I have already blogged on one response made by HMRC to my new reports on the tax gap as reported in the Guardian this morning. The first response was to my comment on tax abuse by companies. The other response was to my use of VAT gap data to suggest the total value of unrecorded sales in the UK. Of this work HMRC are reported to say:

This is a seriously flawed study based on, among other things, a significant overestimate of the UK's VAT gap. HMRC's estimates, produced under the Code of Practice for Official Statistics, show the overall tax gap is £35 billion and falling as a percentage of tax owed.

I am amused first of all by the claim that HMRC must have their data right as it confirms to an official code when, as must be obvious, that code is basically written and published by them. I do not take such comments seriously in that case. It's as good as me saying my work is right because I wrote it, and no one with any sense would ever do that.

More important is the suggestion that my work is seriously flawed. My response to that is that if it is then HMRC must be largely responsible because I have used their data, with the odd twist as noted here.

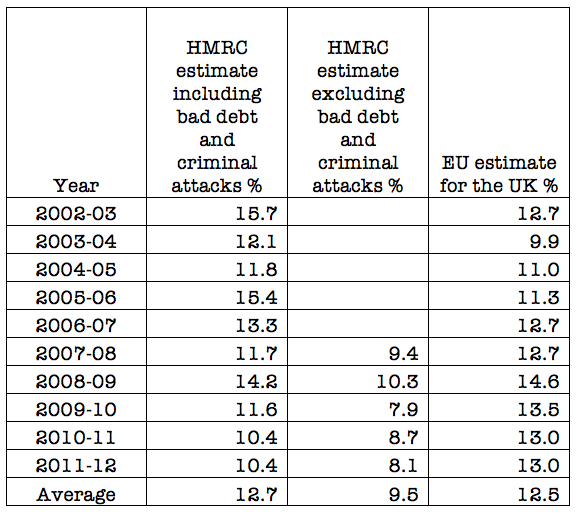

Firstly, I adjusted HMRC's data because they said that the VAT gap was 11.4% in their latest tax gap estimate. I have only used a figure of 9.7%, which is somewhat lower. That's because I cut out their figures for criminal attacks on the VAT system and bad debt because I felt it inappropriate to extrapolate such data to lost sales; clearly that would be inappropriate. On the other hand I did ignore VAT avoidance, because HMRC suggest it is virtually irrelevant. And nor could I ignore EU estimates of the VAT gap and the trends that they showed. Their data is referred to on page 51 of my detailed report and the differences are summarised here:

The EU actually, on average and before bad debt and criminal attacks in both cases, thinks the UK has a lower tax gap than HMRC does, but the trend is very different. The marked recent downward trend HMRC has found is not matched in HMRC data. Given that overall the two strongly agree I took the HMRC data for VAT lost to criminal attacks and bad debt off the EU estimate then averaged the two over five years to come up with my estimate as a base for projection of 9.7%. HMRC may say that's wrong: I would suggest it's fair use of data. I think the likely result from doing so statistically appropriate.

Next, I took the EU's estimate that only 53% of the theoretically possible VAT yield is collected in the UK because of exemptions, allowances and reliefs. Taking the factors into account, and then assuming that the VAT gap occurs at the standard VAT rate of 20% (possible because of the compensating adjustment in the EU data for allowances, exemptions and reliefs) I could gross up the 2011/12 VAT gap net of bad debt and criminal attacks to suggest the total missing sales in the UK - which happened to come to £100 billion. Full explanation is in the report.

The question to then ask is whether it is wrong to use this top down approach and to even then apply it the resulting loss of income tax, national insurance and corporation tax, which is what HMRC clearly imply. Unfortunately for them in doing so they ignore advice provided to them by the IMF when that body reported on HMRC's tax gap methodology in October 2013. As the IMF noted (page 45 and on), HMRC really should in their opinion try top down modelling of the direct tax gaps to prove the logic of their claims made based on the analysis of tax returns they actually receive (which is the basis of much of what HMRC do now and which is bound as a result, ad by virtual definition, to omit a loot of tax evasion by those not submitting returns). How do they suggest this should be done? As they say (para 69):

One possible approach would be to start with the top-down VAT gap analysis

That's exactly what I did HMRC. It's a shame you won't also follow the advice you've been given because then you would find, as I have, that your tax gap estimates are ridiculously low. I'd suggest as a result that it is HMRC who does not understand the data or its implications. You could of course ask why that is. Is it, as I suggest in my report, that they want to turn a blind eye to the obvious, even when those who advise them tell them to think again? It does look very much like it. And, in the meantime, I'm happy to say HMRC are very simply wrong, without saying that my figures are emphatically right because I am well aware that they are indicative of outcomes that are bound to fall in a range. That range would not, however, plausibly include HMRC's estimates.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

“It’s as good as me saying my work is right because I wrote it, and no one with any sense would ever do that.”

Yet that is exactly what you are doing.

You clearly can’t see the massive flaw in your calculation and your logic.

You gross up the VAT gap to a total amount of unrecorded sales – 100bn – on p56.

You then suddenly, on the same page 56, call his 100bn of unrecorded sales as unrecorded *income*.

You’ll note that income and sales are not the same thing – it’s the same difference as turnover and profits. You then apply average tax rates to the 100bn as it if were income, rather than turnover, to get to your 40bn tax gap.

This is of course completely wrong. You cannot conflate sales with income and then assume tax payable on the basis of it. Moreover, both HMRC and the IMF specifically acknowledge this, which is why they give separate treatment to VAT, corporation and non-corporation taxes.

Nor have you given any economic treatment of the shadow economy itself. Some economic activity would simply stop if it were taxed, some would be reduced and as a whole the shadow economy would be smaller, reducing GDP.

It’s also worth pointing out that this is a completely circular argument. Any VAT gap whatsoever would grossed up by diving by 20%, then by 47%, then multiplied by whatever estimate of further taxes avoided you use, to give a significantly larger number than the original tax gap quoted by HMRC. By the very definition of your calculation your tax gap can never be lower than HMRC’s, and HMRC’s value will only be a lower bound when the VAT gap is zero.

It’s pretty obvious that such a test is statistically unsound, aside from what has already been mentioned.

Maybe you should have sanity checked your answer first. Using your number of 1trn for total sales, one could have easily worked out a quick and dirty estimate for VTTL.

VTTL = 1000bn (sales) x 0.20 (VAT) x 0.53 (VATable goods) = 106bn

Even this simple calculation comes relatively close to HRMC’s estimate of 109.8bn, and they receive 98.4bn, for a VAT gap of 11.4%. After deductions for missing traders and bad debt, that reduces to 8.9bn or 8.1%

You’ll also notice that the IMF said this of HMRC:

“In general, the models and methodologies used by HMRC to estimate the tax gap

across taxes are sound and consistent with the general approaches used by other

countries.”

The quotes you’ve rather selectively picked out from the IMF paper are recommendations for improvement or alternative analysis, not a decisive criticism of what HMRC are doing in their methodology.

You really did not read the paper did you?

I did not suggest that the income equalled profit. I suggested it was value added. And that’s not the same thing at all. I very carefully addressed the point, at length and am quite sure I am right

As for the IMF comments – what they note is that HMRC is good at using the returns they get – although I doubt that based on their own data. What they very clearly said is they are not good at finding data outside those returns.

I think your comment wholly ideologically driven because there is remarkably little substance of any sort to it

I’ve read the paper through a couple of times now.

“I did not suggest that the income equalled profit. I suggested it was value added.”

This is simply not true. For example, on p54 of your report you say:

“So if VAT is not paid to HMRC by a business it follows that the sale to which that VAT relates is also not recorded. That means the direct taxes due on that sale such as income tax, national insurance and corporation tax are also lost.”

Also on p54, whilst describing your example of VAT suppression on a sale of 5,000:

“Tax on the net sum of 5,000 after VAT is also lost.”

Here in your example, you treat the 5,000 as income, and apply NICs and income tax to it.

You are directly relating sales to income. Most damningly, you later go on to say on p56:

“An estimate of the overall tax lost can be done in a number of ways. It could be based on the overall tax rate due on unrecorded income of 100bn. For example, in 2011-12 about 36 per cent of GDP was pain in tax. This would imply an overall loss of 36bn arising from this tax gap.”

You are directly stating that sales = income = profit, which by doing so enables you to jump to applying an average tax rate to this “income”, thereby claiming your inflated figure for the tax gap. You spend pages 54-56 making this very argument.

And wages come out of value added

So too do profits

You clearly have no idea what you are talking about

Please do not waste my time – because I will not be engaging with an analysis that is so obviously profoundly wrong. After all, since when was PAYE paid on profits?

let’s phrase this in a way you understand.

The VAT gap alone on this 100bn of *sales* would be:

100 x 0.2 x 0.53 = 10.6bn VAT gap

Using an average rate for taxation in the UK, on 100bn of *income* (not sales) one gets the answer:

100 x 0.36 = 36bn of tax due

Using your model, on 100bn of *sales* you give us an answer of 36bn for the “tax gap”. You then round this up to 40bn.

You are saying that the missing tax on 100bn of sales, where they may be no net profits, so no income or corporation tax due, is greater than the amount of tax due than if those sales were entirely booked as profits.

I know you’ll defend yourself to the bitter end, but it doesn’t change the inevitable outcome.

The £100 bn is missing added value

I explore this issue in detail in the report

And you just show your ignorance of VAT and the concept of value added using your arguments

It so happens the IMF does agree with me…..

But you have already dismissed that view

Your claims are, very obviously from what I have written, wrong

“And wages come out of value added”

No, wages for most companies are a cost, before profits or EBITDA if you like.

“The £100 bn is missing added value. I explore this issue in detail in the report”

I’ve searched your report for the words “value added” using the search function in adobe’s pdf reader. They aren’t in there. You have 100bn sales, which suddenly becomes income.

“It so happens the IMF does agree with me…..”

If so, can you point to a paper of theirs discussing your work on the tax gap? I can’t find one offhand. The IMF seems to broadly agree with HMRC’s methodology, which is similar to the EU’s, whilst recommending some potential improvements.

Going back to that famous 100bn of sales/income/value added. You’ve treated that 100bn in a very specific way. Why in that case haven’t you treated the other 900bn from the total 1trn in the same way, as “income”? Using your logic, 360bn of tax would be due on it.

Is that 1trn number even anywhere near correct? The data we have available suggests it isn’t. Household spending/consumption is running at just under 1trn a year, before accounting for business activity, government spending etc, a lot of which is also clearly subject to VAT.

You haven’t applied a top down analysis. You’ve taken data from a bottom up analysis and then projected up some numbers. True top down analysis would involve taking all the different vatable sectors and drilling down through the data provided to estimate how much VAT is actually due, and how much paid.

I reiterate: if you do not understand the tax you are looking at you make yourself look very foolish

And you are

In VAT terms labour is value added

As the IMF agree

And of course I have not treated the other £900 bn as income as it is not

But it’s your final para that is really funny: that is how the VAT gap is calculated

It seems you are unwilling or unable to answer any of my questions, and have simply been resorting to ad hom attacks. The logical and mathematical inconsistencies in your calculation are obvious, and I’m sure there will be many more people pointing this out. You’ll have to do better than simply shouting “I’m right, they’re wrong” to ward off those attacks.

I can’t find any reference to the IMF agreeing with you, apart from in your own blogs. If they have it should be easy enough for you to provide me with some link to work of yours they have reviewed and commented on.

You are totally inconsistent in your treatment. You say the 900bn is not income, yet subject the missing 100bn to income tax and NICs to get to your 40bn tax gap estimate. Beyond that, you have made no effort to investigate the 1trn number itself.

The VAT gap can be calculated via both top down and bottom up approaches. What you have done is neither. You are using data from a bottom up study to infer a number, and simply called it a top down approach. I certainly don’t see any data or working to suggest you have done anything different.

You have made no attempt at all to include a treatment of any behavioural economics on the tax base, instead treating it as completely fixed.

I could go on, but you get the picture.

In short, all you’ve done is multiply the VAT gap by roughly 3.75. It’s hardly high grade research. You say it has been peer-reviewed. I would be interested to see by whom? Prem Sikka and John Christensen by any chance?

I have answered your questions!

I have pointed out you do not understand value added in which case all you have said is wrong

I have also pointed out you fail to recognise the nature of the HMRC work

Candidly, you are just making wild and unsubstantiated statements

There is nothing to add

Further comments will be deleted

You have studiously failed to answer the questions I have put to you, instead just claiming, without any proof, that I don’t understand and you do.

Let me give you one more chance to answer some very specific questions. I’m sure many of your readers would appreciate the clarity:

Q1. please provide a link or source to verify your claim that the IMF agrees with you.

Q2. please detail where in your report the words “value added” appear.

Q3. please explain why 100bn of “sales” is treated as income to reach your 40bn number.

Q4. please explain, if “sales”, “income” and “value-added” can be used interchangeably, as you have done in your report, why there has been no treatment of the 900bn remainder of the 1trn of total “sales” you assume.

Q5. please explain why you have used 1trn of “sales”, when the data available suggests significantly higher turnover in the economy.

These should all be fairly simple questions to answer, especially for a tax expert and economist of your stature. I’m sure your readership would deeply appreciate it.

The IMf work is in page 46 and following if their report to HMRC on how they could improve tax gap methodology

I discussed the whole problem of value added over a number of pages in the report – without, I admit explicitly using the term as the report is already tough going for the lay reader it is aimed at. From memory look at about page 54. I am on a train with limited connectivity

The same discussion explains why sales and value added can be used interchangeably in this case

Given the £900 bn has been taxed appropriately there was no reason to reconsider it. Tax due on declared and undeclared tax will usually be different for a great many reasons

In your last point you confuse sales with GDP. It is a rudimentary error

“The IMF work is in page 46 and following if their report to HMRC on how they could improve tax gap methodology”

The IMF report does indeed suggest ways that HMRC could improve, but gives them an overall “good” rating. I can’t find any endorsement from the IMF of your work, nor can I find them saying that HMRC are wrong, and you right. Suggesting they do endorse your work as correct is a stretch at best.

“I discussed the whole problem of value added over a number of pages in the report…..”

You discussed the topic from p53-56 roughly. You stated (p53) the “VAT is charged in sales” and then on p54 “That means the direct taxes due on that sale such as income tax, national insurance and corporation tax are also lost.” By this second statement, you are directly implying that sales are equivalent to income, which is not the case. Your example of the 5,000 sale also goes on to make exactly the same point.

I’m not a layperson, having worked in economics, finance and tax for the last 20 odd years. It’s pretty clear to me what has gone on here.

“The same discussion explains why sales and value added can be used interchangeably in this case”

On p55 you try and make this argument, by saying cumulative VAT in regards to the end user. Despite you yourself saying “it always follows that it is VAT on the margin of output less input of the entity that should be charging VAT (but is not)that is evaded and never VAT on the whole turnover” you then go on to simply assert that “…reasonable to assume that the whole sales figure on which VAT is lost in this example should be subject to tax as income…”

This is not a reasonable assumption, as it implies that the sales were net profitable and/or the sales were subject to VAT (which they might not be depending on size of business, export etc). You are also again assuming that the whole sales volume can be counted as profit, or income.

“Given the £900 bn has been taxed appropriately there was no reason to reconsider it.”

Yet you chose to treat the 100bn as if it has not been treated appropriately. We can agree, via HMRC’s numbers, that VAT might not have been paid for a variety of reasons, creating a 10bn tax gap, but that gives us no information on how other taxes have been avoided. Indeed, HMRC specifically strip out the tax gap for other forms of tax to deal with this problem seperately. You are making a simple assertion that given tax A has been avoided/evaded, taxes B and C have also been so in a direct relationship to tax A.

“In your last point you confuse sales with GDP. It is a rudimentary error”

I wasn’t referring to GDP. For a top down approach to VAT you need to dig a little deeper. The IMF paper actually discusses the top-down approach on p46 of the IMF paper you link to above. I won’t reprint it here as it is quite long.

Your problem is that your calculation disregards the W, I, X, M and D terms, reducing the equation to simply stating that expected income = turnover.

Respectfully, and for the final time, you clearly need to read a little more and spend less time on ideological attacks which have no substance, all of which I have dealt with, or which are a figment if your imagination

So far you have made no pint if any substance or wholly miss the point and as such this engagement is concluded

Richard

Sometimes you are just too polite after contending with “doublespeak” from HMRC, you put up with a round of “gaslighting”.

I admire your patience!!

A significant part of the “missing” VAT is due to the exemption from VAT of all those with VATtable revenue of less than £68,000 (unless they choose to be VAT registered). Since the VAT gap is calculated by deducting VAT paid and legitimate deductions from allowances from estimates of VAT due to be paid on household expenditure on items liable to VAT *whether or not VAT was actually paid on such items*. Since around a million small traders have gross revenue less than £68k they do not need to register for VAT or charge VAT so the estimate of the VAT gap is too high.

If you extrapolate from a flawed estimate, your estimate is very likely to be flawed.

That is specifically allowed for in the calculations via the EU estimate of the amount if turnover exempted and as such your claim is wrong

Richard

I am a great admirer of your work but, on this occasion, I am baffled by your hostility to the questions that DG (whomever he/she may be) has asked. I am a CTA of many years’ experience and, having read this paper three times now, I am afraid that I cannot get over the stumbling block of the “value added cf income” point that DG has made (to my mind in a detailed and wholly reasonable fashion).

Would the paper benefit from a bit of revision to clarify this point? I must say that, reading this exchange, I struggle to understand the methodology that you have used. As a full-time tax professional, I have a pretty good understanding of the issues here and consider myself numerate…

In passing, I am not sure the tone you have chosen to deploy here is helpful. I find it hard to see how you find DG’s comments ‘ideological’ when I, as someone who is (I suspect) at least as left-leaning as you, had exactly the same thoughts.

Many thanks.

Thanks for your comments.

The reason for my approach to DG was threefold:

a) His comments were very clearly ideologically motivated, and to be honest I find that very tedious.

b) I find demands that I reference things etc., tedious point scoring: I have a life and cannot be bothered to play such games, especially when it is all to no avail; it will persuade the person of nothing. Long ago a wise man told me not to fight with pigs

c) He was, very simply, wrong.

Let me deal with the last point and start from his claim that I got my entire methodology wrong by using a bottom-up approach when claiming it was a top-down exercise. This is completely untrue: both the HMRC and the EU VAT gaps that I used as the basis for my work are top-down approaches. They work in fundamentally similar ways, and I’m not going to reiterate the whole methodology here. Basically, they look at the consumption method of calculating GDP and then estimate the total VAT that would be charged on that consumption having taken into consideration all allowances and reliefs and those parts of GDP that fall entirely outside the scope of VAT for this purpose e.g. NHS healthcare, state education and quite a lot more. This then gives rise to the estimated total VAT liability (VTTL) which is then compared with the actual VAT recovered to give a VAT gap, from which I then deducted for my purposes the part estimated by HMRC is relating to criminal attacks on the system and bad debt, neither of which can be extrapolated to unrecorded income.

The essential point about this approach, though, which DG missed, is that because this is consumption based every potential element of chargeable input VAT has, at least in principle, already been considered in this process. All that is missing is output VAT. That is inherent in the nature of the VAT system where the net final output VAT is, of course, stated as far as each individual registered trader is concerned net of input VAT. That is, of course, what makes this, by definition, a value added system. I would have thought I hardly needed to state this, but apparently I did.

However, in a macro calculation, which is what this VAT gap is, there are effectively no inputs left, for the reasons noted above. So, what we are effectively looking at when we assess the VAT has to be, at a macro level, total unrecorded outputs, none of which will be further input into the process because they have already been calculated and netted out of consideration. And given that I am considering total sales when coming to my estimates, i.e. all items that could potentially be charged to this tax (which is that the EU 53% estimate allows for), which would include for this purpose exempt supplies such as bank charges and insurance, or rents that have not been subject to the tax, or purchases from unregistered traders, then in effect no business purchases will be left to offset against the missing unrecorded sales income: all will have been allowed for in the original VAT gap calculations. To therefore consider them again would be double counting, and that I’m seeking to avoid.

The consequence is that, as I argue from about page 53 onwards in the paper, what we are effectively looking at is a sales margin for which there will be no related purchase costs, since all will already have been accounted for with just one exception, which is labour expense, on which VAT will never be charged. The result is that this additional sales value represents income which has either not been subject to a profits tax (corporation tax, income tax in the hands of the self-employed) or which has been used to pay unrecorded labour for their input into the process, which will not have been accounted for in the VAT gap calculation. As such the potential charges arising on this additional income are corporation tax, income tax and PAYE combining both income tax and National Insurance, which is exactly why I have taken those taxes into account in my calculations.

Was it in that case correct to say that there were £100 billion of missing sales in the UK coming? In my opinion, the answer has to be yes, because of the way in which I calculated the sum based on the VAT gap. Any other claim would be incorrect in that circumstance. There are, in this calculation, no missing inputs into the VAT exercise; there are only missing outputs, and since outputs are related to sales then there must only be missing sales income. And, because there are no inputs, that sales income gives rise, in its entirety, to potential charges to the taxes that I’ve indicated, and nothing else.

As such, I think my methodology is entirely sound.

Nothing I have said was ideologically motivated. If anything, your logic requires the ideology – it’s a leap of faith to take sales volume and equate it exactly to income.

“I find demands that I reference things etc., tedious point scoring”

Referencing things is standard practice for any kind of research. You say your work has been peer-reviewed. By whom? You seem rather unwilling to share.

“He was, very simply, wrong.”

Your rather biased opinion.

“However, in a macro calculation, which is what this VAT gap is, there are effectively no inputs left, for the reasons noted above.”

This is a poor assumption.

“then in effect no business purchases will be left to offset against the missing unrecorded sales income: all will have been allowed for in the original VAT gap calculations. To therefore consider them again would be double counting, and that I’m seeking to avoid.”

Now simply asserting that the assumption is correct. HMRC specifically strip out the VAT gap, and treat other tax gaps separately to avoid double counting.

“The consequence is that, as I argue from about page 53 onwards in the paper, what we are effectively looking at is a sales margin for which there will be no related purchase costs, since all will already have been accounted for with just one exception, which is labour expense, on which VAT will never be charged.”

Value added. Cost of labour still counts here. Once again, you have simply gone from sales to income (or sales margin as you call it now) – which you simply cannot do.

“The result is that this additional sales value represents income which has either not been subject to a profits tax”

At the risk of repeating myself, you have simply asserted there are profits, and that *all* sales are 100% profitable. While there might be some profits, HMRC account for this part of the tax gap already, and it is simply a ridiculous idea to suggest that any sale is free of input costs.

“Was it in that case correct to say that there were £100 billion of missing sales in the UK”

You haven’t actually looked at the top-down data to investigate this. You’ve taken HMRC’s data and inferred it.

“In my opinion, the answer has to be yes, because of the way in which I calculated the sum based on the VAT gap.”

I doubt your work will stand up to scrutiny. You haven’t even taken the correct basis into account between the HMRC and EU data when coming to your average percentage tax gap.

“There are, in this calculation, no missing inputs into the VAT exercise – See more at”

You have not investigated this in your report. This is a statement, not a result.

“and since outputs are related to sales then there must only be missing sales income”

Again, no investigation of this premise in your report. And once again, sales does not equal income.

“As such, I think my methodology is entirely sound.”

Good luck with this. You will need it.

Let’s start from the beginning….

I referenced my entire report

And from then on all else you say makes no sense

Including the claim that I say all the £100 bn is profit, which is so obviously wrong when I suggest PAYE and NIC are due on part that it is ludicrous

Once again, you simply show you do not know what you are talking about and that makes detailed response a waste of time