Jolyon Maugham has published an excellent blog today in anticipation of the Comprehensive Spending Review, due later this month. I strongly recommend reading it in full.

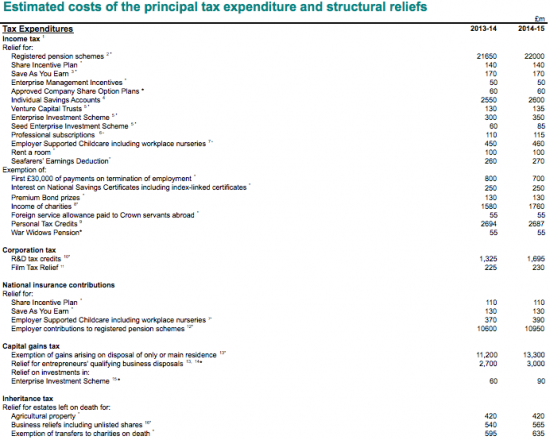

If I can summarise what is a long and detailed piece, Jolyon argues that tax reliefs given by government - or tax expenditures as they are properly called, as they are in economic terms the exact equivalent of spending, amount to more than £111 billion a year and are remarkably little controlled.

What is more, as Jolyon argues, some of the spends, such as that on the so-called Shares for Rights scheme, look to be deliberately mis-stated to hide their true purpose (in this case, bunging cash to private equity) or cost vastly more than anticipated, as my review of entrepreneur's relief at a total cost of £2.77bn in 2013/14, delivering a tax saving of a staggering £600,000 (on average) to each of 3,000 people showed.

Jolyon, rightly in my view, argues that these decisions, and the failure to properly monitor and control these costs is deliberate, and political and should be of cross party concern. I wholeheartedly agree with him. Just start with this incomplete list of tax expenditure to think what could be done:

First, for example, ask why the savings of anybody already wealthy enough to save should be subsidised when millions live in poverty in this country. The subsidies in question easily exceed £35 billion a year, and that's not taking into account the reduced tax rates at which capital gains are charged.

Then question what benefit R & D tax reliefs really provide.

And should there be capital allowances on as wide a basis as currently provided when it is not clear they are providing any real incentive for business to invest?

I could go on. But let me make four suggestions now.

First, if the Comprehensive Spending Review does not consider all these spends then let's be clear that it will not live up to its name.

Second, let's demand that review, and if the government will not do it, let's publish an alternative report.

Third, let's demand an Office for Tax Responsibility to monitor such issues, as I have long demanded.

And last, let's put sunset clauses into all allowances and reliefs requiring that they be re-approved by parliament and that such reapproval can only happen when a comprehensive review of the outcome against expectation and a cost-benefit analysis is provided to justify doing so.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Thank you, Richard. Reposted.

https://www.facebook.com/EqualityNW/posts/1070957696248789

“And should there be capital allowances on as wide a basis as currently provided when it is not clear they are providing any real incentive for business to invest?”

Why is it an outrage that business is taxed on profit rather than expenditure?

If over 4 years a business generates 300 in sales, spends 150 on employee wages/materials and 130 on a machine with a 4 year life to make their produce do you really think it is far that they should be taxed on 150 “profit” in that period rather than 20?

You’ll be shutting down a lot of businesses with your ideas.

Not all spending is allowed now

Please don’t pretend it is

Asking if we have the balance right is an entirely proper thing to do

We may conclude the status quo is OK

Not asking is the mistake

Can you give an example of capital allowances that you would scrap? That should not be taken into account when computing taxable profits?

As Jim says, the current system reflects commercial reality. Business spends on plant & machinery to enable it to operate. To suggest this is somehow wrong and a ‘taxpayer’ subsidy is absurd. To deny a tax relief for this expenditure would be absurd.

It’s all very well ‘asking the question’ but if you have no answers, what’s the point?

You admit you hardly have any clients whose tax affairs you handle. If you did you would know the benefit capital allowances and R&D tax credits bring to small businesses and that they do influence investment decisions.

Ivory towers are not the places to determine tax policy in the real world.

Leasing is an obvious place to start

When I first became self employed (mid 70`s) as I recall Capital allowances were (at least at my level) reclaimable 100% in first year – which to me seemed only just and obvious (NB I`ve never bought anything on credit). I recall being very annoyed when CA`s became partial and complex – early 80`s? – and remember thinking that this was another gift to the financial `industry`: saving your money and buying what you need could actually cost you more than going through a finance/lease company even with them creaming off a good whack in interest and fees.

By and large small business has 100% CAs now, and for them I approve: cash is an appropriate capital maintenance concept for them

Businesses don’t get to claim any tax back on depreciation of machinery, then?

No, they don’t

They only get capital allowances

No, depreciation is explicitly disallowed for tax purposes.

Capital allowances are more or less an analogue of depreciation. The differences are that you don’t normally track individual assets, and the rates are determined by the legislation rather than decided by the taxpayer (or their accountant).

And, quite importantly, not everything that a business would depreciate qualifies for capital allowances.

The last is key

But I would also improve our absurd CA system

Yes, I would improve it by having it cover more assets. To leave real costs out of account is, as you say, absurd.

No, it’s an exercise in discretion

There are no limits to the expenses a company can incur

There is no reason why tax should respect their judgement

Well..OK, businesses clearly can’t claim against tax for depreciation. However, significant costs can be written off with capital allowances.

“And should there be capital allowances on as wide a basis as currently provided when it is not clear they are providing any real incentive for business to invest?”

A “wide” basis? When so many categories of expenditure get no relief?

I think the question is why capital allowance aren’t available on all capital expenditure. The introduction of artificial distinctions such as capital/revenue is what makes tax complicated and unfair.

I think it possible to question whether some sectors require allowances

And in some cases prior clearance may be needed

So, for example, leasing capital allowances is an obvious place to start

Having allowances available to some sectors and not others is another of those artificial distinctions that leads to unfairness.

Why would you want to deny relief for economic costs?

Incidentally, what is the matter with leasing these days, in your view? It’s been pretty heavily reformed of late.

Unfairness is based on what the sector does

Not on its tax treatment

As I argue in The Courageous Sate, finance and advertising are prime candidates for estricted allowances for that reason

Sorry: are you saying that, because you don’t like certain sectors of the economy, they should be taxed on an arbitrarily penal basis?

Of course

All tax is charged for social reasons

Read The Joy of Tax

I see the Capital Gains exemption for main residences is included in the list…

Please oh please add that to your recommendations for removal of tax relief!

Let’s see if all that new politics from Corbyn is real or not?..Let’s see him decide to remove tax exemption from selling homes and really kill his chances!

You keep saying nothing is untouchable and that politics should not drive economic or social justice decisions so go for it!…..see where it gets you!

P.S. If you want sunset clauses on changes then we would also have those for all your new tax increases……still keen for sunset clauses?

All tax increases have sunset clauses

Rates are set annually

As for housing – don’t you realise most of our hosuing problems of unaffordability are precisely because of this exemtpion?

PPR is essential if you are not to lock homeowners into the same house permanently – or force them to move every year or so to make use of the annual exemption. Charging capital gains on sale would make moving an economic impossibility for huge numbers of families.

Read what Howard Reed has said

That is a dodge, you could argue the same with allowances and tax relief, they are all set annually by the budget if required……

So why the need for sunset clauses?

As to housing the capital gains exemption is very much part of the problem, I just don’t think you will get any serious political party suggesting its removal!.

Do you want it removed?…..Do you think it should be Labour Policy to remove it?…..You are very big on principles so write an article suggesting its removal…

I bet Labour would run a mile and disown you, but then you are not interested in politics so why would you care?

I think you should read the Joy of Tax

And as for Labour, if you honestly think I write anything to gain favour you are deeply mistaken

The PPR exemption has very little to do with the current housing unaffordability. PPR is available in some from or another in most developed economies. The real reason house prices are so high is because not enough are being built.

That is not true: housing has come to be seen as a store of value because of its enormously favourable tax treatment combined with overall very low inheritance tax rates

Supply issues compound this but when supply was plentiful values still rose

In terms of the CGT exemption for main residences, there’s really no economic justification for it on either efficiency or equity grounds. Removing it in one fell swoop would perhaps be unpopular but that’s only because many people in the UK live in this brainwashed mindset where property gains are the only legitimate source of wealth. I remember that in the 1980s people said it would be impossible to get rid of MIRAS because homeowners would revolt; well it was gotten rid of (gradually) and now no-one really misses it. If introduced gradually I think CGT on home sales would be just the same. (Particularly if it replaced Stamp Duty!)

Agreed

Let’s see: a family buys a house for £250,000, and sells it after 10 years of 2% inflation (a remarkably *low* figure, you’ll agree).

That gives a gain of around £55,000, which would give tax of around £9k after two annual exemptions.

Make it 5% price inflation and you’re looking at over £30k.

Are you telling me that adding £9-30k to the cost of moving from a fairly modest family home will have no adverse impact on families?

So house price inflation might drop

Which is the goal

What problem do you gave with house prices becoming more affordable?

What would the benefit of that be?

“That is not true: housing has come to be seen as a store of value because of its enormously favourable tax treatment combined with overall very low inheritance tax rates”

It is a myth that property has “enormously favourable tax treatment” – UK property taxes are the highest in the developed world. See the link below.

http://www.theguardian.com/business/2013/nov/07/uk-property-taxes-highest-developed-world-policy-exchange

I wouldn’t say that property attracted “very low inheritance tax rates” either. There is at the moment no exemption for the main home from IHT, and the rate of 40% is hardly low.

“Supply issues compound this but when supply was plentiful values still rose”

When was the last time supply of UK housing was plentiful?

Respectfully, that ref is to what are effectively local authority taxes

Either address issues or don’t bother to comment here

“So house price inflation might drop

Which is the goal

What problem do you gave with house prices becoming more affordable?

What would the benefit of that be?”

The example I gave was of a tax charge where there is no real house price inflation. You would create a cost which would trap people in their current houses – it would be equivalent to a negative equity situation.

The old saying is that you tax things you want to discourage. CGT on a PPR would be taxing people moving house. What problem do you have with people moving house?

So cut stamp duty and it looks pretty neutral

I recommend the end of stamp duty on housing in The Joy of Tax

Won’t this policy just lead to a complete lack of liquidity in the housing market? Generally people either move because they want to upsize, or because they are at retirement and want to downsize and release some funds to live on.

Taxing them will just mean that people can’t upsize because they won’t have sufficient funds to do so after the tax.

Retirees will see less point in freeing up large houses because the Government will take 40%. Might as well live in lots of space instead of giving it to the Government.

Has stamp duty stopped the market?

No, of course not

Nor did the end of MIRAS stop the market

End Help to Sell.. Er I mean Buy

John Maynard Keynes’s most pertinent insight was that for a healthy economy it makes sense to first recognise that spending should equal income but although desirable savings (hoarding) “undermines” the balancing of spending and income. Government privileging a few as opposed to the many through “spending” on tax breaks results in further “undermining” of the balance since much of the “spending” ends up in hoarding for a wealthy few. This is a classic example of human beings failing to recognise that sole reliance on the “greed impulse” needs to be modified by “belief” which stems from experience that allowing excessive hoarding undermines economies.

Excellent report. Whenever I teach union reps and tell them about how tax and NI really works they are all astounded and get very angry at the injustice. I also explain how tax breaks never help the lower paid clearly the chart above is a major indicator of that.

Who really pays for the public services from schools to public transport to pensions….average worker who can afford to pay NI and Tax. More should be taught in schools about how tax and spend really works. Keep up the good work, always keen to read your blog.

Thanks

JJ – what do you mean by “how tax and NI really works”?

Your “average” worker likely doesn’t pay enough in income tax and NI to cover their share of public services over a lifetime so as unpalatable as it may be in union circles, it’s the higher earners covering the shortfall. They aren’t the bogiemen you to make them out to be.

Of course the other way to cover the shortfall is government borrowing which the Tories seem pretty good at.

There is quite deliberately no link made between services supplied and tax paid

And you also wholly miss the point that services are provided up irrespective of tax paid

Tax recovers spending made with the six objectives I explore in The Joy of Tax

If people want to make statements like “Who really pays for the public services from schools to public transport to pensions….average worker who can afford to pay NI and Tax” then I’d suggest this is certainly a link between tax paid and services received.

But the language is wrong

We pay in total, not individually

“We pay in total, not individually.”

A succinct response which I suspect will need unpacking a fair bit if any progress is going to be made in aiding understanding and comprehension as to how the world actually works.

It would seem appropriate as a starting point to set some homework by asking those who are stuck in the limited reductionist mindset to try looking up some basic systems concepts, like emergent properties. Understanding that the whole is greater than the sum of individual parts is not exactly MENSA level thinking.

It’s life Jim, but not as you (currently) know it.

“Understanding that the whole is greater than the sum of individual parts is not exactly MENSA level thinking”

No it’s not. But for the Left it would seem to be more of a comfort blanket for those who in reality consume more than they contribute.

Let us not forget that we got here in the first place by a poster wanted to vent at the nasty high earners who don’t contribute. That seems to be the Union view.

No, that is your caricature

Which reality would that be then?

Would it, for just one example, be the reality in which the Government’s own fraud agency statistics find that the cost to us all from individual and corporate high earners defrauding on their tax obligations is often up to ten times the amount lost in benefit fraud – which itself is more than offset by the amount saved in benefits by those at the bottom not claiming their entitlement?

Whoops, did I just commit a faux pas there by referring to the high earners “defrauding” instead of the more neutral sounding descriptions of “avoiding” or “evading.” I really should remember to more ‘umble by sticking to the convention that it is only those at the bottom of the heep for whom the term “fraud” should be applied.

Or could it be the reality in which high earners are heavily subsidised by taxpayers money from the majority of us. Such as, for just one example, the way pension liabilities for former public sector organisations, which have been privatised, are still on the Government’s books showing up as Government liabilities? For sure, all those who work or used to work for these organisations are covered, including the high earners as well as the front line troops.

A chap by the name of Peter Medawar once said (funnily enough at a MENSA conference) that theories destroy facts. In that instance what he meant was that a general theory can remove the need to record large quantities of isolated facts. Of course the context he was talking about was the way we tend to observe underlying simplicities in the way the physical universe works.

However, like anything else in life it can work the other way around in other contexts. Facts can destroy theories. And the fantady theories that the majority of non high earners, individual or collective, take out more than they contribute, whilst the individual and collective high earners contribute more than they receive is destroyed by the real life facts.

Not that the real world reality which operates outside of the internal reality which exists inside the heads of the army of Uriah Heeps* who regularly infest the world and the internet will prevent them troll, troll, trolling along to touch their forelocks and doff their caps; queuing up to die in a ditch defending the right of a minority to take more, because we all know those they consider their (and our) betters can never ever have sufficient, whilst pretending that black is white and it’s really the other way around.

* Although Heep is a fictional character it seems reasonable to owe him an apology here. His character was putting on an act. Trying to work an angle. He was not sincere. He did not really believe. In short,he was far from self delusional.

“Whoops, did I just commit a faux pas there by referring to the high earners “defrauding” instead of the more neutral sounding descriptions of “avoiding” or “evading.””

Well what you did was deliberately cloud evasion verses avoidance which is a pretty lame and obvious tactic.

Benefit fraud is tiny in comparison to VAT evasion in the shadow economy (for example) and 4/5 times smaller than corporate tax avoidance. What’s your point? Completely irrelevant to where the money comes from to contribute the most towards public services.

From reading the rest of your post, you seem to inhabit a fantasy world detached from reality that simply matches your own rhetoric.

There is ample reason to think evasion and avoidance have the same intent: free-riding the economy

So someone given a choice between paying the most in tax/NI by setting up as a company and paying a salary or setting up as an LLP and so avoiding employers’ NI entirely and paying class 4 NIC and so avoiding the higher rate of Class 1 employees’ NIC is free-riding the economy?

And someone who when he did operate through a company chose to pay himself dividends and so avoid NIC altogether was also free-riding the economy?

Or is there a special class of “OK” avoidance reserved for special cases?

Because most avoidance is having a legitimate choice and choosing that which pays the lower tax/NI, just as you yourself have done throughout your business career.

There can be no avoidance of NIC or indie using an LLP: I oay exactly what I would as a self employed person, which I have been for 31 years

And when I paid dividends the sums involved were not enough to trigger any NIC as I recall it: applying PAYE would have required admin for no payment

But why let facts get in you way?

The point (as you well know), and it’s your point Jim not mine, is about who puts in and takes out the most. That would be the point you introduced to the discussion.

But seeing as I like you today (I might not like you tomorrow) I’ll give you points for irony. Deliberately forgetting and avoiding your own point when called out on it and then avoiding answering the real life facts by dismissing them as detached from reality is zen level chutzpah. It was probably a kindness on my part not to mention the details of the relative levels of positive and negative contributions between the average working taxpayer and the oxygen breathers for the financial bail outs of the banks; or the levels of agricultural and industrial subsidies enjoyed by the “high earners,” you so stoically defend, paid for by the contributions of the majority of average workers.

Bottom line. On the point you brought up, about who contributes and takes the most, the facts do not support the position you have taken. Deal with or get professional help because the dumb choices based on faith based made up claims which do not stand up to scrutiny which people like yourself make don’t just affect yourselves, they impact on everyone else.