I have already mentioned the risk in double taxation today and I am going to do so again.

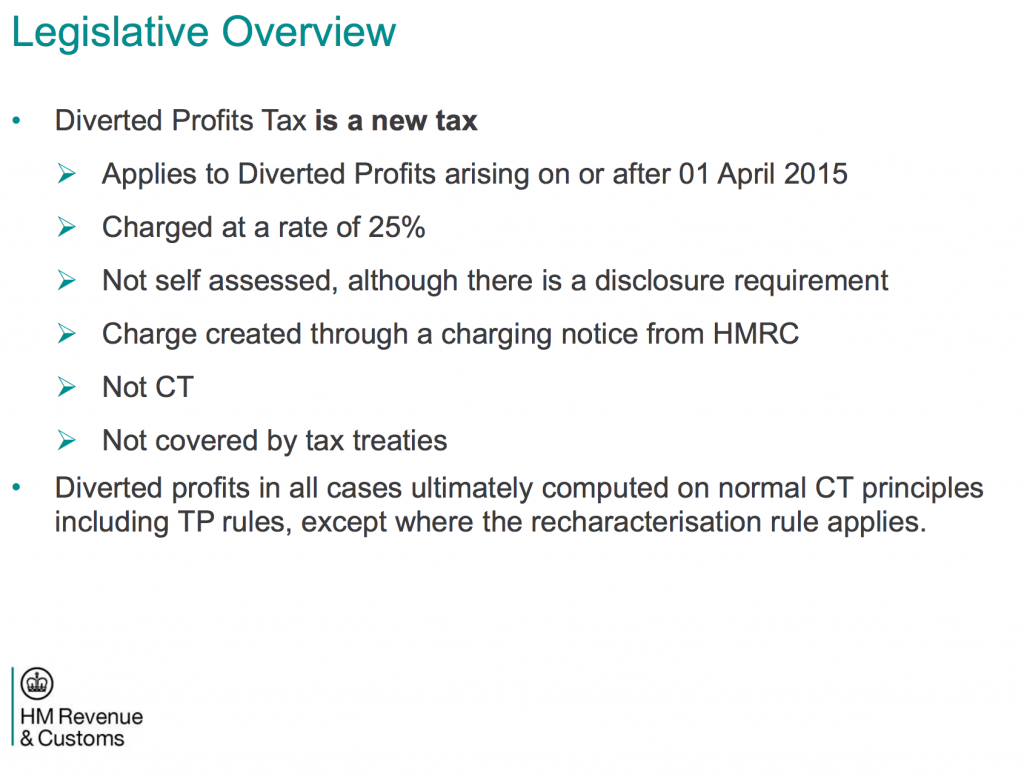

Having mentioned the risks inherent in the government's proposed Diverted Profits Tax this morning this arrived in my inbox at lunchtime relating to this tax:

The sting is in the last two bullet point. This is not corporation tax and it is not covered by tax treaties so there is no credit anywhere else for tax paid here.

Now, it could be argued that there is good reason for that: the aim of DPT is to make sure no one pays it and does instead pay appropriate corporation tax instead. I get that point. But it would have been so much better to have achieved the goal with a proper general anti-avoidance principle. Or to wait for BEPS to conclude.

As it is we have a whole new tax and a mess, from a Conservative chancellor.

Remember that if they ever accuse Labour (0r anyone else) of doing something similar.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Do you think the UK would deny unilateral double tax relief for profits that are taxable in the UK, but are subject to a non-UK DPT charged elsewhere, even if the DPT doesn’t fall within the terms of a double tax treaty?

But did you get to slide 49?

“the company is allowed a credit against the payment of DPT for taxes paid, that are calculated by reference to the profits being charged to DPT. For this purpose taxes can include:

– corporation tax; or

– a non-UK tax which corresponds to corporation tax.”

So the UK DPT charge is reduced to the extent that the “diverted profits” are taxed outside the UK (see section 19 in the draft legislation).

That said, I agree with your main point – this legislation appears to be designed to change behaviour so companies don’t run the risk of it applying.

The problem with this tax is it appears entirely arbitrary and tht is no basis for a tax