George Osborne will announce tonight that he wishes to deliver perpetual government surpluses. I have already discussed some of the social implications; this blog is about whether he can actually achieve that or not.

My answer is that such a policy, that would take economics back to the logic of the Victorian era, is not achievable in the 21st century. The logic is simple, and straightforward, but needs explanation and is based on what is called sectoral balancing. I have discussed this issue at length before, many times, so let me link to another person's explanation instead. This is Frances Coppola's version, and has the merit of showing this is something the Office for Budget responsibility knows all about.

The principle is simple and is that there are just four sectors in the economy. They are:

- Consumers = C

- Government = G

- Business, whose investment = I (their current trading is of course part of the flip side of C, and we must not double count)

- The rest of the world, represented by the balance of trade = E

Now as a matter of fact the surpluses and deficits run by these groups must arithmetically balance in monetary terms, because double entry does work: every debit does indeed have a credit.

So if we use the same letters C, G, I and E to represent the net savings or borrowings of these groups in a period then:

C + G + I + E = 0

So, if consumers borrow someone else must lend. And if business invests then someone else must run a surplus. Most people have problems with the net trade part of this: it works by saying that if we net import i.e. do not pay for all we acquire, then people from overseas save here and if we net export then we save overseas.

Now, let's rearrange the equation and G, which is the expression for government surplus or deficit is expressed as:

G = -C - I - E

Or

G = (C + I + E) x -1

The government surplus or deficit is, in other words, the opposite of what is happening with consumer debt, business borrowing to fund investment and the net trade balance.

What G (or the government surplus or deficit) is not is an independent variable that can be controlled in isolation. It is dependent upon what happens elsewhere in the economy and what the equation makes clear is that if the government deficit is to fall then either consumers must borrow more or business must invest more or net exporting must improve. Those are the only options unless the attempts to cut the deficit, G, are reflected in real falls in GDP, i.e. the net total sum of activity in the economy is reduced because the attempt to cut G reduces the money available to spend and we get recession.

So what chance is there that because George Osborne has announced he is to cut the deficit for good that we will see more consumer sending (and so borrowing), more business investment (and so borrowing) and more net exports?

I think we can dismiss the export issue straight away as a source of a solution. Europe and the US remain mired in slow growth economies and nothing we do will change that. Nor can I see China sweeping more of our exports soon. They seem more intent on buying our assets which is a process helped by our current trade deficit with them. So any salvation here looks unlikely.

That leaves consumers and business needing to borrow more if Osborne's attempts to cut the deficit are to work.

As a matter of fact consumers are saving less in the UK than they were: savings as a proportion reached over 8% in 2009 having become almost non-existent in 2007. They then fell back to 5.5% in 2013 but in the 2015 budget (page 108) the OBR forecasts savings to rise to 7.3% of income by 2016 and then stabilise at about that level. In other words, if people are, overall, going to increase their saving they are in net terms going to reduce their borrowing (the two are the inverse of each other). So there is no chance of deficit reduction coming from this source; the opposite is in fact likely according to this version of OBR thinking.

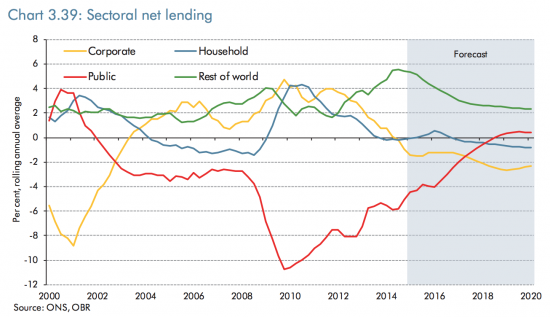

Is business investment the solution? According to the OBR it is. This is their forecast on all four sectors until 2020:

Bizarrely, despite saying the consumer savings ratio will rise they forecast more consumer borrowing. That's a hard position to maintain. Only one of those statements can be true. Let's ignore that for now.

Instead let's note that the OBR faith that exports are going to boom to reduce overseas net saving here is, politely, bizarre.

But so too is their expectation on business borrowing where large businesses (who do most investment) are stubbornly sitting on massive cash piles running to hundreds of billions because, to be blunt they can think of nothing to do with it because consumers are not spending and their other big customer, the government, is saying it's cutting its budgets.

In that case I do not think there is any chance at all that the chart will work out anywhere near what the OBR forecast.

Worse, in fact, the commitment to cut the deficit will actually make it much harder to achieve this goal. People will save more as they will know that the sate will not provide them with a safety net so they must provide one themselves. This will reduce borrowing and increase saving, the exact opposite of what the government wants to happen if the deficit is to be cut. And, in the light of this, business will not invest because both consumers and government will be retrenching and overseas markets are not looking good.

So the deficit will continue, come what may, and whatever Osborne says tonight.

Except it will be worse than that, because George Osborne is making another mistake. He thinks he can cut to a surplus when the reality is that the only way to a surplus is to get consumers to borrow more, business to invest more and overseas to buy more of what we make. These options of cut or promote activity are not alternatives, as the basic formula shows. If you want to cut the deficit you cannot cut to achieve that goal: you can only stimulate what is not happening. Osborne has simply got his logic wrong.

But in that case what will happen if he does cut? The answer is threefold. First, he will stimulate the exact reverse reactions from those he wants as already explored here, and the deficit would actually get worse.

Second, he will steadily withdraw money from the economy - because that's what reducing government spending does. The result is GDP will fall. Incrased saving and a lack of investment will compound that.

And because he will have reduced cash from the economy when there is no lending to make good the shortfall (and remember it is only bank lending and government spending that can create money) he will trigger a liquidity crisis that could also trigger banking problems, a fall in GDP or a crash, or all three.

It's not a pretty picture.

And it's all because George Osborne does not know that C + G + I + E = 0.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Austerity always hits spending.

The Tories have caused MORE national debt by the admin of a tsunami of welfare reforms, with the trebling of staffing of sanction decision makers and huge IT projects that usually end up nowhere.

Passing such a law would actually hit the Tories, who cannot achieve that goal, having spent more in 5 years than Labour did in 13 years.

People will not spend. There is no state pension and no housing benefit coming with changes already here or in the pipeline. This hits people in work.

The rise in employment has been to the working poor in casual insecure temporary part time low waged or low income self employed and they will be hit by cuts in housing benefit and working tax credits, with permanent sanctions under Universal Credit.

Social housing will be gone. So the ‘temporary’ housing in bed and breakfast and single room for an entire family in a hotel will become the norm – more expensive.

Bedroom Tax will just raise evictions with court and bailiff costs and push people into the above. More expense.

The huge rise in starvation has impacted NHS hospital budgets and GPs budgets to care for adults and kids and the rise in premature birth and health consequences of starving pregnant women and families with kids.

The flat rate pension hits new pensioners next year hard.

Half of over 60s are within the working poor being hit by welfare withdrawal

when bosses are not paying anything like a Living Wage.

The flat rate pension is a CUT to basic state pension NOT MORE

or even NIL STATE PENSION FOR LIFE and denies pensioner benefit of

NIL PENSION CREDIT (savings)

so against Tories being a party of ‘hard working people.

https://you.38degrees.org.uk/petitions/state-pension-at-60-now

Osborne might not know what that formula is, Richard, but as you rightly point but the OBR does. So having read the report of what his speech will cover I note that he makes reference to the role the OBR will play in his return to Micawber Economics and that all will become clear when he gives his emergency budget. In which case I wonder what the hell the people at the OBR are being expected to produce to support Osborne’s approach (given that we already know that their role is not as independent as they might like people to believe), because as you point out here, unless they reinvent the formula his logic – and thus the policy – is fundamentally flawed.

We’ll see on 8 July

“Passing such a law would actually hit the Tories, who cannot achieve that goal, having spent more in 5 years than Labour did in 13 years.”

I have no doubt that the Tories won’t be able to run a consistent surplus, but you are mixing up debt and deficit here. Osbournes proposals are about deficit – total debt is irrelevant. Whether Tories or Labour were in power in 2010, the total debt was going to be astronomically higher in 2015 due to the deficit at that time.

I am mixing nothing – Osborne wants to cut the deficit to repay debt

As he will if he succeeds

I think you are doing the mixing up

I’m addressing “Pension Sixty” who says Tories can’t run a surplus because they have doubled the debt. The debt is a natural consequence of the deficit, and doubling debt because you inherited a massive deficit is no indicator as to whether you can run a surplus in the future.

The only twisted logic I can see behind his thinking is that he believes if he can find £100bn worth of stuff to privatise quickly and conjures up a surplus for 2015 then public confidence in his financial wizardry will stimulate the economy sufficiently to put the country into surplus in following years.

Bizarre

But possible

Although it would be false accounting, of course

Interesting stuff Richard.

Given that that the import/export gap is relatively small compared to the deficit, and the average joe isn’t in much of a position to make personal savings, I assume the cash stockpile held by corporates is the biggest issue at present if the deficit is to be reduced?

What happens if these companies pay out their cash as dividends and they go to overseas shareholders? I assume this forms part of the trade deficit with rest of world?

Personal assets and savings are larger than corporates

Heavily skewed of course

And you must recall that repaying a mortgage is saving in economic terms

I see – I didn’t consider mortgages as savings but that makes sense.

With regard to the equation “C + G + I + E = 0”, how did you see the various components in, for example, 2005 when Brown was running a deficit, but also people were borrowing like crazy in the credit boom (and indeed expanding their mortgage facilities to pay for consumer spending)?

I don’t mean in regard to the rights/wrongs of Brown running a deficit, but more where the money went to bring the equation into balance? Did we have a very large trade deficit at that time?

G was small (yes, I mean that)

C was high

I was modest

And yes, you have E right

It is possible that George Osborne spends too much time at his leaders dinners listening to elites from the finance industry. But that does not make sense either. Unless they think that it does not really matter if people can pay their debts because with unlimited liability we will get a bailout anyway.

It is strange how neoliberal chancellors suddenly recognise that they have full control of the sovereign currency when the banks are failing and have billions issued to the commercial banks from the Central Bank to provide liquidity.

As described by Francis Coppola’s sectorial balances, bank money leverages high powered government money, so government will have to pay in the end. The deficit will happen anyway, but Osborne’s way is more painful, especially for those at the bottom of the wealth pile.

There is a very good piece here by an MMTist Stephanie Kelton who describes how deficits will happen regardless, except some are good (those that lead to full employment), and some are bad, (those caused by mopping up a crisis).

She coined the term “deficit owl” and describes how these “owls” view deficits, as injections of high powered money that the economy must have, preferably to create a well managed society with full employment, not to bail out banks after making people live on credit and poor incomes.

http://mediaroots.org/dr-stephanie-kelton-modern-money-theory-explained/

Osbourne is a vandal – purely and simply. The only people who will benefit from this will be the lenders as money production will be left to the banks who will continue to issue it as debt along with interest – further destroying the value of any real money people will have of their own.

Hopefully, someone somewhere will stop this nonsense but it is highly unlikely for now – we are on the road to nowhere.

La-Bore and the Limp-Dems (sic) are trapped by this narrative that Government must not produce money and leave it to the markets.

I’m so angry about what I’ve read here and in the press this morning that the least I can say is that it has shook me out of me election induced stupor. I need to find an outlet for this somehow because it’s getting rediculous – our politicians have just lost the plot completely. We are being governed by imbeciles!!

We are not being governed by imbeciles, they are clever, its just they have a very different agenda than what you think they should have or that they present as their public face.

I shouldn’t criticise the gov too much, people tend to get locked away for that now!

http://akashictimes.co.uk/uk-enforces-law-which-bans-public-from-criticising-the-govt/

Or not!

Seriously though…I consider it likely that social media is shortly going to be the subject of actions to close-down, or have their actions limited: by law.

As for Osborn…he’s nobodies fool, and he knows exactly what he is doing.

He is solely a political chancellor.

That risk is real

http://www.theregister.co.uk/2015/06/11/download_festival_big_brother_playground_leicestershire_police/

More than ever, Osborne’s nonsense/cunning plan reonforces my belief that violence and rioting in our streets moves ever closer. What a disaster endless reliance on propaganda supplemented by voodoo economics is going to bring down on most peoples’ heads.

So, does this mean that governments must always increase deficits? Or do they just keep them at a steady level? If they always increase deficits, surely a point will come when all spending is done by the state.

I do wish you’d engage a brain before coming here

Very clearly this does not mean what you say

It is very obvious that it is possible for a government to run a surplus – and some do

But it is very unlikely in the UK now

Was that so hard to work out?

The external balance can also improve by slashing imports – which happens when you stop people having any income.

So if you split the economy into two halves: George’s mates and the rest of us, then you can have George’s mates saving loads while the rest of us borrow up to the hilt for essentials.

So no money to buy imports and the external balance improves, and extra borrowing by the plebs to offset all that lovely saving of George’s mates and the destruction of the public sector.

It’s a popular plan amongst George’s mates – as currently implemented in Greece.

Ultimately we will get what we voted for. And the more of George’s medicine we get perhaps the less Liz Kendall’s we’ll see.

So every cloud has a silver lining.

Excellent points, Neil, but what worries me is that there will be pressure for EVEN CHEAPER imports which means more environmental problems and the exploitation of somewhere else. All this the result of a highly in debt populace – we’re living in the land of numpty writ large.