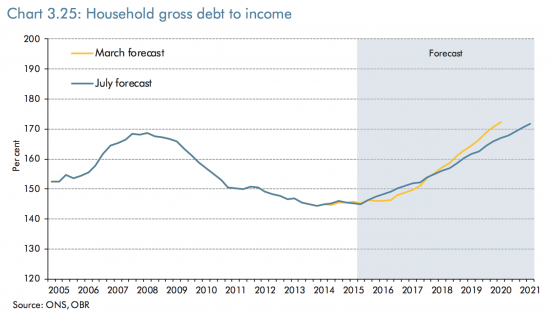

The assumed change in business behaviour is equally dramatic:

To get to required borrowing levels business investment will have to reach real levels substantially higher than anything seen in the Uk for the last 35 years.

To get to required borrowing levels business investment will have to reach real levels substantially higher than anything seen in the Uk for the last 35 years.

Someone is living in cloud cuckoo land if they think that this is going to happen.

And it's only in cloud cuckoo land that Osborne's budget will balance as a result because these assumptions are not just heroic, they are utterly implausible.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

And if Osborne misses those deficit targets he’ll be forgiven for doing so by those Tory voters and his pals in the rightwing media.

He’d be lauded for having his heart in the right place; after all the deficit will be ‘down’ and much lower than it was in 2010.

That kind of superficial analysis wins elections, as we saw in May. It doesn’t do the economy and ordinary people much good but politics trumps everything.

Agreed- Osborne knows it’s a ‘game’ and they know how to load the dice.

I find this very confusing. If the non government sector has to overall borrow in order for the government to run a surplus, who can they borrow from? Surely there is no other sector available to borrow from?

If the government runs a surplus it is repaying other sectors by paying down loans

I’m struggling now to believe that the burdening of “Nation States” with huge amounts of debt was done other than by design.

The treatment Greece has receved during the last couple of weeks does nothing to alleviate my suspicions.

Austerity is a deliberate policy to collapse nation states. GDP in the UK will fall again – but watch this covered up by various devices. Debt as a proportion of GDP will grow etc etc.