HMRC has just published new data on capital gain tax and the reliefs given from it.

One of those reliefs is the so called Entrepreneur's Relief, which can be described as a scheme that is open to directors who own 5pc or more of a company, and which allows them to enjoy a 10pc tax rate on the capital gains they make when selling shares in the companies they own up to a lifetime limit of £10m. This compares with the 28pc rate of tax payable without the relief.

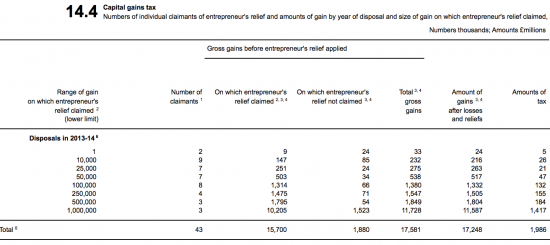

The data on this relief for the tax year 2013/14, the most recent available, is as follows according to HMRC:

Almost two billion of tax has been paid by those claiming Entrepreneur's Relief.

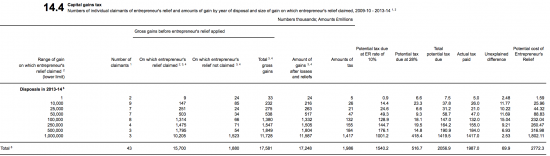

Now, what would have been paid if they had not enjoyed this extraordinary tax rate of 10%? To work this out I have weighted gains subject to the relief and not subject to the relief by the ratio of chargeable gains to total gains and then estimated the total tax due on each part of the gain and compared that estimate with the actual tax paid. The resulting table is this (click on it for a bigger version in another tab):

The key data is in the, admittedly rather small, right hand columns. My tax paid estimates are right within £70 million, which means I am 96.5% accurate, which is plenty good enough for this exercise. And what that tax paid estimate then suggests is that Entrepreneur's Relief costs £2.77 billion in tax foregone in 2013/14. Staggeringly, £1.8 billion of this cost represents tax savings to just 3,000 people in the year at an average cost to the Treasury of £600,000 each.

If you then remember that this is also only calculated by comparison with the 28% tax rate at which capital gains are currently, and in my opinion quite inappropriately, charged when I think normal income tax rates should apply, then this loss is actually significantly understated. If these gains were actually taxed at income tax rates (and I see no reason at all why this should not be the case, not least as Nigel Lawson did this) then the annual cost of this relief is £5.39 billion and the relief to the top 3,000 recipients increases to £3.5 billion at a cost of £1,168,000 each.

These figures are not freaks by the way: if the total cost of Entrepreneur's Relief in 2013/14 at actual tax rates was £2.77 billion then in 2011/12 it was £2.15 billion and in 2012/13 it was £2.17 billion.

So if anyone is looking at how to pay for tax credits here's my answer. In 2013/14 just 10,000 people between them enjoyed tax relief worth than £4.6 billion when Entrepreneur's Relief was compared to the full income tax rate. Three million people are to lose £4.4 billion in tax credits.

Isn't it obvious that these absurd reliefs on capital gains should go to pay for the tax credits families need to make ends meet.

And if not, why not?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

“If these gains were actually taxed at income tax rates (and I see no reason at all why this should not be the case, not least as Nigel Lawson did this)”

As you well know, Retirement Relief existed back then which was essentially the same as today’s Entrepreneurs’ Relief. RR in fact dated from the introduction of CGT in 1965 and was only abolished when taper relief was introduced in 1998 (which again was essentially equivalent to today’s ER).

The fact is that there is a long history of capital (or certain capital) profits being taxed much more lightly than income profits. The rationale for this has always been that there is more risk attached to capital than income (and that is unquestionably true – the cost of equity is far greater than the cost of debt to a company). Whether that justifies the current differentials in rates between income and capital is another matter, but let’s not pretend the differentials never existed, or that there is no rationale for doing so.

To pretend this has something to do with risk is absurd

Since when was tax risk related?

I have to make an obvious point. When chancellors want to encourage or discourage particular activities they adjust the applicable tax rates, in this instance they want to encourage risk taking entrepreneurs by allowing their resulting gains to be taxed at a lower rate. You can question the wisdom of the approach, whether it produces the wider societal gains hoped for and so forth.

But I don’t think you can’t write the article you have and then ask “since when was tax risk related”

I can see no reason at all why tax encourages entrepreneurship

So the entire relief in my view is wasted

“Since when was tax risk related?”

As I stated in my original post(which you appear not to have read particularly closely), there is a long history of capital being charged to tax more lightly than income. For many years capital was not charged to tax at all, and when it was, it has for many years been taxed at lower rates than income often significantly so.

Similarly IHT has for a long time relieved (in the form of BPR) trading companies – which are inherently riskier than passive investment companies which do not attract that relief.

I make no comment as to the efficacy, desirability or otherwise of these reliefs. I am merely making the observation that government has always relieved – to varying degrees – what it deems to be risky activities.

And you appear to have not noticed the fact that I disagree with this policy

“I can see no reason at all why tax encourages entrepreneurship”

An entrepreneur generally seeks to maximise his returns. Tax reduces those returns.

Tax is not the only, or even the main, driver of entrepreneurship. But it is clearly an important one.

You have clearly never met a real entrepreneur

Believing the world is the same as an economics textbook you will never experience reality

I can see the logic for Entrepreneur’s Relief. The justification for it is that it’s a good way to incentivise people to grow their own businesses (which employ people, pay corp tax/VAT etc). Surely that principle is acceptable? I think that, to encourage risk-taking, it makes sense to have a tax concession of some kind.

Where I think ER goes off the rails is in a) the reduced rate, which (compared to a main CGT rate of 28%), is too generous; and b) the amount on which the lower rate can be claimed. It started at £1million when introduced by Labour in 2008; was quickly increased to £2million then, when the Tories came to power in mid-2010, it was immediately raised to £5m then £10m the next year.

It’s worth remembering that a business owner who sells at a gain of £10million gets to keep £9million of that (compared to £7.2million if they paid at 28%, or £5.5million if they paid at income tax rates). So it’s not as though they lose out or are left short of cash with which to pay the tax.

If we accept that the principle is correct, then where would a fairer balance lie? And don’t be too fooled by the Lawson years; yes, IT and CGT were both 40%, but CGT was in practice less because indexation allowance served to reduce gains in most cases.

I also think the qualification of only 1 year’s ownership is too generous for ER. If it’s genuinely about building a business, rather than about investing with an eye on a sale in 2 years, nobody should have a problem with that ownership period being raised to 5 years. At a stroke, that would cut out a lot of speculative private equity-type transactions.

So perhaps impose tax at (say) 75% of the main CGT rate (so currently 21%), on a value up to £2million (index-linked), only after 5 years’ ownership.

Would that sound a better balance? I can’t believe that a special allowance of ‘only’ £2million would put off a would-be entrepreneur. That certainly covers the circumstance of the genuine small business owner, who has spent their lives carefully building up a modest business of the type we are constantly told is the lifeblood of the UK economy. That £2m is just the gain, remember, not the sale price.

Tom

I never knew a person who ran a successful business where ER or its predecessors motivated them

Maybe I was lucky who I met, but I think the real link is very remote

I agree we have the balance wrong: I’d be less generous than you

Richard

I have a lot of successful businesses as clients where ER is a key motivator. In fact I’ve had some comment that without it, it wouldn’t be worthwhile trying to grow the business at all.

I suspect that they are over-stating their case, but they definitely pay attention to tax rates and are encouraged by ER.

Bear in mind that ER comes after CT at 20%, so the effective tax rate on profits reinvested in the business is 28%. If one were to ditch ER and tax all gains at 28%, the effective tax rate would be 42.4%; if one were to apply a 40% income tax rate, then ETR would be 52%. That would be very discouraging – it would seem better to take profits out of the company than to reinvest them.

I personally think that ER is a bit too generous, but it serves a very useful purpose.

I have to admit I think you have a very strange client base

Or odd hearing

Perfectly ordinary SMEs. A lot of family companies, a fair few with wider ownership, a number of partnerships and LLPs, and so on.

I can’t really say how they differ from yours, as I have no idea who your clients are – you don’t talk about them much.

I don’t have many these days

That can’t be a surprise to anyone

Andrew

Richard Murphy appears to be unique amongst tax advisers in that he apparently never had any clients who asked him how they could reduce their tax bills or who generally wanted to pay as little tax as legally possible.

The experience of every other tax adviser I know is that different clients have different risk tolerance levels: a small minority do not care for any sort of tax planning and will go with a structure that HMRC cannot possibly challenge; a similar number will always want to go for the most aggressive route; and the others (majority) will generally be keen to hear any “smart” advice that the adviser has to offer.

Robin

I picked clients who wanted a low risk tax strategy to concentrate on the real deal – making money

But most accountants have no clue how to advise on that more important subject so they resort to lowest common denominator tax advice instead

Which is one reason why we have such a poor SME sector

I was about to bridle at that slur on my colleagues, until I realized that you were actually complimenting me by saying I do lowest common denominator stuff, whereas my accounting colleagues are clueless.

So thank you for the rather left-handed (and entirely inaccurate) compliment 🙂

Did you benefit from taper Relief when you disposed of your partnership interest?

I recall that Taper Relief could reduce capital gains to an effective rate of….what was it again? oh, yes. The extraordinary rate of 10%. When at the time CGT was payable at up to 40%, not just the 28% top rate now.

Perhaps you could recalculate the tax you would have paid without benefitting from Taper Relief and donate the difference to a family losing tax credits, thereby setting a good example.

I think you’ll find I sold at the time of highest possible CGT on such a sale

Agree with all of this, but would add that its always seemed to me that favourable tax rates on capital gains and especially entrepreneurs relief encourage business owners to realise their gains earlier than they might otherwise do, rather than grow their businesses on. This because its always better to take “income” as a capital gain than, as it were, as income income. So it encourages a short termism

Any thoughts Richard?

It does indeed encourage sale

It also encourages a tax driven view rather than an added value one

Not entirely related, but many of the people getting ER, have probably been paying themselves minimum wage salaries, and taking the rest of their income by way of dividends. Would be interesting to know how much this costs the public purse

I’ve not found that. It encourages people to grow up to £10m per shareholder – no-one wants to sell a business at £1m if they think they can keep growing it and hold on to 90% of the increase in value.

To get income as a capital gain you’d have to keep selling the business and starting a new one, which is counter-productive: growing a business is easier than starting one. You could try restructuring to generate capital gains while retaining control, at which point HMRC would issue a s698 notice and tax you at dividend rates anyway.

I wonder how many of these ER claims are from private equity management teams – in other words, not at all the ‘owner entrepreneurs’ at which the relief is aimed.

We’re often told by David Gauke and the BVCA that PE can’t claim ER because the companies through which they hold and dispose of investments are regarded by HMRC as investing not trading; though if that’s true, it’s funny that a number of leading London law firms continue to talk up ER benefits for PE, and that many of them have been publicly fretting about changes in the March 2015 budget that appear to disqualify ManCos for ER (i.e. they’re fretting about the removal of a relief that the government claimed didn’t exist in the first place.) Equally, London law firms are already tentatively offering new structures to allow PE teams to requalify for ER.

So not only is it an incredibly costly relief aimed at the moderately-to-super-wealthy, but may also be being used by wealthy PE executives who may not have much skin in the game at all. Not so much Entrepreneur’s Relief as Mayfair Fund Managers’ Relief.

You may well be right Mike

Not sure what you are talking about. Pe management teams can obviously claim ER. Pe execs in a fund cannot claim it. I think you are confusing the 2

Oh, how simply you represent things

I advise Pe management teams and Pe execs so I know the rules very well thank you and yes the the rules for qualifying for ER are very simple

Mike – I agree (and good to see you commenting on here, by the way: we met a while back when you were looking at the ‘Mayfair Loophole’).

I do a lot of work for PE bods and ER is definitely a factor in a lot of disposals. It’s too easy for it to be used as a method of cutting tax on what was only ever a shortish-term investment, which is one key reason why, in my much longer post above, I suggested that a five-year ownership condition ought to be imposed (as this would cut out most PE transactions).

Anth (below) – PE execs generally have incentive shares and also ‘carry’ shares (i.e. ones which they are given the opportunity to buy at a lowish value and then sell once their targets – to which the incentive shares are linked – are reached). It’s very, very rare for PE execs not to have a degree of skin in the game through the carry, especially where a very low valuation has been finangled up front which makes the carry shares very (some might say artificially) cheap.

Thanks Tom

I think the five year idea is good

Of course that can create a problem though – many options carry a seven year limit

Yes the have carry and coinvest interests. The fund dosent qualify as trading for er purposes though does it. Base cost shift is also now dead and dimf rules deal with the mgt fee point

Perhaps you could enlighten the readers of the blog how a Pe exec in a standard uk fund can get er on their carried interest?

It’s also worth mentioning that tax credit cuts won’t reduce the deficit by £4.4bn. Recipients of tax credits can be expected to reduce their expenditure, presumably by the greater part £4.4bn, given they are on low incomes to start with. That will reduce GDP, and tax receipts. It will also put other people out of work (or partly out of work), as a result of which they will claim more in benefits, and they too will spend less. The latter effect will again reduce GDP, and tax receipts. And so on. Allowing for all these effects on tax receipts and benefit claims, I’m guessing the deficit reduction might be nearer to zero than £4.4bn – but i’d like to see a proper estimate.

Tax credit cuts will also reduce GDP, presumably by more than £4.4bn. So even if they do reduce the deficit a little, the debt-to-GDP ratio will rise. Setting aside the human cost, is it fiscally prudent to reduce the deficit but increase the debt-to-GDP ratio? The ratio is the obvious measure of how big the debt is.

(Beneficiaries of “Entrepreneur’s Relief” might also be expected to reduce their expenditure a little if they had to pay more tax, but by a much smaller percentage of the extra tax paid, given that they are much wealthier to start with.)

You are speculating on the multiplier impact of these cuts

I would expect it is very high indeed because not just those immediately impacted but those who will not spend out of fear will reduce spending

The saving will, as you suggest be very low

It’s plausible it could be negative

The economist Michael Hudson has always said that the main burden of tax should be put onto rentiers and money from financial gains (which CGT is) instead of on earned income like it mostly is now.

I believe he is bang on the money with this view.

Although generous I think the Entrepreneur’s Relief is quite useful for a number of reasons :-

1) It keeps certain businesses going that would otherwise be shutdown, the owners are willing to pump money in, take no salary and keep staff on because one day they can take a big lump out at 10%. without that golden pay day many companies would be closed as the capital employed goes looking for a quicker return.

2) The kind of person that makes a big gain and saves all this tax does not, in my experience, put it in the bank!……They fidget at not running a business and invest it in a new startup or buy into a failing company.

3) It gives a better return to “Business Angels” who put money into small companies which means less has to come from the company to give a certain net return. It also makes risky deals look more attractive meaning certain companies get a chance when otherwise they would not.

In fact just four years ago I saw a company sold at over £4m in 2008 run into trouble in 2011 and fall into liquidation. The original owner bought it back and put in the capital required to save it (with 104 jobs) and get it back on its feet.

He only had that money because such a small amount was taxed at sale……

So what you are saying is business can only survive with enormous state subsidies

It’s an interesting idea

Letting someone keep some more of their own money isn’t a subsidy. Is a personal allowance for income tax purposes a subsidy for someone on 25k? Or is it just when it comes to people who start businesses?

In this case it is very obviously a subsidy

This is a discounted tax rate

And the question is, do those on tax reluefs have greater value than fax credits?

My answer is emphatically, no

If it’s a subsidy then so is a personal allowance. Any tax break is. Indeed by your logic if you tax me at 90 percent then you’re giving me a 10 percent subsidy.

Talking of things like this and capital allowances as subsidies completely undermines the arguments of the Left, some of which are valid.

Too boring to argue with

There is no serious analysis of tax which disputes my logic

is’nt the concept of someones’ money being ‘there own’ of rather dubious provenance?

If I remember, rightly, Richard, in a lecture (which you published on this site) you pointed out that there’ is ‘no such thing as Taxpayers money’ thereby blasting away the myth that is often bleated out.

I’m not sure what the legal status of ‘ownership’ is with regards to money in general (though in the case of banks it can, in the case of ‘bail ins’ magically become their property) but I suspect that Jim’s notion of ‘own money’ is a rather simplistic concept that bears little relation to the fact that the money is issued by the Government and it can call it in, devalue it, change its name and denominations any time.

Republished now

Your fault!

“This is a discounted tax rate”

It is not a discounted tax rate, it is simply the tax rate for a disposal which meets qualifying conditions. I could argue, equally absurdly, that the 28% rate of CGT represents a subsidy of 18% from the taxpayer to the government, being the difference between 10% and 28%. In fact if you take your logic to the extreme you could basically argue that any tax payment is a subsidy to government.

I agree with the other poster who says all this talk about reliefs and exemptions being subsidies is just silly.

Please feel free to ignore the whole question of tax spends if you wish

The debate on the reality of such issues will progress without you because the reality is that what I suggest is consistent with generally accepted economic ligic, including that of HMT

@ Andrew Jackson:-

“I have a lot of successful businesses as clients where ER is a key motivator. In fact I’ve had some comment that without it, it wouldn’t be worthwhile trying to grow the business at all.”

I think the micro-organisms in your body busily cooperating with each other to keep you alive need to have a word with your brain and its delusional psychological egotism which keeps endlessly replaying the same old question “What’s in it for me?” If your micro-organisms kept asking themselves that same question you’d be a pool of sludge on the floor!

Amusing as that reply (possibly) is, I am not sure that it’s fair.

In my experience it is rare for an entrepreneur to be driven by tax considerations from the start. It’s not at all common for a genuine entrepreneur (as opposed to a PE investor, who already has plenty of wonga to invest in what is essentially a financial investment on a medium-term scale rather than a business to be built) to look at tax first up; they want to build a business because they’ve got a good idea to which they are prepared to commit.

When they approach the point of sale, tax starts to enter the equation. In my career, the only people who have come to me in that position already equipped with a detailed knowledge of the tax position are the PE guys. The ‘I’ve built this business making widgets for 30 years from the ground up’ types, on the other hand, are often pleasantly surprised by how generous the tax treatment is, which rather suggests that it was never what motivated them in the first place.

Tom

My experience too

Real entrepreneurs build businesses because frankly it is the only thing they want to do and in many cases the only thing they can do

Like me, they found the idea of a boss impossible and as soon as they can go out on their own

And you’re right re the tax – I had that experience last summer when advising someone. ‘Is that all?’ was the comment when I gave a cautious (over) estimate

Richard

Richard Murphy says:

October 30 2015 at 6:42 pm

“So what you are saying is business can only survive with state subsidies.”

Very true.

Capitalism is independence or it is just big or small corporate welfare and thus not capitalism at all. Indeed I think trying to micromanage what businesses do by giving very specific tax incentives is an insult to any capitalist. Is he his own man or not?

If he is just blindly following tax incentives he is extracting himself from society. (Unfortunately that has been encouraged by government, but it doesn’t make it work any better for the general good).

Isn’t this rather ignoring the point that at a tax rate of 28% or higher it’s likely people’s behaviour would have changed and some may well have made different decisions, so unlikely that it would ‘save’ all the money you calculate.

Longer term ownership may result, I agree

But I doubt it: only fools are driven by tax and not price and if there is no tax plus or minus then tax neutrality is achieved – and when people want to sell they usually know it is time to quit, in my experience

Why not be radical and treat all income the same and tax accordingly? Of course we would then need simpler accounting rules and less jobs for the boys, which is unlikely to get the support of some so called professionals. Transparency is always welcome to shine lights into dark murky corners, which this blog and many others help to achieve.

In the Joy of Tax I do argue that in essence all income is the same, form wherever it comes

Including gifts

I think it the right starting point for thinking about tax

Anything else starts from prejudice

Surely there should be a difference in the rate of taxation of earned and unearned income.

I think so

But you start from the point all is equal and then justify why more or less

We have most of those justifications wrong right now

If cgt was at income rates, while the ‘rich’ would pay more than anyone. However gains (presumably) on scale of the 40p rate would disproportionately pay more. Ie a gain of up to £150k taxed at 40% compared to say a gain in the six figures would pay only 5% more.

Interesting, however lets be done with the whole system.

Pull it all down, slap on a low rate Tobin tax with no exemptions (i.e. universal coverage on all financial transactions) and make redistributive decisions through the welfare system based on community values / decisions. Would then be possible to cut through the haze, have a 5 page Tax Act, and release all tax accountants and tax planners to work overseas or pursue truly productive and beneficial occupations.

I support a transaction tax

But there is no such thing as one tax fixes all problems

And there never will be